T H E T A X CONSEQUENCES O... AND PARTNERSHIP L I F E INSURANCE

advertisement

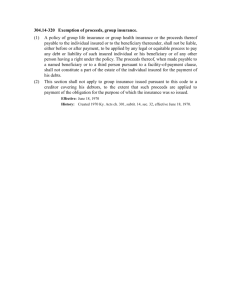

T H E T A X CONSEQUENCES O F " K E Y MAN" AND P A R T N E R S H I P L I F E CHARLES L , INSURANCE SALOMON THE TAX CONSEQUENCES OF "KEY MAN" AND PARTNERSHIP LIFE INSURANCE One of the oldest uses of life insurance in business is the indemnification off the business enterprise against financial loss resulting from the death of a I KEY employee. In its ordinary narrow connotation, "Key man life insurance is viewed as a corporate tool, much like fire or other types of indemnity coverage, which is used as a hedge against the loss of an important £ asset„ but the term has a broader application as it is so well suited to certain business purposes. In the broad area key man insurance is in effect business continuation insurance„ It is a source of liquid funds when a business enterprise can calculate a definite need for them and is used to keep the business £is s @ its together. In this context it applies equally to the partnership and to the corporate, mainly small and medium sized, business structures. The motive, whether in a corporate or partnership context is basically the same, namely to protect the investment of the other Joint owners in the going concern. The difference in the legal structure of the corporation and that of the partnership require different considerations but even though different routes are taken they often reach the same tax result. PREMIUMS In Generalt As a general rule, life insurance premiums are not deductible if the taxpayer has any interest in the policy or proceeds. The Internali Revenue Code specifically provides that no deduction shall be allowed for..... "(1) Premiums paid on any life Insurance policy covering the life of any officer or employee, or of any person financially Interested in any trade or business carried on by the taxpayer, when the taxpayer is directly 3 or Indirectly a beneficiary under such policy," The rule under (a)(1) is an "all or nothing" rule. Sec. 26k (a)(1) of the Code "does not limit the deduction In ratio to the degree of the employer's involvement as a beneficiary under the policy, but Instead provides for total disallowance„" In other words, even if the taxpayer has a right to receive only a portion of the proceeds or is an indirect beneficiary because he has 5 the power to exercise certain incidents of ownership during the insured's life, the entire premium is nondeductible* There is no question that the prohibition of Sec„ 26^ (a)(1) applies when the taxpayer is designated as beneficiary in the policy. For example, in ordinary "key man" insurance the employer is normally both the owner and beneficiary of the policy and therefore the premium payments are clearly nondeductible by reason of Sec. l6V(a|(l). But Sec. 26k (a)(1) also applies when the taxpayer is an indirect beneficiary which will be discussed subsequently. It should be noted though that the deduction will not be denied merely because the employer may derive some benefit Indirectly from G the increased efficiency of the employee. Even if the taxpayer manages to avoid the prohibition of Sec, 26k (a)(1), if he has an interest in the policy it will probably be barred on other grounds. Thus, they may be denied ass they are not ordinary and necessary 7 business expenses with in the meaning of Sec„ 162 (aK els being expenses incurred to obtain tax-exempt income (death proceeds) and consequently are nondeductible under Sec. 265 (1)? as constituting capital expenditures and therefore are not an expense. It should be noted that life insurance, unlike other types of casualty insurance„ is purchase to cover an event that is certain to occur. The Partnership The problem of when is th e taxpayer an indirect beneficiary has been broken down into the different types of business enterprises. Under the Code the partnership is not itself a taxable entity. The taxpayer(s) are the persons carrying on the business as partners in 7 their separate or Individual capacities. This caused quite a lot of early litigation on the question of who was a beneficiary, direct or indirect, under Sec, 26k (a) (1) and Its forruners. The Internal Revenue Service has been quite successful in disallowing the deduction of partnership life insurance premiums and the answer to a questibn of whether premiums paid by a partnership, or by a partner, for Insurance on the life of a co-partner are deductible is almost a universal NO, regardless of who is named beneficiary of the proceeds. In each instance, the Insured partner is a person financially Interested in the business of the partner who is paying the premiums. The scope of the term direct or indirect beneficiary under Sec. Z6b (a)(1) is not limited to the person named in the policy, but may include one whose interests are "indirectly favorably affected thereby*" When the policy or policies are purchased inorder to protect the partnership investment by keeping it in tact, the premium paying partner will benefit from the policy. ance„ This is the purpose of most partnership insurIt can take a form, much like "key-man"' coverage, when one partner insures his own life naming his co-partner (s) as irrevocable beneficiary (s) and vesting in them all of the Incidents of ownership in order to induce the co-partner to maintain his investment in the partnership, the insured partner is indirectly a beneficiary under the policy.11 The insured's benefit is the continued participation of his co-partner in the business.12 The deduction of premiums for life insurance, on the life of a partner to insure repayment of a loan has also been denied along the same grounds. One of the main objects of partnership insurance is to hold together the assets of the firm and pass them to the surviving partners intact, A good analysis of a typical situation is discussed in the Keefe Case. In this case each partner took out a policy on his own life naming his co-partners as irrevocable beneficiaries without retaining any rights in the policy. This was done pursuant to a partnership agreement that required the proceeds from the policy and certain cash on hand be paid into the insured's estate in complete satisfaction of the deceased insured's interests in the business. Each partner was to pay the premiums on the policy on his own life. The court states that this situation must be "viewed as a whole" and that each partner was an indirect beneficiary because of the reciprocal nature of their agreement even though taken separately they would not appear to be beneficiaries.15 -6- It is not necessary to be "the" beneficiary but Just "a" beneficiary and as these policies are part of an interdependent reciprocal arrangement they do receive definable benefits. 16 It makes no difference whether the policies are assigned to the partnership, who pays the premiums,17 or whether 18 a co-partner pays the premiums. It should be noted that the taxpayer is considered to be a "a person financially interested" in his own business under Sec. 26k (a)(1). The opening statement of this section might be regarded as too broad as there might possibly be exceptions to the application of Sec. 26k (a)(1) in the partnership use of business life insurance. There might very well be circumstances that would fall under a literal reading of this section but be outside its intended purpose and as Judge Learned Hand put it "There is no more likely way to misapprehend the meaning of languageu... than to read the words literally, forgetting the object which the document (statute in this situation) as a whole is meant to secure." 20 There is no rule of law forbidding resort to explanatory legislative history no matter how clear the statute appears, 21 But there is nothing to indicate what Congress meant except the words themselves in x Sec 9 l6k (a)(1) as this provision has been in the law for many years without comment B 22 -7- U.4. The Corporationi As a general rule a corporation cannot deduct the premiums it pays on "key man" life insurance as it is usually both owner and beneficiary of the policy, so the deduction is disallowable by reason of Sec. 26^ (a)(1) of the Codej but some problems are presented where the insurance has a duel purpose or where the beneficiary is revocably or irrevocably someone other than the corporation. Deductions have been disallowed, under Sec. 26k (a)(1), where the taxpayer is only indirectly a beneficiary under the policy. Where the corporation had control of the policy it had taken out on the life of the "key man" and could have surrendered the policy and received the cash surrender value the corporation is a beneficiary„^ The Internal Revenue Service has ruled that an employer who purchases a life insurance policy for key employees in order to retain their services may not deduct the premiums during the period the employer has any interests in the policy.2^ This has long been the rule, as in the Omaha Elevator Co. Case25 where the corporation had control of the policies on the lives of its employe® and could not deduct the premiums even though it had entered into a binding agreement with them where the employee designated the beneficiaryo The Court held that the corporation could cancel, receive cash surrender value or make loans on the policies and this control made it a beneficiary under the terms of Sec. 164 (a)(1), Similary, a tax- payer has been deemed to be an indirect beneficiary of a policy where it was assigned as security for the corporate debt,2^ A deduction will probably also be denied for premiums paid under a "key man" policy where the stockholders are named as beneficiaries. An early ruling held that the corporation was an indirect beneficiary^but there is some question in this area as the Internal Revenue Service has declared this ruling to be obsolete po although "not specifically revoked or superseded". Alsoe where the stockholder pays premiums on the life of a "key mian" and the corporation is the beneficiary the premiums are still not deductible to anyone as the business of the corporation is not the business of the stockholders j 2 ^ and therefore the stockholder is not carrying on any trade or business within the meaning of Sec, 162 (a).3° A deduction will be disallowed, also, where the insured is a stockholder and the proceeds are to be used to fianace a redemption of the insured's stock, even though the corporation may have no right to the cash value of the policy, and no right to name or change the beneficiary,^1 The deduction is disallowable because -9- the premium payments are not ordlnai*y and necessary business expenses,-^ TAX LIABILITY OP THE INSURED Generally speaking, the premiums are not taxable to the insured if the insurance is purchased for the benefit of the business and the Insured has no interest in the p o l i c y . a somewhat similar result is reached when the insurance is on the life of a stockholder but is used to fund a stock redemption agreement. The pre- miums are not taxable to the insured provided the beneficiary's right to receive the proceeds is conditioned upon the transfer of his stock to the corporation,-^ There is no distribution to the stockholder. On the other hand, where the proceeds were paid to fund a stock purchase agreement between the individual stockholder*6 3< it has been ruled that these were dividends.JJ The same general rule applies whether the business is a corporation or a partnership, even though the cases concern the corporate entity. The taxation of partner- ship as a group of individuals rather than a entity 36 avoids many of the problems raised in regards to corporations. A much more difficult problem is presented by the Casctle Case37 where the insured was' president of the -10- corporation and its major stockholder (98%). The corporation was both owner and beneficiary or a retirement income contract on the president's life which the corporation had purchased to hedge its obligations to the insured under a deferred compensation agreement. The Tax Court held that the premiums paid by the corporation were additional compensation and therefore taxable income to the insured. They were not deductible by the corporation as it had beneficial interests in the policy. But on appeal the tax court was reversed on the grounds that as long as a corporation was not a sham and alter ego of the president the corporation's separate entity could not be ignored. The Court also found that the insured had received no current economic benefit which would constitute taxable income but this is questionable as upon maturity of the policy the insured had a vested right in benefits. There is another possibility, in similar circumstances the Internal Revenue Service considers the proceeds rather than the premiums to be taxable income aisdthis might be applied whether it's held to be a dividend or compensation.^ further in the proceeds section. -11- This is discussed TAXATION OF DEATH PROCEEDS In Generals As a general rule, the entire lump sum payable to any beneficiary by reason of insured's death Is exempt from income tax whether the beneficiary is an individual, a corporation, a partnership, a trust, or insured's kf) estate. u It should be noted that the Code expressly provides that the proceeds are taxable, under some circumstances, namely where the policy has previously been sold or otherwise transferred for a valuable consideration> There is also danger that the death proceeds may be considered taxable income from a wagering contract instead of tax-exempt life insurance proceeds, insur- able Interest is determined by the law of the various states.^ it faily well settled though that a corp- oration has an insurable interest in its key employees.^ The Partnership When a partner receives the death proceeds of a life insurance policy on the life of a co-partner they are excluded from his income.^ Proceeds received by a part- nership retain their tax-exempt character when passed on to the individual partners.^ It makes no difference -12- • -ilO whether the partner or the partnership is a transferee for value. The transfer-for-value exception of Sec. 101 (a)(2)(b) applies where the policy is transferred to a partner of the insured or to a partnership in which the insured is a partner. Moreover, if a policy is trans- ferred more than once, and the last transfer is to a partner of the Insured, or to a partnership In which the Insured is a partner, the proceeds will be entirely tax-exempt regardless of any previous transfer for value This would allow th^artners to set up a cross-purchase agreement funded by life insurance even if one partner was uninsurable at the time of the agreement by allowing him to transfer any policy previously taken out on his life, even if it had been owned by a third person, and have; the proceeds retain their tax-exempt status. The Corporation The corporation presents a more complicated picture than does the partnership because of the "separate entity" theory. In the simple "keyman" situation, the corporation is both owner and beneficiary of the policy and under Sec. 101 the proceeds would be tax-exempt,,in the hands of the corporation. A corporation can also take advantage of the transfer for value exception where the insured is a stockholder or officer of the corporation in-'much the -13- same manner as the partnership, but not if the insured is a non-officer employee or director. Also, it is doubtful whether the holder of a few qualifying shares would be considered a "shareholder" or whether a person who is only nominally an officer, with no real executive authority or duties would be considered an "officer".**8 The regulations do not define the terms "shareholder" and "officer" for this purpose. It should also be noted that the transfer for value exception does not apply between co-stockholders or co-officers or from the corporation to any person not the insured. The difference between the partnerships treatment and that of the corporation Is most evident when for some reason the corporation finds it desirable to distribute the death proceeds. Once proceeds have been received tax-free by the corporation they lose their tax-exempt character as life insurance proceeds. Therefore, if the corporation distributes the proceeds to its shareholders, the shareholders will be treated as having received a taxable dividend.^9 Also, if the insured is an employee and the proceeds are paid to his widow or other personal beneficiary, they may be treated as 50 compensation for services.-' If the corporation can foresee that it will desire to distribute the death proceeds to the shareholders, it can attempt a tax free distribution. On one hand, if the corporation receives the proceeds and distributes uj jve/?.e them it is taxable but, if, on the other extremeTTthe corporation has no ownership rights in the policy and is not the beneficiary, the proceeds should be received tax free by the beneficiary as life insurance proceeds.^1 Under these circumstances, the payment of premiums by the corporation on policies owned by the stockholders was the taxable distribution, not the payment of the death proceeds, even if paid through a trustee as a conduit, But when the corporation choses the middle ground there is some conflict in the cases. In the Golden C a s e „ t h e corporation entered into a contract with and delivered unmatured insurance policies to a trust company, who agreed to collect the proceeds and distribute them to the stockholders. The Court conceded that the proceeds were life insurance proceeds but said that they were also in the nature of dividends and, possibly because the corporation had retained some interests in the policies, the dividend label was placed on themu The Ducros C a s e r e a c h e d conclusion,, Just the opposite In this case the corporation owned the policy and the individual stockholders were named as revocable beneficiaries in the policy. -15- The Court held that the proceeds, received directly by the shareholders from the Insurance company, were life insurance proceeds and, therefore, tax exempt. The Internal Revenue Service has announced its refusal to follow the Ducros Case. "It is the position of the Service that life insurance proceeds paid to stockholders of a corporation are taxable as dividends in cases where the corporation uses its earnings to pay the insurance premiums and has all incidents of ownership including the right to name Itself beneficiary, even though the corporation does not name itself beneficiary and therefore, is not entitled to and does not in fact receive the proceeds. 57 The view in the Golden Case one. probably is the correct The Court in Ducros^^distinguished the Golden Case"^ pn account of the trust arrangements but this should not make any difference.^0 The Court in Golden^held that a corporation cannot make a gift to its shareholders and any receipt of funds caused to flow from the corporation to the shareholders "out of its (the corporation's) earnings or profits accumulated after Feb. 28, 1913" are dividends?2 The tax free distribution of earnings is obviously opposed to the statute but by allowing the proceeds to go -16- untaxed the Court has done exactly that. The premium payments were not taxable as distributions as the corporation had control over the policy and could cancel the policy, borrow, or change the beneficiary so no economic benefit had accrued to the stockholders.1 In dicta the Court in Pucros^3 indicates that possibly the cash surrender value might be taxed but the point in time when the stockholders became irrevocable beneficiaries was at the death of the insured and at that time the cash surrender value was equal to the proceeds. Therefore, the proceeds should be the value of the distribution received by stockholders under such circumstances . ^ TAXATION -OF THE PROCEEDS OF BUSINESS LIFE INSURANCE IN THE INSURED'S ESTATE The Partnership Where the co-partners of the insured is the complete owner and beneficiary of a policy of life insurance, the proceeds are not includable in the estate of the insured as he has no interest in the policy. The pro- blem in regards to partnership insurance is presented when the partnership rather than the individual partners is the absolute owner and beneficiary of the policy. It then can be contended that the insured partner has -17- • "incidents of ownership" exercised "in conjunction with any other p e r s o n s n a m e l y his co-partners, but some early cases^ have held, that where the partnership is the aboslute owner and the insured has none of the "incidents of ownership" except through the partnership, that the proceeds are not includable but these cases deal primarily with the "payments of premiums test" applicable to estates of decedents dying before Aug. 17, 195^. It appears that the Internal Revenue Service will only include such proceeds of life insurance received by the partnership by Including them with other partnership assets in determining the value of decedents partnership interest for estate tax purposes. If the insured has personal incidents of ownership in the policy the entire value of the proceeds will be includable in his gross estate,^ Some costly errors can be avoided by carefully planning the purchase and use of partnership life insurance, as the actions taken can most effect the estate tax consequences of such use. Where the part- nership is simply insuring Itself against the loss of i a "key man", it should strive to keep as much of the proceeds as possible out of the deceased insured's estate. When the partnership is absolute owner and beneficiary, the proceeds will be considered a -18- partnership asset and decedents pro rata share will fall into his estate. The premiums will not be deductible, whether the partnership or the individual partners pay them and the proceeds will not be taxable as income under Sec. 101. So where the object of the purchase is to compensate the insured's co-partners upon his death, the partners should consider removing the policies from the partnership to the ownership of those intended as beneficiaries, insured's co-partners. None of the pro- ceeds, assuming the insured possessed none of the incidents of ownership, would fall into the insured's estate. But in many Instances, partnership insurance is intended to supply funds fo r the purchase by the remaining partner^ of the deceased partner's interest in the partnership and is reciprocal in nature. If, under sucft an arrangement, the proceeds are not payable to insured's 68 estate, and the insured has no incidents of ownership in the policies on his life, the proceeds are not includable in his gross estate.^ It should be noted that the value of any unmatured policies that the deceased owns on the life of his co-partners will be includable in his gross estate along with his interest in the partnership. If the proceeds are payable to the insured's estate, or if the insured has any of the incidents of -19- ownership in a policy on his life, the proceeds are includable in his gross estate. However, where the proceeds are includable in the gross estate but the estate is obligated to apply them to the purchase price of the insured's business interest, the value of the business interest will be includable in the gross estate only to the extent that it exceeds the value of the proceeds. Therefore, both the business interests and the proceeds are not taxed and double taxation is avoided. Case law has established rules whereby under certain conditions, business purchase agreements can be used to fix the value of a partnership interest or close corporation stock for estate tax purposes but it is beyond the scope of this paper. The Corporation In many respects the inclusion of death proceeds of "key man" insurance in the estate of the Insured is much like that of the partnership where the insured is a noncontrblling stockholder or officer. Where the key-man is only an officer and the corporation is the absolute owner and beneficiary there is no grounds for Including any of the proceeds in the insured's estate. -20- In the case of a non-controlling stockholder, the proceeds will be included as a corporate assets in determining the value of his stock? consequently, like the partnership ownership, only a pro rata share of the value of the proceeds, proportionate to his stock ownership will be included in his gross estate. The entire value of the proceeds, will be included as a corporate asset.^ Note that it may be possible to obtain some reduction in the value of the stock to reflect the loss to the business of the key man"s services.^2 A much more complicated problem is presented when ' the officer-stockholder is the controlling shareholder as is usually the case in a closely held corporation. The indirect possession cf ownership rights by the insured may cause the proceeds to be included in his gross estate. Thus, the regulations state that the term "incidents.of ownership" includes a power to change the beneficiary reserved to a corporation of which the decedent is the sole stockholder.^ ( In the case of a 100$ stockholder, it makes no difference whether the amount of the proceeds is Included in the gross estate as insurance or as a part of the value of the stock, but what happens when the controlling stockholder is not the sole stockholder of the corporation. The -21- 428 Internal Revenue Service ruled?1* that this regulation is applicable in any circumstance where the insured decedent could exercise voting control of the corporation, and pointed out that while "the 100$ ownership situation provides the clearest example of a circumstance under which an insured decedent had the power to exercise incidents of ownership in a policy of Insurance owned by his company, it is not the only situation In which decedent's ownership of stock will include control of incidents of ownership possessed by a corporation;, to the contrary, the regulation is applicable in circumstances where the insured decedent, or his estate, could exercise voting control of the corporation despite the combined votes of all of the other stockholders. Thus, according to this ruling, the entire proceeds of a policy of insurance on the life of a controlling stockholder, although the insurance is owned by and payable to the corporation, are includable in the insured's gross estate. The result in the revenue ruling example would cause 100$ of the proceeds to be included In the deceased insured stockholder's gross estate as insurance on the life of decedent even though the insured only owned 75$ of the corporate stock. The ruling states that if the proceeds are included in the insured's gross estate as insurance, they should not be reflected in the value -22- of the insured's stock and that the actual percentage of stock needed for "control" will depend upon the respective state laws but the meaning of "control" was not otherwise defined though the ruling mentions the power to cause dissolution of the corporation which would effectuate a cancellation or distribution of the insurance policy and the power to elect the officers and directors which would allow the exercise of the incidents of ownership without the necessity of acquiring the policy itself. The Internal Revenue Service has had second thoughts about this ruling insofar as it includes "incidents of ownership" as a power to change the beneficiary reserved to a corporation of which the insured-decedent is in 75 control has withdrawn it pending reconsideration. Depending on the subsequent ruling of the Internal Revenue Service this area will likely fcesult in some future litigation. -23- FOOTNOTES 1.) S. P. Simmons, Federal Taxation of Life Insurance, P. 117, A.L.I.-A.B.A. Taxation/Practice Handbook, (1966). 2.) W. M. Goldstein, Tax Aspects of Corporate Business Use of Life Insurance, 18 Tax L, Rev? 133,(1963). 3.) Internal Revenue Code Sec. 261+(a)(l). ) Rev. Rul. 66-203, 1966-2 Cum. Bull. 10^. 5.) "Incidents of ownership" is not defined in this paper but a concise discussion appears in Simmons supra note 1 at p. 20. 6.) Internal Revenue Reg. Sec. 1.26^-l(b). 7.) Joseph Nussbaum, 19 B.T.A. 868 (1930). 8.) Rev. Rul. 70-117, 1970-1 Cum. Bull. 308 Merrimac Hat Corp., 29 B.T.A. 690 T W 5 k T ° 9.) Internal Revenue Code Sec. 701. 10.) J. H. Parker, 13 B.T.A. 115 at 116 (1928). 11.) Internal Revenue Reg. Sec. 1.26^-1(b). 12.) Rev. Rul. 73, 1953-1 Cum. Bull. 63. 13.) Alexander E. Yarnell, 9 T.C. 616 ( 1 9 W » aff'd per curiam, 170 F.2d 272 (3d Clr., 19^8), 37 A.F.T.R. 355. 1^.) Ernest J. Keefe, 15 T.C. 9^7 (1950). 15.) Nussbaum, supra note 7. 16.) Keefe, supra note l*k 17.) Clarence W. Mc Kay, 10 B.T.A. 9^9 (1928). 18.) Yarnell, supra note 13. 19.) Internal Revenue \ Sec. l„26^-l(a). 20.) Central Hanover Bank & Trust Co. v. Commissoner of Internal Revenue, 159 F.2d 167 at 169, 35 A.F.T.R. 652 (2d Clr., 19^7)o Harrison v. Northern Trust Co., 317 U.S. 476 (1942). Yarnall, supra note 13. Wilcox Investment Co., 3 T.C. 458 (1944). Rev. Rul. 66-203, supra note 4$ Rev. Rul. 70-148, 1970-1 Cum. Bull. 60. Omaha Elevator Co., 6 B.T.A. 8i7 (1927). Peerless Patern Co., 29 B.T.A. 767 (193*0. 0. D. 659, 3 Cum. ftull. 192 (1920). Rev. Rul. 69-661, 1969-2 Gwm. Bull. 265. Burrnett V. Clark, 287 U.S. 410 ( ). Mary E. Cappon, 28 B.T.A. 357 (1933). Rev. Rul. 70-117, 1970-1 Cum. Bull. 30. Atlas Heating and Ventilating Co,, 18 B.T.A. 389 (1929) Edward D. Lacy, 4l T.C. 329 (196*0, acq. 1964-2 Cum. Bull. 6. Rev. Rul. 59-184,1959-1 Sum. Bull. 65? Prunier v. Commissioner of Internal=5?£venTre-r 248 F.29 818, 52 A.F.T.R. 093, (1st Clr., 1957). Atlas Heating and Ventilating Co., supra note 32, Code, supra note 9, Casale v. Commissioner of Internal Revenue, 247 F.2d 440, 52 A.FoT.R. 122 (2d Clr,, 1957). Rev. Rul0 59-184, 1959-1 Gum. Bull. 65. Rev„ Rul. 61-134, 1961-2 Cum. Bull. 251. ^0.) Internal Revenue Code Sec. 101(a)5 Internal Revenue Reg. Sec. 1.101-l(a)§ United States v. Supplee-Biddle Hardware Co., 265 U.S. I89. lH.) Internal Revenue Code Sec. 101(a)(2). ^2.) Internal Revenue Code Sec. 101(a)(2)(B). ^3.) Ducros v. Commissioner of Internal revenue, 272 F.2d ^A.F.T.R.2d 2855(0th Clr. , 1959). kk.) United States v. Supplee-Biddle Hardware Co, supra note 40; Emelold Co. v. Commissioner of Internal Revenue, I89 F.2d 230(3rd Clr., 1951). ^5.) Code, supra note ^0, Internal Revenue Code Sec„ 702(b). ^•7.) Internal Revenue Reg. Sec. 1.101-l(b) (3). k8.) Rev. Rul. 68-300, 1968-1 Cum. Bull. 159. ^9.) Cummings v. Commissioner of Internal Revenue, 73F.2d ^77J A.F.T.R. 736 (1st Cir.v 193*0§ Isaac May, 20 B.T.A. 282 (1930)? Rev. Rul. 71-79, 1971-1 Cum. Bull. 112. 50.) Salmonson v. United States, 11 A.F.T.R.2d 1568 (D.C. Wash. 2963)$ but see Rhodes v. Gray, k A.F.T.R.2d 5382 (D.C. Ky., 1959) and Rev. Rul. 55-63, 1955-1 Cum. Bull. 227* 51.) Code, supra note kOi Doran v. Commissioner of Internal Revenue, Zk6 F.2d 93^. 52 A.P.T.R. (9th Cir., 1957). 52.) Doran, supra note 51. 53.) Golden v. Commissioner of Internal Revenue, 113 F.2d 590, 25 A.F.T.R. ^29 (3rd Cir., 19^0). 54.) Ducros, supra note 55.) Ducros, supra note kj, 56.) Rev. Rul. 61-13^, 1961-2 Cum. Bull. 250. 57.) Golden, supra note 53. 428 :OU 58.) Ducros, supra note 43. 59.) Golden, supra note 53. 60.) Doran, supra note 51. 61.) Golden, supra note 53. 62.) Internal Revenue Code Sec. 316(a)(1). 6 3 . ) Ducros, supra note 43. 64.) Rev. Rul., supra note 56. 6 5 . ) Internal Revenue Code Sec. 2042 (2). 66.) Estate of Frank H. Knipp, 25 T.C. 153 (1955); Estate of George Herbert Atkins, 2 T.C. 332 (1943). 6?.) Code, supra note 655 Hall v. Wheeler, 174 F.Supp. 4l8„ 4 A.F.T.R.2d 6032 91959)? Estate of Grant H. Piggott, T.C. Memo. 1963-61, aff'd 340 F.2d 829, 15 A.F.T»R.2d 1310 (6th Clr,, 1965). 68.) Note Howard F, Infante, T.C. Memo 70,206 (1970), In this case the Tax Court held that a provision in 69.) the agreement which prohibited the policy owner from surrendering the policy, borrowing aganist the policy, or changing the beneficiary of the policy with out the insured's consent did not give the insured incidents of ownership in the policy., 70.) Estate of Ray E. Tompkins, 13 T.C. 1054 (1949), acq. in 1950-1 Cum. Bull. 5. 71.) Estate of D. J. Kennedy, 4 B.T.A. 330 (1926). • 72.) Rev. Rul. 59-60, Sec. 4.02(b), 1959-1 Cum, Bull. 237s Newell v. Commissioner of Internal Revenue, 66 F.2d 102, 12 A.F.T.Ro 936 (7th Cir., 1933). 73.) Internal Revenue Reg. Sec. 20.2042-l(c)(2). 7 4 . ) Rev. Rul0 71-463, I.R0B. 1971-^2, p„ 25. 7 5 . ) Rev. Rul„ 72-167? XqR.B. 1972-15* P» 19. -Z. 7 -