Economic Update 21 June 2010

advertisement

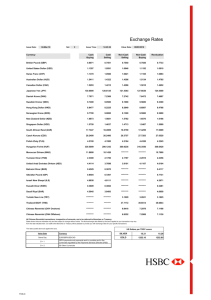

Economic Update 21st June 2010 The Chinese revaluation Contacts: Madan Sabnavis Chief Economist 91-022-67543489 Samruddha Paradkar Associate Economist 91-022-67543407 Krithika Subramanian Associate Economist 91-022-67543321 The Chinese central bank announced on Saturday night that it would increase the flexibility of its exchange rate, an indication that it will resume a policy of gradual appreciation of the renminbi against the dollar after nearly two years, when the rate has remained unchanged. However, it has been careful with its wording of its approach to the exchange rate. The central bank statement suggests that shifts in the exchange rate are likely to be slow, which could result in continued international criticism that the renminbi is still artificially low. The People’s Bank of China said there was no basis for a large-scale appreciation, given the sharp drop in China’s current account surplus over the last year, and that the current trading bands for the currency would remain in place. When Beijing lifted its currency peg in July 2005, it allowed the renminbi to appreciate against the dollar over three years to mid2008 when the peg was reinstated. Beijing could again allow a similar pace of appreciation. But it could go much slower. China remains nervous about Europe’s debt crisis and divided over the wisdom of giving up export competitiveness. This move, if implemented would strengthen Asian currencies in particular. An appreciation of the renminbi would make imports cheaper for the domestic consumers who demand more imported goods – especially capital goods. Countries whose growth is linked with China would tend to gain. But, a lot depends on the extent to which the Chinese central bank appreciates the currency. It may not mean much, according to critics who feel that this move has been done strategically before the G20 conference, where this issue was to come up for discussion. ECONOMIC UPDATE The movement in the renminbi so far $-Renminbi: Jan 2005 to May 2010 8.5 Renminbi/$ 8 7.5 7 Apr-10 Jan-10 Oct-09 Jul-09 Apr-09 Jan-09 Oct-08 Jul-08 Apr-08 Jan-08 Oct-07 Jul-07 Apr-07 Jan-07 Oct-06 Jul-06 Apr-06 Jan-06 Oct-05 Jul-05 Apr-05 6 Jan-05 6.5 China had a virtual pegged exchange rate until June 2005, when it had agreed to correct the currency in light of the current account surplus. The correction via an appreciation was on till midJuly when China reverted to a virtual pegged currency. The renminbi had strengthened from an average of 8.28/$ in June 2005 to 6.84/$ by July 2008 – an appreciation of 17.4% over 3 years. It has remained at this level subsequently. Chinese action The Chinese central bank, PBOC (People’s Bank of China) announced on Saturday that it would increase the flexibility of the exchange rate and that it would be maintained at a ‘stable and adaptive equilibrium level’. It will further effectively abandon its currency peg with the US dollar. The central bank said that the dollar peg had served a role when the international crisis “was at its worst” but that the “the global economy is gradually recovering” and the rebound in the Chinese economy was more “solid”. The PBOC said it will be guided by a “basket” of currencies, not the dollar alone. If the euro resumes its slide in the next few weeks or months, the renminbi (Yuan) might even be nudged down a bit against the dollar, to keep its trade-weighted value stable. It has also pointed to the sharp drop in the country’s current account surplus as evidence that substantial rebalancing of the economy is already taking place. The current-account surplus has narrowed over recent years, from 11% of GDP in 2007 to 6.1% of GDP last year. There was therefore no justification for a “large-scale appreciation” of the exchange rate 2 ECONOMIC UPDATE Why has China changed its mind? The PBOC (People’s Bank of China) insists that the decision was taken for domestic reasons. However, critics aver that this announcement comes a week ahead of a G20 summit in Canada that was shaping up to be something of a showdown over the level of the Chinese currency. China’s announcement that it will introduce more flexibility into its exchange rate is a deft political move amid rising international criticism of Beijing, but the economic implications are much less certain. Likely scenarios - - - - - China’s exchange rate against the euro has already appreciated 15% in recent months, raising worries about slowing exports to China’s biggest market. This being the case China would be more circumspect on the appreciation of its currency. Besides, inflation in China is higher than most of its trading partners, meaning that China’s real exchange rate is also rising. Dealers and analysts expect appreciation against the US dollar in the short term of 0.2% a month – well short of the likely level needed to appease critics. The use of the phrase greater “flexibility” in the exchange rate could potentially include occasional periods of depreciation against the dollar. By stressing that the renminbi will be managed against a basket of currencies, they have an excuse to weaken the currency against the dollar and punish speculators if the euro continues to depreciate. Some analysts feel that the PBOC will first allow the renminbi to change only marginally and when it is confident that China’s economic momentum can survive the euro-area’s woes, it will let the Yuan strengthen at about the same pace as before the crisis, i.e. about 5% a year, on a trade-weighted, inflation-adjusted basis. An appreciation will automatically increase the purchasing power of both China’s corporates and households. History has shown that even a gentle pace of Yuan appreciation is a powerful tonic for economies and assets that are leveraged on Chinese growth. In particular capital goods exporters of Asia such as Japan, South Korea and Taiwan and the world’s bulk commodity exporters like Australia and Brazil are the key beneficiaries of China’s current growth model. In fact both Australia and Korea have shown a very strong correlation with China and hence both currencies and stocks are expected to receive a boost from this move. Economists also hope a higher Yuan could help temper inflation in China by pushing down import prices, which in turn could mean Beijing would have less need to tighten monetary policy aggressively. Markets had been worried that China could over-tighten and suffer a hard landing. The big question mark? The issue really is as to by how much will the renminbi appreciate or rather correct? The extent of correction will guide the movement of trade flows. It was believed that the Yuan was undervalued by as much as 25% giving it an advantage. The Yuan rose as high as 6.8110 per dollar on Monday, the 21st June up just 0.2 percent from its close on Friday of 6.8262, but still the highest level since September 2008. It was also the biggest intraday rise since October 2008, further evidence that the central bank was allowing the currency some room to move more freely. The central bank sets a daily reference point each day for Yuan trade. The currency is allowed to move 0.5 percent either side of the reference point. The central bank earlier set the reference point at 6.8275 per dollar, unchanged from its reference point on Friday, prompting some doubts about China's intentions and a slight cooling in the rally in other markets. 3 ECONOMIC UPDATE Implications for India For the period January 2005 to May 2010, the coefficient of correlation between the Rs/$ and REM/$ rates was -0.32. This was however, skewed due to the static REM/$ for the period subsequent to July 2008. However, for the 3 year period between June 2005 and June 2008 the coefficient of correlation was 0.69 (and significant), meaning thereby that further appreciation of the Yuan would be associated with the rupee also strengthening under ceteris paribus conditions. India’s trade per se with China is significant with China accounting for 10.4% of our imports in FY2009 and 4.9% of our exports being directed to China. --------------------------------------------------------------------------------------------------------------------------------Disclaimer The Report is prepared by the Economics Division of CARE Limited. The Report is meant for providing an analytical view on the subject and is not a recommendation made by CARE. The information is obtained from sources considered to be reliable and CARE does not guarantee the accuracy of such information and is not responsible for any decision taken based on this Report. 4