Document 12828901

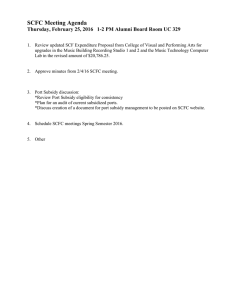

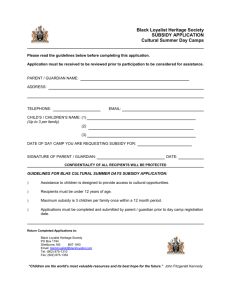

advertisement