Booms, Busts, and Household Enterprise: Evidence from Coffee Farmers in Tanzania ∗

advertisement

Booms, Busts, and Household Enterprise: Evidence from

Coffee Farmers in Tanzania∗

Achyuta Adhvaryu†

Namrata Kala‡

Anant Nyshadham§

March 2013

Abstract

Studies of entrepreneurship in the developing world have struggled to explain the high

prevalence of small, low-growth enterprises, and the limited impacts of financial and training interventions on business expansion. Using data from a unique panel of coffee farmer

households in Tanzania, we demonstrate an important role for microenterprise activity as

a means of mitigating the effects of income shocks. We first verify that global coffee prices

matter for these households, through their effects on farmgate prices, quantity of coffee sold,

farm revenues and, consequently, household expenditures. We then show that households

are more likely to engage in enterprise activity during coffee price busts. Those households

whose businesses stay open during booms, however, actually increase input intensity and

reap large rewards in terms of business survival and profits. Our results suggest that many

agricultural households only intermittently engage in enterprise activity, as a way to weather

productivity or revenue shocks in their principal sector. While some of these household businesses may grow when financial or managerial constraints are relaxed, many find little value

in entrepreneurship beyond as a means of smoothing.

Keywords: microenterprise, coffee, agricultural shocks, Tanzania

∗

Preliminary draft; comments are most welcome. We thank Chris Udry, Dean Karlan, and seminar participants

at PACDEV and the Yale Environmental Economics Workshop for their helpful suggestions. Adhvaryu gratefully

acknowledges funding from the NIH/NICHD (5K01HD071949) and the Yale MacMillan Center Directors Award.

†

Yale University, e-mail: achyuta.adhvaryu@yale.edu. web: www.yale.edu/adhvaryu

‡

Yale University, e-mail: namrata.kala@yale.edu. web: environment.yale.edu/profile/namrata-kala

§

University of Southern California, e-mail: nyshadha@usc.edu. web: www.anantnyshadham.com

1

1

Introduction

A growing body of work in economics seeks to understand what barriers prevent small and

medium-scale enterprises from expanding, and how these barriers may be alleviated. The implied supposition of many studies in this literature is that even the smallest entrepreneurs have

the desire to expand into larger-scale firms, but are constrained by lack of access to financial,

human, or managerial capital. In this view, interventions that make various types of capital

more accessible could facilitate economic development through small business growth.

Credible evidence from randomized controlled trials has demonstrated the effects–or often

the lack thereof–of microcredit, capital provision, input subsidies, and the like. Impacts on labor

and capital inputs, revenues, and profits of small and medium enterprises have been evaluated.

Experimental studies of increased access to credit or financial capital have found heterogeneous

effects on consumption and expenditure on durables by enterprise activity of the household,

but mixed evidence of effects on entrepreneurial entry and enterprise growth (e.g. de Mel,

McKenzie, and Woodruff (2008); Crepon et al. (2012); Banerjee et al. (2012)).1

Some very recent work has begun to explore ability or skill (human and managerial capital) as another potentially important driver for entry into entrepreneurship, performance, and

growth. The typical study in this literature evaluates the impacts of training in business skills,

such as management or bookkeeping. The results of these studies are mixed: some find large,

positive effects on existing enterprise performance (e.g. Karlan and Valdivia (2011); Bruhn et

al. (2012)), while others find insignificant or even negative effects (e.g. de Mel, McKenzie,

and Woodruff (2012); Karlan, Knight, and Udry (2013)). Completed studies in this literature

to date are reviewed in McKenzie and Woodruff (2012). As mentioned in this review, some

common issues with these studies include surprisingly low adoption of training programs; limited implementation of recommended practices, even among adopters; and high attrition rates,

particularly driven by high frequency switching in and out of the entrepreneurial sector.

Most of these studies work with a sample of existing enterprises, so they cannot explain

the entrepreneurial entry decision, and are limited in their ability to deal with the frequent

switching of household participation in enterprise.2 In this study, we show that agricultural

households frequently switch in and out of enterprise, and that part of this switching is driven

by shocks to the farm sector. Specifically, we show, in a sample of Tanzanian coffee farmers,

that when the coffee price is low, households are more likely to operate small-scale businesses;

during coffee price “booms,” households shut these businesses and devote their time to tending

their farms.

Agricultural commodity producers are important to study in this context for several reasons.

1

See Kaboski and Townsend (2012) for a non-randomized study of improved access to credit. For a review of

earlier studies of improved access to financial resources on enterprise outcomes see McKenzie (2010).

2

Some important recent exceptions are Crepon et al. (2012), Banerjee et al. (2012), and de Mel et al. (2012).

2

First, the majority of the global supply of agricultural commodities is from small-holder farming

households in low-income countries. Second, these farm households face substantial revenue

uncertainty due to fluctuations in global commodity prices, and thus agricultural profitability

shocks are salient for them. Third, in developing country contexts in which labor markets are

often imperfect, off-farm wage employment is not a viable option when faced with low output

prices. For all these reasons, microenterprise could play an important smoothing role for these

households.

We begin our analysis with preliminary descriptions of the types of households who own

businesses, which types of businesses they own, and the types of households who persist in microenterprise. Households headed by literate and numerate individuals are more likely to own

a business (specifically non-merchant businesses, which tend to require more skill and capital).

These households are also more likely to be persistent business owners, or “entrepreneurial

stayers,” which we define as households who own businesses in all 4 rounds of the panel survey. Access to financial resources is positively related to owning a business in any wave, with

remittance activity and savings being more associated with non-merchant business, and debt

and financial stock more associated with merchant businesses. Savings and financial stock are

most predictive of persistent entrepreneurship.

We match survey responses of prices, revenues, expenditures, and the labor activities of

coffee farming households in a region of northwest Tanzania to the global coffee prices they

faced in the last harvest. We first show that the global price and the imputed farm-gate price

are strongly positively correlated, as are global prices and household revenues from the sale of

harvested coffee. We show that these revenue shifts generate substantial changes in household

food and non-food expenditures.

Next, we study how global coffee prices affect household entry into the enterprise sector,

measured by ownership of businesses. We find that a one standard deviation rise in the global

coffee price significantly decrease the probability of owning a business, by roughly 5 percentage

points. Specifically, these movements along the extensive margin of enterprise activity pertain

entirely to merchant businesses, as opposed to businesses which require more skill and/or capital.

We then explore movements along the intensive margin, in the allocation of labor, capital,

and enterprise performance. Among households who own businesses, a one standard deviation

rise in the global price of coffee drives household members to allocate nearly 3 more weeks to

enterprise activity in a given 6 or 12-month period. Once again, we find that these effects are

most significant among households with merchant businesses.

This response of labor inputs is mirrored in both the number of household members helping

with the business and the number of hired workers. However, we do not find significant effects

on business capital owned, bought, or sold. Business performance responds significantly with a

3

one standard deviation rise in the global coffee price leading to a 3 month increase in the length

of operation of the business, a 23 percentage point increase in the probability of earning positive

profits, and a nearly 100% rise in profit level.

Finally, we explore heterogeneity in these effects by the demographic characteristics discussed above. We find that households where the head of the household is both literate and

numerate exhibit the strongest effects on the extensive margin (again particularly in merchant

businesses), while households with educated heads show weaker effects on business ownership. Effects of the interactions with baseline financial variables are weaker, but suggest that

positive savings and higher financial stock make households less likely to be entrepreneurial

smoothers (that is, less likely to switch into low capital, low skill business in response to coffee

price shocks).

Coffee farming has features that enable us to identify unbiased estimates of the effects of

agricultural profitability on entrepreneurship. A main concern for identification is that households react to coffee prices by changing the area farmed under coffee or in the extreme, make

entry and exit decisions into and out of coffee farming based on the global price. We argue that

for coffee farming, entry and exit are not salient issues, since coffee trees take at least three years

to produce fruit, and consequently households cannot scale up or down the area under coffee in

a short period of time in response to global price fluctuations. Moreover, we verify in our data

that global coffee price fluctuations did not change selection into the coffee grower sample, or

affect the area under coffee within the sample.

Taken together, our results are consistent with the notion that household enterprise activity falls into at least two distinct types in this context: intermittent, smoothing enterprise and

persistent enterprise. Smoothing enterprise (entrepreneurship in response to agricultural profitability shocks) is concentrated in the merchant sector and among households that are literate

and numerate, but undereducated and active in informal risk sharing, and have relatively low

savings and financial stocks. Persistent enterprise, on the other hand, is less likely to be in the

low capital, low skill merchant sector and is concentrated among households who are more

educated and have higher savings and financial stocks. Additionally, entrepreneurial stayer

households (those who own at least one enterprise in all 4 waves of the data) actually invest

more time (both household and hired labor) into their business when agricultural profits are

high, and their enterprises nearly double in profits and duration of operation in a given year.

Overall, the results of previous literature on access to both financial and managerial capital

suggest, perhaps, that a sizeable fraction of owners of microenterprises in developing contexts

are not, in fact, looking for opportunities to grow their businesses, as many policy interventions

presuppose. It is notable that many of the microfinance interventions discussed above, despite

having found weak or confounding effects on business outcomes, have found strong effects on

consumption and expenditure, suggesting that these households are in need of a smoothing

4

mechanism. We propose in this paper that the smoothing value of casual enterprises may help

explain their existence, as well as the observed unwillingness of households to grow them into

larger-scale businesses.

We provide evidence of this notion by showing that in primarily agricultural households,

participation in microenterprise constitutes an important way to weather negative shocks to

profitability in the agricultural sector, which in this context is the default production sector.

This study relates closely to Adhvaryu and Nyshadham (2013), which explores the enterprise

activity of households and intra-household labor reallocation in response to acute health shocks

to some members of the household.

This paper contributes to the literature on entrepreneurship in developing countries in three

ways. First, we inform the debate on the existence of heterogeneous types of entrepreneurial

households (in terms of preferences, expectations, abilities, and access to financial resources),

and their heterogeneous responses to income shocks. Previous studies (e.g. de Mel, McKenzie,

and Woodruff (2008)) have attempted to define heterogeneous types by observed characteristics

in the cross section. This study is able to use optimized behaviors in response to shocks over

time to reveal the types of entrepreneurial households.

3

Second, we contribute to the literature on the drivers of entrepreneurial growth. We show

that in a given year, households that persist in enterprise during periods of high global coffee

prices and therefore high agricultural profitability allocate more labor hours toward enterprise,

hire more labor from outside of the household, operate their businesses for nearly twice as

long, and earn nearly double profits. Though agricultural profitability shocks such as the ones

studied in this paper will likely have both income and substitution effects, the income effects

can to some degree inform expectations about responses to capital provision and microfinance

interventions. Our results suggest that capital infusions may indeed drive growth, but will do

so only for the types of households who are best equipped for persistent enterprise. Finally, we

provide preliminary evidence on which types of entrepreneurial households benefit from capital

infusions. Our results show that “higher ability” (literate and numerate) and more financially

robust households are more likely to be the persistent entrepreneurs that grow their businesses

in times of agricultural windfalls.

The remainder of the paper is organized as follows. Section ?? reviews the previous literature. Section 2 develops a simple model to formalize our intuition about household enterprise

ownership and operation during booms and busts. Section 3 describes our data set and construction of important variables. Section 4 presents our empirical strategy and discusses its

validity. Section 5 presents results from the empirical tests of the main predictions of the model.

3

This approach is similar in spirit to Nyshadham (2013) which uses optimized histories of household enterprise

responses to productivity shocks in Thailand to test the roles of ability and financial constraints in determining

entrepreneurial entry.

5

Finally, section 6 concludes.

2

Model

We develop a simple model meant to capture some salient features of households’ decisions

to engage in entrepreneurship. Households in our model are “primarily” farmers–a fact that

is modeled through a land endowment and land-labor complementarity–but can also choose

to operate a business. Households differ in entrepreneurial ability, which drives differences in

enterprise sector participation. We show that when farm prices are low, households are more

likely to participate in the business sector; when prices are high, they shut their businesses to

spend more time on the farm. High-ability tend to stay in business even when the farm price is

high–we show that this ability-based selection implies that for those “stayers,” business inputs,

revenues, and profits might actually go up on average when the farm price is high.

2.1

Setup

Consider a household whose preferences for consumption are represented by the utility function u(c). Suppose u is differentiable and increasing in consumption. The household generates

income by participating in up to two sectors: farm production and (non-farm) enterprise. The

farm production function, f , takes labor (lf ) and land (or in our context, trees, T ) as inputs. We

assume that T is fixed in the short run.4 The enterprise production function, e, takes as inputs

labor (le ) and capital (k); the latter can be rented at rate r. We assume enterprise production is

scaled by an ability parameter α ∈ (0, ∞), which is meant to capture entrepreneurial or managerial skill. For parsimony’s sake, we assume leisure is not valued; the household’s time constraint

is thus lf + le = Ω, where Ω is the endowment of time. The price of farm output is pf and the

price of business output is pe . Given these parameters, the household’s utility maximization

problem is:

maxc,lf ,le ,k

c

≤

u(c)

s.t.

pf f (lf , T ) + pe e(le , k, α) − rk,

lf + le = Ω.

(1)

(2)

(3)

We render this general problem slightly more specific to be able to formalize the impacts

of farm (coffee) price booms and busts on entrepreneurship. Suppose that both production

4

This is in keeping with much of the sub-Saharan African context: land markets are thin, if at all existent. In

our context, households during the early 1990s in Tanzania were forbidden by law from uprooting coffee trees, and

newly planted trees take 3-5 years to grow to maturity before producing coffee cherries. We verify in our results that

acreage under coffee does not change with the coffee price.

6

functions are Cobb-Douglas, with weights on farm and enterprise labor equal to γ and δ, respectively:

f (lf , T ) := lfγ T 1−γ

e(le , k, α) :=

2.2

(4)

αleδ k 1−δ .

(5)

Optimal Allocation of Labor and Capital

2.2.1

Interior Solution

At an interior solution to the above maximization problem, the necessary first order conditions

for lf and k must be satisfied (we denote solutions to the maximization problem by ∗ ):5

lf :

pf γ

T

lf∗

!1−γ

=

k:

pe α (1 − δ)

pe αδ

Ω − lf∗

k∗

Ω − lf∗

!1−δ

(6)

δ

k∗

=

r

(7)

Combining equations 6 and 7, with some tedious algebra we can show that at an interior

solution,

lf∗

= T

pf γ(1 − δ)

δr

r

pe α(1 − δ)

δ

(8)

1

1 ! 1−γ

δ

pf γ(1 − δ)

r

δr

pe α(1 − δ)

1

1

1 ! 1−γ

δ

δ

pe α(1 − δ)

r

Ω − T pf γ(1 − δ)

.

=

r

δr

pe α(1 − δ)

le∗ = Ω − T

k∗

1

1 ! 1−γ

(9)

(10)

The above expressions for optimal allocations of capital and labor across sectors have some

intuitive implications. For example, as T , the endowment of trees, increases, farm labor should

increase (because of land-labor complementarity in the farm production function), and labor

and capital investment in enterprise should decrease. As entrepreneurial ability α increases,

time spent in the entrepreneurial sector and capital invested in the household business increase,

while time spent on the farm decreases.

5

Note that only two first order conditions are necessary once we substitute for consumption using the budget and

time constraints.

7

2.2.2

Corner Solution

Of course, the endowment of land (trees) T , combined with the land-labor complementarity

inherent in the Cobb-Douglas form of the farm production function, makes salient the possibility

of a corner solution, in which the household works only in the farm sector, and does not operate

a business (despite free entry into the enterprise sector). In this corner solution, the household

devotes all its time to farm labor (lf = Ω), and no time to business activity (le = 0). Thus, utility

at the corner is u(pf f (Ω, T )).

2.2.3

The Entrepreneurial Decision

The household, therefore, engages in entrepreneurship if and only if

u (pf f (Ω, T )) < u pf f (lf∗ , T ) + pe αe(le∗ , k ∗ ) − rk ∗ .

(11)

Equivalently, since u is monotonically increasing in c, the household engages in enterprise

activity if and only if

pf f (Ω, T ) < pf f (lf∗ , T ) + pe αe(le∗ , k ∗ ) − rk ∗ .

2.3

(12)

Comparative Statics

Our main purpose is to investigate how the entrepreneurial decision and the optimal allocations

of capital and labor conditional business ownership change during coffee price booms (in terms

of model parameters, increases in pf ). We will also use the model to study how coffee price

booms and busts affect entrepreneurial choices along the ability distribution.

We first compute the comparative statics for the optimized quantities lf∗ , le∗ , and k ∗ . From

equations 8, 9, and 10, respectively, it is evident that for each household, an increase in pf would

generate an increase in lf∗ and decreases in le∗ and k ∗ .6

2.3.1

Who chooses to operate a business?

Suppose that each household i receives a draw αi from an ability distribution A on the interval

(0, 1), with associated probability density function a. Household i decides to engage in the

enterprise sector if and only if

∆Γi := pf f (Ω, T ) − pf f (lf∗ , T ) − pe αi e(le∗ , k ∗ ) + rk ∗ < 0.

6

The proof is quite simple and so is omitted.

8

(13)

The following lemma states that there exists an ability type cutoff such that all households

with ability above the cutoff should participate in the enterprise sector, and all below should

not.

Lemma 1 There exists an ability cutoff α̃ such that αi > α̃ ⇔ ∆Γi < 0.

Proof. Showing the existence of a cutoff value α̃ as defined above is equivalent to demonstrating

that ∆Γ is a monotonic function of α. Differentiating the left-hand side of the inequality in

equation 13 with respect to α and rearranging terms, we obtain:

∂l∗

∂k ∗

−pe e + e (pf f1 − pe αe1 ) −

(r − pe αe2 ) .

| {z } ∂α |

{z

}

{z

} ∂α |

X4

(14)

X6

X5

X4 is negative, and, as above, X5 and X6 are equivalent to the necessary first order conditions, which must equal 0 at an optimum. Thus, the derivative above is negative, implying that

∆Γ is strictly decreasing in α. Therefore, there exists some α̃ such that αi > α̃ ⇔ ∆Γi < 0.

Thus, holding other parameter values fixed, the model makes the intuitive prediction that

higher ability types will choose into entrepreneurship, while lower ability types will prefer the

corner solution, devoting all their time to farm production.

2.3.2

Who “drops out” and who “stays in” during coffee price booms?

To understand what happens to entrepreneurial choice across the distribution of types during

coffee price booms, we must determine how α̃ changes in response to an increase in pf .

We begin with the following lemma, which states that for each αi , ∆Γi –the value of choosing

farming alone over farming and enterprise participation–is increasing in the coffee price.

Lemma 2 ∆Γi is increasing in pf .

Proof. Differentiating ∆Γi with respect to pf and rearranging terms, we obtain:7

∂lf∗

∂k ∗

f (Ω, T ) − f (lf∗ , T ) +

(pe αi e1 − pf f1 ) −

(pe αi e2 − r) .

{z

}

{z

} ∂pf |

|

{z

} ∂pf |

X1

X2

(15)

X3

The term X1 above is positive, since f is increasing in labor and Ω > lf∗ . The terms X2 and

X3 must equal 0 at an optimum, since lf∗ , k ∗ , and le∗ are defined by exactly these necessary first

7

f1 , e1 , and e2 denote, respectively, the partial derivatives of the farm production function with respect to labor,

the enterprise production function with respect to labor, and the enterprise production function with respect to

capital.

9

order conditions (see equations 6 7). The derivative of ∆Γi is thus positive.

The following proposition states that the ability cutoff rises during coffee price booms.

Proposition 3 α̃ is increasing in pf .

Proof. Take p1f < p2f , and define α̃1 and α̃2 as the solutions to the equations ∆Γ|p1 (α̃1 ) = 0

f

and ∆Γ|p2 (α̃2 ) = 0, respectively. By lemma 2, for each αi , ∆Γi |p2 > ∆Γi |p1 . In particular,

f

f

f

∆Γ|p2 (α̃1 ) > ∆Γ|p2 (α̃1 ) = 0. Now, since ∆Γ|p2 (α̃2 ) = 0 by construction, and ∆Γ is decreasing in

f

f

f

α by lemma 1, it must be that α̃1 < α̃2 .

Since the ability cutoff α̃ goes up during price booms, the mass of households participating

in entrepreneurship declines. So, we learn from the above proposition that during price booms,

there is, on average, exit from the enterprise sector, but the entrepreneurs who keep their businesses open are the higher-ability ones.

2.3.3

Labor, Capital, Revenues, and Profits for “Stayers”

The final question we study is what happens in this model to inputs, revenues, and profits for

those (high-ability type) households who continue to own businesses during price booms. We

begin with inputs (labor and capital), and then study revenues and profits.

Enterprise labor: We average the expression for labor inputs in 9 over the part of the ability

distribution that participates in enterprise (αi > α̃). The average ¯l∗ |α̃ is equal to

e

1

1 − A(α̃)

¯l∗ |α̃ =

e

Z

∞

le∗ a(α)dα.

(16)

α̃

Differentiating equation 16 with respect to pf , we obtain:

∂ ¯le∗ |α̃

a(α̃)

∂ α̃

=

2

∂pf

(1 − A(α̃)) ∂pf

Z

∞

le∗ a(α)dα

α̃

1

∂

+

1 − A(α̃) ∂pf

Z

∞

le∗ a(α)dα.

(17)

α̃

a(α̃) ∂ α̃ ¯∗

The first term in the equation above equals 1−A(

l |α̃ . The second term above, by Leibα̃) ∂p

R

f e

∗

∞ ∂le

1

∂ α̃

∗

niz’s rule, equals 1−A(

α̃ ∂pf a(α)dα − le |α̃ a(α̃) ∂pf . Plugging these expressions in above

α̃)

and rearranging terms,

∂ l̄e∗ |α̃

∂pf

can be expressed as:

∂ ¯le∗ |α̃

1

=

∂pf

1 − A(α̃)

Z

∞

α̃

∂le∗

∂ α̃

∗

∗

a(α)dα +

a(α̃) ¯le |α̃ − le |α̃ .

∂pf

∂pf

10

(18)

∗

∂le

<

The first term within parentheses in the equation above is negative, since for every α, ∂p

f

∂ α̃

∗

∗

¯

0. The second term is positive, since ∂pf > 0 by proposition 3; a(α̃) > 0; and le |α̃ − le |α̃ > 0

because le∗ is strictly increasing in α.

Equation 18 thus reveals two competing forces pushing average labor inputs for “stayers”

in opposite directions. First, when pf increases, for given αi > α̃, le∗ decreases, because there

is a pressure, arising from the additional profitability of farm production, to put more labor

into the farm sector (first term within parentheses). Second, when pf increases, higher ability entrepreneurs are the ones who stay in, and those households, given their higher returns

to entrepreneurship, spend more time in enterprise than lower ability households, causing an

upward pressure on average labor inputs into enterprise (second term).

The overall sign of

∂ l̄e∗ |α̃

∂pf

is ambiguous, and depends on the size of relative size of the equa-

tion’s various components. For example, if enterprise labor supply is highly elastic with respect

to the coffee price, average labor for “stayers” may decrease. On the other hand, if enterprise

labor is steeply increasing in ability, or if the cutoff α̃ is highly responsive to the coffee price, the

opposite – an increase in average labor for “stayers” – is possible.

Capital inputs, revenues, and profits: Following an analogous derivation, we can express the

change in average capital inputs, revenues, and profits (Π := pe e(l, k, α) − rk) for “stayers”

during price booms as follows:

∂ k̄ ∗ |α̃

∂pf

∂ē∗ |α̃

pe

∂pf

∂ Π̄∗ |α̃

∂pf

=

=

Z ∞ ∗

1

∂k

∂ α̃

a(α)dα +

a(α̃) k̄ ∗ |α̃ − k ∗ |α̃

1 − A(α̃)

∂pf

∂pf

Zα̃∞ ∗

pe

∂k ∗

∂le

∂ α̃

∗

∗

+ e2

a(α̃) (ē |α̃ − e |α̃ )

a(α)dα +

e1

1 − A(α̃)

∂pf

∂pf

∂pf

α̃

= pe

∂ē∗ |α̃

∂ k̄ ∗ |α̃

−r

.

∂pf

∂pf

(19)

(20)

(21)

The same tradeoff discussed earlier for average labor inputs applies to these equations. Note

that if average labor and capital inputs both increase during price booms, it must be that average

revenues also goes up, given that both enterprise labor and capital are monotonically increasing

in ability. However, average profits need not go up, since the sign of the change in profits

depends on both the change in average revenues and the change in average capital.

3

Data

This study uses survey data from the Kagera region of Tanzania, an area west of Lake Victoria,

and bordering Rwanda, Burundi and Uganda. Kagera is mostly rural and primarily engaged

in producing bananas and coffee in the north, and rain-fed annual crops (maize, sorghum, and

11

cotton) in the south. The Kagera Health and Development Survey (KHDS) was conducted by

the World Bank and Muhimbili University College of Health Sciences. The sample consists of

816 households from 51 clusters (or communities) located in 49 villages covering all five districts

of Kagera, interviewed up to four times, from Fall 1991 to January 1994, at 6 to 7 month intervals. The randomized sampling frame was based on the 1988 Tanzanian Census. A two-stage,

randomized stratified sampling procedure was employed. In the first stage, Census clusters (or

communities) were stratified based on agro-climactic zone and mortality rates and then were

randomly sampled. In the second stage, households within the clusters were stratified into

“high-risk” and “low-risk” groups based on illness and death of household members in the 12

months before enumeration, and then were randomly sampled. There was moderate attrition

from the longitudinal sample. 9.6% of households sampled in wave 1 were lost by wave 4. However, to preserve balancing across health profiles in the sample, lost households were replaced

with randomly selected households from a sample of predetermined replacement households

stratified by sickness. KHDS is a socio-economic survey following the model of previous World

Bank Living Standards Measurement Surveys. The survey covers individual-, household-, and

cluster-level data related to the economic livelihoods and health of individuals, and the characteristics of households and communities. Our sample is confined to households who reported

harvesting coffee at least once in the survey period (1991-1994), which includes over 80% of the

households in the entire sample.

We combine the Kagera household survey with data on monthly international coffee prices

available with the International Coffee Association. The monthly prices are robusta coffee

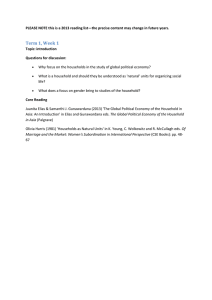

prices, which is primarily the variety of coffee grown in the Kagera region. Figure 1 shows

the graph of monthly prices from 1980-2010, and indicates the prices during the survey period.

Prices during the entire survey period (1991-1994) were relatively low compared to the historical

average. In the following paragraphs, we outline the variables we use in our analyses.

3.1

Price Lag Variable

The first wave of the survey asked households about their economic and labor activities in the

12 months preceding the survey. The second, third and four waves of the survey however,

asked households about their economic and labor activities in the last 6 months. This is because

the time lag between waves was about 6-7 months, and the questions were changed to avoid

questions about overlapping time periods. In order to estimate the impact of international coffee price fluctuations on the household, we match the outcome variables to the appropriate

international price faced by the household at the time when it made decisions regarding labor

allocations and microenterprise ownership.Since we have information on the month and year

in which households were surveyed, we matched the average international price for the time

period about which the survey asked. In the first wave, this was the average price for the last

12

Figure I

0

50

U.S. Cents/lb.

100

150

200

Price Trend (1980 – 2010)

F IGUREHistorical

1: R OBUSTA

C OFFEE P RICE T IME S ERIES

01jan1980

01jan1990

01jan2000

Date

13

01jan2010

12 months preceding the survey month of the households, and for the subsequent waves, it

was the average price for the last 6 months. Thus, if a household was interviewed in wave 1

in September 1991, the price faced by the household is the average international robusta coffee

price from September 1990-August 1991. If it was interviewed in any wave other than the first,

the price faced by the household is the average international robusta coffee price for the preceding 6 months - for instance, if a household was interviewed in September 1993, prices from

March 1993-August 1993 would be considered. The average price computed in this manner is

about 46 cents/lb, with a standard deviation of about 3.9 cents/lb.

Our independent variable of interest is the robusta price divided by its standard deviation

over the survey period. The coefficient on this variable is the marginal effect of a one standard

deviation in the price.

3.2

Household-Level Variables

At the household-level, we examine the impact on revenues from coffee, consumption expenditure and microenterprise ownership. Table 1 presents the summary statistics. Area harvested

for coffee is on average only about 10% of area harvested by households, but annual revenues

from coffee sales comprise about 43% of agricultural revenues for the sample (67% if only households’ reporting non-zero coffee revenues are included). Thus, it is a significant component of

household income.

Regarding micro-enterprise ownership, 40% of the households reported owning an enterprise, and about 12% report owning more than one, the maximum being 7. A little over half

of these are merchant businesses. We also consider the weeks spent in self-employment in the

period of reference, which is conditional on the household owning an enterprise. On average,

households spend about 15 weeks in self-employment - merchant business owner households

spend the same, and non-merchant business owner households spend 19 weeks.

3.3

Enterprise-level Variables

To analyze the operations of the enterprises which continue to operate when the coffee price

is high, we use several enterprise-level intensive margin variables. These comprise three categories of enterprise operations - capital assets, labor and performance. The first category includes a binary variable for whether the enterprise owns a capital asset and another binary

variable for whether the enterprise bought or sold a capital asset. The majority of enterprises

(65%) own a capital asset, although fewer than 15% bought or sold one in the reference period.

The labor category comprises the number of household members that helped in the enterprise

and the number of hired workers. The number of household members active in the business

and the number of hired workers is nearly the same. The performance category consists of three

14

variables - the number of months the enterprise has been operating, the log of business profits,

and a binary variable for whether the business had positive profits. The continuous measure

of profit was a self-reported estimate conditional on the enterprise having a positive amount of

profit, and so is always positive. The literature on entrepreneurship has highlighted the issues

with accurate measurement of financial flows for micro-enterprises in developing countries (de

Mel, McKenzie, and Woodruff 2009). We recommend using the same caution in interpreting the

continuous measure of profits as in the previous literature. The binary variable, which captures

whether positive profits were earned or not, is arguably a more reliable measure of profitability,

although it is not measured at as fine a level as the continuous measure.

4

Empirical Strategy

The empirical analysis proceeds in six stages. First, we explore the determinants of business

ownership in the pooled sample, by regressing a business ownership dummy on a set of household characteristics meant to capture demographics, financial access, and ability. We estimate

the following simple model, in which o is an ownership dummy and h indexes households:

oh = α + X0h β + h .

(22)

Second, we seek to determine the extent to which global coffee prices matter for our sample

of coffee farmers. We do this by testing whether global prices are correlated with the farmgate coffee prices that farmers face, and whether the global price affects quantities of coffee

harvested, coffee revenues, and household expenditures on food and non-food items.8 The following model is estimated, for outcome O, price p, and month (θm ), year (δy ), and household

(µh ) fixed effects:

Ohmy = α + βpmy + µh + δy + θm + hmy .

(23)

As described in the previous section, price p varies at the month x year level. Households

surveyed in the same month of a particular wave will thus face the same (retrospective) coffee

price; households that happen to have been surveyed in different months of the same wave will

face differing prices.

Third, we ask how fluctuations in the coffee price affect business ownership. In the coffee

grower household sample, we regress an ownership dummy on the coffee price, as well as

month, year, and household fixed effects using model specified in equation 26.

8

Since the farm-gate price that households face is likely endogenously determined (for example, bargaining

power of the household or the farming cooperative to which the household belongs could influence farm-gate price),

we focus instead on the international price of coffee. Absent stringent price control policies (which were not relevant

for our time period in Tanzania), fluctuations over time in the international coffee price should generate exogenous

changes in farm-gate prices, and should thus impact agricultural profitability for coffee-growing households.

15

Fourth, we turn to the individual-level data on business ownership to explore labor supply

responses to coffee price movements in the (conditional) sample of individuals who reported

owning a business. We regress weeks spent in self-employment in the last 6 months on the

coffee price, year and month fixed effects, and individual fixed effects (ζi ), where individuals

are indexed by i:

limy = α + βpmy + ζi + δy + θm + imy .

(24)

The model specified in equation 25 is estimated on a sample whose unit of observation is

thus individual x wave, but is only estimated for individuals who reported owning a business

in at least one wave.

Fifth, we examine the responses of capital investments, labor, and performance outcomes of

enterprises to coffee price movements. For this analysis, we use an unbalanced, enterprise-level

panel. The unit of observation is thus enterprise x wave. The specification used is analogous to

equation 25, for enteprises indexed by e and enterprise outcome O:

Oemy = α + βpmy + ηe + δy + θm + emy .

(25)

Finally, sixth, we examine heterogeneous business ownership responses to coffee price movements across various household characteristics. The estimate the following interaction specification, for household characteristics Xh :

ohmy = α + γ (Xh x pmy ) + βpmy + κXh + µh + δy + θm + hmy .

(26)

Standard errors in all regressions are clustered at the level of the enumeration cluster.

5

Results

5.1

Which households own a business?

We begin by exploring the determinants of household enterprise ownership. We estimate pooled

regressions using the whole coffee sample (across all waves). We include the following characteristics of household heads: gender (male dummy); numeracy and literacy dummy (need both

for dummy to equal 1); and a dummy for greater than 0 years of grade completion. For the

household, we include the following financial characteristics (all dummies): any remittance activity (sent or received); positive savings; positive debt; and above-median financial stock.9

The coefficient estimates from the regressions are reported in Table 3. In column 1, we see

that numeracy/literacy is strongly positively related to business ownership. Households with

9

Please see the data appendix for details on the construction of these and other variables used in analysis.

16

heads that are both numerate and literate are about 12 percentage points (pp) more likely to

engage in entrepreneurial activity, from a mean of about 0.38 (i.e., nearly a 1/3 increase above

the mean). Though numeracy/literacy is likely a very noisy predictor of entrepreneurial ability,

the result here is consistent with the small but growing literature emphasizing the importance

of dimensions of ability in business ownership and success.

Household financial variables are highly predictive of ownership, and interestingly, all variables we include positively predict ownership. Remittance activity increases likelihood of business ownership by about 8 pp; positive savings by 11 pp; positive debt by 6 pp; and above

median financial stock by more than 8 pp. These results are consistent with the literature on

financial deepening and microenterprise growth: financial constraints may play a major role in

limiting enterprise development in this context.

Finally, perhaps surprisingly, conditional on numeracy/literacy status, education is not significantly related to ownership: the coefficient is -0.01 and the standard error band is fairly tight

around 0. Households with male heads are slightly more likely to own a business (5 pp), but

this relationship is again statistically significant.

In columns 2 and 3 of Table 1, we break down enterprises into merchant and non-merchant

businesses, and look at correlations separately across the two categories. One should think of

the main delineations as size and fixed cost. Merchant businesses are very small, and usually

involve very little capital input or fixed costs of operation (e.g., many merchants are vendors

that sell fruits, vegetables, and bread on the roadside). Non-merchant businesses are larger and

usually involve bigger capital inputs to production (e.g., a construction business or a drug shop

with a “brick and mortar” location).

Literacy/numeracy seems to matter for both types of businesses, but in both cases the coefficient estimates are not precise. Education conditional on literacy/numeracy status continues

not to play a role in determining ownership. Interestingly, households with male heads are

much more likely to own non-merchant businesses, but no such relationship exists for merchant

businesses. Remittances and savings matter for non-merchant businesses but not for merchants,

whereas for debt and financial stock, the opposite is true.

In column 4, we examine the determinants of “stayers,” that is, those households that operate businesses in all four waves of the panel. We estimate this relationship using household

characteristics from wave 1, only using household-level observations from wave 1. The dependent variable is a dummy indicating “stayer” household. The results here are consistent with

those in column 1 with the pooled sample: numeracy/literacy is strongly positively related to

“stayer” status, and financial variables are also all positively related. Education conditional on

literacy/numeracy is negatively related to “stayer” status, suggesting that perhaps households

with high innate ability but low grade completion are the most likely to be entrepreneurs in this

context.

17

5.2

Effects of Global Prices on Farming Decisions and Expenditures

Next, we test whether global coffee prices actually matter for the coffee farmers in our sample.

The general idea is to regress measures of coffee farmgate pricing and production, as well as

household expenditures, on the global coffee price. Results are reported in Table 4.

We begin by looking at relationship between the global price and the farmgate price, imputed from our transactions data. The results, reported in column 1 of Table 4, demonstrate that

the farmgate price is very sensitive to movements in the global price: a one standard deviation

(SD) decrease in the global price decreases the farmgate price by 24 percent.10

Next, we examine quantity sold and revenues for coffee. These results, reported in columns

2 and 3, show that both quantity and revenue increase with the global price (by about 30 and

48 percent, respectively, for a one SD change in the global price), consistent with an upwardsloping supply of coffee.

Finally, we look at household expenditures, to test the extent to which households are able

to smooth consumption in the face of coffee price fluctuations. We find strong evidence against

consumption smoothing. Total expenditures decline by nearly 20 percent in the coffee farmer

sample for a one SD drop in the coffee price (column 4). We then split expenditures into food

and non-food categories, and find substantial changes in expenditures in both corresponding

to movements in the coffee price. Food expenditures (column 5 – approximately 22 percent)

appear to be more elastic than non-food (column 6, approximately 15 percent).

5.3

Household Enterprise Activity and Coffee Price Fluctuations

Next, we examine whether global coffee price changes affect the probability of household business ownership. Results are reported in Table 5. Column 1 shows results of a regression of an

ownership dummy on the coffee price. We find that a one SD drop in the global price increases

the probability of enterprise ownership by about 5 pp, an increase of about 13 percent above the

mean. We interpret this finding as strong evidence of countercyclical household enterprise starts

in our sample. On average, households are much more likely to engage in enterprise activity

during coffee price busts, and shut their businesses during coffee price booms.

In columns 2 and 3, we examine ownership of merchant and non-merchant businesses. The

results show quite strongly that households are much more likely to “smooth” using merchant

businesses; ownership of non-merchant businesses, on the other hand, does not vary significantly with the coffee price, and the coefficient is 4 times smaller than the impact of coffee price

on merchant-type business ownership.

10

It bears mentioning that we can only impute the farmgate price for households who had non-zero coffee revenues

in the 6-month window prior to survey.

18

5.4

Labor Supply Effects Conditional on Ownership

Next, we examine the impacts of coffee price fluctuations conditional on business ownership, to explore what happens to those households whose businesses stay open during coffee price booms.

We begin by looking at time spent in entrepreneurial activity (self-employment) for those individuals who owned a business. Our measure of entrepreneurial activity intensity is the number

of weeks the individual spent in self-employment in the past 6 months.

The results are reported in Table 6. Column 1 shows self-employment hours conditional

on owning at least one business. In this conditional sample, we find a starkly different result

on the impact of coffee price movements. During coffee price booms, entrepreneurial activity,

conditional on staying open, actually intensifies: weeks in self-employment increase by nearly

3 for a one SD increase in price. This amounts to an increase of nearly 18 percent over the mean

(16 weeks). Columns 2 and 3 report the same effects for the conditional sample of individuals

owning merchant and non-merchant businesses, respectively. The coefficient sizes are roughly

the same, but the impact is more precisely estimated in the sample of merchant business owners.

5.5

Enterprise Outcomes Conditional on Ownership

Next, in the same vein as the labor supply analysis above, we examine households’ inputs to

enterprise and enterprise performance. The results are reported in Table 7. All analysis is done

within the unbalanced enterprise-level panel.

We first look at capital inputs. Conditional on staying open during a coffee price boom,

we find no statistically significant effect of price on the probability of owning or transacting

with business assets (columns 1 and 2, respectively). It bears mentioning, however, that these

impacts are imprecisely estimated, and thus we cannot reject the null of a fairly large effect on

either probability at the conventional levels of confidence.

Labor inputs, in contrast, increase significantly with price conditional on enterprise ownership. For a one SD increase in the coffee price, the number of household members helping in the

business increases by about 0.2 (column 3) and the number of hired workers increases by more

than 0.4 (column 4). Both of these increases are large fractions of their respective means.

Performance outcomes also increase during booms conditional on ownership. A one SD increase in the coffee price generates a 3 month increase in the longevity (months of operation out

of the past 6 months) of businesses (column 5); a doubling of business profits (column 6); and a

23 pp increase in the probability of positive profits. Overall, the results show resoundingly that

for those businesses that remain open during booms, inputs and performance increase substantially.

19

5.6

Heterogeneous Effects

Last, we explore heterogeneity in the enterprise ownership response to coffee price movements

across various household characteristics. Table 8 reports results of these interaction specifications. Recall that the main effect from Table 5 showed that households engaged in more entrepreneurial activity during coffee price busts, and shut down enterprise during booms. Interestingly, we find in Table 8 (column 1) that “high-ability” household heads (those with literacy

and numeracy) were less likely to change ownership status with coffee price movements. The

impact of coffee price changes does not appear to be differential across financial activity indicators.

When we break down ownership into merchant v. non-merchant categories (columns 2 and

3, respectively), we find that ability regulates the relationship between ownership and the coffee

price only for merchant businesses. Further, higher financial activity and access magnify the

impact of coffee price on ownership during price busts, suggesting that financial constraints

may hamper the establishment of even these “intermittent” enterprises.

6

Conclusion

Recent studies exploring the drivers of entrepreneurial entry and growth have produced some

puzzling results. The effects of business skills training on growth of existing enterprises appear

small and insignificant. Returns to capital among microenterprises appear high in some contexts, but experimental microfinance interventions have produced inconsistent results on entrepreneurial entry and growth of existing enterprises. On the other hand, studies consistently

find large effects of improved access to credit on household consumption.

We propose that many developing households are subject to income shocks, particularly

in agricultural activities, and that they may use microenterprise as a mechanism for weathering these shocks. If, for at least a subset of entrepreneurial households, income-smoothing is

the primary motivation of the microenterprise, the above-mentioned results of microfinance

and business training interventions are less surprising. These households may treat capital infusions and microenterprise activity as substitutes for smoothing agricultural productivity or

price shocks. “Intermittent” enterprise owners are less likely to avail themselves of enterprise

growth opportunities, because their businesses do not represent a persistent primary source of

income.

We find that a rise in the global coffee price significantly decreases the probability of owning

a business. We also find that among households who own businesses, a rise in the global price

of coffee drives household members to allocate more productive time to enterprise activity. We

find that these effects along the extensive and intensive margins are most significant with re-

20

spect to low skill, low capital merchant businesses. Movements along the intensive margin of

labor inputs are mirrored in both the number of household members helping with the business

and the number of hired workers. Though we do not find significant effects on business capital owned, bought, or sold, business performance responds significantly in terms of length of

operation and profits.

Finally, we find that households with heads who are both literate and numerate exhibit

the strongest effects on the extensive margin (again particularly in merchant businesses), while

households with educated heads show weaker effects on business ownership. Effects of interactions with baseline financial variables are weaker, but suggest that positive savings and higher

financial stock make households less likely to be entrepreneurial smoothers (that is, less likely

to switch into low capital, low skill business in response to coffee price shocks).

Taken together, our results are consistent with the notion that household enterprise activity

falls into at least two distinct types in this context: intermittent, smoothing enterprise and persistent enterprise. Smoothing enterprise (entrepreneurship in response to agricultural profitability

shocks) is concentrated in the merchant sector and among households that are literate and numerate, but undereducated and active in informal sharing, but have relatively low savings and

financial stock. Persistent enterprise, on the other hand, is less likely to be in the low capital, low

skill merchant sector and is concentrated among households who are more educated and have

higher savings and financial stock. Additionally, entrepreneurial stayer households actually invest more time (both household and hired labor) into their business when agricultural profits are

high and their enterprises nearly double in profits and duration of operation.

Our results suggest that perhaps allocating public resources toward improving access to

credit for high ability, growth-oriented entrepreneurs might be a high return endeavor, both

in terms of growth of these enterprises and from a general welfare-enhancing perspective. Of

course, identifying this high return subset is both very difficult and very important. To the

best of our knowledge, very few studies have attempted to describe microenterprise owners in

terms of their ability, risk preferences, motivations, expectations, and the like. de Mel, Mckenzie,

and Woodruff (2008) is an exception; the authors describe microenterprise owners from a sample in Sri Lanka with respect to some of these dimensions, but are only able to associate these

characteristics with enterprise performance and scale in the cross-section. Our study is able to

categorize entrepreneurial households by their heterogeneous optimized enterprise responses

to shocks over time. Our results suggest that those households who do not shut their businesses

when returns to farming are high must, through an ability-based selection mechanism, be the

highest type households.

21

References

[1] Adhvaryu, Achyuta and Anant Nyshadham. 2013. “Health, Enterprise, and Labor Complementarity.” Working Paper.

[2] Banerjee, Abhijit, Esther Duflo, Rachel Glennerster, and Cynthia Kinnan. 2010. “The miracle of microfinance? Evidence from a randomized evaluation.” Working Paper.

[3] Crepon, Bruno, Florencia Devoto, Esther Duflo, and William Pariente. 2011. “Impact of

microcredit in rural areas of Morocco: Evidence from a Randomized Evaluation.” Working

Paper.

[4] de Mel, Suresh, David McKenzie, and Christopher Woodruff. 2008. “Returns to Capital in

Microenterprises: Evidence from a Field Experiment.” Quarterly Journal of Economics, vol.

123, no. 4: 1329-1372.

[5] de Mel, Suresh, David McKenzie, and Christopher Woodruff. 2008. “Who are the microenterprise owners? Evidence from Sri Lanka on Tokman v. de Soto.” International Differences

in Entrepreneurship. Joshua Lerner and Antoinette Schoar (Eds.): pp. 63-87.

[6] de Mel, Suresh, David McKenzie, and Christopher Woodruff. 2009. “Measuring microenterprise profits: Must we ask how the sausage is made?” Journal of Development Economics

vol. 88, no. 1: 19-31.

[7] de Mel, Suresh, David McKenzie, and Christopher Woodruff. 2012. “Business training and

female enterprise start-up, growth, and dynamics: experimental evidence from Sri Lanka.”

World Bank Policy Research Working Paper no. 6145

[8] Kaboski, Joseph and Robert Townsend. 2012. “The Impact of Credit on Village Economies.”

American Economic Journal: Applied Economics. forthcoming

[9] Karlan, Dean and Martin Valdivia. 2011. “Teaching Entrepreneurship: Impact of Business

Training on Microfinance Clients and Institutions.” Review of Economics and Statistics, vol.

93, no. 2: 510-527.

[10] Karlan, Dean, Ryan Knight, and Christopher Udry. 2013. “Hoping to Win, Expected to

Lose: Theory and Lessons on Micro Enterprise Development.” Working Paper.

[11] McKenzie, David. 2010. “Impact Assessments in Finance and Private Sector Development:

What have we learned and what should we learn?” World Bank Research Observer Vol. 25,

no. 2: 209-233.

[12] McKenzie, David and Christopher Woodruff. 2012. “What are we learning from business

training and entrepreneurship evaluations around the developing world?” working paper.

[13] Nyshadham, Anant. 2013. “Learning about Comparative Advantage in Entrepreneurhsip:

Evidence from Thailand.” working paper.

[14] Schoar, Antoinette. 2009. “The Divide between Subsistence and Transformational Entrepreneurship.” Innovation Policy and the Economy, Vol. 10, No. 1: pp. 57-81.

22

A

Construction of Variables

The following list describes the construction of variables used in analysis. Please note that since

the survey interviewed households about their decisions and outcomes in the 12 months preceding the interview in the first wave, and six months preceding the interview in the second,

third and fourth wave, unless otherwise mentioned, all household-level variables are defined

for these respective time-periods. Furthermore, with the exception of the regression containing

the variable ”Coffee Grower” as the dependent variable, all other regressions are conditional on

the household having reported harvesting coffee in at least one of the four waves.

A.1

Coffee Price Variabes

• Robustalag: a household-level lagged international robusta coffee price. For the first wave,

it is the mean price of the twelve months preceding the interview of the household, and

for the remaining waves, it is the mean price of the six months preceding the household

interview. Since different households were interview at different times, it varies across

households, though households interviewed in the same month and year will have identical values of robustalag. This is done to align the outcome variables, which were asked for

the previous twelve months in wave 1 and previous six months in the other waves, with

the mean coffee price prevailing in the time-interval when the outcomes were determined.

The monthly-level international robusta prices were obtained from the International Coffee Organization(ICO).

• Price/SD(Price): a primary independent variable. It equals robustalag divided by the

standard deviation of robustalag. Thus, the coefficients on this variable in the regressions

indicate the marginal impact of a one standard deviation increase in robustalag.

A.2

Enterprise Ownership

• 1(Household Owns a Business): equals 1 if the the household reported to owning at least

one enterprise, 0 otherwise.

• 1(Household Owns a Merchant Business): equals 1 if the household reported owning at

least one enterprise that undertook trading or other informal non-farm self-employment.

• 1(Household Owns a Non-Merchant Business): equals 1 if the household reported owning

an at least enterprise of the categories that require semi-skilled and skilled work. These

comprise stall keeping, shopkeeping, restaurant owner, garage owner, bus driver, blacksmith, plumber, carpenter, tailor, repair work, mechanic, mason, painter, hair dresser,

shoemaker, butcher, handicrafts, photographer, and doctor.

23

• Stayer: equals 1 if the household reported owning an enterprise in all 4 waves, 0 otherwise.

A.3

Characteristics of the Head of the Household

• 1(Male): equals 1 if the head of the household is male, 0 otherwise.

• 1(Can Write and Do Math): equals 1 if the household head reported being able to write a

letter and perform written calculations, zero otherwise.

• 1(Some Education): equals 1 if the household head reported attending primary schooling

or above for any length of time, including adult or Koranic education, 0 otherwise.

A.4

Household’s Financial Participation Variables

• 1(Any Remittances): equals 1 if the household reported either sending or receiving remittances.

• 1(Positive Savings):equals 1 if the household reported having saving greater than zero, 0

otherwise.

• 1(Positive Debt): equals 1 if the household reported having debt greater than zero, 0 otherwise.

• 1(Above Median Financial Stock): equals 1 if level of financial stocks (Savins + loan debt)

reported by the household are greater than the median level of financial stocks over the

entire sample, which is 2,000 TZS.

A.5

Household variables related to coffee cultivation

• Coffee Grower: equals 1 if the household reported harvesting coffee in a particular wave,

0 otherwise.

• ln(1+ Harvest Area Under Coffee): natural log of one plus the number of acres the household reported harvesting under coffee.

• ln(Price Received by Households): natural log of value of coffee sales reported by the

household divided by the quantity sold in USD/kg (using the exchange rate of iTZS=0.0006

USD).

• ln(1+Quantity Sold): natural log of 1 plus the quantity of household-level coffee sales

reported in kg.

• ln(1+Coffee revenues): natural log of 1 plus the value of household-level coffee sales reported.

24

A.6

Household expenditure variables

• ln(1+Total Expenditure): Total household expenditure, inclusive of food and non-food

expenditure (detailed below), consumption of home production, remittances sent, and

imputed expenditure for wage income in-kind.

• ln(1+Food Expenditure): The sum of seasonal and non-seasonal food expenditure, inclusive of expenditure on meals and beverages consumed away from home, exclusive of consumption of home production.

• ln(1+Non-Food Expenditure): The sum of expenditure on education, health, housing, utilities, funeral and other non-food expenses.

A.7

Household labor outcome variables

• Weeks in Self-Employment: The number of weeks reported at the individual-level spent

in non-farm self employment in the reference period described above, aggregated up to

the household-level .

A.8

Enterprise-level intensive margin variables

• 1(Business Assets Owned): equals 1 if the enterprise owns at least one of the following

category of assets: a) buildings and land, b) vehicles or boats, c) tools, equipment or machinery, or d) other durable assets for use in the enterprise, 0 otherwise.

• 1(Business Assets Bought or Sold): equals 1 if any asset described above was bought for

the enterprise or divested from the enterprise.

• Number of Household Members Helping in the Business: The number of householdmembers who helped in the enterprise, including those were unpaid.

• Number of Hired Workers: The number of hired workers working in the enterprise.

• Mos. Business Operating: The number of months in the reference period described above

that the business was operating.

• ln(1+ Business Profits): The natural log of one plus business profits. Business receipts,

such as revenues and profits, were asked for the last 12 months in wave 1 and the last 6

months in waves 2, 3 and 4. In case the business had begun to be operational after this time

frame, the usual receipts per day, week or month were asked. Hence, the profits variable

we use equals the former measure if the enterprise had been in operation in the respective

25

time-period, and the latter measure if enteprise operations began after the associated time

period. We convert all profits to the daily level.

• 1(Business Had Positive Profits): equals 1 if the enterprise had profits greater than zero, 0

otherwise. Profits are constructed as defined above.

26

Table 1

Summary Statistics: Enterprise Activity, Demographic Characteristics, and Financial Resources

Whole Panel Sample

Households with a business in Households with a business in at least 1 period

all 4 waves (Stayers)

1,087

465

368

92

2,880

753

Number of household‐year observations

Number of households

Mean

SD

Mean

SD

Mean

SD

0.244

0.429

0.508

4.110

0.650

0.146

0.463

0.408

0.465

106.450

0.500

2.713

0.477

0.353

0.840

1.574

0.499

483.630

0.460

4.817

0.766

0.172

0.457

0.516

0.540

125.488

0.499

2.822

0.424

0.378

0.800

1.487

0.499

385.215

Household Head Characteristics

1(Male)

1(Can write AND do math)

1(Some Education)

0.735

0.708

0.813

0.441

0.455

0.390

0.804

0.799

0.894

0.397

0.401

0.308

0.837

0.823

0.880

0.370

0.382

0.325

Financial Resources

1(Remittances Received)

1(Remittances Sent)

1(Positive Savings)

1(Positive Debt)

1(Above median financial stock)

1(Above median physical stock)

0.857

0.975

0.851

0.465

0.507

0.554

0.350

0.155

0.356

0.499

0.500

0.497

0.894

0.990

0.935

0.540

0.641

0.629

0.308

0.100

0.247

0.499

0.480

0.483

0.899

0.992

0.943

0.554

0.677

0.655

0.301

0.090

0.232

0.498

0.468

0.476

Enterprise Activity

1(Household has a merchant business in specified period)

Months business has been operating

1(Business Assets Owned)

1(Business Assets Bought or Sold)

Household members helping with business

Hired workers

1(Business had positive profit)

Business Profits

Notes: Except for variables on Enterprise Activity which are at the enterprise level, all other variables are at the household level.

Table 2

Summary Statistics: Enterprise Histories and Coffee Price

Whole Panel Sample

Mean

SD

1(Enterprise Ownership)

0.377

0.485

Enterprise Histories

1(Household has a business in wave 1)

1(Household has a business in wave 2)

1(Household has a business in wave 3)

1(Household has a business in wave 4)

1(Household ever switched enterprise status)

0.278

0.371

0.439

0.432

0.473

0.448

0.483

0.497

0.496

0.500

Proportion of Households with Enterprises in:

0 waves

0.723

0.448

1 waves

0.04

0.196

2 waves

0.043

0.202

3 waves

0.073

0.260

4 waves

0.122

0.328

Whole Panel Sample

Mean

SD

Coffee Price

International Robusta Coffee Price

International Robusta Coffee Price in 1990

49.344

53.603

6.309

2.76

International Robusta Coffee Price in 1991

48.621

2.3

International Robusta Coffee Price in 1992

42.658

4.451

International Robusta Coffee Price in 1993

52.497

7.335

Notes: Table 3

Which Households Own a Business?

Panel A: Household Head Characteristics

1(Male)

1(Can Write and Do Math)

1(Some Education)

1(Any Remittances)

1(Positive Savings)

1(Positive Debt)

1(Above Median Financial Stock)

Observations

Mean of Dependent Variable

1(Household Owns a Business)

1(Household Owns a Merchant Business)

1(Household Owns a Stayer: 1(Business in all 4 Non‐Merchant Business)

Waves)

0.0476

‐0.00731

0.0655***

0.0402

(0.0334)

(0.0293)

(0.0232)

(0.0274)

0.117**

0.0548

0.0655*

0.0890***

(0.0443)

(0.0337)

(0.0334)

(0.0273)

‐0.0133

0.0133

0.00726

‐0.0756**

(0.0369)

(0.0371)

(0.0304)

(0.0289)

0.0799**

(0.0341)

0.113***

(0.0272)

0.0556**

(0.0264)

0.0842***

(0.0274)

0.0189

(0.0305)

0.0412

(0.0250)

0.0582**

(0.0275)

0.0819***

(0.0199)

0.0761***

(0.0225)

0.0740***

(0.0213)

0.0145

(0.0182)

0.0345

(0.0254)

0.0392

(0.0255)

0.0609**

(0.0256)

0.0321*

(0.0186)

0.0490**

(0.0240)

2,876

0.377

2,876

0.237

2,876

0.217

752

0.122

Notes: Robust standard errors in parentheses (*** p<0.01, ** p<0.05, * p<0.1). Household characteristics are from wave 1.

Table 4

Effects of Coffee Price Changes on Coffee Production and Household Expenditures

Price/SD(Price)

ln(Price Received by Households)

ln(1+Quantity Sold)

ln(1+Coffee Revenues)

ln(1+Total Expenditure)

0.240**

(0.113)

0.293**

(0.116)

0.478**

(0.192)

0.188***

(0.0313)

ln(1+Non Food Expenditure)

Coffee Grower

ln(1+ Harvest Area Under Coffee)

0.219***

(0.034)

0.151***

(0.0303)

‐0.00573

(0.00543)

0.00856

(0.0131)

Household, Year , & Month

Fixed Effects

Observations

Number of Households

Mean of Dependent Variable

Total Expenditure

ln(1+Food Expenditure)

Household, Year & Month

668

486

1,795

714

2,879

753

2,837

753

2,837

753

2,837

753

3,515

975

2,879

753

175.3

63.52

25,069.49

244,716.90

44,211.48

94,148.61

0.761

0.605

Notes: Robust standard errors in parentheses (*** p<0.01, ** p<0.05, * p<0.1). Coffee grower is a dummy variable that is 1 if a household reported harvesting coffee in that wave. Coffee sample is a dummy variable that is 1 if a household reported harvesting coffee in any one of the 4 waves, and 0 otherwise. Harvest area under coffee is the number of acres harvested in the last 12 months if the household is surveyed in the first wave, and the number of acres harvested in the last 6 months if the household is surveyed in any subsequent wave. The mean of all dependent variables are reported in levels e.g. in the column for ln(food expenditure), the mean of the food expenditures in Tanzanian shillings is reported.

Table 5

Does Household Enterprise Activity Respond to Coffee Price Fluctuations?

1(Houshold Owns a Business)

1(Houshold Owns a Merchant Business)

1(Houshold Owns a Non‐

Merchant Business)

‐0.0511***

(0.00991)

‐0.0428***

(0.0118)

‐0.0148

(0.0111)

Price/SD(Price)

Household , Year and Month

Fixed Effects

Observations

Number of Individuals

Mean of Dependent Variable

2,879

753

2,879

753

2,879

753

0.377

0.237

0.217

Notes: Robust standard errors in parentheses (*** p<0.01, ** p<0.05, * p<0.1). Coffee grower is a dummy variable that is 1 if a household dh

ff

h

ff

l

d

bl

h

f h

h ld

dh

ff

f

Table 6

Does Household Enterprise Activity Respond to Coffee Price Fluctuations?

Conditional on Owning Conditional on Owning a Conditional on Owning a a Business

Merchant Business

Non‐Merchant Business

Weeks in Self‐Employment Price/SD(Price)

3.084

2.975**

(1.301)

3.587**

(1.691)

(1.838)

Observations

1,087

683

626

Number of Individuals

Mean of Dependent Variable

465

354

339

15.91

15.37

19.09

Fixed Effects

Notes: Robust standard errors in parentheses (*** p<0.01, ** p<0.05, * p<0.1). Weeks in self‐employment in the last 12months for the first wave and the last 6 months in all subsequent waves.

Table 7

Do Enterprise Inputs and Performance Respond to Coffee Price Fluctuations?

Capital

Price/SD(Price)

Labor

1(Business Assets Owned)

1(Business Assets Bought or Sold)

0.0884

(0.0890)

0.0589

(0.0554)

Number of Household Number of Hired Members Helping in Workers

the Business

0.192*

(0.107)

0.419**

(0.160)

Mos. Business Operating

ln(1+ Business Profits)

1(Business Had Positive Profits)

3.096***

(0.666)

0.984**

(0.381)

0.233**

(0.0995)

1,595

4.108

1,595

137.2

1,595

0.465

Household, Year and Month

Fixed Effects

Observations

Mean of Dependent Variable

Performance

1,595

0.650

1,594

0.146

1,595

0.463

1,595

0.408

Notes: Robust standard errors in parentheses (*** p<0.01, ** p<0.05, * p<0.1). The mean of all dependent variables are reported in levels e.g. in the column for ln(Business Profits) the mean of the profits in Tanzanian shillings is reported.

Table 8

Are Household Enterprise Activity Responses Heterogeneous by Household Characteristics?

1(Houshold Owns a Business)

1(Male) x Price/SD(Price)

1(Can write AND do math) x Price/SD(Price)

1(Some Education) x Price/SD(Price)

1(Any Remittances) x Price/SD(Price)

1(Positive Savings) x Price/SD(Price)

1(Positive Debt) x Price/SD(Price)

1(Above median financial stock) x Price/SD(Price)

1(Houshold Owns a Merchant Business)

1(Houshold Owns a Non‐

Merchant Business)

‐0.0190

0.00953

‐0.0230

(0.0152)

(0.0170)

(0.0158)

0.0411**

0.0573***

‐0.00640

(0.0197)

(0.0177)

(0.0182)

‐0.0129

‐0.0363**

0.0242