2. The fiscal policy framework Summary

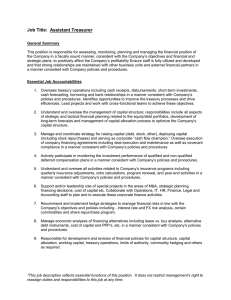

advertisement