Problem Set 5: Income Inequality & Growth I Question 1

advertisement

University of Warwick

EC9A2 Advanced Macroeconomic Analysis

Problem Set 5: Income Inequality & Growth I

Jorge F. Chavez∗

December 3, 2012

Question 1

Consider the Bourguignon model. Production is given by y = f (k) = Ak α . Find the level of

technology  such that for all A <  the unique egalitarian steady state equilibrium is k̄ = 0.

Show that for any A ∈ (0, Â) there exists a sufficiently small λ such that there exists an inegalitarian steady state equilibrium.

Solution. The agent’s utility maximization problem can be written as:

max

i

0≤bit+1 ≤It+1

)}

)

(

{

( i

− bit+1 + β log θ̄ + bit+1

(1 − β) log It+1

Solving for bit+1 we get that1 :

{

bit+1

=

β

(

0

i

It+1

−θ

)

i

≤θ

If It+1

i

If It+1 > θ

which is the usual outcome when preferences are non-homothetic.2

Recall that: (i) because the individual do not consume when young (ctt does not enter in the utility

function), then all the bequest is invested in physical capital: bit = kt+1 ; and (ii) CRS of y = f (kt ) imply

i

that in equilibrium It+1

= Rt+1 bit + wt+1 = yt+1 . Therefore:

{

kt+1 =

bit

=

0

β (f (kt ) − θ)

If f (kt ) ≤ θ

If f (kt ) > θ

Because f (·) is strictly concave and strictly increasing we can guarantee there exists a unique ĥ > 0 s.th.

f (k̂) = θ:

( )1/α

( )

θ

f k̂ = Ak̂ α θ ⇒ k̂ =

A

∗

1

2

e-mail:j.chavez-cotrado@warwick.ac.uk

Where θ = (1 − β)θ̄/β

The corner solution in which bit+1 hits the upper bound of the domain is ruled out

1

EC9A2 (Fall 2012)

{

kt+1

=

Problem Set # 5

0

If kt ≤ k̂

β (f (kt ) − θ) If kt > k̂

≡ φ (kt )

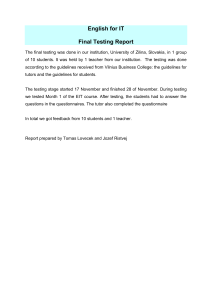

Figure 1a presents the phase diagram for kt+1 = φ(kt ) for the “normal” case in which there are two

steady states. Note that the φ(kt ) curve is not strictly increasing as kt+1 = 0 as long as kt ≤ k̂.

Note that the effect of an increase in A on the phase curve is twofold. On the one hand it will shift the

piece in which kt > k̂ upwards. On the other hand it will reduce the k̂ cutoff, shifting the whole φ(kt )

curve to the left. The point of the exercise is to find the critical value  the model ends with a single

intersection (tangency) point with the 45o line, as shown in figure ??. When A > Â the cutoff k̂ moves to

the left and therefore the curve will have two non-zero steady states. When A > Â the model will have

the trivial steady-state as its unique steady state as the strictly concave piece (defined for kt > hatk) will

no longer intersect the 45o degree line.

Thus, to find  we can use two conditions shown in figure 1b:

i. Tangency condition:

φ′ (kt (Â)) =

k̃(Â)

=

βαÂkt = 1

(

)1/(1−α)

αβ Â

(1)

ii. Steady state condition:

k̃(Â) = β Â(˜(Â))α − βθ

(2)

( )

( )α

From (1): k̃ Â /αβ = Âk̃ Â . Replacing this in (2), we get:

( )

αβθ

k̃ Â =

1−α

(3)

Finally, using equations (1) and (3):

=

[

]1−α

1 αβθ

αβ 1 − α

So, if A < Â we will have kt = kt+1 = 0 as the unique steady-state.

Question 2

Consider the Galor-Zeira model. Suppose that technological progress increases the wage rate of

skilled and unskilled workers by a factor of A > 1. Namely, the wage of skilled workers is Aws

and the wage of unskilled workers is Awu . The interest rate remains unchanged.

(a) Find a sufficiently high level of A for which income distribution would have no effect on

long-run output.

Solution. With returns Aws and Awu to skilled and unskilled workers, respectively, the resulting

Jorge F. Chávez

2

EC9A2 (Fall 2012)

Problem Set # 5

Figure 1: Dynamics

(a) General case

(b) Particular case (cutoff)

45o

45o

i

kt+1

i

kt+1

ϕ(kti )

ϕ(kti )

0

k̂ k L

kH

kti

0

k̂

k̃

kti

dynamic system for intra-dynasty bequests is:

[ u

]

i

bit < b̂

[ β Aw ( + bt R) ]

i

i

s

i

bt+1 =

β Aw + h − bt θR bt ∈ [b̂, h)

β [Aws + (bi − h) R]

bit ≥ h

t

where b̂ is:

[

]

A (wu − ws ) + θRh

b̂ =

R (θ − 1)

(4)

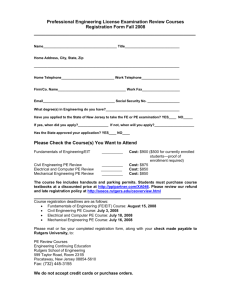

The dynamical system is represented in figure 2a. Note what is the effect of an increase in A: it

will increase the intercept of all pieces, shifting up the phase curve φ(bit ). To make sure that exists

a high steady state (bH ) we need two assumptions

i. βAws > h. This guarantees that the kink between steady-states B and C in figure 2a is above

the 45o degree line.

ii. Rβ < 1. Which as in the original model, guarantees that the first and third pieces of the phase

curve intersect the 45o degree line.

To find the cutoff  such that for any A >  income distribution will have no effect on long-run

output we need the case in which b̂ = bL as is shown in figure 2b. In the intermediate piece of φ(bit ):

(

)

[

(

) ]

b̂

1

s

b̂ = β Aw + h − b̂ θR ⇒ Â = hθR − b̂θR +

β ws

Then using the general expression for b̂ in equation (4) we can pin down Â.

Jorge F. Chávez

3

EC9A2 (Fall 2012)

Problem Set # 5

(b) Suppose that the cost of education is indexed to wages. Namely, the cost of education is

Ah. Derive the conditions under which technological change has no effect on the qualitative

results of the model. (i.e., revise the model’s assumptions if and when needed).

Solution. This will follow the assumptions stated in the lecture notes. Before, note that now b̂ is:

]

[ u

(w − ws ) + θRh

= Ab̂original

b̂ = A

R (θ − 1)

where b̂original is the cutoff in the original version of the model.

(A1) The return to investing in physical capital R is sufficiently small to make investing in human

capital attractive: Aws − Awu > AhR ⇔ ws − wu > hR, which is the original assumption. So

A1 is unchanged.

(A2) The cost of borrowing θ is high enough such that for someone with no bequests it is unprofitable

to invest in human capital (to borrow h): θ is sufficiently large such that Aws −Awu < AhθR ⇔

ws − wu < hR. Again the assumption is unchanged.

(A3) R is sufficiently small and ws is sufficiently large such that Rβ < 1 and βAws > Ah ⇔ βws > h.

The first part does not depend on A at all. The second part is equivalent. So A3 is unchanged

as well.

(A4) wu is sufficiently small such that b̂ > β[Awu + b̂R]. Because now b̂ depends in A, it turns out

that b̂original > β[Awu + b̂original R]

Therefore, regardless of A, initial conditions have an impact on the economy in the long-run.

Figure 2: Galor-Zeira

(a) General case

(b) Particular case (cutoff)

45o

45o

bit+1

bit+1

C

ϕ(bit )

ϕ(bit )

C

β Âws − βRh

s

βAw − βRh

βAws − βRh

B

B

D

Âβwu

A

Aβwu

0

Jorge F. Chávez

A

Aβwu

bL

b̂ bT h

bH

bit

0

b̂orig bT h

bL

b̂ =

bH

bit

bL

2

4

EC9A2 (Fall 2012)

Problem Set # 5

Question 3

Consider the Galor-Zeira model. Suppose that the non-convexity of the technology is removed

(everything else is unchanged). In particular, suppose that the level of human capital of individual i, hit+1 , as a function investment in human capital, eit , is:

hit+1

=

h(eit )

=

i

a + γet

if

eit < e;

a + γe

if

eit ≥ e,

where a > 0, γ > 0. Production is Yt = wHt , where Ht is the aggregate level of human capital.

(w is, therefore, the wage rate per unit of human capital, and the wage income of i is whit+1 ).

Assume that γw > R and γw < θR, where θR is the interest rate for borrowers.

(a) Find the dynamical system governing the evolution of bequests within a dynasty.

Solution. Assume that γw > R (return to investing in human capital is greater than return to

investing in physical capital) and γw < θR (individual do not borrow for investment in human

capital).

Income will be:

(

)

w a + γbit

i

It+1 =

w (a + γē) + R (bi − ē)

t

If bit < ē

If bit ≥ ē

That is, the individual will invest all of her bequest in human capital if it is less than ē and will

invest up to the cutoff ē and the rest bit − ē will go to investment in physical capital.

i

. Hence:

From the UMP we know that (recall preferences are homothetic here) bit+1 = βIt+1

bit+1

i

= βIt+1

(

)

βw a + γbit

=

βw (a + γē) + Rβ (bi − ē)

t

If bit < ē

If bit ≥ ē

( )

≡ φ bit

(b) Can you find a set of parameters such that income distribution will have an effect on long

run output?

Solution. Note that the φ(bit ) is concave (piecewise linear) with slopes:

βwγ If bit < ē

(

)

′

i

φ bt =

Rβ If bi ≥ ē

t

where by assumption βwγ > Rβ. Because the intercept of the first piece is βwa > 0, then will

always exists a unique, globally stable, non-zero steady state for any set of parameters (i.e. income

distribution will not play a role). This can be seen in figure 3a. Note that the position of the kink

in the φ(bit ) function, and therefore of the steady-state, will depend on the cutoff value ē.

Jorge F. Chávez

5

EC9A2 (Fall 2012)

Problem Set # 5

Figure 3: A version of Moav (2002)

(a) General case

(b) Particular case (cutoff)

45o

bit+1

45o

bit+1

B

A

β[wa

+ē1 (wγ − R)]

C

βwa

0

D

β[wa

+ē2 (wγ − R)]

βwa

b̄

ē1

bit

0

ē2

b̄

bit

Suppose now that preferences are represented by the following utility function: uit = log cit +

(1 − β) log cit+1 + β log bit+1 . Further, θ = ∞,and hence, the young consume part (or all) of their

bequest, investing in human capital only the rest: bit − cit = eit . For the sake of simplicity assume

that e = ∞. That is:

hit+1 = a + γeit .

(c) Find, bit+1 as a function of eit , and find eit as a function of bit .

Solution. Solving the problem backwards (i.e. first solving the problem in the second period and

later plugging the indirect sub-utility function into the whole utility function to solve the problem

in the first period) we get:

If γbit > a

0

i

et+1 =

γbit −a If γbi ≤ a

t

2γ

(d) Find the dynamical system governing the evolution of education within a dynasty, eit+1 =

ϕ(eit ).

(

)

i

Solution. Because preferences are homothetic, bit+1 = βIt+1

= β a + γeit . Then, replacing this

Jorge F. Chávez

6

EC9A2 (Fall 2012)

Problem Set # 5

into the equation for eit1+1 we get:

eit+1

0

(

)

If γβ a + γeit w > a

γβ (a+γeit )w−a

2γ

(

)

If γβ a + γeit w ≤ a

=

( )

≡ ϕ eit

(e) Find a sufficient condition assuring that ϕ(0) = 0.

Solution. Note that for 0 to be a fixed point of ϕ(eit ) we need:

ϕ (0) = 0 ⇔

γβ (a + γ0) w ≤ a

⇔

γβwa ≤ a

⇔

γβw ≤ 1

(f) Prove that a set of parameters such that income distribution has an effect on long run

output, does not exist. (hint: show that if ϕ(0) = 0, ϕ′ (eit ) < 1 for all eit ).

Solution. Following the hint, if the conditions that ensure that ϕ(0) = 0 hold, then the slope of the

ϕ(eit ) will always be less than unity. This implies that the economy will always converge to the e = 0

steady state (no one will invest in education in the long-run). This can be see in figure 3b.

Figure 4: Dynamic system eit+1 = ϕ(eit ) when γβw ≤ 1

45o

eit+1

φ(eit )

βγw/2 < 1/2 ⇐ ϕ(0) = 0

0

ê

eit

(g) Generalize your conclusion to any homothetic preferences.

Solution. Homothetic preferences imply that:

Jorge F. Chávez

7

EC9A2 (Fall 2012)

Problem Set # 5

i. Second period income is divided between consumption and bequest at constant shares, in pari

ticular denote the fraction of income that is bequeathed β, such that bit+1 = βIt+1

.

ii. For an interior solution, eit > 0, the ratio between second period income (cit+1 + bit+1 ) and first

period consumption (cit ), is constant, for any given return to investment,γw. Denote λ(γw) =

It+1 /ct for eit > 0.

Suppose e = 0 is a steady state: ϕ(0) = 0. In this steady state ct = βwa and It+1 = wa, and

It+1 /ct = wa/βwa = 1/β ≥ λ. (if It+1 /ct < λ, the individual will increase e and therby increase It+1

on the account of ct ).

Suppose ē > 0 is a steady state: ϕ(ē) = ē. In an interior solution I/c = λ, I = (a + γē)w, c = b̄ − ē

and b̄ = β(a + γē)w, therefore:

I

(a + γē)w

=

=λ

c

β(a + γē)w − ē

Which implies:

ē =

aw (βλ − 1)

γw(1 − β) + λ

However, if e = 0 is a steady state, 1/β ≥ λ → βλ ≤ 1, and ē ≤ 0.

Jorge F. Chávez

8

EC9A2 (Fall 2012)

Problem Set # 5

Question 4

Consider the Moav 2002 model, with the following human capital production technology:

ht+1 = h(et ) = 1 + A ln[1 + et ]

(a) Find the optimal unconstrained level of investment in human capital.

Solution. The unconstrained problem is:

{ [

(

)

(

)]}

w 1 + A log 1 + eit + R bit − eit

max

i

i

0≤et ≤bt

i. Interior solution:

Aw

Aw

− R = 0 ⇒ eit =

−1>0

i

R

1 + et

ii. Corner 1:

Aw

− R < 0 ⇒ Aw < R

1

iii. Corner 2:

Aw

Aw

Aw

−R>0⇒

>R⇔

> 1 + bit

i

i

R

1 + bt

1 + bt

Assume that Aw/R > 1 so that it is profitable to go to school. That is we are ruling out the case in

which eit hits the lower bound 0. Then:

bit If bit < Aw

R −1

i

et =

Aw If bi ≥ Aw − 1

t

R

R

(b) Find the dynamical system governing the evolution of income within a dynasty

Solution. Given the assumption that Aw > R:

i

It+1

wht

=

wh + R (bi − ei )

t

t

t

If bit = eit

If

Aw

R

− 1 ≤ bit

[

(

)]

w 1 + A log 1 + bit

=

w [1 + A log ( Aw )] + R (bi − Aw − 1)

t

R

R

If bit <

Aw

R

−1

If bit ≥

Aw

R

−1

Finally, since:

bit+1

Jorge F. Chávez

=b

(

i

It+1

)

=

0

β (I i − π )

t+1

i

It+1

≤π

i

It+1

>π

9

EC9A2 (Fall 2012)

Problem Set # 5

Then:

i

It+1

=

w

[

(

(

))]

w 1 + A log 1 + β Iti − π

( )

( (

)

[

w 1 + A log Aw

+ R β Iti − π − Aw

R

R

(

)

If β Iti − π ≤ 0

(

) (

]

If β Iti − π ∈ 0, Aw

R −1

)]

(

)

−1

If β Iti − π > Aw

R −1

≡ φ(Iti )

(c) Define sufficient conditions on the model’s parameters to assure that income distribution

will have an effect on long run output.

Solution. In principle there are multiple possibilities for the shape of the phase curve φ(Iti ) to produce

one or multiple steady states. The most straightforward one to discuss is the case analogous to the

“normal” version of the Galor-Zeira (one in which the two extreme pieces of the φ(Iti ) intersect the

45o degree line, as is shown in figure 5

i

Figure 5: Dynamic system It+1

= φ(Iti )

45o

i

It+1

N

w 1 + A log( Aw

R )

C

B

A

w

0

M

IL = w

π

IM

Iˆ

IH

Iti

This case requires three conditions:

i. w < π, which guarantees that the kink point M in figure 5 lies below the 45o degree line. That

is, this guarantees the existence of the poverty trap.

(

)

Aw−R

ii. w 1 + A log( Aw

+ π. This guarantees that the other kink (point N ) lies above the

R ) >

Rβ

o

45 degree line.

iii. Rβ < 1, which guarantees that the last piece will intersect the 45o degree line.

Note that condition (ii) is not necessary for a high steady state to exist. It could also be the case

that the N kink is below the 45o degree line, meaning that the middle piece intersects this line twice.

This potential case is shown in figure 6a. In contrasts figure 6b shows a case in which the distribution

of income will have no effects on long-run output.

Jorge F. Chávez

10

EC9A2 (Fall 2012)

Problem Set # 5

Figure 6: Two potential additional cases

(a) Case 1

(b) Case 2

45o

i

It+1

45o

i

It+1

C

C

N

N

B

A

w

0

w

M

IL = w

Jorge F. Chávez

π

IM

IH

Iˆ

Iti

0

M

π

Iˆ

IH

Iti

11