Life and AD&D and Disability Income Insurance Enrollment Form

advertisement

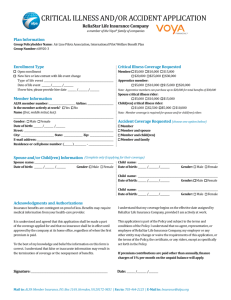

Life and AD&D and Disability Income Insurance Enrollment Form INSTRUCTIONS: Top box to be completed by the Employer/Plan Sponsor. Remainder to be completed by the Employee. Name of Employer/Plan Sponsor Smith College Class/Occupation Group/Plan Number 674508 Annual Salary Account Number/Location 0001 Date of Hire (mm/dd/yyyy) Employment Active Full-Time Status: Effective Date of Coverage This change is due to: (check all that apply) Late Entrant* or Change: Initial Eligibility Following Hire Other: ___________________________________________ Change in Coverage Amount *A late entrant is an individual who is first enrolling for supplemental or dependent life or disability income coverage after the first available opportunity. Employee Information Employee Name (last, first, middle initial) Date of Birth (mm/dd/yyyy) Social Security # Work Phone Number Employee Address (street address, city, state, zip code) Employee I.D. # Home Phone Number Female Male Disability Income Coverage Your employer provides Long Term Disability (LTD) coverage that replaces 60% of your monthly earnings during disability up to $15,000 per month. If you are a late entrant, you must complete an Evidence of Insurability form subject to approval by ReliaStar Life. Employee Life Insurance and Accidental Death & Dismemberment Insurance (AD&D) Employee Basic Life Employee Only—Elect Coverage (Note: Basic Life and Basic AD&D insurance are employer provided.) and Basic AD&D Guaranteed Issue Limit = 3 times your basic yearly earnings or $475,000 (whichever is less) Employee Supplemental Life When you are first eligible for Employee Supplemental Life coverage, you can elect up to the Guarantee Issue limit without evidence of insurability. To elect or increase coverage at all other times, you must complete an Evidence of Insurability form subject to approval by ReliaStar Life. Employee Supplemental Life Election Total Employee Supplemental Life coverage up to 5 times your basic yearly earnings or $700,000 (whichever is less) is available if you complete an Evidence of Insurability form subject to approval by ReliaStar Life. I currently have Employee Supplemental Life coverage of: 0 1 2 3 4 5 times my annual salary I am applying for additional Employee Supplemental Life coverage of: 1 2 3 4 5 times my annual salary Total Employee Supplemental Life coverage (current plus additional): 1 2 3 4 5 times my annual salary Waive Beneficiary Information Designate your beneficiary(ies) below. Name of Beneficiary (last name, first, middle initial) Address Date of Birth Name of Beneficiary (last name, first, middle initial) Address 48495 Primary Primary Contingent Date of Birth Underwritten by ReliaStar Life Insurance Company Relationship to Employee Benefit % Social Security Number Phone Number Relationship to Employee Benefit % Social Security Number Phone Number DIS/GATGI (03/10) Dependent Spouse Supplemental Life Insurance If you are covered for Employee Supplemental Life, you may elect Dependent Spouse Supplemental Life coverage. Guarantee Spouse Supplemental Life Issue Limit: $40,000 When you are initially eligible, you can elect Dependent Spouse Supplemental Life coverage up to the guarantee issue limit without evidence of insurability. To elect or increase Dependent Spouse coverage at all other times, our spouse must complete an Evidence of Insurability form subject to approval by ReliaStar Life. Spouse Name and Date of Birth Dependent Spouse Supplemental Life Election Total Dependent Spouse coverage from $10,000 up to $150,000 is available if your spouse completes an Evidence of Insurability form subject to approval by ReliaStar Life. Dependent Spouse coverage is limited to 50% of the employee’s coverage amount. Spouse Name Spouse Date of Birth I currently have Dependent Spouse Supplemental Life coverage of: $_______________ I am applying for new or additional Dependent Spouse Supplemental Life coverage of: $_______________ ($10,000 increments) Total Dependent Spouse Supplemental Life coverage (current plus additional): $_______________ Waive Note: The employee is the beneficiary for any Dependent Spouse insurance coverage. Dependent Child(ren) Supplemental Life If you are covered for Employee Supplemental Life, you may elect $5,000 or $10,000 of Dependent Child(ren) Supplemental Dependent Life coverage on your children age 6 months but less than 19 years, and full-time students less than 25 years. Children age 15 Child(ren) Supplemental Life days but less than 6 months are covered for $100 (when $5,000 is elected) of $500 (when $10,000 is elected). When you are initially eligible, you can elect Dependent Child(ren) Supplemental Life coverage without evidence of insurability. To elect or increase Dependent Child(ren) coverage at all other times, you must complete an Evidence of Insurability form for your child(ren) subject to approval by ReliaStar Life. $5,000 for each eligible dependent child. (Children age 15 days but less than 6 months are covered for $100.) Child(ren) Life $10,000 for each eligible dependent child. (Children age 15 days but less than 6 months are covered for $500.) Election Waive Note: The employee is the beneficiary for any Dependent Child(ren) insurance coverage. READ THIS INFORMATION CAREFULLY AND THEN SIGN AND DATE BELOW I authorize my employer to deduct from my wages the premium, if any, for the elected coverage. To the best of my knowledge and belief, the information I have provided on this form is correct. I understand my coverage begins on the effective date assigned by ReliaStar Life, provided I am actively at work. I also understand that evidence of insurability may be required for coverage to become effective. Employee's Signature Date Signed (mm/dd/yyyy) 48495 Underwritten by ReliaStar Life Insurance Company DIS/GATGI (03/10)