NOTICE TO INSUREDS READ THIS NOTICE CAREFULLY BEFORE ACCESSING THE FOLLOWING

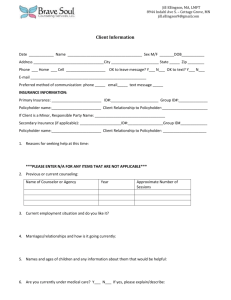

advertisement