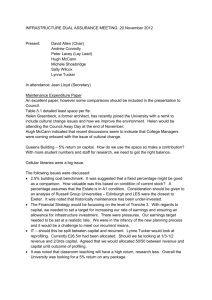

7. Policies to help the low paid Summary

advertisement