Business tax road map Helen Miller © Institute for Fiscal Studies

advertisement

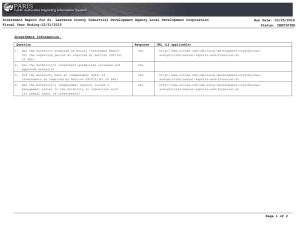

Business tax road map Helen Miller © Institute for Fiscal Studies Corporation tax - BEPS actions • Extend scope of hybrid mismatch rules • Changes to withholding tax on royalties • Implement new Patent Box approach • Incorporate new Transfer Pricing Guidelines • Country-by-country reporting • Ongoing work on a multilateral instrument • Restrict interest deductibility © Institute for Fiscal Studies Corporation tax - restrict interest deductibility • Anti-avoidance rule involves a trade-off between preventing avoidance and distorting genuine activity • From Apr 2017 limit interest deductions to 30% of EBITDA (taxable earnings) • Reduced effect of rule on: – domestic UK groups (removed via group rule) – public benefit infrastructure (exemption) – firms with net interest below £2mn (de minimis threshold) • More stringent rule than the current UK provision – raise: £1.2bn 2018-19, £1bn 2019-20 – contrast with position in 2010 roadmap: ‘UK’s current interest rules, which do not significantly restrict relief for interest, are considered by businesses as a competitive advantage’ © Institute for Fiscal Studies Corporation tax - revenue shifts & rate cut • Shift timing of payments to bring in £6bn in 2019-20 • Rate cut further to 17%; costs ~£2 billion 35% 30% 25% 20% 15% Previous policy 2021 2020 2019 2018 2017 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997 © Institute for Fiscal Studies 2016 Budget 2016 10% Corporation tax rates in G20 UK, 2020-21 UK, 2017–18 UK, 2015–16 Saudi Arabia Russia Turkey EU South Korea Indonesia China Canada Italy South Africa Mexico Australia Germany Japan India Brazil France Argentina US 0 © Institute for Fiscal Studies 5 10 15 20 25 30 35 40 45 Corporation tax - restrict loss offsets • Good tax system would give full loss offsets – asymmetric treatment discourages risk taking • From Apr 2017 losses can be offset against other income streams or other companies within a group - a good move that adds flexibility • Also restrict carried forward loss offsets to 50% profits, if profits above £5 million – not a good move • Raises: £415m 2018-19, £295m 2019-20, largely just brings revenue forward • Further restrict banks’ pre-2015 losses – raises: £465m 2018-19, £375m 2019-20, largely just brings revenue forward © Institute for Fiscal Studies North Sea oil & gas • Petroleum revenue tax to 0% – kept in place to allow decommissioning costs • Supplementary charge from 20% to 10% • Both backdated to 1 January 2016 – cost: ~£0.2bn a year from 2016 – 17 © Institute for Fiscal Studies © Institute for Fiscal Studies 2020-21 2018-19 2016-17 2014-15 2012-13 2010-11 2008-09 2006-07 2004-05 2002-03 0 2000-01 1998-99 1996-97 1994-95 1992-93 1990-91 1988-89 1986-87 1984-85 1982-83 1980-81 1978-79 Oil and gas revenues, £billion North Sea oil & gas revenues 14 12 10 8 6 4 2 Budget 2015 forecast Budget 2016 forecast -2 Business rates • Tax on rental value of non-residential properties • Policy change ‘to ensure ... system remains fit for purpose in the twenty-first century’ © Institute for Fiscal Studies Business Rates 50% 45% 40% 35% 30% 25% 20% 15% 2015-16 system 10% Planned 2016-17 system 5% Budget 2016 0% £0 £10,000 £20,000 £30,000 £40,000 Rateable value £50,000 £60,000 £70,000 Business Rates 50% 45% Threshold for higher rate increased takes ~1/6 properties out of higher rate 40% 35% 30% Cost: £1.4bn 2019-20 25% 20% 15% 2015-16 system 10% Planned 2016-17 system 5% Budget 2016 0% £0 £10,000 £20,000 100% Small Business Rate Relief made permanent, threshold increased takes ~1/3 properties out of tax £30,000 £40,000 £50,000 £60,000 £70,000 Business Rates • Move indexation from RPI to CPI from Apr 2020 – not clear why index to inflation, but RPI discredited – revenues will increase less quickly • Consult on more frequent revaluations • Business rates revenues retained by local authorities by 2020 – plan to compensate for Budget 2016 policy changes – in future, policy change at central government will affect revenue streams of local authorities • Doesn’t deal with main concern: levied on value of business property & therefore distort decisions © Institute for Fiscal Studies Stamp duty on non-residential property £70,000 Also new 2% rate for leasehold rent transactions if NPV> £5m £60,000 Overall: 90% of transactions pay the same or SDLT, 9% will pay more Tax payable £50,000 Raise ~£0.5bn £40,000 £30,000 £20,000 £10,000 Post Budget Pre Budget © Institute for Fiscal Studies £1,500,000 £1,350,000 £1,200,000 £900,000 £1,050,000 Sale price £750,000 £600,000 £450,000 £300,000 £150,000 £0 £0 Summary • For large business – cut to rate – BEPS actions, inc interest deductibility • For ‘small’ business – cut to rate – Business rates, include SBRR for those occupying low rental value property • Business road map spans large number of areas but lacks vision – continued move towards low rates plus anti-avoidance – lots of small policies rather than discussion of design or ideas for substantial improvements © Institute for Fiscal Studies