Incidence of Social Security Contributions: Evidence from France Discussion:

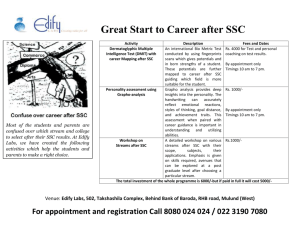

advertisement

Incidence of Social Security Contributions: Evidence from France Antoine Bozio, Thomas Breda, Julien Grenet Discussion: Andrea Weber, WU Vienna February 2016 Discussion Bozio Breda Grenet SSC February 2016 1/6 Summary Effects of social security contributions on earnings and labor costs Exploit reforms in France 1981 - 2005 Change in employer contributions to SS above the cap SST Yesterday: SSC reforms related to development of earnings inequality in France Today: Detailed evidence from diff-in-diff analysis comparing workers below and above the SST Large share of incidence borne by employers even 6 to 8 years after the reform Discussion Bozio Breda Grenet SSC February 2016 2/6 Comments Advantages: Great admin data on balanced panel of employed workers’ net earnings and labor costs Measures of short to medium/long run effects Challenges: Separate policy changes from behavioral responses Comments: Regression Kink Design Additional research questions Discussion Bozio Breda Grenet SSC February 2016 3/6 RKD Test for identifying assumptions: I I I I I Is there evidence of bunching in earnings above the SST? How does the density of earnings around SST change with the reforms? Density of predetermined variables: change in earnings, change in SSC in pre-reform years Predicted earnings growth based on covariates Motivation for the kink design: I I Marginal SS tax rate is a step-wise function of gross earnings Why not look at the discontinuity in change in marginal tax rates? Discussion Bozio Breda Grenet SSC February 2016 4/6 Implementation of RKD Running variable w0i , cutoff SST0 Outcome ∆wyi = wyi − w0i Policy variable ∆SSCyi = SSCyi − SSC0i RKD relate change in slope in ∆wyi to change in slope in ∆SSCyi Fuzzy RKD endogenous variable ∆SSCyi = SSCyi − SSC0i Problem: SSCyi is based on wyi and cutoff SSTy Plot first stage: where is the kink? (might be more illustrative to plot marg. tax rates) Plot share of individuals with wyi above SSTy by w0i ME in location of cutoff is not covered by CLPW(2015). Discussion Bozio Breda Grenet SSC February 2016 5/6 Additional Interesting Questions Do responses differ if tax is on employers or employees? How do firms adjust wages? Effects on stayers versus movers Responses at the firm level: is there a difference in responses of firms with high/low exposure? How does SSC affect career progress of high wage workers? Discussion Bozio Breda Grenet SSC February 2016 6/6