Press Release Inflation high but impact evenly felt

advertisement

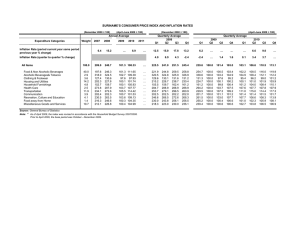

Press Release Tel: +44 (0) 20 7291 4800 Fax: +44 (0) 20 7323 4780 Inflation high but impact evenly felt mailbox@ifs.org.uk www.ifs.org.uk Today the Office for National Statistics published its inflation figures for the year to January 2011. These figures are the first to include the effect of the increase in the main rate of VAT from 17.5% to 20%, which took place on January 4th. Annual inflation was 5.1% in January based on the Retail Prices Index (RPI) and 4% based on the Consumer Prices Index (CPI). 7 Ridgmount Street London WC1E 7AE These rates are economy-wide averages based on average spending patterns. However, inflation rates vary for individual households depending on their own spending behaviour. Based on the RPI measure of inflation, Table 1 shows our estimates of annual average household inflation rates in January 2011 according to total household income. It shows that inflation was high for households across the income distribution with little variation across income groups. The poorest income decile (the poorest 10% of the population) experienced an average inflation rate of 4.9% whilst the average inflation rate for the richest decile was 5.2%. Table 1: Average household-level inflation rates, by income group Income Quintile Inflation Rates Jan 2010 – Jan 2011 Poorest 4.9% 2nd 4.9% 3rd 4.9% 4th 5.1% 5th 5.2% 6th 5.2% 7th 5.2% 8th 5.3% 9th 5.2% Richest 5.2% All RPI Embargo Immediate release Tues 15 February 2011 Contacts Bonnie Brimstone Institute for Fiscal Studies 020 7291 4800 5.1% 5.1% The fact that the average rates do not differ greatly across the income distribution is driven by the fact that the prices of different spending categories have increased at more similar rates than they have in recent years. Previous IFS research showed that in 2008 and early 2009, there were substantial differences in the average rates experienced by richer and poorer households. Table 2 shows annual average household inflation rates in January 2011 according to the age group of the household head. There are no large differences in average inflation rates across age groups. Those aged between 45 and the state pension age (60 for women, 65 for men) saw a slightly higher inflation rate than average whilst the youngest age-group saw a slightly lower inflation rate than average. Pensioners experienced average inflation rates that were slightly lower than for non-pensioners. Director: Paul Johnson Research Director: Richard Blundell The Institute for Fiscal Studies Limited by Guarantee, Registered in England: 954616 7 Ridgmount Street London WC1E 7AE Registered Charity: 258815 VAT no: GB 394 5830 17 Table 2: Average household-level inflation rates, by age group of head Inflation Rates Jan 2010 – Jan 2011 Under 35 4.8% 35-45 5.1% 45-Pensionable age 5.3% All Non Pensioners Pensioners 5.2% 5.0% Table 3 shows annual average inflation rates in January 2011 according to family type. “Other household types” (e.g. extended families and multiple family units within the same household) experienced the highest inflation rate among these groups while single pensioners experienced the lowest. Table 3: Average household-level inflation rates, by family type Family Type Inflation Rates Jan 2010 – Jan 2011 Non Pensioner groups Single Male 4.7% Single Female 4.9% Lone Parent 4.7% Couple, no children 5.2% Couple, with children 5.3% Pensioner groups Single Male Single Female Couple 4.6% 4.6% 5.4% Other household types, with children Other households types, without children 5.5% 5.4% IFS Research Economist Peter Levell said “Although today’s figures show that the headline rate of inflation was high, there is relatively little variation in average inflation rates across household types”. ENDS Notes to Editors: 1. This analysis was funded by the ESRC Centre for the Microeconomic Analysis of Public Policy and Consumer Focus. 2. A more detailed analysis of household specific inflation rates across groups and across time with a particular emphasis on the impact of inflation in fuel and water prices will be published next month by IFS as part of research funded by Consumer Focus. 3. This analysis was carried out using detailed expenditure data from the 2009 Living Costs and Food Survey (LCFS) and the January 2011 price data published today by the ONS. 4. Previous IFS research on this issue can be found at http://www.ifs.org.uk/pr/inflation_fss09.pdf. 5. Table 1 shows that the average inflation rate across households in January 2011 was the same as the RPI figure. These numbers need not however be the same in general. For instance, the RPI figure will be more heavily influenced by the inflation rate of richer households since, as they spend more, they contribute more to the average economy-wide expenditure patterns on which the overall RPI is based. Our average gives equal weight to richer and poorer households. Our methodology is explained in Section 3 of Leicester, A., O’Dea, C., Oldfield, Z., The Inflation Experience of Older Households, IFS Commentary 106, available at http://www.ifs.org.uk/comms/comm106.pdf The Institute for Fiscal Studies Limited by Guarantee, Registered in England: 954616 7 Ridgmount Street London WC1E 7AE IFS hosts two ESRC Research Centres.