Tackling tax avoidance by multinationals Thomas Pope @TheIFS #IFSGB2016

advertisement

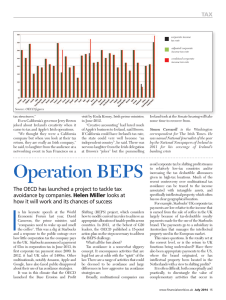

Tackling tax avoidance by multinationals Thomas Pope @TheIFS © Institute for Fiscal Studies #IFSGB2016 Context: multinationals in the political spotlight • Significant political action in the UK – Prominent interventions by Public Accounts Committee in last few years – Numerous UK Corporate tax policies over the last 5 years – Business roadmap to be released with the Budget • OECD Base Erosion and Profit Shifting (BEPS) project completed in October 2015 – A large multilateral attempt to update the international tax rules © Institute for Fiscal Studies How big is the problem? • HMRC defines avoidance as: • ‘bending the rules of the tax system to gain a tax advantage that Parliament never intended...operating within the letter – but not the spirit – of the law’ • Hard to know the scale of avoidance • OECD estimate avoidance cost at between $100 billion-$250 billion worldwide: 4-10% of global corporate income tax revenues © Institute for Fiscal Studies Corporate tax receipts % GDP, 1979–2014 5.0 4.5 4.0 Percent of GDP 3.5 3.0 2.5 2.0 1.5 1.0 0.5 United Kingdom Notes and sources: See Figure 8.2 of Green Budget document © Institute for Fiscal Studies OECD average 2013 2011 2009 2007 2005 2003 2001 1999 1997 1995 1993 1991 1989 1987 1985 1983 1981 1979 0.0 How do we tax multinational companies? (1) • We need to divide profits between different jurisdictions • The system does not try to tax profit based on sales • The principle of the international tax system is that we should tax profits at source; where the value is created © Institute for Fiscal Studies How do we tax multinational companies? (2) Pharmaceutical drugs Ideas Transfer price ££ © Institute for Fiscal Studies £ How do we tax multinational companies? (3) • Note that this system, even when applied perfectly, can lead to: – Large sales and low tax payments – Large reported profits in low tax jurisdictions • However, in practice there are avoidance opportunities – Hard to calculate transfer prices – Other difficulties arise at the boundaries between tax systems © Institute for Fiscal Studies OECD Base Erosion and Profit Shifting (BEPS) project • 2 year multilateral attempt to improve the international tax system, relying on international consensus • Addressed 15 ‘action points’ looking at different elements of the rules. Either: – Changes that all countries have agreed to enact (eg transfer prices) – OR recommended changes that governments can choose to follow • Next: implementation © Institute for Fiscal Studies Improvements for the UK • Country by country reporting will help countries target resources – But it won’t mean avoidance can always be identified • Changes to the definition of taxable presence in tax treaties – While it ‘moves the goalposts’ the incentive to cheat it remains • UK to implement ‘anti-hybrid’ rule from 2017 – Though as a recommended best practice it won’t be implemented everywhere • Patent boxes to be modified by July 2016 to be more closely linked to real activity – The patent box remains a poorly targeted innovation policy © Institute for Fiscal Studies George’s big BEPS decision – interest deductibility • Many countries, including the UK, have rules to restrict interest deductibility • UK has consulted on a change to interest deductibility, announcement expected at the budget • OECD rule would restrict interest deducted to a proportion of operating profit • A more stringent rule than the current UK provision • Tradeoff between preventing avoidance and distorting genuine activity • Especially for business models that include large amounts of debt © Institute for Fiscal Studies The incentive to compete – the elephant in the room? • Second tradeoff: between preventing avoidance and maintaining competitiveness ‘The UK’s current interest rules, which do not significantly restrict relief for interest, are considered by businesses as a competitive advantage’. Corporate tax roadmap, 2010 • Minimum standard vs recommendation: countries unwilling to sacrifice competitive advantage © Institute for Fiscal Studies Summary: where do we go from here? • The BEPS process is an impressive project, but is not a silver bullet • Underlying problems remain unaddressed • Only time will tell how effective these measures will be • Countries face a trade-off between competition and collaboration • Uncertain effect on UK revenues • EC published anti-avoidance plan on 28th January 2016 • Depending on how effective these measures prove, we may want to consider more radical changes, eg allocate profits based on location of sales © Institute for Fiscal Studies