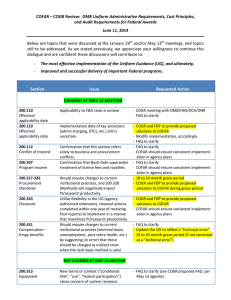

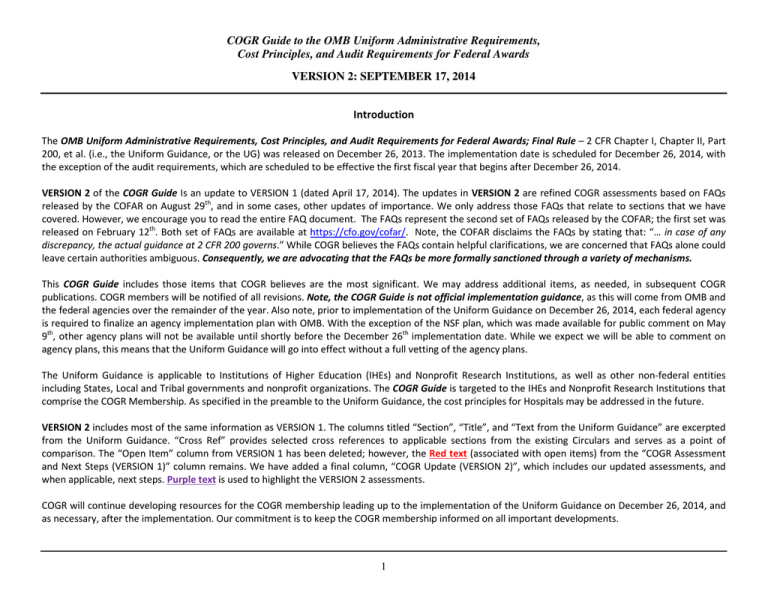

COGR Guide to the OMB Uniform Administrative Requirements,

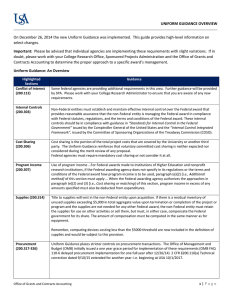

advertisement