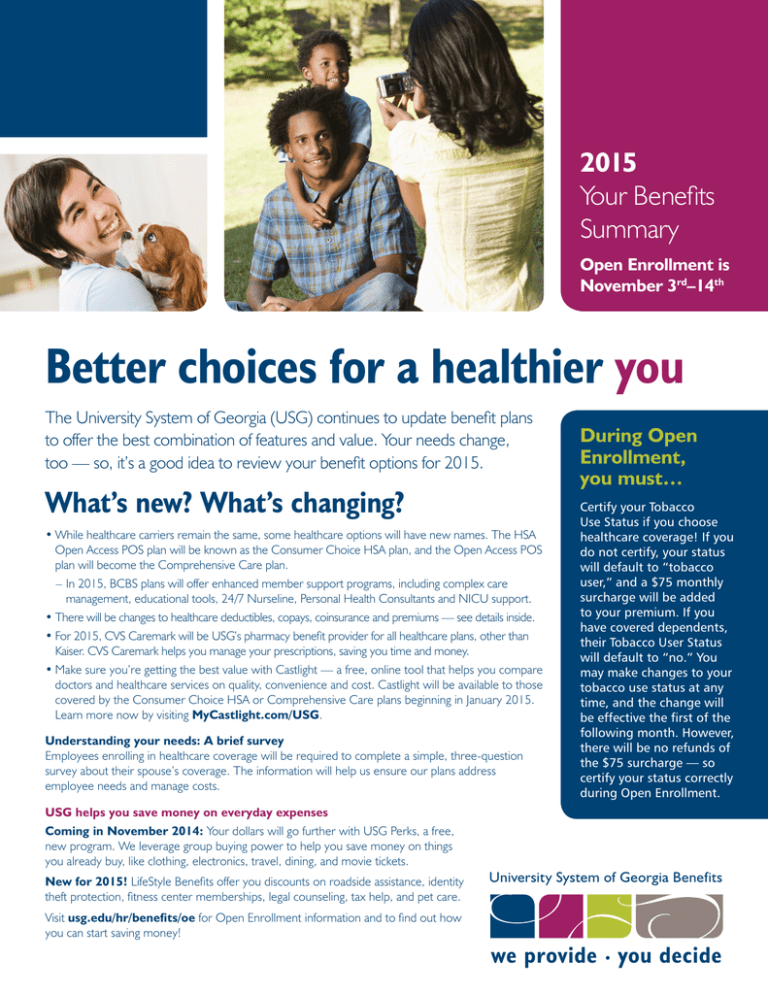

Better choices for a healthier you 2015 Your Benefits

advertisement

2015 Your Benefits Summary Open Enrollment is November 3rd–14th Better choices for a healthier you The University System of Georgia (USG) continues to update benefit plans to offer the best combination of features and value. Your needs change, too — so, it’s a good idea to review your benefit options for 2015. What’s new? What’s changing? •While healthcare carriers remain the same, some healthcare options will have new names. The HSA Open Access POS plan will be known as the Consumer Choice HSA plan, and the Open Access POS plan will become the Comprehensive Care plan. –– In 2015, BCBS plans will offer enhanced member support programs, including complex care management, educational tools, 24/7 Nurseline, Personal Health Consultants and NICU support. •There will be changes to healthcare deductibles, copays, coinsurance and premiums — see details inside. •For 2015, CVS Caremark will be USG’s pharmacy benefit provider for all healthcare plans, other than Kaiser. CVS Caremark helps you manage your prescriptions, saving you time and money. •Make sure you’re getting the best value with Castlight — a free, online tool that helps you compare doctors and healthcare services on quality, convenience and cost. Castlight will be available to those covered by the Consumer Choice HSA or Comprehensive Care plans beginning in January 2015. Learn more now by visiting MyCastlight.com/USG. Understanding your needs: A brief survey Employees enrolling in healthcare coverage will be required to complete a simple, three-question survey about their spouse’s coverage. The information will help us ensure our plans address employee needs and manage costs. USG helps you save money on everyday expenses Coming in November 2014: Your dollars will go further with USG Perks, a free, new program. We leverage group buying power to help you save money on things you already buy, like clothing, electronics, travel, dining, and movie tickets. New for 2015! LifeStyle Benefits offer you discounts on roadside assistance, identity theft protection, fitness center memberships, legal counseling, tax help, and pet care. During Open Enrollment, you must… Certify your Tobacco Use Status if you choose healthcare coverage! If you do not certify, your status will default to “tobacco user,” and a $75 monthly surcharge will be added to your premium. If you have covered dependents, their Tobacco User Status will default to “no.” You may make changes to your tobacco use status at any time, and the change will be effective the first of the following month. However, there will be no refunds of the $75 surcharge — so certify your status correctly during Open Enrollment. University System of Georgia Benefits Visit usg.edu/hr/benefits/oe for Open Enrollment information and to find out how you can start saving money! we provide • you decide Healthcare When it comes to keeping you and your family healthy, we’ve got you covered. •Consumer Choice HSA — Provided by Blue Cross Blue Shield •Comprehensive Care — This BCBS plan was formerly known of Georgia (BCBS), this plan was formerly known as the Health as the Open Access POS, and it offers coverage for both in-network Savings Account (HSA) Open Access POS. This is the only healthcare and out-of-network providers. plan that provides you with access to an HSA — see more •BlueChoice HMO — You receive benefits when your care is information on page 3. coordinated by your BCBS primary care physician. •Moving to the Consumer Choice HSA for 2015? If you have •Kaiser Permanente (KP) HMO — You receive benefits when an FSA now, make sure the balance is zero by December 31, 2014 — your care is coordinated by your KP primary care physician. otherwise, you won’t be able to open an HSA until April 1, 2015. What if I don’t enroll? If you have healthcare coverage for 2014 and do not enroll for 2015, your 2015 coverage will default to your 2014 coverage. Your healthcare options Consumer Choice HSA In-network Comprehensive Care In-network BlueChoice HMO In-network only Kaiser Permanente HMO In-network only Deductible (Single/Family) $1,500/$3,000 $500/$1,500 None None Out-of-pocket max (Single/Family) $3,500/$7,000 $1,250/$2,500 $5,500/$9,900 $6,350/$12,700 No No Yes Yes 100% 100% 100% 100% Physician office visit/ Specialist visit 80% after deductible $20 copay/$30 copay $30 copay/$50 copay $20 copay/$25 copay Inpatient hospital services 80% after deductible 90% after deductible $500 copay $250 copay 80% after deductible $150 copay, then 90% after deductible $250 copay $250 copay • Generic $10 copay $10 copay $10 copay • Preferred brand $35 copay $35 copay Kaiser pharmacies: $35 copay Contracted non-Kaiser pharmacies: $45 copay limited to a one-time fill per medication 20% with $45 min and $125 max 20% with $45 min and $125 max Not covered $25 copay $25 copay $20 copay $87.50 copay $87.50 copay $70 copay through Kaiser pharmacies only 20% with $112.50 min and $250 max 20% with $112.50 min and $250 max Not covered Primary care physician required Preventive care Emergency care Prescription drugs Retail 80% after deductible • Nonpreferred brand Mail order (90-day supply) Retail • Generic • Preferred brand • Nonpreferred brand 80% after deductible Bold text indicates change for 2015. Your dental options You can choose from these dental options through Delta Dental. *Preventive and diagnostic services don’t count toward the annual maximum. **Benefit limits on full replacement of existing dentures or crowns apply. For 2015, you can choose dental and vision coverage for eligible dependents without student verification until the end of the month in which they turn 26. If your dependent has been dropped from your coverage in the past, you may add the dependent(s) to your dental and vision coverage during Open Enrollment. Delta Dental Base Plan Delta Dental High Plan In-network In-network $1,000 per person* $1,500 per person* $50/$150 $50/$150 Diagnostic/preventive services* 100% 100% Basic benefit services 80% 80% Major benefit services** 50% 80% Orthodontia (child and adult) No coverage 80% Lifetime orthodontia maximum No coverage $1,000 Annual maximum Deductible (Single/Family) Your vision option Healthcare FSA You can choose to enroll in vision coverage through EyeMed, whose provider network includes top national retail chains. Vision benefits are provided for the following services and supplies once per 12-month period. A Healthcare FSA can save you money on healthcare, prescription drug, dental, or vision expenses. You can contribute up to $2,500 a year. EyeMed Vision In-network Out-of-network reimbursement Exam $10 copay $40 Single vision lens $25 copay $40 Frames contribution $150 allowance $58 Contact lenses $150 allowance $130 Paid in full $210 Medically necessary contact lenses NEW! CVS Caremark For 2015, CVS Caremark will be USG’s pharmacy benefit manager for employees enrolled in BCBS healthcare plans. You will receive one ID card with your BCBS and CVS Caremark benefit information. CVS Caremark will provide ways to save you time and money, whether you fill your prescription at a network retail pharmacy or choose convenient mail service for your refills. Dependent Care FSA A Dependent Care FSA can save you money on dependent care expenses you pay while you’re at work. These include day care expenses and summer camps for children under age 13 and care for an elderly parent. You can contribute up to $5,000 a year, or $2,500 if you’re married and file separate income tax returns. Plan carefully! FSAs have a “use it or lose it” policy. Money left in an FSA cannot be returned to you. Protect your income We provide you with coverage to help protect your family’s income against the unexpected. Disability coverage 2015 Rates: •Short-term disability (STD) — After you’ve been disabled for 14 days, this benefit replaces 60% of weekly salary, up to $2,500. Benefits may last up to 11 weeks. Evidence of Insurability is required if you elect this coverage during Open Enrollment. •Long-term disability (LTD) — After you’ve been disabled for 90 days, this benefit replaces 60% of monthly salary, up to $15,000. No evidence of insurability is required. See premiums for all 2015 benefit options in the Comparison Guide: http://www.usg.edu/hr/ benefits_docs/BOR_Comparison_Guide_NEW.pdf Do you already have a condition? You may not be eligible for LTD benefits for 12 months if you received treatment for a condition within three months of when your disability coverage begins. Save money on healthcare and dependent care A U.S. Bank Health Savings Account (HSA) and/or Flexible Spending Account (FSA) can save you money on health and dependent care expenses. Your contributions to these accounts are tax-free, saving you money on federal and state income taxes and Social Security taxes. Health Savings Account (HSA) If you’re enrolled in the Consumer Choice HSA plan, you’re eligible to have an HSA. Unlike an FSA, money left in your HSA rolls over from year to year. When you contribute to your HSA, USG will match you dollar-fordollar until your contributions reach $375 for an individual or $750 for a family. In 2015, you can personally contribute up to $2,975 for an individual or $5,900 for a family. And the HSA is always yours, even if you leave USG! Limited Purpose Healthcare FSA A Limited Purpose Healthcare FSA is an additional tax-free account for those enrolled in the Consumer Choice HSA. You may contribute up to $2,500 for eligible dental and vision expenses only. Life insurance You can protect your family’s income in the event of a death due to illness or accident. •Basic life and AD&D — You’ll receive life and Accidental Death & Dismemberment (AD&D) insurance equal to $25,000 at no cost to you. •Supplemental life insurance — You can buy additional life insurance coverage from one to eight times your salary, up to a maximum of $2.5 million. Each year, you can elect or increase your coverage by one times your salary without having to provide proof of good health to the lesser of three times your salary or $500,000. •Dependent coverage — You can choose life insurance coverage for your dependents, too: –– Spouse coverage options of $10,000 to $500,000. Proof of good health is required for all requests for spouse coverage during Open Enrollment. –– Child(ren) coverage options of $5,000, $10,000 or $15,000. No proof of good health is required. •Supplemental AD&D insurance — You can buy additional supplemental AD&D insurance in amounts of $10,000 to $500,000. Coverage is available for you alone, or you and your family. Bonus! You’ll also receive these benefits: beneficiary financial counseling, legacy planning services, legal services, and travel assistance. Protect those who matter Your USG benefits can also cover your eligible dependents. Healthcare benefits: Your legal spouse; your natural, adopted, or stepchild(ren) through the end of the month of their 26th birthday; your disabled child(ren) with proof of disability. Dental, Vision, Life, and AD&D benefits: Your legal spouse or domestic partner; your natural, adopted or stepchild(ren) who live with you, through the end of the month of their 26th birthday; your disabled child(ren) with proof of disability. If you are adding new dependents to any coverage, you may be required to show documentation of your relationship or your child’s age. Examples include a marriage certificate, birth certificate, adoption certificate, and income tax returns. If both you and your spouse are eligible University System of Georgia employees, only one may elect to cover the other spouse and/or dependent children. Get help when you need it Have questions about your benefits? We have answers. Visit usg.edu/hr/benefits/oe or call your institution’s HR/Benefits office. When you need to contact our benefits partners … Healthcare BCBS 1-800-424-8950 bcbsga.com/usg Kaiser Permanente HMO 1-404-261-2590 1-888-865-5813 (Outside of Atlanta) kp.org Pharmacy (BCBS plans) CVS Caremark 1-800-231-4403 caremark.com (available 1/1/2015) Healthcare transparency tool (Comprehensive Care and Consumer Choice HSA plans only) Castlight 1-800-424-8950 (first-level service support mycastlight.com/usg provided by BCBS) Dental Delta Dental 1-800-471-4214 deltadentalins.com/usg Vision EyeMed 1-866-800-5457 eyemedvisioncare.com/usg HSA & FSA U.S. Bank 1-877-470-1771 mycdh.usbank.com Disability MetLife 1-866-647-6766 mybenefits.metlife.com Life and AD&D Minnesota Life 1-866-293-6047 lifebenefits.com Discounts on services LifeStyle Benefits 1-855-647-6766 (available 1/1/2015) MyMemberPortal.com (available 1/1/2015) Online purchasing program USG Perks Contact the Help Center via the website usg.affinityperks.com • Consumer Choice HSA • Comprehensive Care • BlueChoice HMO The University System of Georgia Health Plan meets the Affordability requirement under the Affordable Care Act. Therefore, generally, University System of Georgia employees will not be eligible for a tax credit in 2015 through the Health Insurance Marketplace created under the Affordable Care Act. BENEFITS SUMMARY