LATAX A multi-country flexible tax micro-simulation model Institute for Fiscal Studies

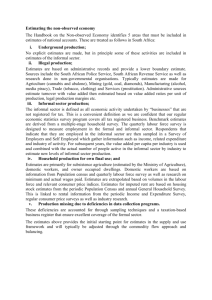

advertisement