Finding the hidden costs in

broken supply chains

With tariffs at 30-year lows, what’s really holding up

cross-border trade?

By Mark Gottfredson

Mark Gottfredson is a partner with Bain & Company based in Dallas and a

senior member of Bain’s Performance Improvement practice.

Copyright © 2013 Bain & Company, Inc. All rights reserved.

Finding the hidden costs in broken supply chains

For decades, governments and companies around the

world have focused almost exclusively on tariffs as

the biggest impediment to global trade. Despite tariffs

dropping to a 30-year low, reform efforts have stalled

in recent years and international trade remains seriously

constrained. A big reason: The inefficiencies and chokepoints that hobble the global supply chain turn out to

be a much bigger factor than government-imposed

tariffs in restricting the flow of goods and services

across borders.

they want to truly unlock the economic potential of

global trade. For companies looking to take advantage

of international markets, the message is more immediate: Making the right choices about where and how

to deploy assets globally requires a full understanding

and analysis of how these supply chain barriers affect

return on investment. Failing to anticipate the costs and

risks involved can wipe out the business advantages of

sourcing, operating or selling in foreign markets.

Strengthening supply links

Together with the World Bank, Bain & Company has

analyzed the business implications of supply chain

barriers—everything from border delays and inconsistent product regulations to poor infrastructure and

rampant corruption—presenting our findings in a

report for the World Economic Forum. Our analysis demonstrates that reducing even a subset of

these obstructions could increase global GDP over six

times more than removing all tariffs (see Figure 1).

Supply chain barriers include anything that obstructs

the easy movement of goods from one link in the supply

chain to the next: subpar roads, outmoded border policies, restrictive local-content rules. Their effects vary

by region, industry and country, but the report found

that they often work in concert to slow down trade and

drive up costs in both developing and developed nations.

That drains resources that might otherwise be used to

create jobs and increase prosperity.

That has broad, long-term implications for policymakers,

suggesting that governments need to refocus their

efforts on creating efficiencies in the supply chain if

Many corporate leaders know of these chokepoints from

direct experience. One diversified chemical company

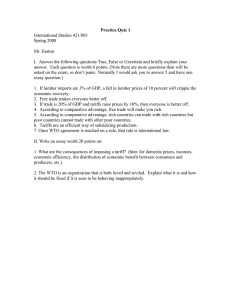

Figure 1: Reducing supply chain barriers has a larger effect than removing tariffs

Increase in trade* and GDP (US $ trillion)

$3

$2.6

2

$1.6

$1.5

4.7%

1

$1.1

$1.0

14.5%

2.6%

9.4%

$0.4

10.1%

0.7%

0

Ambitious scenario

Modest scenario

Tariffs

Countries improve halfway to

global best practice

Countries improve halfway to

regional best practice

All tariffs removed globally

The GDP effect of reducing supply chain barriers is much higher than for tariffs

GDP

Trade

*Based on export value; includes only the effect of “border administration” and ”telecommunication and transport infrastructure.”

Source: Ferrantino, Geiger and Tsigas, The Benefits of Trade Facilitation—A Modelling Exercise. Based on 2007 baseline.

1

Finding the hidden costs in broken supply chains

that exports acetyl and other products to the US, for

instance, needs approvals for every shipment from as

many as five different US regulatory agencies, delaying

30% of inbound shipments and causing cancellations

from customers fed up with waiting. A global food products company sources a significant amount of its raw

materials from Brazil. But a combination of poor roads

and shoddy communications infrastructure slows shipments and makes them difficult to track, increasing

security risk. At port, cargo “dwell” time averages five

to 10 times longer than in Chile and developed nations.

That drives up operating costs and forces the company

to stockpile inventories, tying up working capital.

of payments to the government. Developing nations,

in particular, stand to benefit from improvements. So

too would small and midsize companies, many of which

are blocked from selling internationally by prohibitive

supply chain barriers that strain their limited resources.

Getting past the tipping points

While tariffs can generally be eliminated with the stroke

of a pen once political obstacles are addressed, eliminating

supply chain barriers is a complex task requiring coordinated policy action and investment. As with tariffs,

regulators have to deal with reluctance from companies

and local industries protected by supply chain barriers.

And they have to make smart choices about which

changes will have the greatest impact.

Supply chain barriers fall into four main categories—

market access, telecom and transport infrastructure,

border administration and business environment. We

identified global best practices for each category based

on case studies, calculated what a country’s deviations

from those standards cost it in terms of lost trade and

lower GDP and compared that to the effect of eliminating all tariffs.

Real improvement depends on achieving specific “tipping

points” of new efficiencies across various kinds of barriers that encourage companies wary of wasting resources

to risk new investments in a given market. For example, if the market’s supply chain barriers add 10% to a

company’s cost of doing business there, reducing those

barriers to just 2% won’t likely spur on new investment

activity. But the research shows clearly that once those

tipping points are reached, the impact on trade and foreign investment can be dramatic as companies move to

take advantage of newly opened markets and pathways

to increased growth.

The results were startling. Data showed that if countries

could reduce just two of the supply chain barriers—

border administration and telecom/transport infrastructure—halfway to their global best practice levels,

global GDP could rise by nearly 5%, or $2.6 trillion,

while trade could improve almost 15%. By comparison,

eliminating all import tariffs could increase global GDP

just 0.7%, while boosting trade by 10%. Even if countries

were able to reduce barriers halfway to less aggressive regional best practice levels, global GDP could

rise by 2.6%—still outpacing the benefit from tariff

elimination.

Consider the results of a pilot program initiated by

eBay, the global online commerce platform. In many

ways the Internet has created vast new low-cost opportunities for eBay sellers to connect with previously

inaccessible customers around the world. But when

eBay surveyed its merchants—most of them small

businesses—it found that the opportunity to sell internationally was too often going unrealized. Efforts to

develop all but the most accessible foreign markets are

still inhibited by complex regulations, poor international

shipping services and high fixed costs, meaning merchants with narrow resources could risk doing business

in only a limited number of foreign markets.

The efforts to eliminate tariffs remain an important

area of focus for governments. But a coordinated push

to free up supply chain chokepoints will give policymakers significantly more leverage to increase economic

growth through free trade.

How? While both supply chain barriers and tariffs

increase the cost of trade, barriers create greater inefficiencies than tariffs because they often represent a

pure waste of resources rather than a simple transfer

Responding to the problem, eBay set up a pilot program

to help eliminate the barriers. For a pre-selected group

2

Finding the hidden costs in broken supply chains

can countries but far longer than comparable supply

routes in Asia.

of merchants it made listings available to a global customer base and then undertook steps to ease reluctance

among both buyers and sellers by providing full

transparency on what it would cost to ship goods

and when they would arrive. It worked through

shipping issues and facilitated communication

among people who spoke different languages. Preliminary results indicate that making these improvements could lead to a 60% to 80% increase in crossborder activity among these Internet-enabled small

businesses. Given the global importance of small

companies in terms of job creation and economic

activity, the broad benefits of such an increase in

trade activity would be substantial.

These supply chain costs completely offset Madagascar’s

labor-cost advantage and undermine the company’s

ability to compete in segments of the “fast-fashion”

business, where speed to market is crucial. Producing

some apparel in Madagascar makes sense because the

company can ship tariff-free to Europe and compete

with Asian producers that still face duties—a reminder

that tariffs do still matter. But if those tariffs disappeared,

Madagascar would not be competitive.

The message is that supply chain barriers can significantly

upset conventional cost and revenue calculations. Most

companies involved in cross-border trade have become

expert in standard return-on-investment analysis to justify investments abroad. They know how to evaluate

tax breaks, labor costs, capital expenses and the costs

associated with logistics, sourcing equipment and finding

raw materials. But often these traditional analyses fall

short when it comes to capturing the true cost of doing business.

What companies can do right now

While governments can help reduce supply chain barriers,

companies can’t afford to wait. As a business matter,

they must make investments in their global operations

right now to remain competitive. Recognizing the

importance of “hidden” supply chain costs, the leading

companies are incorporating more rigorous due diligence into their decisions about where to produce and

sell their wares. For executive teams, the report’s findings offer important insights on key areas to consider

when analyzing the true costs of doing business in a

particular country or region.

Breaking down the costs

Over the years, Bain has worked with many companies

weighing the merits of trading with Mexico or moving

production there, especially after the North American

Free Trade Agreement ended most formal trade barriers

on the continent. While a traditional analysis might show

that Mexico has a 25% cost advantage relative to the US

and Canada, more than half of that advantage could be

eliminated by supply chain friction costs. In doing the

analysis, we’ve been able to quantify those costs and

how they affect a company’s real return on investment.

Even large companies often fail to anticipate the costs

and risks imposed by supply chain barriers. No central

data bank exists that can tell an executive team how long

its products are likely to be delayed at a given border

or what the average speed of trucks is along a specific

shipping route or transport corridor. Yet leaving barrierrelated costs out of the equation could open companies

to hidden costs that significantly erode returns.

The benefits of investing in Mexico are well known. A

hypothetical manufacturer weighing whether to relocate

production capacity there would see that hourly wage

rates are about one-fifth of what they are in the US, while

capital expenditures related to building facilities are

typically 10% lower than in the US or Canada.

One apparel company established operations in Madagascar, for instance, only to find that supply chain barriers seriously limited its opportunity there. The company was initially attracted by the country’s low labor

costs and proximity to high-quality African cotton suppliers. But its products are frequently delayed at the border

and moving finished goods the 330 miles from mill to

port takes 14 hours—not bad compared with many Afri-

Depending on the company’s product mix, there can

be other advantages as well. Products best suited for

3

Finding the hidden costs in broken supply chains

production in Mexico are those with the highest level

of direct and indirect labor content. They are made from

basic materials that can be easily sourced in Mexico.

And because those materials have to travel long distances

to market, they are typically nonperishable (to avoid

the cost of refrigerated trucks) and have a high valueto-weight ratio.

might require the investing company to take extraordinary measures to safeguard building assets as well as

goods in transit—putting armed guards on all trucks,

for instance. Security measures alone can boost fixed

costs by as much as 7% per year.

Clearly, many companies have profitable operations in

Mexico and it might make sense for our hypothetical

manufacturer to establish a beachhead there as well. But

the key to any such decision is to take a full accounting of all the relevant cost inputs, while extrapolating

the consequences of supply chain inefficiencies: Will

delays force a company to stockpile buffer inventories,

which tie up working capital and add to direct costs such

as warehousing? If so, what risks follow on in the form

of depreciation, spoilage or production bottlenecks?

Even if those considerations support a positive investment

conclusion, however, a number of hidden costs complicate

a more thorough analysis (see Figure 2). Mexico’s lack

of federal and provincial tax breaks, for instance, can add

1% to investment costs up front. The lower productivity

of Mexican hourly workers coupled with a lack of automation means a company might have to boost staffing

levels 25%, erasing some of the labor-cost advantage.

When these costs are factored in, return-on-investment

cost calculations will be adjusted upward to reflect the

level of risk anticipated. But companies often fail to take

these costs into account; as a result they find themselves locked into uneconomical production and marketing decisions.

Transporting goods in Mexico is also a problem. Gaps

in road and rail connections require shipments to

travel extra distances that will eat into margins. And

while Mexican trucks entering the US no longer have

to switch drivers and cabs as they did until 2011, they

do have to buy US insurance at the highest possible

rate. Then there’s safety. High crime rates in Mexico

Figure 2: Producing in Mexico has hidden costs that companies must recognize

Manufacturing facility costs

(indexed to US costs)

Net benefit of 9%

1.0X

1.00X

Initial view suggests

Mexico is 25% cheaper

0.8

0.16X

0.91X

Barriers

0.75X

0.6

Border administration,

inadequate infrastructure,

reduced availability of local suppliers,

security and lower productivity labor

increase the cost 16%

0.4

0.2

0.0

US

Mexico

(based on labor and capital expenditure)

Note: Hypothetical example based on Bain experience

Source: Bain & Company

4

Supply chain barriers

Total cost of Mexico

Finding the hidden costs in broken supply chains

The high price of success in Africa

costs are high, but controlling production yields the

lowest-cost finished goods. To protect itself, the company requires that any such full-scale investment have

an expected return of 25% to 50% and a payback period of less than four years.

One consumer products company operating in Africa

demonstrates that it is possible to take advantage of

market opportunities in countries plagued by supply

chain problems—as long as decision makers remain

intently focused on mitigating the high risks and costs

those barriers impose.

Where to look for “hidden” costs

Clearly, supply chain barriers to trade are both complex and widespread. A more comprehensive approach to foreign investment decisions means recognizing costs in four important categories of the supply

chain (see Figure 3) . Executive teams can begin

by asking some key questions relating to each category:

Africa is fraught with complexity for foreign companies

hoping to capitalize on its strong growth potential. The

continent is rife with political and social instability,

economic mismanagement, mercurial regulatory regimes

and persistent security concerns. A lack of services and

shoddy transportation infrastructure create massive

inefficiencies that drive up prices. “Facilitation payments” can speed shipments through borders and ports.

But for those unwilling to participate in this so-called

“soft corruption,” even more severe delays can result.

Market access

A global packaged goods manufacturer has experienced

the worst of many of these supply chain barriers. Civil

unrest in Nigeria has brought its operations to a temporary halt in the past. Sudden currency depreciations

have cost it millions overnight. In historically unstable

markets like Zimbabwe and Malawi, the inability to trust

credit agreements means business is done in cash. That

constrains investment and inhibits growth.

•

Do you know how many regulatory agencies you

have to deal with as you move goods into or out of

your chosen market?

•

Do you have a list of the licensing regulations that

apply to your product or service?

•

Are there preferential rules or regulations that give

local companies a leg up in the market? Will that

affect your costs or competitiveness?

Border administration

But because the company sees real value in selling its

goods in these rapidly developing markets, it has devised

a strategy for dealing with the uncertainty that involves

categorizing African markets by their risk profiles and

tailoring its approach case by case. Depending on conditions, the company weighs three different options for

building its market presence.

In high-risk countries, for instance, it imports finished

goods only. That means higher landed unit costs due to

increased inventory and freight expense. But the tradeoff is decreased financial exposure and risk. In more

stable countries, the company eliminates some of these

costs by contracting with local manufacturers, though

that still means sacrificing economies of scale. The

third option is producing its own goods onshore, a

strategy reserved for the least volatile countries. Initial

•

What percentage of shipments will be inspected

at the border, on average? How does that compare

with other markets?

•

What is the typical delay time at a particular border

or port, and what will that cost in terms of spoilage,

theft or the need to stockpile additional inventories?

•

How often do border officials demand “facilitation

payments” to move goods efficiently? Are you prepared for the repercussions of not paying (i.e.,

potentially severe delays)?

Telecom and transport infrastructure

•

5

Does the country have an electronic system at the

border allowing shippers to declare goods in advance,

Finding the hidden costs in broken supply chains

Figure 3: Companies should take a comprehensive approach to supply chain decisions

Consequence

Barrier

Factor costs

Costs

Increased

operational

costs

Increased

investment/

working

capital

Delay

Increased

average

delay

Increased

variable

delay

(unpredictability)

Volume

Risk

Decreased

volume

Increased

(political)

risk

(unpredictability)

Domestic and foreign

market access

Barrier costs

Efficiency of customs

administration

Efficiency of import-export

procedures

Transparency of border

administration

Compare alternatives

Availability and quality of

transport infrastructure

Availability and quality of

transport services

Availability and use of ICTs

Strategic implications

Regulatory environment

Physical security

Source: Bain & Company

speeding up processing? Are those systems reliable

and used consistently?

•

How fast on average are trucks or rail shipments

able to move to and from key ports? What are the

common delays and how costly are they?

•

What special fees, licenses or other special regulations

do local authorities impose on truckers that add costs

or slow the movement of goods?

All of these costs can be estimated to gauge the effect on

potential investment returns. But if your team can’t provide definitive answers to questions like these, moving

forward can have real repercussions. In Brazil, for instance, an attempt to build an electronic freight-invoicing

system should have helped speed shipments. Instead,

subpar government information and communications

technology (ICT) systems couldn’t handle the volume and

often crashed, causing longer delays than the old system.

Border regulations that affect efficiency also vary widely:

An express delivery company estimates that inspection

rates on its shipments range from 2% in the Netherlands

to roughly 10% in Mexico. A pharmaceutical company

that has won “trusted trader” status in both China and

Canada finds that Canada’s streamlined system gets

goods on their way quickly while China’s cumbersome

procedures cost the company six times as much due to

delays and related expenses.

Business environment

•

What are the political and administrative realities

in your chosen market, and how will that affect the

ease and security of doing business there?

•

Do businesses enjoy the support and encouragement

of government officials, or is there a history of random taxation, excessive fees or other attempts to

extract value from the private sector?

•

When it comes to business environment, developing

countries can often promise as many barriers as opportunities. As the consumer products company doing

business in Africa has found, security concerns and

Are the rules and regulations that pertain to your

business clear and consistent? Are there established

procedures for working through them?

6

Finding the hidden costs in broken supply chains

efforts to cope with a highly disruptive sociopolitical

environment often create a cascade of costs that can

upset even the most carefully considered investments.

Conditions are more stable in China, but one large semiconductor manufacturer reports that it constantly wrestles

with various rules that are vague and inconsistent. Struggling to comply with them can often lead to confusion

and delays.

impact business. A reliable assessment of what it truly

costs to operate in a given market is the necessary foundation for the next step in evaluating foreign investment:

comparing alternatives and deciding which best suit a

company’s long-term strategy and business objectives.

Global trade has increased sharply over the past 30

years, and the opening of markets long considered inaccessible has created rich opportunities for companies of

all sizes in every industry. But the companies that get

it right are the ones that can best identify and analyze

the real cost of capturing those opportunities and avoiding the mistake of going in unprepared.

For every company and industry the supply chain challenge

is different. But all share the need to recognize potential

barriers where they are most likely to be encountered

and to develop a full understanding of how they will

Calculating the biggest barriers in trade

Economists and executives have known for a long time that supply chain barriers are real. But the

full scope of their corrosive effect on global trade and prosperity emerges when a quantitative model

is combined with on-the-ground case studies showing how companies actually think about their supply chains and how that affects their decision making.

Many studies have measured the macroeconomic effect of supply chain barriers. But most lack insight

into how those issues affect corporate investment and strategy. By augmenting their analysis with

18 detailed “real-world” case studies, Bain & Company, along with economists from the World Bank,

the World Economic Forum and the US International Trade Commission, were able to gain those insights,

leading to a set of policy recommendations aimed at breaking down impediments to action.

The study identified four broad categories of supply chain barriers—market access, border administration,

transportation and telecom infrastructure, and business environment. Researchers focused on the two

that have the most immediate upside, border- and infrastructure-related barriers, building models to

measure the impact of these barriers on GDP by region and comparing the results to the effects of

eliminating tariffs. They used the case studies representing major industries, barriers and supply chain

steps to illuminate real problems and estimate how improvements in these categories would affect behavior.

The study shows plainly that policies to improve border administration and infrastructure could have six

times the impact on global GDP as the elimination of all tariffs, largely because improvements would

eliminate so much of the waste and inefficiency that hobbles growth. But the data also suggest that

improvements could be even more dramatic: If policymakers could forge improvements across all

four of the barrier categories, the positive effect on GDP would be approximately 70% higher.

7

Finding the hidden costs in broken supply chains

Key contacts in Bain’s Performance Improvement practice:

Americas:

Greg Gerstenhaber in Dallas (greg.gerstenhaber@bain.com)

Mark Gottfredson in Dallas (mark.gottfredson@bain.com)

Lee Delaney in Boston (lee.delaney@bain.com)

EMEA:

Niels Peder Nielsen in Copenhagen (nielspeder.nielsen@bain.com)

Asia-Pacific:

Gerry Mattios in Beijing (gerry.mattios@bain.com)

8

Shared Ambit ion, True Results

Bain & Company is the management consulting firm that the world’s business leaders come

to when they want results.

Bain advises clients on strategy, operations, technology, organization, private equity and mergers and acquisitions.

We develop practical, customized insights that clients act on and transfer skills that make change stick. Founded

in 1973, Bain has 48 offices in 31 countries, and our deep expertise and client roster cross every industry and

economic sector. Our clients have outperformed the stock market 4 to 1.

What sets us apart

We believe a consulting firm should be more than an adviser. So we put ourselves in our clients’ shoes, selling

outcomes, not projects. We align our incentives with our clients’ by linking our fees to their results and collaborate

to unlock the full potential of their business. Our Results Delivery® process builds our clients’ capabilities, and

our True North values mean we do the right thing for our clients, people and communities—always.

For more information, visit www.bain.com