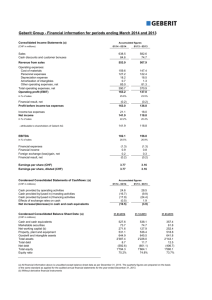

2014 ITU IPSAS FINANCIAL

advertisement