A Survey of the UK Benefit System IFS Briefing Note BN13

advertisement

A Survey of the UK Benefit System

IFS Briefing Note BN13

James Browne

Andrew Hood

A Survey of the UK Benefit System

Updated by James Browne and Andrew Hood

November 2012

Institute for Fiscal Studies

Acknowledgements

This briefing note is a revision of earlier versions by Claire Crawford, Carl Emmerson,

Michelle Jin, Greg Kaplan, Andrew Leicester, Peter Levell, Richard May, Cormac O’Dea,

David Phillips, Jonathan Shaw, Luke Sibieta and Alexei Vink. A version by the original

authors, Carl Emmerson and Andrew Leicester, can be downloaded from

http://www.ifs.org.uk/bns/benefitsurvey01.pdf. The paper was funded by the ESRC Centre

for the Microeconomic Analysis of Public Policy at IFS (grant ES/H021221/1). The authors

would like to thank Stuart Adam, Rowena Crawford and Robert Joyce for their help and

advice during revision of this briefing note. The paper has been copy-edited by Judith Payne.

All remaining errors are the responsibility of the authors.

*Addresses for correspondence: andrew_h@ifs.org.uk, james_browne@ifs.org.uk

© Institute for Fiscal Studies, 2012

ISBN: 978-1-903274-99-6

Contents

1.

Introduction ................................................................................................ 3

2.

Government spending on social security benefits .................................. 4

3.

A description of the current benefit system ................................................... 8

3.1. Benefits for families with children ...................................................................... 9

3.2. Benefits for unemployed people ...................................................................... 16

3.3. Benefits for people on low incomes ................................................................. 21

3.4. Benefits for elderly people................................................................................ 32

3.5. Benefits for sick and disabled people ............................................................... 41

3.6. Benefits for bereaved people ........................................................................... 52

4.

Trends in social security spending ................................................................ 56

4.1. Social security spending, 1948–49 to 2011–12 ................................................ 56

4.2. Changes in the composition of social security spending .................................. 58

4.3. Major reforms since 1948 ................................................................................. 60

4.4 Future benefit reforms....................................................................................... 62

5.

Conclusions ............................................................................................... 71

Appendix A. Benefit expenditure from 1948–49 to 2011–12 ................................. 72

Appendix B. Benefits available only to existing claimants ..................................... 73

Appendix C. The Social Fund ................................................................................. 80

Appendix D. War pensions and AFCS .................................................................... 84

© Institute for Fiscal Studies, 2012

2

1. Introduction

This briefing note provides a survey of the benefit system in Great Britain.1 We begin

in Section 2 with an overview of the current system, giving total expenditure on

social security and the cost of individual benefits. In Section 3, we look closely at the

present system, examining each benefit in turn. Benefits are arranged into six broad

categories based on the primary recipients: families with children, unemployed

people, those on low incomes, elderly people, sick and disabled people, and

bereaved people. Current benefit rates are for the financial year 2012–13,

expenditure figures are out-turns (where possible) or estimates for the financial year

2011–12, and claimant data are for February 2012 unless otherwise noted.

Whenever possible, expenditure and claimant figures relate to Great Britain.

In Section 4, we look at how the system has evolved to its present state and assess

how the patterns of expenditure on social security have changed over the past 50 or

60 years. We also present a brief discussion of upcoming reforms to the social

security system, in particular the introduction of Universal Credit. Section 5

concludes.

Further details on benefit eligibility and information about relevant legal issues can

be found in the Child Poverty Action Group’s Welfare Benefits and Tax Credits

Handbook 2012/2013.2 Current benefit rates, numbers of claimants and expenditure

figures are given in the Department for Work and Pensions (DWP)’s Annual Reports,

Benefit Expenditure Tables and annual press release detailing new benefit rates.3 In

addition, much of the information contained herein can be found on the DWP

website, http://www.dwp.gov.uk.

1

Note that the benefit system in Northern Ireland is extremely similar but is managed by the Department for

Social Development of Northern Ireland (DSDNI), which does not provide comparable indices of claimants and

expenditure.

2

Hereafter referred to as CPAG 2012/13.

3

Department for Work and Pensions, Benefit Expenditure Tables,

http://research.dwp.gov.uk/asd/asd4/index.php?page=medium_term.

Department for Work and Pensions, Benefit Rates, http://www.dwp.gov.uk/docs/benefitrates2012.pdf.

© Institute for Fiscal Studies, 2012

3

2. Government spending on social security benefits

In 2011–12, over £200 billion was spent on social security benefits in Great Britain

(henceforth GB).4 This amounts to approximately £3,324 for every man, woman and

child in the country, or 13.5% of GDP. At 29%, expenditure on social security

represents by far the largest single function of government spending.5

Approximately 30 million people in the UK – approximately half the total population

– receive income from at least one social security benefit. For means-tested benefits

such as Income Support, receipt of the benefit usually depends on the claimant’s

family income, together with their family circumstances and personal characteristics.

For contributory benefits such as state pensions, eligibility usually depends on the

claimant having paid sufficient National Insurance contributions (NICs) during their

lifetime. NICs are made by employees whose earnings are above a threshold (£146

per week in 2012–13), although the government usually treats those earning

between the lower earnings limit (LEL, £107 in 2012–13) and £146 per week as

though they were making contributions.6 Some benefits, such as Disability Living

Allowance, are neither contributory nor means-tested and are universally available

to all people who meet some qualification criteria.

All benefits require some residence conditions to be met (usually that the person be

present and resident in the UK), although different degrees of ‘residence’ are

required for different benefits. By and large, people ‘subject to immigration control’

(i.e. people who require leave to enter or to remain in the UK but who do not have

it) are unable to claim benefits. As the UK was a signatory to the 1951 UN

Convention on the Status of Refugees, refugees in the UK have the right to claim

certain benefits, such as Income Support. However, the Asylum and Immigration Act

1999 removed asylum seekers from mainstream benefit payments, and they now

have payments administered by the National Asylum Support Service.

4

Some spending data are on a UK basis because those for GB are not available, as explained in the notes below

Table 2.1. Appendix A provides details of government spending on social security from 1948–49 to 2011–12.

5

Sources: Great Britain population estimate from http://www.ons.gov.uk/ons/publications/allreleases.html?definition=tcm:77-22371; GDP from http://www.hm-treasury.gov.uk/data_gdp_fig.htm;

government expenditure from http://www.hm-treasury.gov.uk/pespub_natstats_july2012.htm. The quoted

13.5% is calculated based on an estimate of GB GDP, whilst some tax credit figures included here are for the UK;

it is therefore a slight overestimate. Unfortunately, tax credit expenditure for Great Britain only is not readily

available.

6

For more about the National Insurance system, see J. Browne and B. Roantree, A Survey of the UK Tax System,

IFS Briefing Note 9, 2012 (http://www.ifs.org.uk/bns/bn09.pdf). Entitlement conditions for contributory benefits

are complex – see chapter 35 of CPAG 2012/13.

© Institute for Fiscal Studies, 2012

4

Table 2.1. GB expenditure and claimant figures for all benefits and tax credits, 2011–12

Expenditure (£m)

Benefits for families with children

Child Benefit (including former One Parent Benefit)

Child Tax Credit

Statutory Maternity Pay

Maternity Allowance

Guardian’s Allowance

Education Maintenance Allowance (no longer available)h

Total benefits for families with children

Benefits for unemployed people

Income-based Jobseeker’s Allowance

Contribution-based Jobseeker’s Allowance

Job Grant

In Work Credit

Return to Work Credit

New Deal (no longer available)k

Total benefits for unemployed people

Benefits for people on low incomes

Income Support

Working Tax Credit

Housing Benefit

Council Tax Benefit

Social Fund payments

Total benefits for people on low incomes

Benefits for elderly people

Basic State Pension (contributory)

Basic State Pension (non-contributory)

Additional state pension

Pension Credit

Winter Fuel Payments

Over-75s television licences

Total benefits for elderly people

Benefits for sick and disabled people

Statutory Sick Pay

Incapacity Benefit

Employment and Support Allowance

Severe Disablement Allowance

Disability Living Allowance

Attendance Allowance

Carer’s Allowance

Independent Living Funds

Motability grants

Industrial injuries benefits

War pensions and AFCS

Total benefits for sick and disabled people

Benefits for bereaved people

Widows’ and bereavement benefits

Industrial Death Benefit

Total benefits for bereaved people

Other benefits

Christmas Bonus

TOTAL

© Institute for Fiscal Studies, 2012

5

a

% of total

expenditure

b

Claimants

12,222c,d

22,036c,d,f

2,203

361

2c,d

174i

36,998

6.08%

10.96%

1.10%

0.18%

0.00%

0.09%

18.41%

7,884,760d,e

5,186,200d,g

229,000

53,400

Not available

Not applicable

4,175

732

54

116

41

47

5,164

2.08%

0.36%

0.03%

0.06%

0.02%

0.02%

2.57%

1,199,000

254,000

Not available

58,700j

Not available

Not applicable

6,925

6,889c,d

22,736l

4,928

334m

41,811

3.45%

3.43%

11.31%

2.45%

0.17%

20.80%

1,509,350

2,516,000

5,051,120

5,922,130

8,703,000 awards

58,033

62

16,124o

8,068

2,146

578

85,011

28.88%

0.03%

8.02%

4.01%

1.07%

0.29%

42.30%

12,672,860n

34,780

Not available

2,615,540

12,650,000

4,361,000

49

4,910

3,619

878

12,578

5,322

1,728

325p

18q

853r

935d,t

31,215

0.02%

2.44%

1.80%

0.44%

6.26%

2.65%

0.86%

0.16%

0.01%

0.42%

0.47%

15.53%

Not available

1,385,630

991,190

217,030

3,243,530

1,600,670

594,860

18,387

c. 600,000

321,460s

162,595

590

33

623

0.29%

0.02%

0.31%

65,110u

7,000

155

200,978

0.08%

100%

15,545

Notes to Table 2.1

a

Figures are estimated out-turns, from DWP Benefit Expenditure Tables unless otherwise stated. Out-turns and

percentages may not sum exactly due to rounding. Source:

http://research.dwp.gov.uk/asd/asd4/index.php?page=medium_term.

b

Details of sources and of the date on which the claimant count for each benefit was taken are given in the

relevant part of Section 3 of this survey.

c

Source: HMRC 2011–12 Annual Report and Accounts (http://www.hmrc.gov.uk/about/annual-report-accounts1112.pdf).

d

UK figure.

e

Number of families, covering 13,721,160 children in total as at 31 August 2011. Source: HM Revenue and

Customs, Child Benefit Geographical Statistics: August 2011 (http://www.hmrc.gov.uk/statistics/child-geogstats/chb-geog-aug11.pdf).

f

Note that, unlike the figure for the number of families (see note g), the expenditure figure does not include

payments made to out-of-work families receiving the equivalent amounts via benefits from DWP, which is

included in spending figures for benefits for unemployed people.

g

Number of families, covering 9.27 million children as at 1 April 2012. This figure includes out-of-work families

receiving the Child Tax Credit or the equivalent amount via Income Support (see Appendix B). Source: HM

Revenue and Customs, Child and Working Tax Credits Statistics, April 2012

(http://www.hmrc.gov.uk/statistics/prov-main-stats/cwtc-apr12.pdf).

h

Education Maintenance Allowance was abolished in England at the end of the academic year 2010–11.

i

Figure is for England only. Source: http://www.parliament.uk/briefing-papers/SN05778.

j

This is the number of new starts in 2011–12.

k

The Work Programme replaced New Deal benefits from June 2011.

l

This is the sum of Housing Benefit and discretionary housing payments (see Sections 3.3.3 and 3.3.5).

m

This is the sum of net expenditure on individual benefits, as detailed in Appendix C. Source: Annual Report by

the Secretary of State for Work and Pensions on the Social Fund 2011/2012

(http://www.dwp.gov.uk/docs/2012-annual-report-social-fund.pdf).

n

This figure includes all claimants of a contributory state pension, both basic and additional.

o

Sum of expenditure on S2P and Graduated Retirement Benefit.

p

GB expenditure in Independent Living Fund, Quarterly User Profile Analysis: June 2011 / September 2011 /

December 2011 / March 2012 (http://www.dwp.gov.uk/ilf/publications/corporate-publications/statistics/).

q

Source: Table 4 of Motability, Annual Report and Accounts 2011/12 (http://www.motability.co.uk/aboutus/annual-reports/).

r

Includes Industrial Injuries Disablement Benefit, as well as £1 million of other industrial injuries benefits (see

Section 3.5.7 and Appendix B).

s

Figure is for Industrial Injuries Disablement Benefit and Reduced Earnings Allowance, as of March 2012. The

figure includes 56,730 people who were receiving both IIDB and REA. Source: Department for Work and

Pensions, Industrial Injuries Disablement Benefit Quarterly Statistics: March 2012

(http://research.dwp.gov.uk/asd/index.php?page=iidb).

t

Most recent data available are for 2010–11 UK expenditure. Includes both War Disablement and War

Widow(er)’s Pensions. Does not include AFCS spending. Source: Ministry of Defence, MOD Annual Report and

Accounts 2010-11

(http://www.mod.uk/DefenceInternet/AboutDefence/CorporatePublications/AnnualReports/).

u

This figure includes claimants of Bereavement Allowance and Widowed Parent’s Allowance; claimants of War

Widow(er)’s Pension are included in the war pensions statistics (see note t above).

© Institute for Fiscal Studies, 2012

6

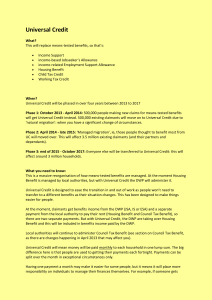

Figu

ure 2.1. Expe

enditure byy recipient ass a percentage of total, 2011–12

2

Sick and disabled

15..5%

Widows

0.3%

Others

0.1%

Families

18.4%

Unem

mployed

2

2.6%

Lo

ow income

20.8%

Elderly

42.3%

Families

Unemployed

d

Low Incom

me

Elderly

Sick and Dissabled

Wido

ows

Otherss

Sourcces: As for Table 2.1, includingg notes.

Table 2.1 preseents a breakkdown of estimated exxpenditure for each beenefit for 20

011–

7

12 and

a a claim

mant countt for Februaary 2012, organised by primaryy recipient. The

cateegories are: families with

w childreen, unemplo

oyed peoplle, those on

n low incom

mes,

eldeerly people, sick and disabled peeople, bere

eaved people, and oth

hers. Figure

e 2.1

also

o provides a breakdow

wn for theese groups. Retiremen

nt pensionss are the most

m

expensive beneefit, accoun

nting for jusst under 37

7% of total expenditure

e

e. The ‘top five’

nefits – retirement pensions, Hou

using Benefit, Child Taax Credit, D

Disability Liiving

ben

Allo

owance and Child Beneefit – togeth

her make up

p over 70% of total exp

penditure.

Notte that altho

ough most of

o the figures in Table 2.1 relate to

t Great Britain, figures for

som

me benefits were only available on

o a UK bassis, e.g. Child Benefit aand tax cre

edits.

How

wever, sincee total Nortthern Irelan

nd benefit expenditure

e

e is only aro

ound £4 billion,

figures for Greaat Britain would

w

not bee significanttly differentt for these b

benefits.

7

Feb

bruary 2012 is the date on which the claimantt count was takken in most cases. See Section

n 3 for details off

excep

ptions.

© In

nstitute for Fisscal Studies, 2012

7

3. A description of the current benefit system

We look at the benefit system by dividing it into six major categories of primary

recipient: families with children, unemployed people, those on low incomes, elderly

people, sick and disabled people, and bereaved people. Each subsection starts with a

table that summarises every benefit in terms of whether it is taxable or non-taxable,

contributory or non-contributory, and whether or not receipt is means-tested. We

also give details of total expenditure and the total number of claimants.

The Christmas Bonus is the only national benefit not included in any of these

sections. This is a one-off payment of £10 to the recipients of certain benefits in the

week beginning the first Monday of December. Only one bonus can be received per

person, although in couples where both partners receive qualifying benefits, two

separate payments can be made. If both partners are over the State Pension Age,

then both will receive the Christmas Bonus under certain conditions, even if only one

receives a qualifying benefit.8 Total expenditure on the Christmas Bonus was

estimated to be £155 million in 2011–12, with around 15.5 million claimants.

8

This is the case if the only benefit claimed is Pension Credit, or if the individual in receipt of a qualifying benefit

is entitled to an increase in that benefit for their partner.

© Institute for Fiscal Studies, 2012

8

3.1. Benefits for families with children

3.1.1

3.1.2

3.1.3

3.1.4

3.1.5

8

8

9

8

Claimants, as at

Feb. 2012a

7,884,760c

Not available

5,186,200e

229,000g

Expenditure,

2011–12 (£m)b

12,222d

2d

22,036f

2,203g

8

53,400h

361

Benefit

T

C

M

Child Benefit

Guardian’s Allowance

Child Tax Credit

Statutory Maternity,

Paternity and Adoption Pay

Maternity Allowance

8

8

8

8

8

8

8

9

8

9

T = taxable, C = contributory, M = means-tested

a

Unless otherwise specified.

b

Source: DWP Benefit Expenditure Tables unless otherwise stated

(http://research.dwp.gov.uk/asd/asd4/index.php?page=medium_term).

c

Number of families, covering 13,721,160 children in total as at 31 August 2011. Source: HM Revenue and

Customs, Child Benefit Geographical Statistics: August 2011 (http://www.hmrc.gov.uk/statistics/child-geogstats/chb-geog-aug11.pdf). UK figure.

d

Source: HMRC 2011–12 Annual Report and Accounts (http://www.hmrc.gov.uk/about/annual-report-accounts1112.pdf). UK figure.

e

Number of families, covering 9.27 million children as at 1 April 2012. This figure includes out-of-work families

receiving the Child Tax Credit or the equivalent amount via Income Support (see Appendix B). Source: HM

Revenue and Customs, Child and Working Tax Credits Statistics, April 2012

(http://www.hmrc.gov.uk/statistics/prov-main-stats/cwtc-apr12.pdf). UK figure.

f

Source: HMRC 2011–12 Annual Report and Accounts (http://www.hmrc.gov.uk/about/annual-report-accounts1112.pdf). Note that, unlike the figure for the number of families (see note e), the expenditure figure does not

include payments made to out-of-work families receiving the equivalent amounts via benefits from DWP. UK

figure.

g

Figures are for Statutory Maternity Pay only. Claimants in 2011–12; source: table 1c of

http://research.dwp.gov.uk/asd/asd4/index.php?page=medium_term.

h

As at 30 November 2011. Source: Maternity Allowance Quarterly Statistics: November 2011

(http://statistics.dwp.gov.uk/asd/asd1/ma/index.php?page=ma_quarterly_nov11).

3.1.1. Child Benefit

Non-taxable, Non-contributory, Non-means-tested9

Approximately 7.9 million families received Child Benefit (CB) in August 2011,

covering nearly 14 million children. Introduced in April 1977 to replace the Family

Allowance and the Child Tax Allowance, CB has remained universal (though will be

gradually withdrawn for families with at least one individual earning over £50,000

from January 2013), payable to all families with children regardless of income. It is

paid at a higher rate for the eldest or only child, and then at a lower rate for all

subsequent children. For the purposes of receiving CB, a ‘child’ is someone under the

age of 16, between 16 and 20 and in full-time non-advanced education or training, or

16 or 17 and registered for work, education or training with an approved body. CB

9

Child Benefit will be gradually withdrawn for families with at least one individual earning over £50,000 from

January 2013.

© Institute for Fiscal Studies, 2012

9

does not count as income for the entitlement calculation of other benefits and tax

credits.

Table 3.1.1. Current rates of Child Benefit, £ per week

Eldest or only childa

Subsequent children (each)

a

20.30

13.40

Prior to 6 July 1998, an additional payment for the eldest (or only) child was available to lone parents. This

higher rate remains available to claimants who were eligible to receive it prior to the policy change (and who

remain so today).

CB rates have conventionally been uprated annually in line with the Retail Prices

Index (RPI). However, it was announced in the June Budget that these rates would be

frozen for three years from April 2011. This freeze is forecast to save almost

£1 billion per year by 2014–15.10 From January 2013, CB will be withdrawn through

an income tax charge from families where one parent’s income is above £50,000.

Claimants will lose 1% of their CB for every £100 over that level, meaning families

with an individual earning £60,000 or more will receive no CB. This is expected to

save £1.7 billion each year from 2014–15.11 In 2011–12, Child Benefit is estimated to

have cost the exchequer £12.22 billion.

3.1.2. Guardian’s Allowance

Non-taxable, Non-contributory, Non-means-tested

Guardian’s Allowance (GA) is a benefit paid in addition to Child Benefit to families

bringing up a child or children whose parents have died. If only one parent has died,

GA may still be payable if the whereabouts of the other parent is unknown. The

claimant need not be the child’s legal guardian, but the child must be living with the

claimant or the claimant must be making contributions for the maintenance of the

child of at least £15.55 per week. A step-parent does not count as a parent and so

may be entitled to receive GA for raising a stepchild if both natural parents have

died. Adoptive parents count as parents, and so cannot receive GA in most cases.

The rules concerning who counts as a child are the same as for Child Benefit (see

Section 3.1.1).

Expenditure on Guardian’s Allowance amounted to an estimated £2.0 million in

2011–12.

10

Source: Table 2.1 in HM Treasury, Budget 2010, June 2010 (http://www.hmtreasury.gov.uk/d/junebudget_complete.pdf

11

Source: Tables 2.1 and 2.2 in HM Treasury, Budget 2012, March 2012 (http://cdn.hmtreasury.gov.uk/budget2012_complete.pdf).

© Institute for Fiscal Studies, 2012

10

Table 3.1.2. Current rate of Guardian’s Allowance, £ per week

All children (each)

15.55

3.1.3. Child Tax Credit

Non-taxable, Non-contributory, Means-tested

The Child Tax Credit (CTC) combines support previously provided by the Children’s

Tax Credit, child credits in the Working Families’ Tax Credit,12 child additions to most

non-means-tested benefits, and the child elements (i.e. child additions and family

premiums) of Income Support and income-based Jobseeker’s Allowance.13 CTC is

paid on top of Child Benefit (see Section 3.1.1) and directly to the main carer in the

family (as with the childcare element of Working Tax Credit (WTC) – see Section

3.3.2). Since CTC is a tax credit, it is administered by HM Revenue and Customs

(HMRC). Under international accounting conventions, tax credits are counted as

negative taxation to the extent that they are less than the income tax liability of the

family and as government expenditure for payments exceeding the tax liability. For

our purposes, however, we count all tax credit expenditure as if it were a cash

benefit (and therefore public spending).

CTC is made up of a number of elements: a family element (the basic element), a

child element, a disabled child additional element and a severely disabled child

element (see Table 3.1.3). The baby element (for families with children under 1) was

abolished from April 2011. Entitlement to CTC does not depend on employment

status, but does require that the claimant be responsible for at least one child under

the age of 16 (or aged 16–19 and in full-time education). As with WTC, certain

changes in family circumstances (for example, a single claimant becoming part of a

couple, or vice versa) must be reported immediately to HMRC if penalties are to be

avoided.

CTC and WTC are subject to a single means test operating at the family level.

Families with annual pre-tax income of £6,420 or less (£15,860 for families eligible

only for CTC, i.e. not for WTC) are entitled to the maximum CTC and WTC payments

appropriate for their circumstances (see Section 3.3.2 for details of WTC). Income

from most other benefits (including Child Benefit, Housing Benefit, Disability Living

Allowance and Council Tax Benefit) is not included in the CTC–WTC calculation, while

entitlement to Income Support, income-based Jobseeker’s Allowance, income12

For details of these, see A. Dilnot and J. McCrae, Family Credit and the Working Families’ Tax Credit, IFS Briefing

Note 3, 1999 (http://www.ifs.org.uk/bns/bn3.pdf).

13

The non-means-tested ones include the Basic State Pension, Incapacity Benefit, Severe Disability Allowance

and Widowed Parent’s Allowance. Some existing claimants still receive child increases rather than CTC; further

details can be found in Appendix B.

© Institute for Fiscal Studies, 2012

11

related Employment and Support Allowance or Pension Credit acts as an automatic

passport to maximum CTC14. From April 2012, claims can only be backdated by one

month, compared with a previous maximum of three months; this change is

expected to save over £300 million per year.15 In-year increases in income are

disregarded for this calculation if they are below £10,000. This income disregard will

be reduced to £5,000 from April 2013. From April 2012, in-year falls in income are

disregarded if the change is less than £2,500, which is expected to save over £500

million per year.16

Table 3.1.3. Current rates of Child Tax Credit

Family element

Child element (each)

Disabled child additional element (each)

Severely disabled child element (each)

£ per annum

545

2,690

2,950

1,190

£ per week

10.45

51.59

56.58

22.82

6,420

15,860

41%

123.12

304.16

41%

Income below which maximum CTC is payable

Income below which maximum payable if not entitled to WTC

Withdrawal rate

Note: Weekly numbers are calculated based upon there being 365/7 weeks a year.

For those with an annual family pre-tax income above £6,420, CTC and WTC awards

are tapered away at a rate of 41%. WTC entitlement apart from the childcare

element is withdrawn first, then the childcare element of WTC, then the child and

disability elements of CTC, and finally the family element of CTC.

Tax credits have suffered a significant problem of overpayments. One important

reason is that entitlement values are not finalised until about 12 months after the

tax year in which entitlements are accrued. Tax credits awards are initially assessed

and paid on a provisional basis based on circumstances and estimated income

reported at the time the claim was made. HMRC then relies on families to report

their actual incomes and circumstances by the following July (or, in some cases,

January).17 This means a large number of overpayments and underpayments are

generated each year due to changes in circumstances between the date of the claim

14

Source: HM Revenue and Customs, A Guide to Child Tax Credit and Working Tax Credit, April 2010

(http://www.hmrc.gov.uk/leaflets/wtc2.pdf).

15

Source: HM Treasury, Budget 2010 Policy Costings, June 2010 (http://www.hmtreasury.gov.uk/d/junebudget_costings.pdf).

16

Source: HM Treasury, Budget 2010 Policy Costings, June 2010 (http://www.hmtreasury.gov.uk/d/junebudget_costings.pdf).

17

Most families have until 31 July following the end of the entitlement year to report their finalised incomes for

the year in question. However, families where someone completes an income tax self-assessment return

(generally the self-employed) have until 31 January of the following year to do this.

© Institute for Fiscal Studies, 2012

12

and the dates awards are paid. While underpayments are often repaid afterwards,

overpayments are difficult to recover. The scale of this problem has been reduced

since the first two years of operation of CTC and WTC, but HMRC still overpaid

between £2.08 billion and £2.46 billion (and underpaid between £0.17 billion and

£0.29 billion) in 2010–11.

HMRC estimates that expenditure on the Child and Working Tax Credits were

£22.04 billion and £6.89 billion respectively in 2011–12. These figures reflect the

initial awards authorised for 2011–12 but do not include any adjustments that take

place for under- and over-payments in the finalisation process the following year,

since these cannot be reliably estimated. In addition, just under half a billion pounds

was paid in equivalent child additions to some pre-2004 claimants of out-of-work

benefits (see Appendix B).

As at 1 April 2012, CTC (or the equivalent amount in out-of-work benefits) was

received by 5.186 million families, containing 9.27 million children.18 That includes

1.47 million families where no adult works, 1.93 million in-work families who were

also receiving WTC and 1.78 million in-work families receiving CTC only.

3.1.4. Statutory Maternity Pay, Statutory Paternity Pay and Statutory Adoption Pay

Non-taxable, Contributory, Non-means-tested

Statutory Maternity Pay (SMP) is a legal minimum amount that employers must pay

to their employees during maternity leave, although almost all the cost can be

recouped from the government. Many women receive more than the minimum, but

this is paid for by employers and not by the government. To claim, the woman must

have been in continuous employment with the same employer for at least 26 weeks

up to and including the 15th week before the week the baby is due. She must also

have earned at least the lower earnings limit for National Insurance contributions

(currently £107 per week) on average during the eight weeks up to and including the

15th week before the week in which the baby is due. To claim SMP, the woman need

not intend to return to work.

SMP can be paid for up to 39 weeks: the first six weeks’ pay will be at a higher rate,

and the remaining 33 at a lower rate (see Table 3.1.4). The period of payment can

begin at any time from the 11th week before the baby is due until the day after the

birth itself (to coincide with maternity leave). Some special circumstances, such as

absence from work, might change the start of the SMP period.19

18

Source: HM Revenue and Customs, Child and Working Tax Credits Statistics, April 2012

(http://www.hmrc.gov.uk/statistics/prov-main-stats/cwtc-apr12.pdf). UK figure.

19

Rules for deciding the SMP period are available at http://www.dwp.gov.uk/publications/specialistguides/technical-guidance/ni17a-a-guide-to-maternity/statutory-maternity-pay-smp/when-smp-is-paid/.

© Institute for Fiscal Studies, 2012

13

Government expenditure on SMP in 2011–12 is estimated to have been

approximately £2 billion, with around 229,000 claimants.

Table 3.1.4. Current rates of Statutory Maternity, Paternity and Adoption Pay,

per week

Higher rate of SMP

Lower rate of SMP, SPP, SAP

90% of the claimant’s average weekly earnings

The lesser of £135.45 or 90% of average weekly earnings

Statutory Paternity Pay (SPP) and Statutory Adoption Pay (SAP) were introduced on 6

April 2003. Both are legal minimum amounts that employers must pay to their

employees during paternity/adoption leave, and most of the cost can be reclaimed

from the government. SPP is usually paid to individuals whose partner has given

birth, but can also be paid when a child is adopted. SAP can only be claimed by one

parent (the other may be able to claim SPP).

The eligibility requirements for SPP and SAP are very similar to those for SMP, except

that they include more stringent employment conditions. For SPP (birth), the

claimant must satisfy the 26-week employment rule (see above), and must also be

continuously employed by the same employer from the end of the 15th week before

the child is due until the child is born. For SPP (adoption) and SAP, the claimant must

have been continuously employed for at least 26 weeks ending the week in which

notification is received that a child has been matched for adoption. For SPP

(adoption) only, employment must then continue with the same employer until the

day of the adoption placement.

Both SPP and SAP are payable at the lower SMP rate. Ordinary SPP is available for up

to two consecutive weeks between the date of birth or adoption and eight weeks

after that date. Additional SPP has been introduced from 6 April 2010, applicable to

children due or matched on or after 3 April 2011. It enables eligible fathers to take

up to 26 weeks additional paternity leave and get paid the lower rate of SPP if the

mother/partner returns to work (the additional SPP leave should be taken between

20 weeks and one year after the child is born or placed for adoption, and the

additional SPP is payable during the mother/partner’s SMP period, Maternity

Allowance period or SAP period).20 SAP is available for up to 39 weeks, starting no

later than when the child arrives and no earlier than two weeks beforehand.

Claimant and expenditure figures for SPP and SAP are not recorded centrally.

20

Source: http://www.dwp.gov.uk/publications/specialist-guides/technical-guidance/ni17a-a-guide-to-maternity.

© Institute for Fiscal Studies, 2012

14

3.1.5. Maternity Allowance

Non-taxable, Contributory, Non-means-tested

Maternity Allowance (MA) may be payable to pregnant women and new mothers

who are unable to claim SMP. To be eligible for MA, claimants must satisfy both an

employment test and an earnings condition. To satisfy the employment test, the

claimant must have been employed or self-employed (not necessarily continuously

or for the same employer) for at least 26 of the 66 weeks up to and including the

week before the baby is due (known as the employment test period). The earnings

condition requires that average weekly earnings in any21 13 of the previous 66 weeks

are at least equal to the MA threshold that applies at the start of the employment

test period; the MA threshold is currently £30.00 per week.

MA (and SMP) claimants receiving certain means-tested benefits may also be

entitled to receive a Sure Start Maternity Grant from the regulated Social Fund (see

Section 3.3.6 and Appendix C for further details).

MA is payable for up to 39 weeks. The period in which this can begin is normally the

same as for SMP, i.e. from the 11th week before the baby is due until the day after

the birth itself. The start date is affected by special circumstances such as claiming

Employment and Support Allowance or Severe Disablement Allowance.22

Table 3.1.5. Current rates of Maternity Allowance, per week

Standard rate

The lesser of £135.45 or

90% of average weekly earnings

Claimants used to be entitled to an additional payment for a dependent spouse or

other dependent adult who cares for at least one of their children, which was only

available if the dependant’s earnings were not too high. This extra payment for an

adult dependant (£41.35 per week) has been abolished for those beginning to claim

MA on or after 6 April 2010. Increases for child dependants have, since 6 April 2003,

been replaced by the Child Tax Credit for all new claimants.

As at 30 November 2011, 53,400 women were receiving MA.23 The total expenditure

for the year 2011–12 was estimated at around £361 million.

21

The 13 weeks do not have to be in a row, and can be chosen in order to maximise the average weekly earnings.

22

Rules for deciding the MA period are available at http://www.dwp.gov.uk/publications/specialistguides/technical-guidance/ni17a-a-guide-to-maternity/maternity-allowance-ma/when-ma-is-paid/#mapaid.

23

The most recent figures available, from Maternity Allowance Quarterly Statistics: November 2011, at

http://statistics.dwp.gov.uk/asd/asd1/ma/index.php?page=ma_quarterly_nov11.

© Institute for Fiscal Studies, 2012

15

3.2. Benefits for unemployed people

Benefit

T

C

M

Claimants, as at

Feb. 2012a

Expenditure,

2011–12 (£m)b

9

8

9

1,199,000c

4,175

9

9

8

254,000c

732

3.2.2

3.2.3

Income-based

Jobseeker’s Allowance

Contribution-based

Jobseeker’s Allowance

Job Grant

In Work Credit

8

8

8

8

9

9

Not available

58,700d

54

116

3.2.4

Return to Work Credit

8

8

9

Not available

41

3.2.1

T = taxable, C = contributory, M = means-tested

a

Unless otherwise specified.

b

Source: DWP, Benefit Expenditure Tables unless otherwise stated

(http://research.dwp.gov.uk/asd/asd4/index.php?page=medium_term).

c

Figures for 2011–12. Both numbers include 21,000 people who receive both the income-based JSA and the

contribution-based JSA. Source: http://research.dwp.gov.uk/asd/asd4/index.php?page=medium_term.

d

This is the number of new starts in 2011–12. Source: DWP, In-Work Credit Statistics, August 2012

(http://statistics.dwp.gov.uk/asd/asd1/in_work_credit/index.php?page=in_work_credit_arc).

3.2.1. Jobseeker’s Allowance

Taxable, either Contributory or Means-tested

Jobseeker’s Allowance (JSA) replaced Unemployment Benefit and Income Support

(IS) for unemployed people from 7 October 1996. There are two main types of JSA:

contribution-based JSA is paid to individuals who have satisfied the National

Insurance contribution (NIC) conditions; income-based JSA is paid to claimants who

satisfy a family income-based means test (more details below).24

To qualify for either type, the claimant must be aged 18 or over but below State

Pension Age;25 some 16- and 17-year-olds may qualify for JSA in special cases.26 In

addition, the claimant must not be working for 16 hours or more per week, and must

be capable of starting work immediately and of actively taking more than two ‘steps’

a week to find a job, such as attending interviews, writing applications or seeking job

information. They must also have a current ‘jobseeker’s agreement’ with Jobcentre

Plus, which includes such information as hours available for work, desired job and

any steps that the claimant is willing to take to find work. Claimants must be

prepared to take a job that would involve working for at least 40 hours per week and

24

A third type of Jobseeker’s Allowance, joint-claim JSA, is paid to members of joint-claim couples. It is very

similar to income-based JSA. Figures for income-based JSA include joint-claim JSA.

25

Those above pension age are entitled to Pension Credit, which is more generous than JSA. Male claimants over

the female State Pension Age are entitled to a premium of £71 per week.

26

For details, see section 5, chapter 19 of CPAG 2012/13.

© Institute for Fiscal Studies, 2012

16

have a reasonable prospect of securing employment (i.e. they must not place too

many restrictions on the type of work they are willing to undertake). If a claimant

refuses to take up a job offer without good cause, they may be denied further

payments of JSA.

Income Support (IS) and JSA cannot be claimed at the same time. Income-based JSA

cannot be claimed at the same time as Pension Credit (PC) or income-related

Employment and Support Allowance (ESA). If one member of a couple claims IS,

income-related ESA or PC, the other may claim contribution-based JSA but not

income-based JSA.

After claiming JSA for a certain length of time, claimants have to take part in the

Work Programme. This is the case after 9 months for claimants aged 18–24 and 12

months for those aged 25 and over. As participants in the Work Programme,

claimants are assigned to non-governmental providers, who help them into work by

providing help with CVs, job applications and more substantial barriers such as drug

and alcohol problems. These providers are paid on the basis of their record in

moving claimants into sustained employment.

Contribution-based Jobseeker’s Allowance

Contribution-based JSA can be paid for up to 182 days. To claim contribution-based

JSA, the individual must have paid sufficient Class 1 National Insurance contributions

in the two tax years prior to the beginning of the year in which they sign on and

claim benefit.27 The individual must not have earnings above a specific level (see

below). If the claimant qualifies, they can receive contribution-based JSA irrespective

of savings, capital or partner’s earnings.

If the claimant has any part-time earnings, £5 per week is disregarded (or up to £20

for some occupations). Any earnings over this disregarded amount are deducted

from contribution-based JSA entitlements pound for pound. Thus the most someone

aged 25 or over could earn per week and still receive contribution-based JSA is

£75.99 (assuming that they are not in one of the special occupations). The rate of

contribution-based JSA is also reduced by the amount of weekly pension above

£50.00 per week. Other types of income do not affect the amount of contributionbased JSA.

The number of individuals claiming contribution-based JSA has remained constant

over the last two years at around 250,000. Contribution-based JSA cost the

government around £732 million in 2011–12.

27

For details, see section 4, chapter 35 of CPAG 2012/13.

© Institute for Fiscal Studies, 2012

17

Table 3.2.1. Current rates of contribution-based Jobseeker’s Allowance, £ per week

Age of claimant:

Under 25

25 or over

56.25

71.00

Income-based Jobseeker’s Allowance

Those who do not qualify for contribution-based JSA may be able to receive incomebased JSA if they have sufficiently low income. Only one partner in a couple can

receive income-based JSA, and the partner of the claimant must not be working for

more than 24 hours per week (as described above, both forms of JSA require that

the claimant is not working 16 hours or more per week). Couples without children

must claim JSA jointly. This means that both usually have to sign on and meet the

conditions for benefit.28

Income-based JSA is designed to top up the claimant’s income to a specified level

(called the ‘applicable amount’), which is intended to reflect the needs of the

claimant’s family. The applicable amount is the sum of personal allowances,

premiums and some housing costs (primarily mortgage interest payments29). The

amount for each individual is usually identical to that for Income Support (see Table

3.3.1).30 Clearly, to be eligible, the claimant’s income (minus an earnings disregard31)

must be less than their applicable amount. The level of JSA payable is just the

applicable amount minus the income.

Income-based JSA is only payable if the claimant’s savings and other capital (ignoring

their home) do not exceed £16,000. Capital up to £6,000 is ignored (£10,000 for

those in care homes). Between these two thresholds, income-based JSA entitlement

is reduced by £1 for every £250 of capital exceeding the lower threshold. Incomebased JSA is payable for as long as the qualifying conditions are met.

The expenditure on income-based JSA rose from £3.7 billion in 2010–11 to

£4.2 billion in 2011–12. There are currently nearly 1.2 million claimants. Receipt of

income-based JSA automatically entitles individuals to free school meals, health

benefits (including free prescriptions, dental treatment and sight tests), maximum

28

In certain circumstances, a joint-claim couple can qualify for JSA even if one of them does not satisfy all the

rules for claiming JSA. For details, see page 396 of CPAG 2012/13.

29

Some housing costs can be met by not only income-based JSA but also Income Support (Section 3.3.1), incomerelated ESA (Section 3.5.2) and Pension Credit (Section 3.4.3). The weekly amount covered is the home loan –

subject to an upper limit and restrictions – multiplied by a centrally set standard rate of interest, currently 3.63%.

More details on calculating housing costs can be found in chapter 38 of CPAG 2012/13.

30

There is a 104-week limit on help with certain types of housing costs for JSA claimants if the 13-week waiting

period applies. In contrast, those on IS, ESA or PC may get help with housing costs indefinitely. For details, see

chapter 38 of CPAG 2012/13.

31

The earnings disregard is £20, £10 or £5 depending on the circumstances of the claimant. For details, see pages

913–14 of CPAG 2012/13.

© Institute for Fiscal Studies, 2012

18

Council Tax Benefit, maximum Housing Benefit and certain Social Fund payments

(including the Sure Start Maternity Grant and funeral payments; see Appendix C for

further details).

Table 3.2.2. Current rates of income-based Jobseeker’s Allowance, £ per week

Personal allowance – single person:

Aged 16–24

Aged 25 or over

56.25

71.00

Personal allowance – lone parent:

Aged 16–17

Aged 18 or over

56.25

71.00

One or both aged 16–17

Both aged 18 or over

Variesa

111.45

Personal allowance – couple:

a

If both members of the couple are under 18, there are two rates: £56.25 and £84.95 (payable in special

circumstances). If only one is under 18, there are three rates: £56.25 (if the other is 18–24), £71.00 (if the other

is 25 or over) and £111.45 (payable in special circumstances). For details, see pages 817–19 of CPAG 2012/13.

3.2.2. Job Grant

Non-taxable, Non-contributory, Means-tested

The Job Grant is a one-off, tax-free payment to individuals who move directly from

benefit into work of at least 16 hours a week. An individual also qualifies for a Job

Grant if their partner starts working at least 24 hours a week and as a result their

benefit stops. The payment is £100 in the case of single people and couples without

children and £250 for those with children. To be eligible, the job must be expected to

last for at least five weeks, and applicants must have been receiving a qualifying

benefit such as Jobseeker’s Allowance (Section 3.2.1), Income Support (Section

3.3.1), Employment and Support Allowance (Section 3.5.2), Incapacity Benefit or

Severe Disablement Allowance (Appendix B) for the 26 weeks immediately before

moving into work. There will be no new Job Grant payments from 1 April 2013.

In 2011–12, approximately £54 million was paid out in Job Grants.

3.2.3 In Work Credit

Non-taxable, Non-contributory, Means-tested

In Work Credit is a fixed tax-free payment of £40 per week (£60 in London) for lone

parents who start work. To qualify, the claimant should be bringing up at least one

child under 16 on their own. They also need to end a claim to a qualifying benefit

that has lasted for at least 52 weeks. The qualifying benefits are Jobseeker’s

Allowance, Income Support, and Employment and Support Allowance (in certain

circumstances). In London, the set of qualifying benefits is widened to include all

cases of ESA, Incapacity Benefit and Severe Disablement Allowance. The

employment being taken up must be for at least 16 hours per week, be expected to

© Institute for Fiscal Studies, 2012

19

last more than five weeks and pay at least the National Minimum Wage. The In Work

Credit payment is on top of other benefits and is not taxable, and it is payable for up

to 12 months. There will be no new awards of In Work Credit from 1 October 2013.

In 2011–12, In Work Credit cost the government approximately £116 million, with

around 60,000 new starts.

3.2.4 Return to Work Credit

Non-taxable, Non-contributory, Means-tested

The Return to Work Credit is a fixed tax-free payment of £40 per week for those who

return to work after illness or despite a disability. The work must be for at least 16

hours a week (including self-employment) and expected to last at least five weeks.

The claimant must be paid at least the National Minimum Wage, but not more than

£1,250 gross a month (£288.46 a week). They also need to end a claim to a qualifying

benefit that has lasted at least 13 weeks. The qualifying benefits are Incapacity

Benefit, Employment and Support Allowance, Income Support (on grounds of illness

or disability), Severe Disablement Allowance and Statutory Sick Pay. The Return to

Work Credit is on top of other benefits and is not taxable, and it is payable for up to

12 months. There will be no new payments of Return to Work Credit from 1 October

2013.

Return to Work Credit cost the government £41 million in 2011–12.

© Institute for Fiscal Studies, 2012

20

3.3. Benefits for people on low incomes

Appendix C

3.3.1

3.3.2

3.3.3

3.3.4

3.3.5

3.3.6

Benefit

T

C

M

Income Support

Working Tax Credit

Housing Benefit

Council Tax Benefit

Discretionary housing payments

Social Fund payments:

Regulated:

Sure Start maternity grants

Cold weather payments

Funeral payments

Discretionary:

Community care grants

Budgeting loans

Crisis loans

8

8

8

8

8

8

8

8

8

8

8

8

9

9

9

9

9

9

Claimants, as

at Feb. 2012a

1,509,350c

2,516,000d

5,051,120f

5,922,130f

Not available

Expenditure,

2011–12 (£m)b

6,925

6,889e

22,706

4,928

30

89,000g

5,167,000g

38,000g

45.3

129.2

46.3h

216,000g

1,122,000g

2,071,000g

139.2

–11.1h

–15.2h

T = taxable, C = contributory, M = means-tested

a

Unless otherwise specified.

b

Out-turn figures from DWP Benefit Expenditure Tables unless otherwise stated

(http://research.dwp.gov.uk/asd/asd4/index.php?page=medium_term). Expenditure figures for Social Fund are

from the Annual Report by the Secretary of State for Work and Pensions on the Social Fund 2011/2012

(http://www.dwp.gov.uk/docs/2012-annual-report-social-fund.pdf).

c

Source: DWP, Income Support tabulation tool, available at http://83.244.183.180/100pc/is/tabtool_is.html.

d

Number of families (including 581,700 families without children and 1,934,300 families covering 3,456,400

children), as at April 2012. Source: HM Revenue and Customs, Child and Working Tax Credits Statistics, April

2012 (http://www.hmrc.gov.uk/statistics/prov-main-stats/cwtc-apr12.pdf).

e

Source: HMRC 2011–12 Annual Report and Accounts (http://www.hmrc.gov.uk/about/annual-report-accounts1112.pdf). UK figure.

f

Source: Department for Work and Pensions, First Release: Housing Benefit & Council Tax Benefit Statistics,

November 2012 (http://statistics.dwp.gov.uk/asd/index.php?page=hbctb).These figures refer to claimants in

August 2012.

g

Number of awards made in 2011–12. Source: Annual Report by the Secretary of State for Work and Pensions on

the Social Fund 2011/2012 (http://www.dwp.gov.uk/docs/2012-annual-report-social-fund.pdf).

h

Net expenditure in 2011–12. This differs from gross expenditure mainly because loans are recovered. In

addition, £0.4 million of funeral payments was recovered from estates and therefore excluded in net

expenditure. Source: Annual Report by the Secretary of State for Work and Pensions on the Social Fund

2011/2012 (http://www.dwp.gov.uk/docs/2012-annual-report-social-fund.pdf).

3.3.1. Income Support

Non-taxable, Non-contributory, Means-tested

Income Support (IS) is a benefit paid to people on low incomes, although it is not

available to the unemployed (who may be able to claim Jobseeker’s Allowance) or

© Institute for Fiscal Studies, 2012

21

those in ‘full-time’ paid work32 (who may be able to claim Working Tax Credit). IS is

thus mainly payable to lone parents with a child under 5 and carers (although some

other individuals are also eligible).33 Claimants should be between 16 and the age

they can get Pension Credit. IS cannot be claimed at the same time as JSA or

Employment and Support Allowance (ESA). The partner of an IS cannot claim

income-based JSA (including joint-claim JSA), income-related ESA or Pension Credit.

The level of IS payable depends on the family’s needs (the ‘applicable amount’) and

their income. The applicable amount is the sum of basic personal allowances and

premiums (see Table 3.3.1 and Appendix B) and housing costs for owner-occupiers

(rent is provided for through Housing Benefit; see Section 3.3.3).34 To be eligible, the

claimant’s family income (minus any earnings disregards) must be less than their

‘applicable amount’. The level of IS payable is just the applicable amount minus

income.

Some benefits are not counted as income for the purpose of the IS calculation (e.g.

Attendance Allowance and Housing Benefit), and recipients of certain benefits may

have up to £20 of their income disregarded for the entitlement calculation.35 IS is not

payable if the claimant and the claimant’s partner together have more than £16,000

of capital. Capital up to £6,000 is ignored (£10,000 for those in care homes).36

Between these two thresholds, IS entitlement is reduced by £1 for every £250 of

capital exceeding the lower threshold.

In the past, IS provided support to a wider group of claimants: disabled people now

on the whole claim Employment and Support Allowance (though IS is still available to

certain groups such as those in receipt of Statutory Sick Pay (SSP)); the elderly now

claim Pension Credit (though in a small number of cases pensioner premiums are still

payable under IS, e.g. when a claimant aged under 60 has a partner aged over 60);

32

‘Full-time paid work’ for the purposes of Income Support normally means at least 16 hours per week for the

claimant and at least 24 hours per week for their partner. This definition does not apply to special situations such

as being on holiday or sick leave. For details, see page 353 of CPAG 2012/13.

33

To qualify for IS, one needs not only to satisfy the conditions on income, working hours, age, residency etc., but

also to fit into one of the groups of people who can claim IS. The groups include sick and disabled people, people

with childcare responsibilities and carers, students on training courses, and others. (Details on eligibility are

provided in chapter 17 of CPAG 2012/13.)

34

Housing costs are calculated in the same way as for income-based JSA (see Section 3.2.1). Deductions from

housing costs are made for non-dependants in the same way as for Housing Benefit (see Section 3.3.3 and Table

3.3.3).

35

For details, see pages 913–14 of CPAG 2012/13.

36

None of these thresholds includes the value of owner-occupied property.

© Institute for Fiscal Studies, 2012

22

lone parents whose youngest child is aged 5 and over now claim JSA; and Child Tax

Credit has replaced child additions to IS.37

Table 3.3.1. Current rates of Income Support, £ per week

Personal allowance – single person:

Aged 16–24

Aged 25 or over

56.25

71.00

Aged 16–17

Aged 18 or over

56.25

71.00

One or both aged 16–17

Both aged 18 or over

Variesa

111.45

Personal allowance – lone parent:

Personal allowance – couple:

Premiums :

Disability

Severe disabilityb

Enhanced disabilityc

Carerd

Pensioner

Single/Couple

30.35/43.25

58.20/116.40

14.80/21.30

32.60/65.20

NA/106.45

a

If both members of the couple are under 18, there are two rates: £56.25 and £84.95 (payable in special

circumstances). If only one is under 18, there are three rates: £56.25 (if the other is 18–24), £71.00 (if the other

is 25 or over) and £111.45 (payable in special circumstances). For details, see pages 817–19 of CPAG 2012/13.

b

The severe disability premium is paid to those receiving either of the two highest rates of the care component

of Disability Living Allowance (see Section 3.5.3) who have no one living with them to care for them. The couple

rate only applies when both partners qualify.

c

The enhanced disability premium is payable where the claimant or a family member receives the highest rate

of Disability Living Allowance (care component) – see Section 3.5.3 – and is aged 60 or below.

d

The higher rate only applies if both members of the couple are eligible for Carer’s Allowance

In February 2012, around 1.5 million people received IS, with total expenditure in

2011–12 estimated at £6.9 billion. Receipt of IS automatically entitles individuals to

free school meals, health benefits (including free prescriptions, dental treatment and

sight tests), maximum Council Tax Benefit, maximum Housing Benefit and certain

Social Fund payments (including the Sure Start Maternity Grant and funeral

payments; see Appendix C for further details).

37

Prior to November 2008, most lone parents were eligible for IS. In order to encourage lone parents to work, an

upper age limit on the youngest child has been introduced for IS eligibility. Eligibility was initially restricted to

lone parents with a child under 12, in October 2009 to those with a child under 10, and in October 2010 to those

with a child under 7. As of 21 May 2012, Income Support for lone parents is restricted to those with children

under 5. There are transitional arrangements that allow lone parents with older children to continue claiming IS

for a certain period of time. For details, see page 352 of CPAG 2012/13. More circumstances are listed in DWP, A

Guide to Income Support (http://www.dwp.gov.uk/docs/is-20.pdf).

© Institute for Fiscal Studies, 2012

23

3.3.2. Working Tax Credit

Non-taxable, Non-contributory, Means-tested

Working Tax Credit (WTC) has been available since 6 April 2003 and provides in-work

support for low-paid working adults. It replaced the adult and childcare-cost

elements of the Working Families’ Tax Credit, Disabled Person’s Tax Credit and the

New Deal 50-Plus employment credit, and extended in-work support to cover

households without children. Since WTC is a tax credit, it is administered by HM

Revenue and Customs. Under international accounting conventions, tax credits are

counted as negative taxation to the extent that they are less than the income tax

liability of the family and as government expenditure for payments exceeding the tax

liability. For our purposes, however, we count all tax credit expenditure as if it were

a cash benefit (and therefore public spending).

WTC requires the claimant (or the partner) to be in full-time paid work. Normally,

claimants aged 25 or over are only eligible if they work at least 30 hours per week.

More lenient rules apply to disabled workers, those over 60, lone parents and

couples with children. The first three of these groups are eligible for WTC provided at

least one adult in the household works 16 or more hours per week. To be eligible for

WTC, couples with children must, in addition to meeting that condition, work for a

combined total of at least 24 hours. This additional requirement is waived if the nonworking partner is entitled to Carer’s Allowance, incapacitated or in prison.

Table 3.3.2. Current rates of Working Tax Credit

Disability element

Severe disability element

2,790

1,190

£ per week

36.82

37.40

15.15

175.00

300.00

53.51

22.82

Income below which maximum WTC is payable

Withdrawal rate

6,420

41%

123.12

41%

Basic element

Couple and lone-parent element

30-hour element

Childcare elementa

£ per annum

1,920

1,950

790

One child

Two or more children

a

70% of eligible childcare payments are payable (up to the maximum shown).

Note: Weekly numbers are calculated based upon there being 365/7 weeks per year.

WTC is made up of a number of components (see Table 3.3.2). There is a basic

element, with an extra payment for couples and lone parents (i.e. for everyone

except childless single people), as well as an additional payment for those working at

least 30 hours per week (30 hours in total for couples). WTC also includes

supplementary payments for disability and severe disability. Severe disability

© Institute for Fiscal Studies, 2012

24

supplements are payable where the recipient or their partner receives the highest

rate of the care component of Disability Living Allowance (see Section 3.5.3) or the

higher rate of Attendance Allowance (see Section 3.5.4).

The maximum amount of WTC payable is calculated by adding together all applicable

elements. Claimants are automatically entitled to the maximum amount of WTC if

they receive Income Support, income-based JSA, income-related ESA or Pension

Credit, although it should be noted that there are few situations in which any of

those four benefits can be claimed at the same time as WTC (due to the working

restrictions). WTC also counts fully as income in calculations for all those four

benefits.

WTC that either includes a disability element or is received with Child Tax Credit

passports recipients to a number of health benefits, including free prescriptions,

dental treatment, and sight tests and glasses. The childcare element of WTC is

available to lone parents working 16 hours or more per week and to couples where

both partners work for 16 hours or more per week (or if one is incapacitated or in

prison and thus unable to care for children and the other works for 16 hours or more

per week). This element is payable until the first week in September following the

child’s 15th birthday (16th birthday for disabled children), and care must be given by

approved providers such as registered childminders, nurseries and after-school

clubs. The childcare component provides 70% of eligible childcare expenditure of up

to £175 per week for families with one child or £300 for families with two or more

children (i.e. up to £122.50 or £210 per week respectively). Unlike the rest of WTC,

which is necessarily paid to the individual in full-time work (or to the individual

agreed upon by the couple where both are in full-time work), the childcare credit is

paid directly to the main carer, as with Child Tax Credit (CTC).

WTC is subject to a joint means test with CTC (see Section 3.1.3). The claimant must

be in paid work at the time the claim is made, or expect to start work within 7 days

of making the claim. The claim runs from the date it is received by HM Revenue and

Customs. A claim for WTC can usually be backdated for up to a month. In some

instances, changes to personal circumstances affect WTC entitlement, and HMRC

must be notified within one month of the date of change or the date the claimant

becomes aware of the change. Examples include a single claimant becoming part of a

couple (or vice versa), or where childcare costs are reduced by £10 per week or more

for four consecutive weeks. Other changes to circumstances can be disclosed either

at the time that they occur or at the end of the tax year, although the latter course

may subsequently lead to irrecoverable underpayments because most changes that

increase the entitlement can only be backdated for three months. Overpayments as

a result of delayed notification will usually be recovered.

© Institute for Fiscal Studies, 2012

25

The changes that have been made to both WTC and CTC are discussed in Section

3.1.3. Recent reforms to WTC in particular are:

•

freezing the basic and 30-hour elements for three years from 2011–12, saving

over £1 billion a year by 2015–16;38

•

reducing the percentage of childcare costs payable from 80% to 70% from

April 2011, saving around £400 million a year by 2015–16;39

•

abolishing the 50-plus return-to-work bonus from April 2012, saving around

£35 million a year;40

•

introducing the requirement for a combined total of at least 24 hours in work

for couples with children from April 2012, saving around £550 million a

year.41

In April 2012, approximately 1.9 million families were receiving both WTC and Child

Tax Credit (see Section 3.1.3) and 581,700 families were receiving WTC only (as they

had no dependent children). For 2011–12, expenditure on WTC is expected to be

around £6.9 billion (see Section 3.1.3 for more details on the problem of

overpayment).

3.3.3. Housing Benefit

Non-taxable, Non-contributory, Means-tested

Housing Benefit (HB) is payable to families with low incomes who rent their homes

(for families who own their own homes, mortgage interest payments may be met

through Income Support, JSA, ESA or Pension Credit).

The level payable depends on the ‘maximum HB’, the ‘applicable amount’, and the

claimant’s income and capital. The maximum level of HB is equal to ‘eligible rent’

minus possible deductions made for any non-dependants because they are expected

to contribute towards the rent. An amount is deducted for each non-dependant

aged at least 18 based on their gross weekly income.42 (Since April 2011, these have

38

Source: HM Treasury, Budget 2011, March 2011 (http://cdn.hm-treasury.gov.uk/2011budget_complete.pdf).

39

Source: HM Treasury, Budget 2011, March 2011 (http://cdn.hm-treasury.gov.uk/2011budget_complete.pdf).

40

Source: HM Treasury, Budget 2012, March 2012 (http://cdn.hm-treasury.gov.uk/budget2012_complete.pdf).

41

Source: HM Treasury, Budget 2012, March 2012 (http://cdn.hm-treasury.gov.uk/budget2012_complete.pdf).

42

No deductions are made for any non-dependant if either the claimant or the claimant’s partner is blind, or

receives Attendance Allowance or the care component of Disability Living Allowance. No deductions are made for

an individual non-dependant when the non-dependant is a full-time student, or under 25 and on IS or incomebased JSA, or in a range of other situations. A single deduction is made for non-dependent couples. For further

details, see pages 265–9 of CPAG 2012/13.

© Institute for Fiscal Studies, 2012

26

been uprated in line with the Consumer Prices Index (CPI), having previously been

frozen at 2002–03 levels.) Eligible rent is the weekly contractual rate of rent less

ineligible charges included in the rent (such as certain fuel charges, service charges

for washing, cleaning, etc., and water charges), and subject to rent restrictions. Note

that these restrictions depend on the tenancy type (see below).

Table 3.3.3. ‘Applicable amounts’ for Housing Benefit, £ per week

Under 25

Aged 25 or over

Qualifies for PC but under 65

Aged 65 or over

56.25a

71.00b

142.70

161.25

Both aged 16–17

One or both aged 18 or over

One or both attained the PC

qualifying age but both under 65

One or both aged 65+

84.95

111.45c

217.90

Personal allowance – single person:

Personal allowance – couple:

Personal allowance – child:

Premiums:

Family-related:

241.65

Under 20

64.99

Familyd

Family (lone parent)e

17.40

22.20

Disability-related:

Disabled child (each)

Disability

Enhanced disability:f child (each)

adult

Severe disabilityg

Carer

ESA components:i

Work-related activity

Support

Single/Couple

56.63

30.35/43.25

22.89

14.80/21.30

58.20/116.40

32.60/65.20h

28.15

34.05

a

This is also the allowance for lone parents aged under 18.

b

This is also the allowance for those on main phase ESA (including lone parents) and for lone parents aged 18 or

over.

c

This is also the allowance for those on main phase ESA.

d

A family premium is payable if there are any dependent children in the household.

e

The lone-parent premium, £4.80 on top of the standard family premium, is now available only to existing

claimants, further details of which can be found in Appendix B.

f

The enhanced disability premium is payable where the claimant or a family member receives the highest rate

of Disability Living Allowance (care component) and is aged 60 or below.

g

The severe disability premium is paid to those receiving either of the two highest rates of the care component

of Disability Living Allowance who have no one living with them to care for them. The couple rate only applies

when both partners qualify.

h

The couple rate only applies when both partners qualify.

i

See Section 3.5.2 for details on eligibility

© Institute for Fiscal Studies, 2012

27

People on Income Support, income-based JSA, income-related ESA or the guarantee

credit element of Pension Credit are automatically entitled to maximum HB. For

other claimants, the amount of HB payable depends upon income relative to the

‘applicable amount’ in much the same way as for IS or income-based JSA. The

individual’s applicable amount is calculated as the sum of the relevant personal

allowance, premiums and components (set out in Table 3.3.3). If income is less than

or equal to the ‘applicable amount’, maximum HB is payable. When income exceeds

this level, there is a 65% taper (so HB entitlement is equal to maximum HB minus

65% of the amount by which income exceeds the applicable amount).

Some benefits are not counted as income (e.g. Attendance Allowance, Disability

Living Allowance and Guardian’s Allowance), and recipients of certain benefits may

have up to £20 of their income disregarded for the HB entitlement calculation.

Earnings spent on childcare costs (of up to £175 per week for one child, or £300 for

two or more) are also disregarded in the cases of lone parents working 16 hours a

week or more and couples who both work 16 hours or more. Since October 2009,

Child Benefit has been disregarded in the calculation of income for both Housing

Benefit and Council Tax Benefit, but tax credits are counted as income.

If the claimant and their partner together have capital that exceeds the upper limit

(£16,000), no HB is normally payable. But for individuals receiving the guarantee

credit element of Pension Credit, all capital and income are fully ignored. Capital

under the lower limit – £10,000 for those above the female State Pension Age or

living in a care home, and £6,000 for others – is ignored. Between the two limits,

every £250 is assumed to generate £1 of income for those under pension age,

compared with every £500 for those above female State Pension Age.

Rent restrictions apply if the claimant is not a local authority tenant. For most private

sector tenants, the eligible rent is the lower of the Local Housing Allowance (LHA)

rate applicable to the claimant and the ‘cap rent’. The LHA rate is based on the

amount of rent at the 30th percentile in the local rental market for the number of

bedrooms to which the claimant is entitled, which is itself determined by household

composition.43 As of April 2011, LHA rates have been subject to an absolute cap,

ranging from £250 per week for a one-bedroom property to £400 per week for a

four-bedroom property. The ‘cap rent’ is the rent that the claimant is liable to pay

for his/her home. For tenants renting mobile homes, those whose rent includes

board and attendance, and some housing association tenants, eligible rents are

43

From April 2012, single claimants under 35 are only entitled to one-bedroom shared accommodation

(previously the age cut-off was 25). Room entitlement more generally depends on the number of adults and the

gender and age of any children, and it is currently capped at four bedrooms. For details, see page 309 of CPAG

2012/13.