The public finances Election 2005 Institute for Fiscal Studies www.ifs.org.uk/election/index05.php

advertisement

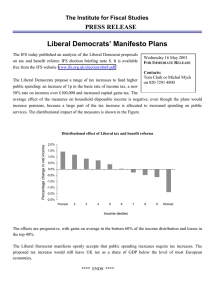

The public finances Election 2005 Institute for Fiscal Studies www.ifs.org.uk/election/index05.php Liberal Democrats • Giveaway policies • Abolition of council tax • Stamp duty threshold increased to £150k • Enhanced citizen’s pension for those aged 75+ • Free personal care for those aged 65+ • Abolition of tuition fees • In 2007–08 this equates to £8.1bn of spending increases and £23.7bn of tax cuts Liberal Democrats • Takeaway policies • 49p rate of income tax on incomes >£100,000 pa • New local income tax on incomes up to £100,000 (set at lower level than current council tax) • Large cuts to business subsidies, abolition of child trust fund and eurofighter, plus others • In 2007–08 this equates to £5.7bn of spending cuts and £26.6bn of tax increases The parties compared: 2007–08 Net change in tax Liberal Democrats +£2.9bn Net change in spending +£2.4bn Net change in borrowing –£0.5bn Liberal Democrats • Risks: • 49p rate might not raise as much as expected • Spending commitments might cost more than expected • But margin averaging £1.0bn a year over first 4 years could cover any shortfall Conservatives • Giveaway policies • Cutting council tax of some pensioners • Increased support for pension saving • Stamp duty threshold increased to £250k • Earnings-indexation of the basic state pension • Slightly more spending on police and defence • In 2007–08 this equates to £1.3bn of spending increases and £4.0bn of tax cuts Stamp duty land tax • Rationale for taxing property transactions unclear • Abolition would probably increase economic efficiency • Increases in threshold moves towards abolition • Primary gainers owners of properties • Unless cutting stamp duty increases the property stock Conservatives • Takeaway policies • Gershon efficiency savings • James Review • In 2007–08 this equates to £13.3bn of spending cuts (and no tax increases) The parties compared: 2007–08 Conservatives Net change in tax –£4.0bn Net change in spending –£12.0bn Net change in borrowing –£8.0bn Conservatives • Risks: • Spending cuts might not be deliverable in planned timescale • Spending plans might lead to lower than expected quality of public services Redistributing ‘savings’ 30.0 Labour / Liberal Democrats Conservatives 20.0 £ billion 0.0 -10.0 23.0 21.5 10.0 0.0 -12.0 -21.5 -21.5 -20.0 -13.5 -30.0 Efficiency 'Additional' 'savings' spending Net change Efficiency 'Additional' & other spending 'savings' Net change Note: Figures rounded to nearest £½ bn Spending growth: Labour Average annual real growth in spending, April 2006 to March 2008 NHS 7.1 Int Development 5.7 Education 3.5 Total spending 2.9 Other 2.5 Police 2.4 Transport 2.2 Defence 1.3 Social security 0.9 -2 -1 0 1 2 3 4 5 Average annual real growth 6 7 8 Note: Real growth estimated using GDP deflator Spending growth: Conservatives Average annual real growth in spending, April 2006 to March 2008 NHS 7.1 Int Development 5.7 Schools 3.3 Total spending 1.9 Other -0.8 Police 3.2 Transport 2.2 Defence 1.6 Social security 1.1 -2 -1 0 1 2 3 4 Average annual real growth 5 6 7 8 Note: Real growth estimated using GDP deflator Planned differences in 2007–08 Spending in 2007–08 by the Conservatives relative to Labour Defence (+£0.6bn) 1.8 Cut relative to Labour Social security benefits and tax credits (+£0.5bn) Education and Skills (–£0.9bn) 0.3 Increase relative to Labour -10.1 -10.9 Home Office (–£1.5bn) Const. Affairs and Attorney General's (–£0.5bn) Foreign and Commonwealth Office (–£0.2bn) Culture, Media and Sport (–£0.3bn) -17.6 Trade and Industry (–£1.2bn) -17.9 -12.5 Chancellor's Departments (–£1.2bn) -21.8 Office of the Deputy Prime Minister (–£2.8bn) -28.6 -28.6 Environment, Food and Rural Affairs (–£1.0bn) Work and Pensions (–£2.7bn) Non-NHS health (–£0.9bn) -2.5 -32.9 -42.9 -50 -45 -40 -35 -30 -25 -20 -15 -10 -5 0 Percentage difference relative to Labour plans 5 The parties compared: 2007–08 Conservatives Liberal Democrats Net change in tax –£4.0bn +£2.9bn Net change in spending –£12.0bn +£2.4bn Net change in borrowing –£8.0bn –£0.5bn The parties compared: 2007–08 Conservatives Liberal Democrats Net change in tax –£4.0bn +£2.9bn Labour baseline plans +£14bn Net change in spending –£12.0bn +£2.4bn +£5bn Net change in borrowing –£8.0bn –£0.5bn –£8bn 2011–12 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 Labour 2002–03 2001–02 2000–01 1999–2000 45.0 44.0 43.0 42.0 41.0 40.0 39.0 38.0 37.0 36.0 35.0 1998–99 1997–98 1996–97 Percentage of national income Total public spending Budget 2005 basis Conservatives Liberal Democrats 2011–12 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 2002–03 2001–02 2000–01 1999–2000 45.0 44.0 43.0 42.0 41.0 40.0 39.0 38.0 37.0 36.0 35.0 1998–99 1997–98 1996–97 Percentage of national income Total public spending IFS Green Budget 2005 basis Labour Conservatives Liberal Democrats Average public spending 41.5 42.2 Liberal Democrats 1? Labour 1+2 42.1 Conservatives 1? 39.1 Labour 3? 38.2 40.1 Labour 2 Percentage of national income 50.0 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Labour 1 Budget 2005 basis Budget 2005 basis 45.0 44.0 43.0 42.0 41.0 40.0 39.0 38.0 37.0 36.0 35.0 Labour Conservatives Liberal Democrats 2011–12 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 2002–03 2001–02 2000–01 1999–2000 1998–99 1997–98 Conservatives - with additional tax cuts 1996–97 Percentage of national income Total current receipts Percentage of national income 38.8 37.9 38.4 40.0 39.8 40.2 39.5 Labour 2 Labour 1+2 Labour 3? Conservatives 1? Liberal Democrats 1? Conservatives extra cuts 1? 50.0 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 Labour 1 Average Government receipts Budget 2005 basis 2011–12 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 2002–03 2001–02 2000–01 1999–2000 1998–99 45.0 44.0 43.0 42.0 41.0 40.0 39.0 38.0 37.0 36.0 35.0 1997–98 1996–97 Percentage of national income Total current receipts IFS Green Budget 2005 basis Labour Conservatives Liberal Democrats Current budget surplus Budget 2005 basis 2.0 1.0 0.0 -1.0 Labour (also Conservatives with additional tax cuts) Conservatives Liberal Democrats -2.0 -3.0 2011–12 2010–11 2009–10 2008–09 2007–08 2006–07 2005–06 2004–05 2003–04 2002–03 2001–02 2000–01 1999–2000 1998–99 1997–98 -4.0 1996–97 Percentage of national income 3.0 -1.0 -1.5 0.5 0.0 -0.5 -0.9 0.1 0.4 Liberal Democrats 1? Conservatives 1? 0.2 Labour 3? 2.0 Labour 1+2 Labour 2 1.5 Labour 1 Percentage of national income Average current budget surplus Budget 2005 basis 1.3 1.0 0.2 2011–12 2010–11 2009–10 2008–09 -3.0 2007–08 -2.0 2006–07 2005–06 2004–05 2003–04 2002–03 2001–02 2000–01 1999–2000 3.0 1998–99 1997–98 1996–97 Percentage of national income Current budget surplus IFS Green Budget 2005 basis 2.0 1.0 0.0 -1.0 Labour Conservatives Liberal Democrats -4.0 Percentage of national income Average current budget surplus IFS Green Budget 2005 basis 2.0 1.5 1.3 1.0 0.5 0.2 0.0 -0.5 Conservatives 1? Labour 1+2 Labour 2 Labour 1 -1.5 Labour 3? -0.8 -0.9 -0.7 Liberal Democrats 1? -0.5 -1.0 The public finances Election 2005 Institute for Fiscal Studies www.ifs.org.uk/election/index05.php Average Government receipts 38.8 37.9 38.4 39.2 38.9 39.4 Labour 2 Labour 1+2 Labour 3? Conservative 1? Liberal Democrat 1? IFS Green Budget 2005 basis Labour 1 Percentage of national income 50.0 45.0 40.0 35.0 30.0 25.0 20.0 15.0 10.0 5.0 0.0 The public finances Election 2005 Institute for Fiscal Studies www.ifs.org.uk/election/index05.php