Document 12753398

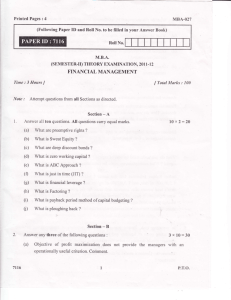

advertisement