Document 12897014

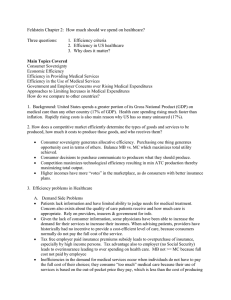

advertisement