Document 12928575

advertisement

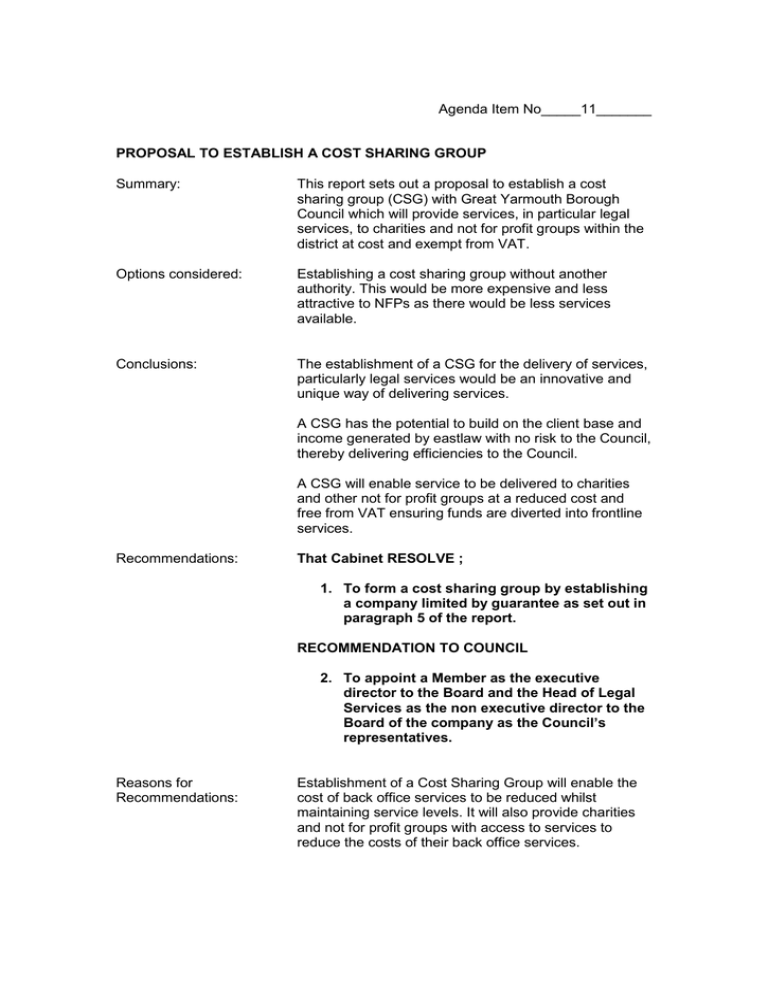

Agenda Item No_____11_______ PROPOSAL TO ESTABLISH A COST SHARING GROUP Summary: This report sets out a proposal to establish a cost sharing group (CSG) with Great Yarmouth Borough Council which will provide services, in particular legal services, to charities and not for profit groups within the district at cost and exempt from VAT. Options considered: Establishing a cost sharing group without another authority. This would be more expensive and less attractive to NFPs as there would be less services available. Conclusions: The establishment of a CSG for the delivery of services, particularly legal services would be an innovative and unique way of delivering services. A CSG has the potential to build on the client base and income generated by eastlaw with no risk to the Council, thereby delivering efficiencies to the Council. A CSG will enable service to be delivered to charities and other not for profit groups at a reduced cost and free from VAT ensuring funds are diverted into frontline services. Recommendations: That Cabinet RESOLVE ; 1. To form a cost sharing group by establishing a company limited by guarantee as set out in paragraph 5 of the report. RECOMMENDATION TO COUNCIL 2. To appoint a Member as the executive director to the Board and the Head of Legal Services as the non executive director to the Board of the company as the Council’s representatives. Reasons for Recommendations: Establishment of a Cost Sharing Group will enable the cost of back office services to be reduced whilst maintaining service levels. It will also provide charities and not for profit groups with access to services to reduce the costs of their back office services. LIST OF BACKGROUND PAPERS AS REQUIRED BY LAW (Papers relied on to write the report, which do not contain exempt information and which are not published elsewhere) Draft Memorandum and Articles of Association Solicitors Practice Framework Rules Cabinet Member(s) Ward(s) affected Cllr Ivory Contact Officer, telephone number and email: Emma Duncan Head of Legal ext 6045 emma.duncan@north-norfolk.gov.uk 1. Introduction 1.1 Members will be aware of the drive by central government to generate efficiencies in local authorities from the provision of back office services such as finance, legal, ICT, property and HR. 1.2 Some local authorities are looking to reduce costs by providing services to external bodies through a charging arrangement which returns income to the Council and therefore reduces the cost of the service to the Council. 1.3 NNDC currently does this with its own legal services which provides external clients (other district councils, housing associations and charities) with legal advice and assistance through its trading brand “eastlaw”. For the financial year 2012/13 eastlaw returned £86,000 of income to the Council and there is an increasing demand for services. 1.4 The imperative to reduce costs is coupled with the government’s “Big Society” agenda which encourages more delivery of services by the not for profit (“NFP”) sector. 1.5 As funding streams become more limited, NFP organisations ability to deliver is being hindered by their inability to have access to the necessary operational capacity and infrastructure to deliver services and initiatives at a reasonable cost. This is particularly true in relation to small charities and NFP organisations and their “back office” functions such as finance, IT, HR and legal which are in many cases, prohibitively expensive for NFP organisations to access and results in valuable (and diminishing) charitable income being diverted away from the delivery of frontline objectives. 1.6 In addition to this many NFP organisations pay VAT (20%) on the services they buy which cannot be reclaimed and adds to the already prohibitive cost. 1.7 In February 2013 the law surrounding the provision of services by and to NFP and public sector organisations changed when the government legislated in the Finance Act 2012 to make the supply of services between not for profit bodies exempt from VAT, where those services are being supplied at cost through a Cost Sharing Group (CSG). 2.0 What is a Cost Sharing Group? 2.1 A CSG is a separate legal entity (usually a Company Limited by Guarantee) consisting of members who undertake exempt and/or non business activities (i.e local authorities, parish councils, charities, Registered Social Landlords, academies, unincorporated associations). 2.2 The members supply “directly necessary” services to and between the members at cost and these services are free of VAT. 2.3 At “cost” includes the full amount of any additional costs incurred in the provision of the service (i.e central charges – buildings, telephony, IT, HR finance, corporate management etc) which currently forms significant part of the Council’s costs. 2.4 A CSG could ultimately provide a full range of services to the NFP sector including (but not limited to) legal, accountancy, property (management, surveying and valuation, conservation and design), payroll, HR, communications, reprographics and ICT. It could be a “one stop shop” for NFPs. 2.5 It could also play a key role in delivering income back to “provider” authorities to reduce the cost of back office services to the Council and would be an attractive provider of services to NFP organisations by selling services at cost and with no VAT. This would enable NFP organisations to reduce their expenditure. 2.6 It would also enable the Council to “shrink” the back office function, without any degradation of service levels. It would also obviate any need for redundancies and whilst retaining resilience and flexibility in the service, and without losing jobs locally. 2.7 Importantly the establishment of a CSG could be a key driver in realising the ambitions of the Council’s localism agenda by building capability in not for profit and charitable organisations. 2.8 Dependant on how successful the CSG was, it could ultimately provide high quality employment in North Norfolk through expansion. 2.9 Having taken advice from the Council’s VAT advisors and specialist Counsel, it is clear that a separate legal entity could be established as a CSG by the Council to provide back office functions to NFP organisations. 2.10 As the legislation is still new, a CSG has not been established by any other local authority and would be an opportunity for the Council to deliver services in an innovative way. 3 Delivery of Legal Services through a CSG 3.1 Legal Services, through eastlaw, currently deliver legal advice and assistance to a number of external partners and will contribute £86k of income in 2012/13 exceeding the targets set in the business plan by 44%. eastlaw’s focus is on delivering affordable high quality and specialist legal services within the public sector and over the past two years of operation there has been a growing demand for those services. 3.2A substantial part of this income comes from organisations such as housing associations and charities who are not able to recover the VAT on legal services and who would therefore benefit from a reduced total cost if the service was delivered through a CSG. 3.3Additionally, there has been a recent change to the Solicitors Practice Framework Rules to allow local authorities to deliver legal services to charities at a cost without a waiver from the Solicitors Regulation Authority. This change is intended to support local authorities in seeking to access new forms of income through the provision of legal services. 3.4 Providing legal services through the medium of a CSG would be a logical progression for eastlaw and its current clients and enable eastlaw to access new client markets. 3.5 The CSG would provide eastlaw with a unique selling point and also provide a tool to market its services to other NFPs who would initially come to the CSG for the provision of a different service (eg. Property, etc) 3.6 Furthermore, other small charities that eastlaw act for currently have responded extremely positively to the concept of a CSG and the potential savings, not just in terms of legal work but in terms of services which could be provided. 4 Potential Partners in a CSG 4.1 In order to make the CSG as effective as possible, as many services as possible need to be provided through it. This will enable the CSG to offer a “one stop shop” for NFP and will also enable services to work together to deliver a holistic solution for their clients. 4.2 There are a number of NFP organisations that would be willing to engage with the Council but as purchasers of services, not providers. 4.3 Great Yarmouth Borough Council has also taken advice on the establishment of a CSG in relation to a number of services and have indicated their willingness to work with NNDC in terms of setting up the formal structure of the CSG. There is no intention to deliver services to each other but simply to allow both organisations (together with others) to use the same framework for the delivery of services. 4.4 There seems to be little incentive to incur two sets of costs in setting up and administering the CSG for exactly the same purpose when one “umbrella” organisation would be more sustainable. 4.4 A combined CSG would be a significant resource for NFP organisations locally enabling a comprehensive service to be provided, utilising the skills and experience of local government across a wide range of functions which are expensive for NFP bodies to access. It would also be a model of innovation and excellence. 4.5 Furthermore a CSG operating with two local government areas would give eastlaw access to markets outside of North Norfolk. 5. Potential Structures 5.1 A CSG is required to be a separate legal entity from the individual partners. 5.2 The concept of a CSG lends itself to a number of different legal structures but having taken advice from leading Counsel, the preferred delivery model is a company limited by guarantee (CLG) as it retains flexibility and control. 5.3 It is suggested that a combined CSG with GYBC should consist of initially 5 Directors (2 exec and 3 non exec) 2 from each authority (a Member and an Officer), together with an independent non exec board member with expertise in the NFP sector. The Board would have control over the strategic and structural decisions relating to the CLG. As the provider authorities they would retain control. 5.4 It is recommended that a Member be appointed to the Board on behalf of the Council and that the Head of Legal having developed the concept of the CSG and who will perform the role as Company Secretary to the CSG also be appointed to the board as the officer representative. 5.5 Below that would sit an operating committee consisting of representatives of key clients or client groups and service providers dealing with any operations issues (SLAs etc). 5.6 To become a recipient member of the company in order to benefit from the VAT exemption there would be a simple administrative process and no initial charge for as it is considered that this would act as a barrier to NFPs joining the company. 5.7 The company structure allows the structure and Board to change as the CSG evolves. 5.8 There would no additional liabilities arising from this company as it would simply offer an environment within which the CSG could operate rather than owning assets and incurring liabilities. 5.9 Service providers would simply bill those members buying services through their own internal processes and not charge VAT. 5.10 A Member’s Agreement would cover these arrangements and make provision for the remainder of the operating arrangements between the parties. 6. Conclusion 6.1 The proposal to establish and develop a CSG by taking advantage of the changes in the Finance Act 2012 is an innovative and new service delivery method which has the potential to deliver savings to the Council and at the same time support the delivery of services within the NFP sector. It has the potential to significantly change the way in which the public and NFP sector work together 6.2 It supports NFP groups by giving them access to services at a reduced cost at a time when their own funding is being squeezed. By giving smaller organisations access to a raft of specialist advice and assistance at cost it will enable them to be fit for purpose in the delivery of their own services to the public. NFP organisations would be able to direct more funding into the delivery of frontline services rather than having to pay for expensive infrastructure support, meaning that more charitable/ public income can be applied where it is most needed. 6.3 As identified above a CSG could reduce the costs of provision of services to the Council by charging other bodies to use them at cost. It enables the Council to retain control over costs incurred through retaining control over the service. 6.4 There is the potential to grow services within a CSG, supported by external funding streams to increase resilience which will benefit provider members. This would retain high quality employment in the local area rather than the jobs being provided elsewhere. 6.5 The Council is identified as a provider of services to NFP organisations but also could, if needed purchase services at cost from another partner (at cost) potentially delivering savings for the Council. 6.6 Establishing a CSG would meet a number of the Council’s key objectives, particularly reducing the costs of internal services and using that released capacity to support the ambitions and capability of other organisations. 4. Implications and Risks Benefit Risks Provides minimum cost services to a range of not for profit partners enabling more money to be delivered into front facing services. This is a new piece of legislation and consequently the establishment and operation of such a CSG will be “cutting edge”. This will involve using an exemption to the VAT rules but specialist advice has been sought to protect the Council’s position. Reduces costs of provision of services to “host” organisation and enables host organisation to retain control over costs incurred. Risk that the savings will not be able to be realised or will be delivered more slowly because of a lack of purchasers for the services. Retains flexibility and resilience. Retains a “tailored” service at the Council delivered through SLAs. Supports delivery of “Big Society” through building capacity at NFP organisations Retains high quality employment in the local area rather than incurring the costs of redundancy and the loss of experienced staff. The providing authority can still provide a "profit" based service to clients outside the CSG thereby supporting income levels from those streams. 5. Financial Implications and Risks Any costs associated with the establishment of the CSG will be met by existing budgets although these are expected to be minimal. Extensive legal advice has been taken in order to protect the Council’s VAT position and there is not expected to be any impact.