In Harm’s Way? Payday Loan Access and Military Personnel Performance

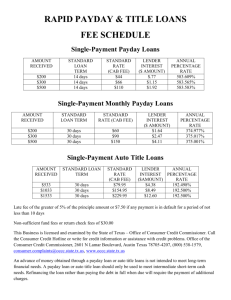

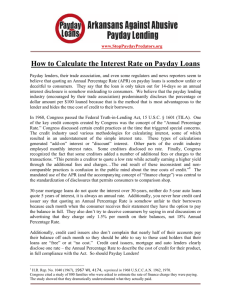

advertisement