Document 12609504

advertisement

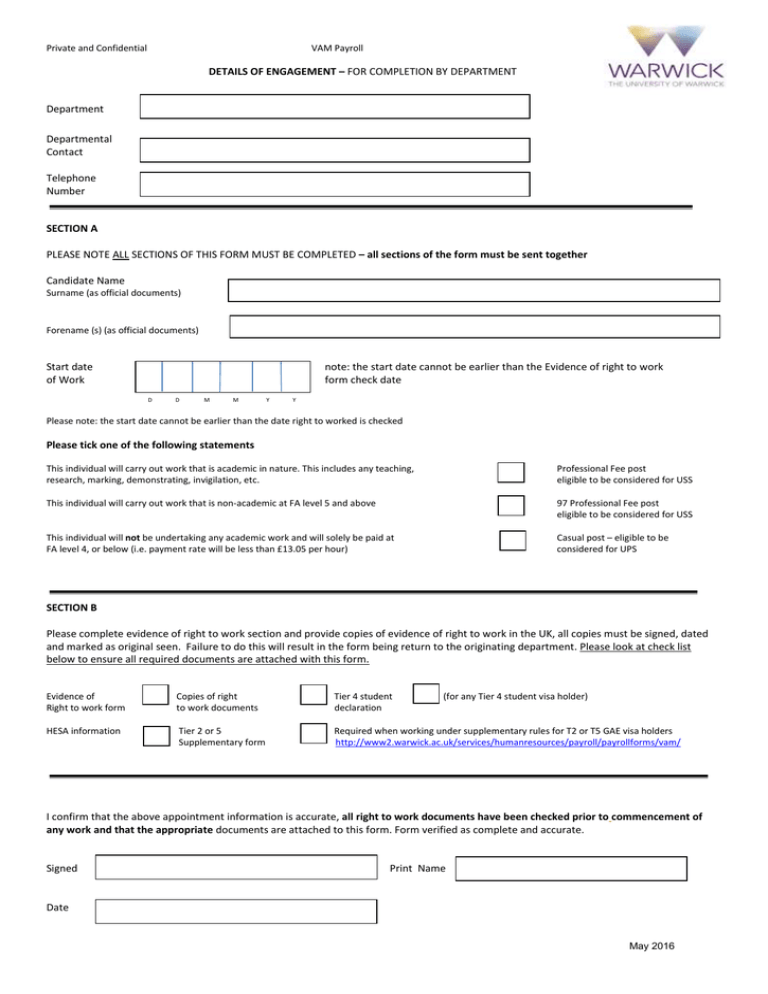

Private and Confidential VAM Payroll DETAILS OF ENGAGEMENT – FOR COMPLETION BY DEPARTMENT Department Departmental Contact Telephone Number SECTION A PLEASE NOTE ALL SECTIONS OF THIS FORM MUST BE COMPLETED – all sections of the form must be sent together Candidate Name Surname (as official documents) Forename (s) (as official documents) Start date of Work note: the start date cannot be earlier than the Evidence of right to work form check date D D M M Y Y Please note: the start date cannot be earlier than the date right to worked is checked Please tick one of the following statements This individual will carry out work that is academic in nature. This includes any teaching, research, marking, demonstrating, invigilation, etc. 97 This individual will carry out work that is non-academic at FA level 5 and above Professional Fee post eligible to be considered for USS 97 Professional Fee post eligible to be considered for USS This individual will not be undertaking any academic work and will solely be paid at FA level 4, or below (i.e. payment rate will be less than £13.05 per hour) 98 Casual post – eligible to be considered for UPS SECTION B Please complete evidence of right to work section and provide copies of evidence of right to work in the UK, all copies must be signed, dated and marked as original seen. Failure to do this will result in the form being return to the originating department. Please look at check list below to ensure all required documents are attached with this form. Evidence of Right to work form Copies of right to work documents Tier 4 student declaration (for any Tier 4 student visa holder) HESA information Tier 2 or 5 Supplementary form Required when working under supplementary rules for T2 or T5 GAE visa holders http://www2.warwick.ac.uk/services/humanresources/payroll/payrollforms/vam/ I confirm that the above appointment information is accurate, all right to work documents have been checked prior to commencement of any work and that the appropriate documents are attached to this form. Form verified as complete and accurate. Signed Print Name Date May 2016 Private and Confidential VAM Payroll EVIDENCE OF RIGHT TO WORK - FOR COMPLETION BY DEPARTMENT University of Warwick – Prevention of Illegal working (from 29 February 2008) Immigration, Asylum and Nationality Act 2006. This form must be completed for ALL offers of work. Candidate Name Surname (as official documents) Forename (s) (as official documents) Please indicate on the attached pages exactly which original documents have been presented. Details of identification checker Name Position Dept. Tel No Signature Date The Evidence of right to work must be signed and copies of right to work documents must be signed, dated and marked as original seen. IMPORTANT - Please note this must be prior to the commencement of any work. Is the work going to be undertaken in the UK YES NO If no please specify where the work will be undertaken and provide evidence of right to work in that country (e.g. copy of a passport Showing the individual is a national of that country) Country of work I confirm I have seen the original documents indicated prior to the commencement of any work and that to the best of my knowledge: they relate to the candidate named above any photo ID seems to match the physical identity of the candidate named above names and dates of birth are consistent across documents the original documents show no obvious signs of tampering or forgery the relevant visa has been checked and copies attached I have read the immigration information on the HR website re student tier 4 working hours (http://go/hr/newpolicies/student_workers) Does this individual have a Tier 4 student Visa? Please tick the appropriate box: - Yes No If yes please complete the following: Undergraduate Restricted to 20 hours work per week in term time, no restrictions on working hours in vacation. Undergraduate students must provide evidence of the dates of the academic terms for the duration of their studies for the period they intend to work Masters PhD Completed Studies Restricted to 20 hours work per week Restricted to 20 hours work per week Official confirmation of degree pass required – no restriction on working hours The student must present either the original degree certificate or an official letter from the Graduate School which contains the wording 'officially conferred by Senate' Tier 4 students must complete a student declaration form (refer to the last page of this form) confirming that they are employed under Tier 4 regulations, otherwise paperwork will be returned to the department. If you have any queries on this documentation please contact either your link HR Administrator or Julia Foulks, HR Officer – Immigration on ext. 73161 or e-mail J.Foulks@warwick.ac.uk Please indicate in one box from List A or List B to confirm which original document or combination of documents have been presented. If any work is undertaken by a migrant worker under Tier 2 supplementary employment rules, please refer to the Tier 2 supplementary form on the payroll web pages. Attach the form and a copy of the Tier 2 visa to the Evidence of Right to Work Renewal form which is located at http://www2.warwick.ac.uk/services/humanresources/payroll/payrollforms/vam/ May 2016 Private and Confidential VAM Payroll Please note that you need to check the validity of the document and satisfy yourself that the prospective or existing worker is the person named in the documents they present. List A 1. A passport showing the holder, or a person named in the passport as the child of the holder, is a British citizen or a citizen of the UK and Colonies having the right of abode in the UK. 2. A passport or national identity card showing the holder, or a person named in the passport as the child of the holder, is a national of a European Economic Area country or Switzerland. 3. A Registration Certificate or Document Certifying Permanent Residence issued by the Home Office to a national of a European Economic Area country or Switzerland. 4. A Permanent Residence Card issued by the Home Office, to the family member of a national of a European Economic Area country or Switzerland. 5. A current Biometric Immigration Document (Biometric Residence Permit) issued by the Home Office to the holder indicating that the person named is allowed to stay indefinitely in the UK, or has no time limit on their stay in the UK. 6. A current passport endorsed to show that the holder is exempt from immigration control, is allowed to stay indefinitely in the UK, has the right of abode in the UK, or has no time limit on their stay in the UK. 7. A current Immigration Status Document issued by the Home Office to the holder with an endorsement indicating that the named person is allowed to stay indefinitely in the UK or has no time limit on their stay in the UK, together with an official document giving the person’s permanent National Insurance number and their name issued by a Government agency or a previous employer. 8. A full birth or adoption certificate issued in the UK which includes the name(s) of at least one of the holder’s parents or adoptive parents, together with an official document giving the person’s permanent National Insurance number and their name issued by a Government agency or a previous employer. 9. A birth or adoption certificate issued in the Channel Islands, the Isle of Man or Ireland, together with an official document giving the person’s permanent National Insurance number and their name issued by a Government agency or a previous employer. 10. A certificate of registration or naturalisation as a British citizen, together with an official document giving the person’s permanent National Insurance number and their name issued by a Government agency or a previous employer. List B Group 1 1. A current passport endorsed to show that the holder is allowed to stay in the UK and is currently allowed to do the type of work in question. 2. A current Biometric Immigration Document (Biometric Residence Permit) issued by the Home Office 3. A current Residence Card (including an Accession Residence Card or a Derivative Residence Card) issued by the Home Office to the holder which indicates that the named person can currently stay in the UK and is allowed to do the work in question. 4. A current Immigration Status Document containing a photograph issued by the Home Office to the holder with a valid endorsement indicating that the named person may stay in the UK, and is allowed to do the type of work in question, together with an official document giving the person’s permanent National Insurance number and their name issued by a Government agency or a previous employer. List B Group 2 1. A Certificate of Application issued by the Home Office under regulation 17(3) or 18A (2) of the Immigration (European Economic Area) Regulations 2006, to a family member of a national of a European Economic Area country or Switzerland stating that the holder is permitted to undertake work which is less than 6 months old together with a Positive Verification Notice from the Home Office Employer Checking Service. 2. An Application Registration Card issued by the Home Office stating that the holder is permitted to take the work in question, together with a Positive Verification Notice from the Home Office Employer Checking Service. 3. A Positive Verification Notice issued by the Home Office Employer Checking Service to the University, which indicates that the named person may stay in the UK and is permitted to do the work in question. 1. List A You have a continuous statutory excuse for the full duration of the person’s work with you. You are not required to carry out any repeat right to work checks on this person. 2. List B: Group 1 You have a time-limited statutory excuse which expires when the person’s permission to be in the UK and undertake the work in question expires. You should carry out a follow-up check when the document evidencing their permission to work expires. 3. List B: Group 2 You have a time-limited statutory excuse which expires 6 months from the date specified in your Positive Verification Notice. This means that you should carry out a follow-up check when this notice expires. Documents that do not provide proof of permission to work in the UK a Home Office Standard Acknowledgement Letter or Immigration Service Letter (IS96W) which states that an asylum seeker can work in the UK. If you are presented with these documents then you should advise the applicant to call the Border and Immigration Agency on 0151 237 6375 for information about how they can apply for an Application Registration Card; a temporary National Insurance Number beginning with TN, or any number which ends with the letters from E to Z inclusive; a permanent National Insurance number when presented in isolation; a driving licence issued by the Driver and Vehicle Licensing Agency; a bill issued by a financial institution or a utility company; a passport describing the holder as a British Dependent Territories Citizen which states that the holder has a connection with Gibraltar; a short (abbreviated) birth certificate issued in the UK which does not have details of at least one of the holder’s parents; a licence provided by the Security Industry Authority; a document check by the Criminal Records Bureau; a card or certificate issued by the Inland Revenue under the Construction Industry Scheme. May 2016 Private and Confidential VAM Payroll VAM PERSONAL RECORD FORM FOR COMPLETION BY WORKER Please note it will not be possible to process payments without this form. Please complete ALL sections in BLOCK CAPITALS. On completion of this form you will be have a record on the variable payroll and therefore be subject to tax and National Insurance at source. Payroll Number (Will be set up by Payroll) Department Title Surname (as official documents) Forename (s) (as official documents) Preferred Forename Home Address Please note your address May be passed onto your Department for their records Post Code Telephone No Mobile No Date of Birth National Insurance No D D M M Y Y A A N N N N N N A Gender Start Date of paid Work with the University der D D M M Y M If UOW Student advise Student No F Please (please tick as appropriate) Y Payment Details – All payments are made by BACS For overseas accounts please use the Foreign Bank details form available on the Payroll website. Submit this form with your personal record form http://www2.warwick.ac.uk/services/humanresources/payroll/expenses/ Sort Code - - Name of Bank _________________________________________________________________ Account Number Bank Branch _______________________________________________ Account Name Bank Address _________________________________________________________________ Building Society Roll Number Emergency Contact Details (Please provide details to be used in case of emergency) Contact Name Telephone No Mobile No Please note this information may be passed to your department but will only be used in the event of an emergency I confirm that the personal information given on this form is correct. I also agree that in the event of overpayment of any salary or other remuneration, the University is entitled to make the relevant deduction from any subsequent payment(s). The University will let you know and agree in advance the relevant deduction, but its failure to do so will not affect its right to reclaim the overpayment. Signed___________________________________ Date_____________________________________ (Please note a typed signature is not valid) PAYROLL USE ONLY UK workevidence Received. List… A/B Returned to Dept _____/_______/_____ For ‘B’ enter the expiry date of visa Previous Payroll Number PSE updated by PSE checked by Additional Payroll Number Unitemp May 2016 Private and Confidential VAM Payroll TAXATION STATUS / STUDENT LOAN/ PENSION INFORMATION/ MARITAL STATUS FOR COMPLETION BY WORKER Surname (as official documents) Forename (s) (as official documents) Taxation Status – Do not leave this section blank. Please confirm your current circumstances Please read all of the statements carefully. You must enter X in the ONE box that applies to you. A This is my first job in the current tax year (6 April onwards). I have no other forms of income and I do not receive a pension or state B I have received taxable Job Seekers Allowance, Incapacity Benefit, Employment and Support Allowance or this is not my first job in the current tax year (6 April onwards). However, this is now my only job or main (highest earning) job. I do not receive a state or occupational pension. C This is a secondary position (i.e. I work for another organisation excluding Unitemps) or I am in receipt of a state pension. D benefits I have been working for Unitemps in the current tax year (6 April onwards). If you have ticked this box you MUST tick ONE additional statement below. I no longer wish to work for Unitemps. (NB Your Unitemps role will be closed and your P45 will be transferred to your new University post.) (Payroll – advise Unitemps agency worker made to leave.) I am still engaged with Unitemps and I wish Unitemps to be my main source of income. I am still engaged with Unitemps and I wish the University to be my main source of income. NB you will need to contact HMRC to change your tax code tel. 0300 200 3300. UOW tax reference – 190/U50, Unitemps tax reference 120/ZA76059. Until confirmation is received you will be taxed at basic rate, currently 20%, with no allowance. If no statements apply then tax will be deducted on code 0T month 1 Student Loan – Please confirm your current circumstances Please read the following statements carefully and enter an X in each box which applies to you Statement 1 I have a Student Loan which is not fully repaid. (If you answer yes to statement 1 please go to statement 2) Statement 2 I am repaying my Student Loan direct to the Student Loan Company by agreed monthly payments and the University shouldn’t deduct loan repayments from my pay. (If you answer yes to statement 2 then you do not need to answer statements 3 or 4) Statement 3 I have a Plan 1 student loan You have a plan 1 student loan if you lived in Scotland or Northern Ireland when you started your course or you lived in England and Wales and started your course before 1st September 2012 Statement 4 I have a plan 2 student loan You will have a plan 2 student loan if you lived in England or Wales and started your course after 1st September 2012 Statement 5 I finished my studies before the last 6th April PENSION With effect from 1 March 2013 the University of Warwick is required to comply with government legislation to automatically enrol eligible workers into an occupational pension scheme. This process is called auto enrolment. An assessment will be made to determine your status within the legislative rules at the time of your first payment and on an on-going basis thereafter. We will write to you at that time to confirm your position. If you are automatically enrolled into a pension scheme you will have the right to subsequently opt out. The details of the opt-out process including getting a refund, will be explained in your letter. MARITAL STATUS Should you be auto enrolled and wish to remain in the scheme, please indicate your marital status by ticking one of the following boxes:Married / Civil Partnership Widow/Widower Single Prefer Not to Say Divorced Separated I confirm that the personal information given on this form is correct. I also agree that in the event of overpayment of any salary or other remuneration, the University is entitled to make the relevant deduction from any subsequent payment(s). The University will let you know and agree in advance the relevant deduction, but its failure to do so will not affect its right to reclaim the overpayment. Signed_________________________________________ (Please note a typed signature is not valid) Date________________________________ May 2016 Private and Confidential VAM Payroll EQUALITY AND DIVERSITY FOR COMLETION BY WORKER Surname (as official documents) Forename (s) (as official documents) The University is required to collate and report on equality and diversity information. Ethnicity In order for us to comply with this requirement could you choose the entry that best describes your ethnicity? White 10 Asian/Asian British-Pakistan 32 Mixed-White and Asian 43 Gypsy or Traveller 15 Asian/Asian British-Bangladesh 33 Other Mixed Background 49 Black/Black BritishCaribbean Black/Black British-Africa 21 Chinese 34 Arab 50 22 Other Asian Background 39 Other Ethnic Background 80 Other Black Background 29 Mixed-White and Black Caribbean 41 Prefer Not to Say 98 Asian/Asian British-India 31 Mixed-White and Black African 42 Please enter your nationality Religion What is your religion? No religion Jewish Any other religion or belief Buddhist Muslim Prefer not to say Christian Sikh Hindu Spiritual Gay man Prefer not to say Gay woman/lesbian Heterosexual/straight Sexual Orientation What is your sexual orientation? Bisexual Other Disability The Equality Act 2010 states that a disabled person is someone who has a physical or mental impairment which has a substantial, adverse and long-term (usually 12 months or greater) effect on their ability to carry out their day to day duties. If your impairment would have a substantial effect on you without medication then this part of the definition would be satisfied (this excludes glasses or contact lenses). Please note that cancer, HIV, multiple sclerosis, are automatically classed as a disability from the day of diagnosis. Do you have a disability? Y N The University is required by the Higher Education Statistics Agency (HESA), to collect information from staff on the nature of their disability. The following list has been drawn up by HESA and provided to all universities to ensure consistency of data collection. If you indicated Yes to the disability question above, please select at least one disability from the options below. Blind or serious visual impairment Mental health condition (eg depression or schizophrenia) Cognitive impairment (eg autistic spectrum disorder or resulting from a head injury) Physical impairment or mobility (eg use of arms or using a wheelchair or crutches) General learning disability (such as Downs syndrome) Other type of disability Long-standing illness (eg diabetes, epilepsy, cancer, HIV, or chronic heart disease) Prefer not to say Deaf or serious hearing impairment Specific learning disability (such as dyslexia or dyspraxia) This information is confidential, however, in order to ensure that appropriate reasonable adjustments and support are in place to assist you in your role, do you agree to meet with your line manager and HR Advisor for your department, to discuss support mechanisms Yes No If responding Yes a meeting will be organised by the HR Adviser for your department. May 2016 Private and Confidential VAM Payroll HESA INFORMATION FOR COMLETION BY WORKER Surname (as official documents) Forename (s) (as official documents) As part of its statistical reporting the University must make annual returns to HESA (Higher Education Statistics Authority). To assist in the reporting of this data PLEASE tick the appropriate statements below: Previous work/employment before Warwick Another Higher Education Institute in the UK. Please provide the name of the institution: 01 HEI in an overseas country 02 Student in UK 07 Private industry/commerce in UK 12 Other education institution in UK 03 Student in an overseas country 08 Self-employed in UK 13 Other education institution in an overseas country Research institution in UK 04 NHS/General medical or dental practice in the UK 09 Other work/employment in UK 14 05 Health services in an overseas country 10 Other work/employment in an overseas country 15 Research institution overseas 06 Other public sector UK 11 Not in regular work/employment 21 Please enter your nationality PLEASE Tick the entry that relates to your highest qualification Doctorate Other Higher Degree PGCE Other Postgraduate Qualifications (in professional) First Degree First Degree with Qualified Teacher Status (QTS) Other qualifications at first degree level including professional Diploma of HE HND/HNC Other undergraduate qualification (including professional) A level, Scottish Higher or equivalent (NVQ/SVQ 3) O level /GCSE or equivalent (NVQ/SVQ 2) Other qualifications No qualifications 01 02 03 09 11 12 19 21 22 29 31 32 97 98 Academic teaching qualification - Please state if you have any teaching qualifications or have been recognised in other ways for your teaching experience regardless of your current position. _____________________________________________ Current academic teaching discipline 1 – If you will be doing teaching or research work, please indicate the academic discipline that covers your primary subject area. ______________________________________________ Current academic discipline 2 – If you will be working in more than one subject area, please indicate the academic discipline that covers your secondary subject area. ________________________________________________ May 2016 Private and Confidential VAM Payroll Our refTier4Visa/Croatia Dear Student If you are an international student studying in the UK and hold a Tier 4 student visa or are a Croatian national in receipt of a Yellow Registration Certificate and you intend to undertake any paid work you must adhere to the Immigration rules relating to student working. You cannot be self-employed, provide services as a professional sportsperson or entertainer or fill a full time permanent vacancy in the UK. If you are a national of Croatia you can live and study in the UK without restriction, but must obtain an EU Yellow Registration Certificate before taking up any work. The maximum number of hours you can work each week depends on the type of course upon which you are registered. Undergraduate course You can work for a maximum of 20 hours per week during term time with no restriction on hours during the University vacations. The 20 working hours per week applies to all work (with any organisation) you are paid for. During vacation you have no restriction on the hours worked but should you work more than 20 hours per week during term time you will only be paid for a maximum of 20 hours. Postgraduate course - Master’s You can only work for a maximum of 20 hours per week for the duration of your course. Postgraduate course - PhD You can work for a maximum of 20 hours per week for the duration of your course. Completion of Studies (Undergraduate and Postgraduate) If you have confirmation you have passed your degree (either by presenting the degree certificate or official confirmation from the University) you can work full time for the remaining period of time left on your visa providing this period is 6 months or less. Croatian students – You will not have an end date on your Yellow Registration Certificate, but you must inform HR when you have completed your studies because you will no longer be eligible to work under student rules when you are no longer registered as a student at a UK HEI. Before undertaking any work submit this form together with a copy of your student visa/yellow registration certificate to the Departmental Administrator/Secretary of the department who wish to employ you. If you have completed your studies and wish to work full time refer to the paragraph above. After the work has been completed, the department for whom you worked will request Payroll to pay you. By signing the attached declaration you are agreeing to comply with these rules at all times. You must advise Human Resources of any change in circumstances in your work or student status. The University is legally obligated to comply with the Immigration rules and action will be taken against any student found to be in breach of the rules. Yours sincerely HR Manager HR Services Manager The University of Warwick Coventry CV4 8UW United Kingdom Tel: 024 7652 22720 Fax: 024 7652 4583 Email: May 2016 Private and Confidential VAM Payroll STUDENT DECLARATION FORM FOR COMPLETION BY WORKERS WHO HOLD A TIER 4 STUDENT VISA For Tier 4 visa holders and Croatian students with a Yellow Registration Certificate Surname (as official documents) Forename (s) (as official documents) Student Number: (Mandatory for University of Warwick Students) Full name of institution of study (Mandatory): __________________________________________________________________________________ Level of Course: (tick one box below): Undergraduate Masters PhD Expected date of completion of studies: D D M M Y Y Proof of the term dates of the University at which you are enrolled as a student must be provided, this can be a print out from the University’s website. This is required for undergraduate students wishing to undertake paid work. NB: postgraduate students are not allowed to work for more than 20 hours per week for the duration of their studies. NB: By signing the statement below you are confirming your compliance with UKVI Regulations; if you do not sign and return this form to Human Resources you will not be paid for any work undertaken. --------------------------------------------------------------------------------------------------------------------------------------Student Declaration I agree to undertake any paid work in accordance with the UKVI regulations which apply to working under the restrictions of my tier 4 student visa. Details of the working restrictions relating to student visas can be found on the Human Resources website: http://www2.warwick.ac.uk/services/humanresources/newpolicies/student_workers Signed………………………………………………………………………… Date ……………………………………………………………………..... (Please note a typed signature is not valid) Print name…………………………………………………………………. Department (at University of Warwick) requesting work assignment: _______________________________________ Name of department contact: ______________________________________________________________ Work to be undertaken: ______________________________________________________________ Number of hours worked per week: ___________________ Dates of work from: ___________________ to _____________________ Proof of the university term dates as relating to your course must be attached. Please return to the Departmental Administrator/Secretary of your employing department to return to Human Resources before you commence work with a copy of relevant documentation. May 2016