Michael Yeadon Letter Code: V

advertisement

Michael Yeadon

Letter Code: V

Qualifying Examination: Microeconomics

18 January 2013

General Instructions

Answer all questions in Part I. Choose and answer only one question in Part II., and only one

question in Part III. You will have five hours to complete the three parts of the examination.

Read all the questions carefully, make your choices of which questions you are best prepared to

answer, and plan your time accordingly.

All answers should be graduate-level. Clearly explain and show all your work whether or not

the question formally asks for explanation and/or asks you to indicate the steps in your

analysis. As microeconomics faculty members may not be available at every point during the

exam to offer clarifications, please make sure to state clearly any assumptions you find you

absolutely need to make in order to answer a question. In general, though, all answers should

impose as few assumptions as possible.

Each student is expected to answer the questions without consulting notes, books, outside

resources, or other students. Your answer is to reflect your own work during the examination

period. See the Honor Pledge below. If you observe any irregularities during the examination

process, please let the proctor know.

Submit your answers in the order the questions are asked. Scrambling the order of the answers

interferes with readers’ ability to locate the answers in the grading process. (A suggestion is to

answer each question on a separate page, and then collate them in order.) Put the questions

and your answers in the envelope provided; fold your scratch paper in half and put it in the

envelope. You may request a photocopy of the exam and your answers, after the exam results

are known. Your exam will be with the graduate program assistant in the department office.

Honor Pledge

Please complete and sign the following pledge:

I, ____________________________, pledge that I did not and will not give or receive

unauthorized information to any person concerning either the questions or answers in this

examination. I understand that violation of this pledge in even the slightest degree will result

in an automatic result of FAIL, and more severe measures according to University procedures.

Signed: ____________________________________ Date: _____________________

Note: You may leave the exam room as needed for breaks.

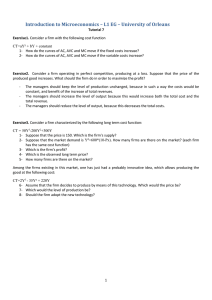

PART I. State whether each of the following propositions is TRUE, FALSE, or UNCERTAIN, and

briefly but effectively justify your answer. Answer all 9 questions.

1. A firm with the production function q = f(K, L) = 10KL / (K + L) has an elasticity of scale

equal to 2, and an elasticity of factor substitution equal to ½.

2. If a person’s expenditure function is e(p,u) and demand function for good j is xj(p,m),

where p is a vector of prices and m > 0 is income, then xj is a normal good if and only if

∂2e/∂pj∂u > 0.

3. Suppose a per unit tax of t dollars is imposed on the output of a monopoly which has

constant unit cost of production and is facing a market demand function q = p- e, with

e >1. Then, the monopoly price will be raised by less than t dollars.

4. If a person is risk-seeking (or risk-loving), the utility function representing his or her

preferences must be convex.

5. Compensated (Hicksian) demand functions must be homogeneous of degree 0 in prices

and homogeneous of degree 1 in utility.

6. Imagine a 2-person, 2-commodity exchange economy. If both consumers consider the 2

goods to be perfect complements and the total amounts of good X and of good Y are

different, then the contract curve will resemble a step function.

7. Imagine you are behind Rawls’ “veil of ignorance.” You know that you are going to be a

member of a three-person society. If income is distributed according to a competitive

market system, the incomes of these people will be 16, 25 and 36, and for each person

U(y) = y1/2. Before you know who you are, you must vote for one of three income

redistribution rules: (I) do nothing; (II) at a cost of 1 unit of the rich person’s output, tax

the rich person 9 units and give 6 units to the poor person and 3 units to the middle

person; and (III) at a cost of 1 unit of the rich person’s output, tax the rich person 9 units

and give all of these units to the poor person. The decision rule is that if two people can

agree on either II or III, it is adopted; otherwise, I is adopted. Given this context, Rule II

would be preferred by a rational, self-interested person who maximizes expected utility,

and therefore would be unanimously adopted by the group if all are rational and

similarly motivated.

8. Consider a game where two players, 1 and 2, bargain to determine the split of a pie of

size v. Bargaining works as follows. Player 1 offers a split, s, which must take one of the

following three values: 0, v/2, or v. Player 2 observes this offer, and either accepts it or

rejects it. If 2 accepts the offer, 1 gets a payoff of s, and 2 gets a payoff of v-s. If 2

rejects the offer, both players get 0, and the game ends. In this game, no strategies are

strictly dominated, but one strategy is weakly dominated for player 1 and two strategies

are weakly dominated for player 2.

9. In the game below, the only perfect Bayesian equilibrium is (½L + ½M, ½A + ½B) μ= ½.

R

1

½, ½

L

M

[μ]

A

0,1

2

B

[1- μ]

A

1,0

1,0

B

0,1

Part II. Choose one of the following questions and answer clearly and completely.

10. Consider a household whose preferences between leisure hours H and consumption X are

given by the utility function U = ln H + ln X, who has an endowment of H0 (hours in a year) and

X0 (non-labor income), and who can only buy additional X (at a price of 1) by selling some H

(supplying labor) at wage rate of w. Other feasibility constraints are X ≥ 0 and H0 ≥ H ≥ 0.

a. For an interior solution, give a mathematical statement of the household’s utility

maximization problem, and state the first-order necessary conditions.

b. Graphically illustrate an interior solution for the maximization problem.

c. Use the first-order conditions to determine when an interior solution will apply (stated

as a condition about w), and to derive the labor supply function for that case, and then

discuss the implied shape of the labor supply curve.

d. Suppose labor is taxed at a rate of t per hour supplied, and the market wage rate w is

unaffected. Give a mathematical and graphical presentation of how the tax affects the

household’s choices.

e. If, as an alternative, the same amount of tax revenue could be collected from the

household via a lump-sum taken out of X0, would the household prefer that? Explain.

11. Consider a generic, divisible good (for instance, electricity) for which there could be two

possible production technologies, each with a Total Cost (as a function of firm output q) as

follows:

“Small scale” technology:

TC = 200 + 0.50 q2

“Large scale” technology:

TC = 5000 + 0.005 q2

a. For each technology, give the Average Cost and Marginal Cost functions. Discuss why

the “small scale” and “large scale” labels are appropriate.

b. Suppose that at first, only the “small scale” technology is available. And suppose market

demand for the good is given by Qd = 1200 – 20 p where p is price. Describe the likely

market structure and equilibrium outcome, specifically: firm size q*, number of firms n*,

total production Q*, price p*, consumer surplus, and profits.

c. What if the “large scale” technology subsequently becomes available? Will it be

economically beneficial for society? Compare the new values with those you derived in

part b, and discuss the implications.

Part III. Choose one of the following questions and answer clearly and completely.

12. Consider the infinitely repeated Bertrand competition game with two firms and

homogeneous goods. Assume that both firms discount future payoffs at the rate δ. Suppose

when both firms set the same price, the demand is split equally between them. Each firm has

unit cost c, the demand function is D(p), and suppose the profit function π(p) = (p – c)D(p) has a

unique maximizer pm and π(p) is increasing for all p ≤ pm. Suppose that for i = 1, 2, firm i cannot

detect a deviation until ki ≥ 1 periods after the deviation (so ki = 1 for both i is the standard case

with no detection lag). k1 and k2 are common knowledge.

a. Find, as a function of δ, the highest symmetric profit (or equivalently, highest symmetric

price) sustainable in a subgame perfect equilibrium.

b. Now suppose that at the beginning of the game, each firm i simultaneously chooses any

positive integer ki or chooses φ (meaning no detection at all). Choosing φ incurs no cost,

while the cost of choosing detection after k periods is given by function c(k) for each

firm, where c > 0, c’ < 0. The choices of both firms are perfectly observable. Solve for the

pure strategy subgame perfect equilibrium (or equilibria) of this game.

13. Consider an economy with linear production sets. Suppose there are 2 agents and 4

commodities. Commodities 1 and 2 are consumption goods while commodities 3 and 4 are

skilled and unskilled labor. Agents' utility functions are U1(c1,c2,c3,c4) = 3log(c1) + log(c2) and

U2(c1,c2,c3,c4) = – 1/c1 – 4/c2.

Agents' endowments are e1 = (0,0,8,0) and e2 = (0,0,0,10). Suppose there are 4 possible

activities transforming skilled and unskilled labor into commodities 1 and 2: a1 = (3,0,–4,0); a2 =

(1,2,–4,0); a3 = (2,0,0,–4); a4 = (0,2,0,–4). Suppose there is a single firm whose production set Y

∑

is given by the convex hull of these activities, Y = {

:

for some

}.

a. Define (in words) a competitive equilibrium for this economy.

b. Solve for each consumers’ demand curves as a function of prices.

c. Compute a competitive equilibrium for this economy. In the solution, normalize p3 = 1.

d. Is your solution to part c unique?