R How Competitive Are California's Local Phone

advertisement

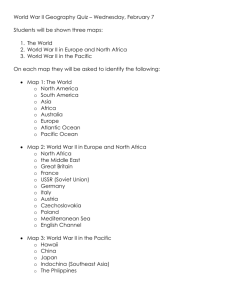

R How Competitive Are California's Local Phone Markets? Walter S. Baer DRU-2009-RC December 1998 This draft presents preliminary results of RAND research, which have not been reviewed or edited. The views and conclusions expressed are tentative. The draft should not be quoted or cited without permission of the authors. RAND is a nonprofit institution that helps improve policy and decisionmaking through research and analysis. RAND’s publications and drafts do not necessarily reflect the opinions or policies of its research sponsors. How Competitive Are California's Local Phone Markets? Summary from the Forum on Local Telecommunications Competition October 27, 1998 Background Since the passage of the Telecommunications Act of 1996, California consumers and businesses have been waiting for the promised benefits of local telephone competition – more choices, lower prices, and better service. Nearly three years later, the issues raised in the Telecom Act are still unresolved. As the California Public Utilities Commission (CPUC) currently considers Pacific Bell’s application to offer long distance service, it also must evaluate the status of competition in the state's local phone markets. What is the reality? Are California consumers and businesses getting the benefits of competition in the local telephone market? Is real competition emerging for highspeed Internet access? What’s at stake for California consumers and business users? To address these questions, RAND and the Annenberg School for Communication at the University of Southern California (USC) brought together a panel of experts from the telecommunications industry, consumer organizations and the CPUC. This report summarizes the discussion at the “Forum on Local Telecommunications Competition in California,” which was held before a live audience at the USC Faculty Center on October 27 and audiocast over the World Wide Web.* The panelists included: Walter Baer, RAND and USC (moderator) William Blase, Vice President-Regulatory Affairs, Pacific Bell Jim Conran, President, Consumers First Regina Costa, Telecommunications Research Director, The Utility Reform Network Doug Garrett, Senior Director, ICG Communications Lois Hedg-peth, Regional President, AT&T James Lewis, Regional Executive, MCI WorldCom Tim McCallion, Vice President-Regulatory and Governmental Affairs, GTE Helen Mickiewicz, Staff Counsel, California Public Utilities Commission Mark Phigler, President, Americans for Competitive Telecommunications Steve Slusser, General Manager-Southern California, Covad Communications Richard Smith, Director-Regulatory Affairs, Cox Communications _____ * The audio archive is available on the Web at http://www.usc.edu/annenberg/events. 1 The Status of Local Phone Competition in California Is local phone competition thriving or struggling in California? How much market share have the competitive local carriers (CLCs) gained at the expense of Pacific Bell and GTE, the principal incumbent local exchange carriers (ILECs) in the state? The answers to these questions seem quite different for the business and residential phone markets. "The monopoly of local markets is dead," said William Blase of Pacific Bell. According to Mr. Blase, 30-35 percent of new local business phone lines today are served by Pacific's competitors. Even GTE has taken some large business accounts, such as the University of Southern California, in Pacific Bell territory. But Doug Garrett of ICG Communications and other CLCs on the panel challenged these figures. The 30-35 percent figure "strains credibility," Mr. Garrett said. "There has been some movement in competition [for business lines], but it's like pushing sand uphill." The panelists agreed that ILEC dominance over residential local phone lines essentially remains unchallenged. Competitors today serve fewer than 3 percent of all local telephone access lines in the state. Competition for Small Business and Residential Phone Subscribers The CPUC-regulated local phone rates remain low -- below $20 per month for residential service, which also includes an unlimited number of local calls. This makes local service relatively unattractive to many ILEC competitors, compared with long distance or other higher priced services. Still, cable operators such as Cox Communications and MediaOne are offering local phone service at prices below those charged by Pacific Bell and GTE. As Richard Smith of Cox Communications explained, "we can deliver telephone service for $9.99 a month and make a profit because we already have the cable network in place." In response to a concern about CLC reliability in the event of an earthquake or other disaster, raised by Regina Costa of The Utility Reform Network (TURN), Mr. Smith said that the Cox hybrid-fiber-cable network used distributed sources of electrical power and had shown high reliability for telephone and data services. Competitors also want direct local access to subscribers in order to bundle the many services -- local, long distance, international, cellular, Internet and other data -- that both residential and business customers demand. Jim Conran, representing the California Small Business Association (CSBA), said that small businesses want convenience and one-stop shopping for telecommunications as much as lower prices. The CSBA favors competition in all telecom markets, "the more competition, the better," but many CLCs have seemed uninterested in small business accounts, he said. The panelists from AT&T, MCI and ICG replied that their companies very much want to serve small businesses, but the high costs of obtaining interconnection and local facilities from the ILECs currently limit their pace of expansion. 2 Alternative Ways to Reach the End-User James Lewis of MCI WorldCom described the three ways contemplated in the 1996 Telecom Act for CLCs to reach local end-users: 1) reselling ILEC local service, 2) building their own local networks and 3) leasing parts ("unbundled elements") of the ILEC network. Reselling has proved uneconomic in California, according to Mr. Lewis, because the ILEC wholesale discounts of 12-17 percent are not sufficient for MCI WorldCom or other CLCs to provide services profitably. Competition thrives in the long distance arena, where discounts of 40-60 percent are the norm. In response, William Blasé of Pacific Bell and Tim McCallion of GTE said that these relatively low wholesale discounts result from specific wording in the Telecom Act. The CPUC and other state regulators cannot require ILECs to offer larger discounts. In a later comment from the floor, Ernest Ellis of ACS Systems said that reselling ILEC service is essential for thousands of smaller CLCs who serve segments of the small business market. CLCs have built their own switches and fiber optic facilities primarily to serve large business customers in California's major cities; while cable companies use their networks to deliver local phone service to consumers. Still, facilities-based competitors must interconnect with the ILECs to exchange traffic, and interconnection has led to considerable contention among the parties. Richard Smith reported that some Cox phone subscribers have been unable to connect to Pacific Bell lines, and that the source of the problem remained unresolved for several weeks. Leasing portions of ILEC facilities and networks is the third way for competitors to offer local services, but making satisfactory arrangements between ILECs and CLCs has proven difficult. The CLC panelists complained of high costs and repeated delays in getting the necessary space within the ILEC Central Offices (the so-called "co-location cages") to place their equipment. Lois Hedg-peth of AT&T said that obtaining colocation cages "has been a very difficult process which can take as little as three months or as long as forever." Steve Slusser of Covad Communications added that Pacific Bell had been "up to a lot of shenanigans," such as not supplying electrical power to co-located equipment, which delayed Covad's offering of high-speed data service in Los Angeles for six months. The process, he said, was very expensive and "overburdensome." James Lewis reported that Pacific Bell charges MCI WorldCom a one-time cost of $410, as well as monthly charges, to interconnect each access line. The economics may work for large accounts, he said, but MCI WorldCom cannot recover the high one-time cost from small business or residential customers. In contrast, local competition has proceeded faster in New York, where NYNEX (now part of Bell Atlantic) offers much lower interconnection charges. William Blasé responded that Pacific's $410 one-time interconnection charge was in fact negotiable. "We want to see competition continue to emerge, and we are doing everything we can to facilitate that," he said. The Current CPUC Proceeding on Local Competition Helen Mickiewicz, Staff Counsel of the California Public Utilities Commission, discussed the current CPUC proceeding on Pacific Bell's application to enter long 3 distance services. Under the 1996 Telecom Act, the CPUC must determine whether Pacific has complied with a fourteen point checklist intended to spur local telephone competition (In California, this checklist applies only to Pacific Bell -- GTE already is permitted to offer long distance services). After hearings in February 1998, the CPUC instituted a "collaborative process" in which competitors met extensively with Pacific Bell to try to work out their differences and agree on a common approach toward implementing local competition. The CPUC final staff report, released on October 5, 1998, found Pacific in compliance with only four of the fourteen points. Ms. Mickiewicz also emphasized that the relationships between Pacific and the CLCs have been "more litigious than collaborative." Pacific has dealt with the CLCs as competitors rather than as potential customers, she said. Similarly, Jim Conran of the CSBA thought that the collaborative process was not working because "too much money is at stake." His organization favors an expedited process that would allow Pacific Bell into the long distance business as well as facilitate local competition. Americans for Telecommunications Competition (A.C.T.), a grassroots organization that monitors carrier compliance with the 1996 Telecom Act checklist, gave Pacific a somewhat higher grade of complying with six of the fourteen points. Mark Phigler, president of A.C.T., said that he still held out hope for the collaborative process in California, since similar collaborations between ILECs and CLCs seemed to be working in New York and Texas. How Do Industry Mergers Affect California Phone Users? Panel opinions differed widely on whether Pacific Bell's recent merger with SBC Communications has benefited California. William Blasé said that the combined company's jobs in the state have increased since the merger and no requests have been made to raise basic telephone rates. Regina Costa of TURN replied that SBC has moved customer service centers from California to other states and has used its local monopoly power to increase charges for Directory Assistance and other nonbasic services. She also said that complaints about service quality have risen since the merger. However, according to Jim Conran, on balance small business users think service has improved. From the CPUC's point of view, said Helen Mickiewicz, "the verdict is not yet in" on the benefits and costs of the SBC/Pacific merger. In particular, the CPUC has issued a Notice of Inquiry on the service quality issue. Other recent telecommunications business combinations include AT&T's purchase of TCG, a leading CLC, and the merger between MCI and WorldCom. Merger proposals are pending for AT&T and TCI, the largest U.S. cable operator; GTE and Bell Atlantic; and SBC Communications and Ameritech. Panelists agreed that global competition drives telecommunications companies to seek increases in both scale and scope through mergers and acquisitions, but there was little consensus on the resulting impact on local service competition. William Blasé said that SBC Communications has told regulators it intends to offer competitive services in 30 cities once its merger with Ameritech is completed. Others pointed out, however, that SBC is already a very large company that need not wait for the Ameritech combination to begin (and facilitate) serious local competition. 4 Moving Ahead on Local Telecommunications Competition in California One question posed to the panel was how local competition in California had advanced, if at all, in the nearly three years since passage of the 1996 Telecommunications Act. Some observers believe that very little has in fact changed. Panelists responded by citing several important developments: • • • • • competitors have installed more than 70 local switches and made other large infrastructure investments in California, primarily to serve business customers; cable companies such as Cox and MediaOne have successfully begun to offer telephone and high-speed data services to residential cable subscribers; wireless has grown rapidly to become a real alternative to ILEC local service, especially for second lines; competition for intrastate toll calls has increased significantly, resulting in lower prices for calls within California; local telecommunications competition is now high on the agenda of the CPUC and other state regulatory authorities. Still, panelists pointed out, making significant inroads into ILEC dominance of local telephone markets will take a good deal more time. Equal access and full-blown competition in the U.S. interstate long distance market took about a decade after it was authorized by the Federal Communications Commission in the mid-1970s. While the GTE and Pacific Bell representatives thought that local competition was on the whole proceeding satisfactorily, the non-ILEC panelists generally called for a stronger CPUC role in reducing the time and cost of local interconnection arrangements. The role of the New York State Public Services Commission in facilitating local competition in New York City was cited as a possible model for the CPUC. Another suggestion was that federal and state regulatory commissions should withhold approval of ILEC mergers and acquisitions until the ILEC complies in full with the fourteen point checklist contained in the 1996 Act. In summary, the panelists agreed that local telecommunications competition appears inevitable in California, as well as in other states, but it hasn't been and won't be easy to implement or regulate. 5