MAX'S TAXES: A TAX-BASED TRUSTS

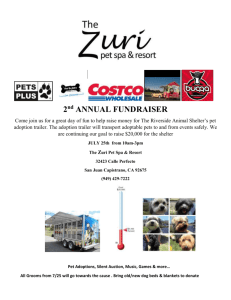

advertisement