Document 12622452

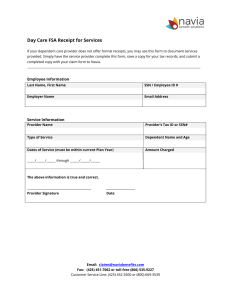

advertisement