Who gives, who gains? Progressivity and Preferences Pablo Beramendi (Duke University,

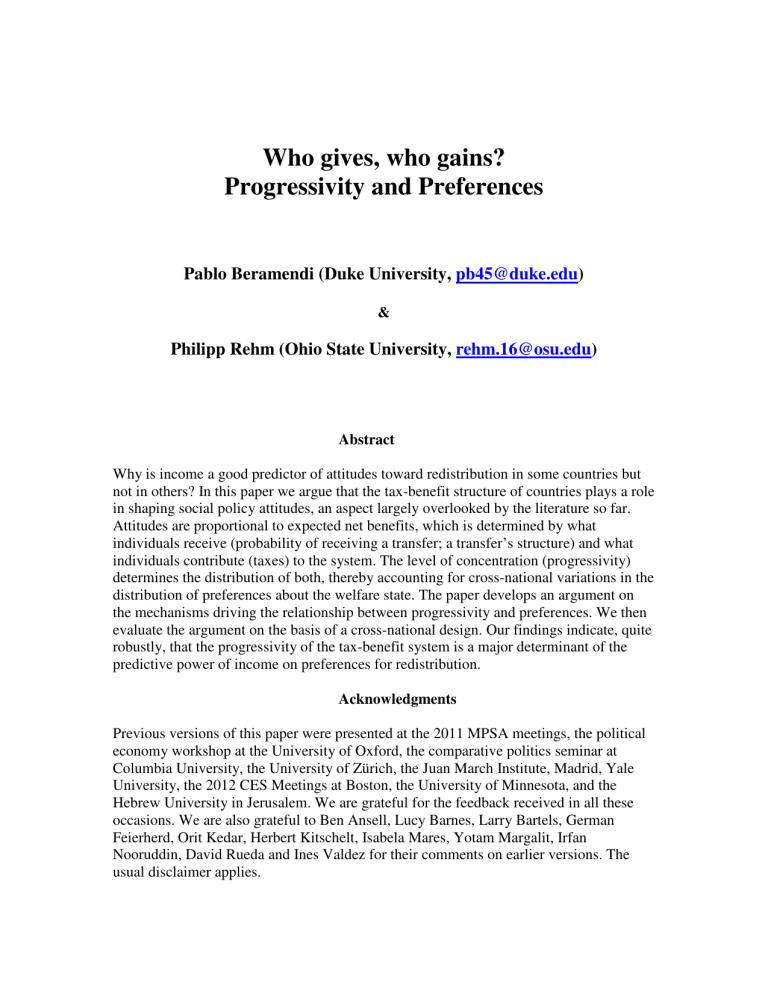

Who gives, who gains?

Progressivity and Preferences

Pablo Beramendi (Duke University, pb45@duke.edu

)

&

Philipp Rehm (Ohio State University, rehm.16@osu.edu

)

Abstract

Why is income a good predictor of attitudes toward redistribution in some countries but not in others? In this paper we argue that the tax-benefit structure of countries plays a role in shaping social policy attitudes, an aspect largely overlooked by the literature so far.

Attitudes are proportional to expected net benefits, which is determined by what individuals receive (probability of receiving a transfer; a transfer’s structure) and what individuals contribute (taxes) to the system. The level of concentration (progressivity) determines the distribution of both, thereby accounting for cross-national variations in the distribution of preferences about the welfare state. The paper develops an argument on the mechanisms driving the relationship between progressivity and preferences. We then evaluate the argument on the basis of a cross-national design. Our findings indicate, quite robustly, that the progressivity of the tax-benefit system is a major determinant of the predictive power of income on preferences for redistribution.

Acknowledgments

Previous versions of this paper were presented at the 2011 MPSA meetings, the political economy workshop at the University of Oxford, the comparative politics seminar at

Columbia University, the University of Zürich, the Juan March Institute, Madrid, Yale

University, the 2012 CES Meetings at Boston, the University of Minnesota, and the

Hebrew University in Jerusalem. We are grateful for the feedback received in all these occasions. We are also grateful to Ben Ansell, Lucy Barnes, Larry Bartels, German

Feierherd, Orit Kedar, Herbert Kitschelt, Isabela Mares, Yotam Margalit, Irfan

Nooruddin, David Rueda and Ines Valdez for their comments on earlier versions. The usual disclaimer applies.

Who gives, who gains?

Progressivity and Preferences

Abstract

Why is income a good predictor of attitudes toward redistribution in some countries but not in others? In this paper we argue that the tax-benefit structure of countries plays a role in shaping social policy attitudes, an aspect largely overlooked by the literature so far.

Attitudes are proportional to expected net benefits, which is determined by what individuals receive (probability of receiving a transfer; a transfer’s structure) and what individuals contribute (taxes) to the system. The level of concentration (progressivity) determines the distribution of both, thereby accounting for cross-national variations in the distribution of preferences about the welfare state. The paper develops an argument on the mechanisms driving the relationship between progressivity and preferences. We then evaluate the argument on the basis of a cross-national design. Our findings indicate, quite robustly, that the progressivity of the tax-benefit system is a major determinant of the predictive power of income on preferences for redistribution.

Acknowledgments

[Redacted to preserve anonymity]

What drives people’s attitudes towards redistribution? If politics is about who gets what the answer should follow naturally: income. However, a robust and consistent pattern documents large levels of variation in the capacity of income to predict redistributive preferences (see

Figure 1 below). In other words, countries vary largely in the extent to which rich people support redistribution and poor people oppose it. In this paper we return to the intuition that politics is indeed about who gets what at which price to argue that the field has overlooked an important institutional mechanism in the process of preference formation, namely the degree of progressivity in the tax-transfer system. Progressivity shapes how concentrated ( who ) both benefits ( what ) and taxes (the price ) are.

We argue that, by shaping the distribution of citizens’ expected net benefits, the organization of the tax and transfer system mediates the impact of income on preferences for redistribution. For example, self-interested rich citizens may well support social policies if they are regressive. As the degree of progressivity varies hugely across countries and social policy domains, the design of the tax and transfer system is bound to play a key role in explaining why income is a better predictor of attitudes toward redistribution in some countries. To give a preview of our core result, we find that income is a better predictor of preferences towards redistribution in those societies with more progressive fiscal systems. To the extent that inequality or the size of the welfare state matter for the formation of social policy preferences, we argue and show that they do so indirectly at best, by enhancing (or muting) the implications of progressivity.

Our argument contributes to the scholarship on the micro-foundations of the welfare state by identifying an important institutional mechanism that affects preference formation. Preferences respond to the actual distribution of who gets what (i.e., progressivity) which is determined jointly by the tax system, the transfer structure, inequality, and risk. Existing contributions typically focus exclusively on individual-level determinants of social policy preferences, emphasizing mechanisms as diverse as self-interest,

1

values and believes,

2

and other-regarding preferences.

3

We build on the micro-level literature and offer a micro-level account of social policy attitudes, but we advance an argument that links institutional characteristics to preference formation. Linking micro- and macro-level arguments and analyzing “preferences in context”

(Gingrich and Ansell 2012) strikes us as a pressing research agenda.

4

1

Income and its variability (“risk”) are the key variables in these approaches. See, for example the literature on social upward mobility (Alesina and La Ferrara 2005; Bénabou and Ok 2001; Piketty 1995), insurance (Cusack,

Iversen, and Rehm 2006; Iversen and Soskice 2001; Moene and Wallerstein 2001; Rehm 2009; Sinn 1995; Varian

1980; Margalit 2013), or class-based explanations (Svallfors 2004).

2

Examples include norms of “deservingness”, standards of fairness, beliefs about the causes of inequality, partisan ideology, altruism, national identity, religion, and many other factors have been explored (Alesina and Angeletos

2005; Bénabou and Tirole 2006; Fong 2001; Kangas 1997; Kangas 2003; Kangas et al. 1995; Scheve and Stasavage

2006; Shayo 2009).

3

Examples include references to group loyalty (Luttmer 2001), altruism (Rueda 2013), the importance of relative status (Corneo and Gruner 2000; Wilensky 1975; Lupu and Pontusson 2011) and race or ethnicity (Alesina, Glaeser, and Sacerdote 2001).

4

To be sure, there is a growing literature that explores the correlation between different welfare regimes (Esping-

Andersen 1990) and aggregate support for redistribution (Arts and Gelissen 2001; Bean and Papadakis 1998;

Gelissen 2000; Gelissen 2002; Jaeger 2006; Jaeger 2009; Jakobsen 2010; Mehrtens 2004; Svallfors 1997), but this literature tends not to focus on causal mechanisms. As far as we know, progressivity does not play a role in these accounts.

3

The paper proceeds as follows. Section I motivates the question by presenting the key theoretical puzzle. Section II develops the theoretical argument. Section III outlines the empirical strategy.

Section IV presents the results. Finally, section V summarizes the findings, discusses some of the limitations in the paper, and points to future lines of inquiry.

I. The Puzzle: Income and Preferences for Redistribution

Insofar as democracies are effectively representative, redistributive policies and outcomes will reflect, at least in part, the degree of support for redistribution existing in a society. In turn, according to layman’s intuition – and economists’ formalizations (Meltzer and Richard 1981;

Romer 1975; Robertson 1976) – , one should expect income to be closely correlated with redistributive references. If politics is about who gets what, it would appear almost self-evident that poor people like redistribution for the same reasons that rich people resist it. However, available evidence suggests that the issue requires some additional thought. Figure 1 displays the size of the income-coefficient when predicting attitudes on the following ISSP question:

“On the whole, do you think it should be or should not be the government’s responsibility to: Reduce income differences between the rich and poor” [1. Definitely should not be; 2.

Probably should not be; 3. Probably should be; 4. Definitely should be]

- Figure 1 about here -

The bars indicated the size of the income coefficient from regressing redistribution attitudes on income and a small set of controls (gender, education, age); these coefficients refer to around

2006, and are recovered from a multi-level model.

5

The layman’s expectation appears correct in that income almost always has a negative effect on support for redistribution across all nations, but the diversity in the magnitude of the effect is striking (Dion and Birchfield 2010; Dion 2010).

Why is income such a strong predictor of redistributional attitudes in New Zealand, but not in

Portugal? What explains the fact that income seems to have the same effect on preferences for redistribution in Sweden and the United States, two radically different welfare states? Why does income seem to be a worse predictor of support for redistribution in France or Finland? Why are richer respondents in Portugal more likely than poorer respondents to express support for redistribution?

The literature offers three clues to account for cross-national differences in the importance of income as a predictor of preferences. Two of them point to redistributive motives and link income slopes to either pre-tax inequality or the size of the welfare state. The connection between income slopes and pre-tax income inequality follows rather directly from median voter accounts of preferences, most notably Meltzer and Richards’ (Meltzer and Richard 1981): As the

5

To produce these slopes, we estimate hierarchical linear models predicting social policy attitudes with income and a set of controls (education, gender, and age), with random intercepts and random slopes. We then recover countryspecific income-slopes (income-gradients) and their standard errors from best linear unbiased predictions (BLUPs).

Our analysis refers to roughly 2005/2006 (ISSP Research Group 2006). We limit our sample to respondents aged

18-65 since our macro-level measure of progressivity refers to the same working age population.

4

gap between the rich and the poor increases, so does the gap between the median voter income and the average income in society, thereby fostering support for higher taxes and redistribution.

Under those circumstances the degree of polarization around the welfare state is likely to increase, rendering income a stronger predictor of preferences for redistribution. In addition to inequality, a second aspect of contention over redistribution is the size of the effort: the larger the amount of transfers at stake in fiscal policy, the higher the importance of income as a determinant of preferences. Hence, one may expect that income slopes should be larger in more generous welfare states.

A third logic builds on the premise that welfare states are primarily insurance systems tailored to solve inter-temporal trade-offs in economies organized around different types of skills (Estevez-

Abé, Iversen, and Soskice 2001; Iversen and Soskice 2001; Mares 2003). Those economies organized around the production of goods intensive in specific skills by firms competitive in international markets develop welfare states to ameliorate the risks incurred by workers with little transferability to other sectors during economic downturns. In contrast, workers with general skills face less risk, and their skill’s transferability reduces their demand for comprehensive insurance programs. According to this logic, in those countries with labor markets where general skills are prevalent, we might expect income to be a stronger predictor of redistributive preferences.

Yet, however compelling in their simplicity, none of these three logics seems to work. Figure 2 plots income slopes as reported in Figure 1against four variables: the Gini coefficient of pre-tax income inequality (top left panel) and post-tax income inequality (top right panel), the size of the welfare state, measured as total public social expenditure as % of GDP (bottom left panel), and the incidence of vocational training (Iversen and Soskice 2001, 888), i.e. the share of people of a certain age-cohort that goes through vocational training programs (bottom right panel).

- Figure 2 about here -

Across the board, Figure 2 conveys a consistent message: income slopes do not correlate well with pre-existing patterns of inequality, nor the size of the welfare state, nor the skill composition of the labor force. As such, the patterns of variation depicted in Figure 1 do not sit well with the dominant theoretical approaches in the field. The rest of the paper develops an alternative argument that points to the degree of progressivity in the fiscal system as the key mechanism, largely overlooked by the literature so far, accounting for the cross-national variation in income slopes on preferences for redistribution.

II. The Argument: Progressivity, Redistribution, and Preferences

Different welfare states rely on different mixes of taxes/contributions and benefits/entitlements, and different societies are characterized by different income and risk distributions. In conjunction, these factors influence who benefits and who loses from social policy, who actually gets what and at what cost. The distribution of expected net benefits, in turn, should have stark consequences for the politics of the welfare state and for individuals’ predispositions towards it.

Some systems pitch winners against losers, while others are much less zero sum.

5

The size of the welfare state – arguably the most prominent dependent variable in the social policy literature – has no obvious connection to the distribution of expected net benefits, and therefore no clear link to interests and politics. In fact, any given distribution of expected net benefits can be the result of any number of combinations of transfers, taxes, inequality and risk.

For example, some social policy programs are largely paid for by the rich and largely used by the poor. These (progressive) programs are characterized by a very uneven distribution of expected net benefits, and we would expect them to cleave citizens along income lines. In other programs, premiums are scaled to risk – these programs follow actuarial principles with a much more even distribution of expected net benefits; income should be much less important in shaping attitudes.

And some public policies are financed by everybody but are disproportionally consumed by the rich. These (regressive) policies should cleave citizens’ attitudes along income – but the rich should actually favor these policies, while the poor should oppose them.

Of course, that the politics of welfare states isn’t just about the Benjamins has been recognized before. The welfare regime literature uncovered different types of welfare states (Esping-

Andersen 1990), which finance and distribute benefits in very different ways. Social policy preferences shape (Brooks and Manza 2007) or are being shaped by these regimes (Arts and

Gelissen 2001). The social insurance literature shows how incorporating risk into the analysis changes our understanding of welfare state politics (Baldwin 1990; Mares 2003; Iversen and

Soskice 2001; Rehm, Hacker, and Schlesinger 2012; Moene and Wallerstein 2001; Moene and

Wallerstein 2003). Risk exposure offers a motive for affluent citizens to support social policy programs. The small literature on taxation and social policy uncovered what became to be known as “the paradox of redistribution” (Korpi and Palme 1998).

6

However, our rich understanding of welfare state politics at the macro-level has not been leveraged for explaining its micro-level underpinnings. We argue that the complex macro-level interplay of financing (taxes/contributions), generosity (benefits/entitlements), inequality and risk leads to different distributions of expected net benefits (across programs; across countries; over time), which in turn shape individual-level social policy attitudes. We further argue that the complex macro-level mix can be approximately summarized by the concentration of benefits and taxes across the income distribution – something we call progressivity. In particular, in more progressive systems,

7

we expect income to be more closely connected to social policy attitudes

(income slopes are more negative).

To illustrate the logic, we next present a model that builds on the canonical Meltzer-Richard formalization (Meltzer and Richard 1981) [MR]. Citizens have an exogenously given level of income (w i

), which is taxed by function t i

. Taxes are collected and handed out as a flat-rate benefit c. Taxation leads to disincentive effects (labor supply decreases as taxation increases), which we capture (indirectly) by function L. Individuals’ utility is then:

= 1 − + −

[1]

6

“The more we target benefits at the poor only and the more concerned we are with creating equality via equal public transfers to all, the less likely we are to reduce poverty and inequality” (Korpi and Palme 1998, 681–682).

7

Benefits are concentrated at the bottom of the income scale, costs are concentrated at the top of the income scale; inequality is high and income-risk correlations are negative and high.

6

This formulization departs from the MR model in two main ways. First, it simplifies the original model by taking incomes as exogenous. Second and more interestingly, t i

varies by individuals, adding a progressive tax design to the original model. In particular, we follow de Donder and

Hindrik (De Donder and Hindriks 2003) and set:

= +

[2]

With this quadratic income tax function, individual i ’s tax payment is:

= +

[2’]

Parameter alpha captures a proportional tax rate (everybody pays, say, 20% of their income as taxes). Parameter beta is the progressivity tax parameter, with β > 0 indicating a (marginally) progressive income tax and β < 0 representing a (marginally) regressive one.

8

In the MR model,

β =0, i.e. taxes are proportional.

Balanced budgets require that the sum of benefits equals the tax take, which implies:

= +

[3] where w is the average wage.

Note that tax policies are bidimensional: benefit c depends on α and β . Without strong assumptions it is not possible to find a median voter type solution to such a model (since it is always possible to find a majority coalition to defend the status quo, leading to cycling).

However, this simple set up allows us to explore the impact of progressivity ( β ) on preferred spending levels (c). Rewriting the utility function

9

and taking the derivative with respect to c leads to the following expression:

= − + 1 − − + [4]

Setting this expression to zero lets us solve for optimal c, which we call c

*

:

∗ = − +

[5]

Ignoring w (since it is constant) leads to a simplified expression of c

*

:

∗ ∝ − + [6]

Comparative statics on this expression reveal the following:

8

De Donder and Hindrik set c ≥ 0, 0 ≤α≤ 1, and –( α /2) ≤β≤ (1α )/2.

9

Modeling disincentive effect as L=(w i t i

)

2

/2, solving [3] for α and substituting the expression into [1].

7

∗

= − + 1 − [7]

Or

∗

= − +

[8] with

= 1 − [9]

For positive values of β (i.e. in progressive systems), citizens with above average incomes

(w i

>w) want zero benefits (no taxes, no transfers), while those below it want a positive benefit; the poorer a person, the higher the preferred benefit. In somewhat regressive systems (for fairly negative values of β , i.e. β + ε <0), the relationship between preferred benefits and income flips to positive.

10

The pogressivity parameter mediates the preference gap between different income levels: the gap between the most and least preferred benefit level increases as β raises.

11

In other words, the income differences in preferred levels of redistribution increase in β . In more progressive systems, income is a better (more negative) predictor of redistribution preferences.

More formally, the cross-partial with respect to β is negative:

∗

= −1

[10]

The results in [8] and [10] summarize our argument. Our model shows how progressivity and income slopes are connected. Of course, our model is very abstract and simplifies as much as possible. Moreover, we model progressivity via the tax function. In reality, the progressivity of a social policy program is the result of many factors, as mentioned above (financing, benefit, inequality, income-risk correlations, etc.). In our empirical analysis below we will employ measures of progressivity that take these various sources into consideration.

We also assume the status quo level of progressivity to be exogenous and given to the individual’s process of preference formation. We believe this to be a reasonable theoretical assumption. This paper analyzes the effect of progressivity on income slopes, not on the origins of progressivity. And the latter is clearly a given for any individual entering politics: what individuals experience as the status quo are the results of previous compromises on the politics of risk management and fiscal burden allocation.

12

Our argument suggests that institutional differences translate directly into the process of preference formation. What matters for understanding the role of income in preference formation is not the level of inequality per se, nor the level of generosity, but the set of rules that govern the allocation of costs and benefits across income groups. Pre-existing levels of progressivity shape

10

The flipping point is not β =0, but somewhat to the left of that (loosely speaking, that’s because of the disincentive effects of taxation, which show up in ε )

11

Note that for positive β the most preferred level of c is zero; the gap still increases because poor citizens prefer a positive level of c. Progressivity parameter β myltiplies that gap.

12

On the politics behind these compromises: Stigler (1970); Dixit and Londregan (1995, 1998); Beramendi and

Cusack (2009).

8

individual’s preferences formation. Speaking directly to the questions above, we derive the following testable empirical implication:

The impact of income on preferences over redistribution is higher in systems with higher levels of progressivity

The remainder of the paper offers empirical assessments of this expectation.

III. Empirical Strategy

Our argument is that progressivity – resulting from the interplay of the tax-benefit structure in combination with the distribution of income and risk – influences the predictive power of income when it comes to attitudes towards social insurance programs. We test this claim in four different ways:

(1) Across countries: do income-slopes (from predicting redistributional / social insurance attitudes) vary systematically with the degree of progressivity?

(2) Across social policy domains, across countries: do income-slopes vary with the degree of progressivity in different social policy domains in different countries?

(3) Over time: a dynamic analysis of the relationship between tax progressivity and income slopes in Sweden during the period 1968-2010.

(4) A natural experiment, based on the German case before and after re-unification, where we can exploit an exogenous change in the degree of progressivity and assess its implications for income slopes.

Our dependent variable is the predictive power of income for social insurance attitudes. To compute a reliable measure, we estimate hierarchical linear models predicting social insurance attitudes with income and a set of controls (education, gender, and age), with random intercepts and random slopes. We then recover country-specific income-slopes (and their standard errors) from best linear unbiased predictions (BLUPs). These income-slopes are our dependent variable

(and we use the inverse of the standard errors as weights in all further country-level estimates).

Figure 1 above displayed these slopes.

Larger (more negative) coefficients indicate that social policy issues are a more salient cleavage in a society. One advantage of this approach is that it allows us to take into account other relevant factors: the partial correlation coefficient of social policy attitudes and income is net of control variables. Perhaps the largest challenge for the income-slope approach is that the income data in our public opinion survey are of problematic quality and not necessarily comparable

9

across countries. It is therefore reassuring that the estimated income-gradients from alternative data-sources with better and more comparable income variables are comparable.

13

Our main source for measuring our dependent variable is the International Social Survey

Program’s (ISSP) “Role of Government” (RoG) module IV (ISSP Research Group 2006). Our core explanatory variable – discussed in detail below – is available for about the same year (and not for other years). We therefore restrict our analysis to ISSP 2006. To construct our dependent variable, we recover income slopes on the following attitudinal items:

•

On the whole, do you think it should or should not be the government's responsibility to ... o

Reduce income differences between rich and poor o

Provide decent standard of living for the old o

Provide decent standard of living for the unemployed o

Provide health care for the sick o

Provide decent housing for those who can’t afford it

The answer categories are 1 “Definitely should not be”, 2 “Probably should not be”, 3

“Probably should be”, and 4 “Definitely should be.”

Our main focus is on the redistribution item (government responsibility to reduce income difference between rich and poor). In turn, for the comparative analysis of contestation across social policy domains, we rely on the items asking about government responsibility for the old, unemployed, sick, and those in need of housing.

Our key explanatory variable is “progressivity” – parameter β in the model presented above.

How should it be measured? One prominent measure in the literature is the redistributive effect taxes and transfers have, which is typically measured as the (proportional) reduction in the gini coefficient comparing market and disposable income distributions (Bradley et al. 2003;

Kenworthy and Pontusson 2005).

14

Standard measures capturing the overall reduction in inequality due to taxes and transfers, such as the difference in Gini coefficients before and after taxes and transfers, provide a summary of the scope of redistribution but do not speak to the directionality of the policy effects behind observable redistribution nor about the subspace of the income distribution in which the reallocation of resources actually takes place. For instance a 10 percent reduction in pre-tax inequality may reflect transfers from the top to the middle, from the middle to the bottom, or

13

We convert the country-specific family income variables in the ISSP surveys into income noviles. But not all countries report detailed income data. For Portugal, for example, we only have six income categories, and we therefore drop that country from our analysis involving survey data. To get a sense of the robustness of our estimates of the dependent variables, we also relied on the European Social Survey (ESS) (ESS 2008). In particular, the ESS

2002, 2004, 2006, and 2008 contain the following survey item: “Using this card, please say to what extent you agree or disagree with each of the following statements: The government should take measures to reduce differences in income levels. [The answer categories are 1 “Disagree strongly”, 2 “Disagree”, 3 “Neither agree nor disagree”, 4

“Agree”, 5 “Agree strongly”]. While the income data in the ESS 2008 survey are better suited for our purposes

(since they are reported in national income deciles), the ESS sample is restricted to European countries. We therefore prefer to use the ISSP surveys. However, a comparison of the estimates of contestation from the two different data sources shows a fair degree of overlap.

14

In the literature on measurement of inequality, this is known as the Reynolds-Smolensky index.

10

from the top to the bottom. These are three very different scenarios in terms of progressivity and the politics of social policy – and yet the overall reduction in the Gini coefficient for pre-tax inequality offers no leverage to distinguish between them. This is not to say though that redistribution and progressivity are unrelated.

Following Kakwani and Lambert the overall redistributive impact of the fiscal system – measured by the difference between market and disposable income gini coefficients – can be broken into two components (Kakwani 1977; Kim and Lambert 2009): the scope of the effort and its progressivity. The relationship can be formally stated as follows:

15

!"#$% − &'(&!)*$ =

+

,+

=

%

-

.)/

0

/

,%.)

[10] where t denotes the tax level, b denotes the benefit level and β

T

and β

B

indicate the progressivity of taxes and benefits. Assuming balanced budgets ( t = b= α ), we can rewrite this equality as:

!"#$% − &'(&!)*$ = 1 + | 3 |

[11]

In words: the overall reduction in inequality due to taxes and transfers can be decomposed into the product of the size of the welfare state ( α ) and the progressivity of its taxes ( β

T

) and benefits

( β

B

). It is our contention that progressivity is a central ingredient of welfare state politics.

The literature has followed Kakwani in measuring β

T

and β

B

. Kakwani defines progressivity as a tool to “measure deviations of the tax [or transfer] system from proportionality” (Kakwani 1977,

74), which are commonly captured by concentration curves of taxes and benefits, respectively.

The concentration of taxes is derived by plotting the share of taxes paid against rank-ordered income groups. In a progressive system, those at the bottom of the income scale pay a lower share of taxes and the concentration curve is below the 45-degree line, while it is above the 45degree line for richer income groups. The concentration coefficient of taxes ( β

T

) sums the area between the concentration curve and the 45-degree line in a way that more positive values indicate more progressive systems.

Progressivity of benefits is measured analogously. The concentration of benefits is derived by plotting the share of benefits received against rank-ordered income groups. In a progressive system, those at the bottom of the income scale receive a higher share of benefits and the concentration curve is above the 45-degree line, while it is below the 45-degree line for richer income groups. The concentration coefficient of benefits ( β

B

) sums the area between the concentration curve and the 45-degree line, where the area above the 45-degree line has a negative sign, while the area below the 45-degree line has a positive sign. More negative values indicate more progressive systems.

15

The first equality has been established by Kakwani (Kakwani 1977, equation 3.2), the second by Lambert (Kim and Lambert 2009, equation 3).

11

In the empirical analysis below, we will capture progressivity by the concentration of benefits

( β

B

) as well as a measure of overall progressivity ( β

T

-| β

B

|).

16

In both cases, a value of zero indicates proportionality. With respect to the concentration of benefits, negative values indicate more progressive benefits systems, and we expect a positive correlation between income slopes

(welfare state contestation) and that measure. With respect to the combined measure of progressivity – taking into account taxes and benefits – positive values indicate more progressive systems, and we expect a negative relationship between income slopes and overall progressivity.

We take these measures from the OECD (Förster and Whiteford 2009; OECD 2008), and they refer to the mid-2000s. The OECD also provides concentration measures of cash benefits for various social policy domains. Together with an indicator of the importance of benefits

(percentage share of public cash transfers in household disposable income), these measures are displayed in Table 1.

- Table 1 about here -

Our theoretical framework predicts that the importance of social policy as a political cleavage will be larger, the higher the levels of progressivity. But, clearly, the tax-benefit structure is not the only plausible factor influencing how contested welfare states are. We already noted that three plausible explanatory variables are income inequality (higher inequality should lead to more contestation, per Meltzer-Richard), the incidence of vocational training (the large the incidence of vocational training, the less contested social policy), and the magnitude of the welfare state (the more is at stake, the more contested should welfare states be). Neither of these variables performed well in bivariate analysis (see Figure 2), but it nevertheless may make sense to include them as control variables. Welfare state size seems particularly relevant,

17

and we therefore include three different measures thereof (percentage share of public cash transfers in household disposable income; total social expenditure as % of GDP; average tax wedge).

18

Since it is plausible that attitudes towards government intervention are shaped by dominant (left) parties and unions, we include control variables for left party dominance (cumulative share of cabinet posts for left parties) and trade union density . Moreover, the overall level of risk in a society may shape attitudes towards social policy and have an impact on the link between income and redistribution preferences. To take this possibility into account, we control for the unemployment rate . Table 2 lists all variables and their sources.

19

16

To arrive at a measure of overall progressivity, we take the concentration coefficient of taxes ( β

T

) and subtract the absolute value of the concentration coefficient of benefits ( β

B

). Higher values indicate more progressive systems.

17

Equation [11] above suggests that we should control for the overall size of the welfare state.

18

Defined as: “Sum of personal income tax and employee plus employer social security contributions together with any payroll tax less cash transfers, expressed as a percentage of labour costs.”

19

In robustness checks, we have also controlled for a variety of other variables. These include factors that are discussed in the growing literature exploring the link between income and voting (De La O and Rodden 2008; Huber and Stanig 2007; Shayo 2009). We included control variables that measure religious fractionalization (Alesina et al.

2003); the share of confessional groups (such as Catholics or Protestants), with data from the Religion and State

Project (Fox 2004; Fox 2008); ethnic fractionalization (Alesina et al. 2003) to account for the possibility that ethnic issues alter the link between income and redistributional preferences; and variables containing information on immigration stocks and flows (such as inflow of asylum seekers, inflow of foreigners, stock of foreign-born population, etc.). None of these change the results we report below.

12

IV. Findings

We now turn to the results. We are primarily concerned with the correlation of welfare state contestation and the structure of tax-benefit systems (the who-gets-what-at-which-price question). We will concentrate on two explanatory variables only: the concentration of cash benefits and the concentration of net benefits, namely joint impact of benefit and financing concentration (“overall progressivity”). Figure 3 displays bivariate correlations between these two core explanatory variables and the income-slopes. The figure shows that the more redistributive benefits, the more contested they are. This is what we expected from our theoretical framework.

20

The close fit between income-slopes and the concentration of (taxes and) benefits, as displayed in Figure 3 is remarkable.

- Figure 3 about here -

We now explore whether these correlations withstand the inclusion of (more or less plausible) control variables. As elaborated above, we include the following controls: income inequality; size of the welfare state measured in various ways; incidence of vocational training; left party dominance; trade union density; and the unemployment rate. We include these control variables one at a time. Table 3 displays the results when we predict income-slopes with the concentration of cash benefits, while Table 4 has the results when we predict income-slopes with overall progressivity (concentration of taxes – concentration of benefits).

- Table 3 and Table 4 around here -

The results are easy to report: the key explanatory variables in Table 3 and Table 4 – the concentration of benefits and overall progressivity, respectively – turn out to be statistically significant in all models, while none of the control variables is found so. The substantive impact of cash benefit concentration is also significant. The estimated slope in the top panel of around

0.18 suggests that a one standard deviation (0.19) change in the concentration of benefits changes the income slope by about 0.034. Since the income-slope ranges from about to -0.15 to about -0.02, this is a 20% change.

21

Based on our theoretical framework, we expected cash benefit concentration and overall progressivity to be statistically and substantively significant predictors of the saliency of social policy as a political issue. In contrast, the finding that none of the more or less standard variables in the comparative political economy literature took us by surprise.

We turn now to the analysis disaggregated by policy domain (unemployment, pensions, health care, and housing). To this end, we need to match survey items on social policy domains to

20

There are also good reasons why the results are generally stronger when we solely look at the benefit structure

(top panel) as opposed to both the benefit and financing structure (bottom panel): benefit structures vary more across countries than tax structures. This certainly does not imply that financing structures can or should be neglected. But it implies that in our empirical investigations, their effects are smaller than those generated by the structure of benefits.

21

Income slopes: Mean=-.07; SD=.04; Min=-.15; Max=.02; N=21. Concentration of cash benefits: Mean=-.11;

SD=.19; Min=-.43; Max=.31; N=21. Overall progressivity: Mean=.57; SD=.2; Min=.21; Max=.54; N=18.

13

concentration measures of social policy domains. While there is often more than one possible match, many mappings are straightforward. In particular, the ISSP RoG survey includes the following social policy attitudinal items

22

that can be easily matched with concentration measures of benefits:

•

Provide decent standard of living for the unemployed

→

concentration of unemployment benefits

•

Provide decent standard of living for the old

→

concentration of old age pensions

•

Provide health care for the sick

→

concentration of disability benefits

•

Provide decent housing for those who can’t afford it

→

concentration of housing benefits

When we explore the correlation between income-slopes (from multi-level models predicting a social policy attitude) and concentration measures within each of these domains, we find the expected positive correlations (the more concentrated benefits towards the poor, the more contested the social policy area). Figure 4 shows the results, pooling the four social policy domains together.

- Figure 4 about here -

Each symbol in the scatter-plot represents one of four social policy domains, for a given country: unemployment (U), pensions (P), disability benefits (D), or housing benefits (H). As can be seen from the Figure, there is a positive correlation between the concentration of benefits and the income-slopes, within each domain (dotted lines) and overall (solid line). The overall correlation is quite strong, and statistically significant (whether we include fixed effects for social policy domains or not), as was the case with the overall progressivity measures.

To recapitulate, we have tested our hypothesis that social policy polarization (measured in terms of the strength of income as a predictor of attitudes) can be explained by the progressivity of the tax-benefit system. Our findings suggest, in line with our theoretical expectations, a strong impact of the level of progressivity of the tax-transfer system. This finding is robust across measures of concentration (cash benefits vs. benefits and taxes), income measures (not shown), and policy domains, as well as to the inclusion of relevant control variables.

These are solid empirical grounds. Yet, however robust, the joint endogeneity between progressivity and support for redistribution continues to loom large over these findings. The correlational evidence presented so far cannot identify the causal effect of progressivity on preferences for redistribution. Two potential concerns stand out: first, a necessary yet insufficient condition for a causal effect of progressivity on income slopes is that these two variables co-vary over time; second, for causality to be identified, an exogenous increase (decrease) of progressivity should lead to a subsequent increase (decrease) in the magnitude of income slopes.

We address each of these two points in turn.

22

These are based on ISSP survey items, with the following wording stem: “On the whole, do you think it should or should not be the government's responsibility to ...”. The answer categories are 1 “Definitely should not be”, 2

“Probably should not be”, 3 “Probably should be”, and 4 “Definitely should be.”

14

Unfortunately, data limitations prevent us from performing a viable time-series cross-sectional analysis.

23

However, in some cases, there are enough data on both progressivity and income slopes to evaluate the relationship over time. We make use of a time series of progressivity indicators in Sweden from 1968-2009. Bengtsson et al. (2012) compute these indicators on the basis of the Swedish Longitudinal Individual Data Base (LINDA), a dataset that captures a 3.35 percent random sample of the Swedish population and incorporates demographic information as well as entries for all tax payments and deductions registered by tax authorities and population censuses. This source allows us to trace the evolution of income tax progressivity in Sweden for over forty years.

24

The top-panel in Figure 5 traces the evolution of progressivity in Sweden.

- Figure 5 about here -

During this time, two major reforms took place. The first one, in 1971, increased significantly the levels of income tax progressivity. Before 1971 the Swedish tax system had two distinctive features: first, couples and singles were taxed under two different schedules; second, proportional local income taxes were deductible from national income taxes. The 1971 reform made all income from employment taxable on the basis of a single scale, regardless of marital status, and eliminated the possibility to deduct local taxes from national taxes, thereby significantly increasing the levels of progressivity. The second major reform, enacted by the first conservative government to gain office in decades, took place in 1991 and worked in the opposite direction. The 1991 tax reform enacted a massive reduction of the top marginal tax rate from 80 to 50 percent and a simplification of the tax code such that about 85 percent of the population were no longer required to file an income tax (Bengtsson, Holmlund, and

Waldenstrom 2012; Steinmo 2002, 850). Instead, all tax payers pay a proportional tax of 20%

(which eventually increased to 30% in most districts) and the top 20% of income earners pay an additional national tax rate or either 20 or 25 % depending on their pre-tax income level. In addition, capital and corporate marginal tax rates dropped significantly. Overall, the reform reduced massively the pre-existing levels of progressivity in the system.

Accordingly, we expect the income slopes to increase after the 1971 reforms and to decrease after 1991. Figure 5 plots the evolution of progressivity between 1968 and 2009 (top-left panel) along with the income slopes on preferences for redistribution in twelve Swedish National

Election Studies between 1964 and 2006 (bottom-left panel). It also displays a scatterplot between these two variables, along with a fit-line (top-right panel).

25

23

The main constraint is the absence of estimates for the concentration curves over time, our core explanatory variable.

24

Since we do not have access to LINDA, we have to rely on published data to approximate progressivity.

Bengtsson, Holmlund, and Waldenstrom (2012, Table A7) publish time-series on the evolution of the gini coefficient of market and disposable income, respectively, as well as the so-called re-ranking effect. We approximate progressivity by “vertical redistribution”, which can be calculated as: Gini(market)-

Gini(disposable)+reranking effect (Kim and Lambert 2009, equation 4). This measure is inferior to the concentration based measures we employ in the analysis above, but it addresses some of the shortcomings of the gini-reduction measure.

25

The dependent variable comes from a question that asks respondents to react to the following statement: “Social reforms in this country have gone so far that the state ought to reduce rather than increase social benefits and support for people”. Respondents have four options: 1 "agree completely"; 2 "agree on the whole"; 3 "disagree on the whole"; 4 "disagree completely" A negative slope for income indicates that wealthier respondents are more likely to agree with the statement. In turn, income is measured as a five scale variable: 1 "low income"; 2 "fairly low

15

- Figure 5 about here -

The longue durée analysis of the Swedish case reveals a pattern consistent with our theoretical expectations. As the progressivity of the fiscal system increased between 1972 and 1990, so did the income slopes. By contrast, the 1991 reform caused a change in trends that reduced and ultimately stabilized the importance of income as a predictor of preferences for redistribution.

The change in trends is less sharp than one would ideally like to see – we think for two reasons.

First, the change in progressivity is contemporaneous to a major economic crisis that triggers automatic stabilizers and reduces the tax contributions of low income citizens (via unemployment effects). Hence, the effects of the reform did take some time to become apparent.

Second, the return of the Social Democrats to power in 1994 implied a marginal adjustment of the 1991 Tax Reform. While the fundamental spirit of the 1991 reform, that is the need to preserve high wage earners for paying an exceedingly high share of the tax burden, remained in place, the new government introduced a series of changes that scaled back the scope of the reform. These adjustments included a 5% increase in the top marginal tax rate and a drop in the

VAT for food of 50% (Steinmo 2002, 852). These changes slowed down the reduction of progressivity and its impact on income slopes. Overall, however, there is clear, strong and negative relationship between the degree of progressivity and the impact of income slopes in

Sweden over time, as shown in the top-right panel of Figure 5. Higher levels of progressivity imply a stronger negative impact of income, as predicted by our argument.

This result, however, does not address the joint endogeneity between progressivity and preferences for redistribution over time as neither the 1971 nor the 1991 reforms can be said to be exogenous with respect to the pre-existing distribution of preferences. To address this problem we exploit German Reunification (1989-1990) as a natural experiment where by virtue of sharp increases in the pool of recipients from the East and ad hoc modifications of the tax and transfers system the levels of progressivity increased sharply (Beramendi 2012). The West incorporated five new poorer Länder and twenty million new and largely poorer citizens, triggering an increase of progressivity through four mechanisms: (1) the concentration of financing effort among tax payers in the West;

26

(2) the concentration of risk among the new citizens in the East; (3) the increase in unemployment induced by the recession following Reunification; and (4) the rapid incorporation into the benefit system of the new pool of welfare dependents into the system.

27

The fundamentals of the fiscal system did not change, despite a massive alteration in the geography of income and labor markets. Rather, it assimilated the new members in a short period of time, triggering an unprecedented redistributive effort from the

West to the East and a substantial increase in the levels of progressivity in the system.

Together, these processes combined two types of redistribution: interpersonal redistribution from rich to poor individuals in both the East and West, and inter-territorial redistribution from income"; 3 "neither low nor high income"; 4 "fairly high income"; 5 "high income". The analysis also controls for age, gender, marital status, education, and whether the respondent is affiliated with a union.

26

For example, a 7.5% surcharge on personal and corporate income, introduced in 1996, was met primarily by

Western tax payers.

27

For instance, Eastern citizens were incorporated into the unemployment insurance system as early as 1990, and to social assistance and public insurance pensions by 1992. For a more detailed account of the rapid process of incorporation of Eastern lander into the existing welfare structures, see Beramendi (2012:149-159).

16

Western taxpayers to Eastern recipients. The latter, however, decreased marginally over time as the cost and the size of transfers to the East became a major focus of political contention in the late 1990s. From a geographic perspective, progressivity will be at its highest in the newly unified Germany, reflecting the joint effect of interpersonal and inter-territorial redistribution. Of the two Germanys, the East will be one with the lowest degree of progressivity as its population has an overconcentration of welfare beneficiaries, whereas in Western Germany the majority of tax payers coexists with a sizable group of welfare recipients. Hence, income slopes should be larger in the new Germany than in Western Germany, and larger in the West than in the East. In turn, in terms of dynamics, according to the model, increasing progressivity should translate into larger (i.e. more negative ) income slopes.

To assess the validity of these predictions, we rely on the German General Social Survey,

ALLBUS (GESIS - Leibniz-Institut für Sozialwissenschaften 2012). In particular, we explore the predictive power of income on the response to the following statement: “the state should secure income in times of hardship”

28

with responses ranging from strong disagreement (1) to strong agreement (4).

29

Figure 6 reports the income slopes for Germany, West Germany, and East

Germany.

- Figure 6 about here -

The evolution of income slopes in Germany after Re-unification validates our theoretical expectations. Income slopes are larger in the newly unified Germany than in either of its constituent parts throughout the period. In terms of dynamics, it is important to distinguish between the West and the East. In the West, due to the concentration of tax payers, income slopes are large from the beginning and strengthen marginally over time. Indirectly, this reflects a conflict of motives. Western citizens want to sustain a comprehensive insurance system in the

West but grow increasingly opposed towards the scale and the efficiency implications of the unification effort. In the East, slopes increase sharply during the period 1991-2010. Early on in the process there is virtual unanimity in the East about the need and desirability of massive income transfers. However, as time goes by, preferences sort along income lines, especially from the late 1990s onwards when the scope and nature of the post-unification effort becomes the subject of significant political contention. Overall, the evolution of income slopes in Germany after Re-unification lends support to our theoretical expectations in a context in which the increase in the level of progressivity was clearly exogenous.

V. Conclusion

We began this paper by showing that the importance of income as a predictor of redistribution varies greatly across rich democracies (Figure 1), but not in a way we would expect from the dominant theoretical approaches in the field (Figure 2). What, then, does explain welfare state

28

German question wording: “Der Staat muss dafuer sorgen, dass man auch bei Krankheit, Not, Arbeitslosigkeit und im Alter ein gutes Auskommen hat.”

29

Reported estimates are, as before, BLUP from multilevel models, with individuals nested in time. Control variables include gender, age, marital status, and education. As before, the sample is restricted to respondents aged

18-60.

17

contestation? We have argued that progressivity is a key ingredient for understanding the politics of the welfare state, since it decidedly shapes the distribution of expected net benefits, i.e. who gets what at which price. And we have shown that, indeed, a higher concentration of taxes and transfers (higher progressivity) produces higher levels of polarization over social policy (more negative income slopes). This finding is robust across a wide range of different tests (crossnational; cross-domain; time-series; exogenous shock).

We believe it is futile to understand the politics of the welfare state without considering progressivity. Politics is, after all, the question of who gets what (at which price), and progressivity crucially shapes expected net benefits. This implies that there are large payoffs from analyzing systematically and jointly the role of taxes (not just transfers) and the distribution of risk (not just income). For example, consider Figure 7, which shows a clear negative correlation between welfare state size and progressivity.

30

Our approach helps us understand the politics behind this finding: in more progressive systems, welfare state contestation will be higher, slowing welfare state expansion.

- Figure 7 about here -

By unpacking the linkage between who actually gets what and preference formation, this paper has a number of implications. First, it unveils an important mechanism in the formation of citizens’ attitudes towards the welfare state. The mechanism highlights the role of an institutional component largely neglected in the literature, namely fiscal institutions.

31

Second, it provides a framework to approach the political consequences of fiscal reforms, an important issue in the context of the current financial crisis. Third, it provides a corrective to the dominant social policy paradigms, which tend to focus on the role of income inequality and welfare state size.

In closing, we highlight three avenues for future research. First, progressivity may itself reflect pre-existing levels of support for redistribution. We have presented evidence on Germany that reveals an impact of progressivity on preferences in circumstances where the case for exogeneity is plausible. This evidence would suggest then that the concerns about endogeneity apply only in the long run. A sizeable stock of research indicates that fiscal institutions have remained pretty sticky since their consolidation between the inter-war and the post-war period. They do change, but very slowly and within their own logic, in ways heavily constrained by their own feedback effects on political coalitions. Thus, we believe that our assumption that citizens evaluate the expected net benefits given a rather stable pre-existing design remains plausible. Having that said, however, progressivity is itself the outcome of political contentions in the medium- to longrun (Cusack and Beramendi 2006; Beramendi and Rueda 2007). A natural next step in this agenda is to explain the political origins of different equilibria in terms of concentration and generosity.

Second, while our paper makes use of individual-level data to measure the dependent variables and our core explanatory variables, it does not directly test the micro-level mechanisms that our

30

This is somewhat different from the “paradox of redistribution”, which is concerned with targeting and poverty reduction.

31

For another analysis on the role on institutions as context for preference formation, see Gingrich and Ansell

(2012).

18

logic assumes in terms of preference formation. For example, we do not test whether expected net benefits are good predictors of social policy benefits. To be sure, previous research has established aspects of this mechanism, showing that income and risk are strong predictors of social policy attitudes. We doubt that there are cross-national surveys that provide respondentspecific estimates of expected net benefits, but they may be derived at cohort-levels (such as income groups, or occupations), and then merged into existing public opinion surveys. This seems one fruitful way to pursue the mechanisms underpinning the link between material interests and preference formation.

Third, we argue that the expected benefits of social policy are determined by the interplay of income, risk, benefits, and financing. We measure progressivity by the concentration of benefits

(and the concentration of taxes), which does not unravel the impact of these different sources on progressivity. Future research should disentangle and measure the different contributors to progressivity directly. At a minimum, this would give a richer picture of who gets what at which price. And that is what arguably politics is all about.

19

References

Alesina, Alberto, and George-Marios Angeletos. 2005. “Fairness and Redistribution.” American

Economic Review 95 (4): 960–980.

Alesina, Alberto, Arnaud Devleeschauwer, William Easterly, Sergio Kurlat, and Romain

Wacziarg. 2003. “Fractionalization.” National Bureau of Economic Research Working

Paper Series No. 9411. http://www.nber.org/papers/w9411.

Alesina, Alberto, and Eliana La Ferrara. 2005. “Preferences for Redistribution in the Land of

Opportunities.” Journal of Public Economics 89 (5-6): 897–931.

Alesina, Alberto, Edward Glaeser, and Bruce Sacerdote. 2001. “Why Doesn’t the United States

Have a European-Style Welfare State?” Brookings Papers on Economic Acticity 2001

(2): 187–254.

Armingeon, Klaus, Panajotis Potolidis, Marlène Gerber, and Philipp Leimgruber. 2009.

Comparative Political Data Set 1960-2007 . Berne, Switzerland: Institute of Political

Science, University of Berne.

Arts, Wil, and John Gelissen. 2001. “Welfare States, Solidarity and Justice Principles: Does the

Type Really Matter?” Acta Sociologica 44: 283–299.

Baldwin, Peter. 1990. The Politics of Social Solidarity: Class Bases of the European Welfare

State, 1875-1975 . Cambridge, MA: Cambridge University Press.

Bean, Clive, and Elim Papadakis. 1998. “A Comparison of Mass Attitudes Towards the Welfare

State in Different Institutional Regimes, 1985-1990.” International Journal of Public

Opinion Research 10 (3) (September 1): 211–236. doi:10.1093/ijpor/10.3.211.

Bénabou, Roland, and Efe A. Ok. 2001. “Social Mobility and the Demand for Redistribution:

The POUM Hypothesis.” Quarterly Journal of Economics 2001 (May): 447–487.

Bénabou, Roland, and Jean Tirole. 2006. “Belief in a Just World and Redistributive Politics.”

The Quarterly Journal of Economics 121 (2) (May 1): 699 –746. doi:10.1162/qjec.2006.121.2.699.

Bengtsson, Niklas, Bertil Holmlund, and Daniel Waldenstrom. 2012. “Lifetime Versus Annual

Tax Progressivity: Sweden, 1968-2009.” http://papers.ssrn.com/sol3/papers.cfm?abstract_id=2098702.

Beramendi, Pablo. 2012. The Political Geography of Inequality . New York: Cambridge

University Press.

Beramendi, Pablo, and Thomas Cusack. 2009. “Diverse Disparities.” Political Research

Quarterly 62 (2) (June 1): 257 –275. doi:10.1177/1065912908319220.

Beramendi, Pablo, and David Rueda. 2007. “Social Democracy Constrained: Indirect Taxation in

Industrialized Democracies.” British Journal of Political Science 37 (04): 619–641.

Bradley, David, Evelyn Huber, Stephanie Moller, François Nielsen, and John D. Stephens. 2003.

“Distribution and Redistribution in Postindustrial Democracies.” World Politics 55 (2):

193–228.

Brooks, Clem, and Jeff Manza. 2007. Why Welfare States Persist: The Importance of Public

Opinion in Democracies . University Of Chicago Press.

Corneo, Giacomo, and Hans Peter Gruner. 2000. “Social Limits to Redistribution.” American

Economic Review 90 (5): 1491–1507.

Cusack, Thomas, and Pablo Beramendi. 2006. “Taxing Work.” European Journal of Political

Research 45 (1): 43–73.

20

Cusack, Thomas, Torben Iversen, and Philipp Rehm. 2006. “Risks at Work: The Demand and

Supply Sides of Government Redistribution.” Oxford Review Economic Policy 22 (3):

365–389. doi:10.1093/oxrep/grj022.

Dion, Michelle L. 2010. “When Is It Rational to Redistribute? A Cross-national Examination of

Attitudes Toward Redistribution.” http://polmeth.wustl.edu/mediaDetail.php?docId=1232.

Dion, Michelle L., and Vicki Birchfield. 2010. “Economic Development, Income Inequality, and

Preferences for Redistribution

1

.” International Studies Quarterly 54 (2): 315–334. doi:10.1111/j.1468-2478.2010.00589.x.

Dixit, Avinash, and John Londregan. 1995. “Redistributive Politics and Economic Efficiency.”

American Political Science Review 89 (4): 856–866. doi:10.2307/2082513.

———. 1998. “Ideology, Tactics, and Efficiency in Redistributive Politics.” Quarterly Journal of Economics 113 (2): 497–529.

De Donder, Philippe, and Jean Hindriks. 2003. “The Politics of Progressive Income Taxation with Incentive Effects.” Journal of Public Economics 87 (11) (October): 2491–2505. doi:10.1016/S0047-2727(02)00051-8.

Esping-Andersen, Gosta. 1990. The Three Worlds of Welfare Capitalism . Princeton, NJ:

Princeton University Press.

ESS. 2008. European Social Survey Round 4 Data. Data File Edition 4.0

. Norway: Norwegian

Social Science Data Services. http://ess.nsd.uib.no/ess/conditions.html.

Estevez-Abé, Margarita, Torben Iversen, and David Soskice. 2001. “Social Protection and the

Formation of Skills: A Reinterpretation of the Welfare State.” In Varieties of Capitalism :

The Institutional Foundations of Comparative Advantage , edited by Peter A. Hall and

David Soskice, 145–183. Oxford University Press.

Fong, Christina. 2001. “Social Preferences, Self-interest, and the Demand for Redistribution.”

Journal of Public Economics 82: 225–246.

Förster, Michael, and Peter Whiteford. 2009. “How Much Redistribution Do Welfare States

Achieve? The Role of Cash Transfers and Household Taxes.” CESifo DICE Report 7 (3).

CESifo DICE Report: 34–41.

Fox, Jonathan. 2004. The Religion and State Project . Ramat Gan, Israel: Bar Ilan University. http://www.thearda.com/ras/.

———. 2008. A World Survey of Religion and the State . 1st ed. Cambridge, MA: Cambridge

University Press.

Gelissen, John. 2000. “Popular Support for Institutionalised Solidarity: a Comparison Between

European Welfare States.” International Journal of Social Welfare 9 (4): 285–300. doi:10.1111/1468-2397.00140.

———. 2002. Worlds of Welfare, Worlds of Consent? Public Opinion on the Welfare State .

Brill.

GESIS - Leibniz-Institut für Sozialwissenschaften. 2012. Allgemeine Bevölkerungsumfrage Der

Sozialwissenschaften ALLBUS - Kumulation 1980-2010 (ZA4574 Datenfile Version

1.0.1) . Köln: GESIS Datenarchiv. doi:10.4232/1.11486.

Gingrich, Jane R., and Ben W. Ansell. 2012. “Preferences in Context: Micro Preferences, Macro-

Contexts and the Demand for Social Policy.” Comparative Political Studies 45 (12):

1624–1654.

Huber, John, and Piero Stanig. 2007. “Why Do the Poor Support Right-wing Parties? A Crossnational Analysis.”

21

ISSP Research Group. 2006. International Social Survey Programme (ISSP): Role of

Government IV . Distributor: GESIS Cologne Germany ZA4700, Data Version 1.0 (2008-

08-18).

Iversen, Torben, and David Soskice. 2001. “An Asset Theory of Social Policy Preferences.”

American Political Science Review 95 (December): 875–895.

Jaeger, Mads Meier. 2006. “Welfare Regimes and Attitudes Toward Redistribution: The Regime

Hypothesis Revisited.” European Sociological Review 22 (2): 157–170.

———. 2009. “United But Divided: Welfare Regimes and the Level and Variance in Public

Support for Redistribution.” European Sociological Review 25 (6) (December 1): 723–

737. doi:10.1093/esr/jcn079.

Jakobsen, Tor. 2010. “Welfare Attitudes and Social Expenditure: Do Regimes Shape Public

Opinion?” Social Indicators Research . doi:10.1007/s11205-010-9666-8. http://dx.doi.org/10.1007/s11205-010-9666-8.

Kakwani, Nanak C. 1977. “Measurement of Tax Progressivity: An International Comparison.”

The Economic Journal 87 (345) (March 1): 71–80. doi:10.2307/2231833.

Kangas, Olli E. 1997. “Self-Interest and the Common Good: The Impact of Norms, Selfishness and Context on Social Policy Opinions.” Journal of Socio-Economics 26 (5): 475–494.

———. 2003. “The Grasshopper and the Ants: Popular Opinions of Just Distribution in

Australia and Finland.” Journal of Socio-Economics 31: 721–743.

Kangas, Olli E., David Miller, Per Arnt Petterssen, Stefan Svallfors, and Peter Taylor-Gooby.

1995. In the Eye of the Beholder. Opinions on Welfare and Justice in Comparative

Perspective . Umea: Scandbook.

Kenworthy, Lane, and Jonas Pontusson. 2005. “Rising Inequality and the Politics of

Redistribution in Affluent Countries.” Perspectives on Politics 3 (3): 449–471.

Kim, Kinam, and Peter J Lambert. 2009. “Redistributive Effect of U.S. Taxes and Public

Transfers, 1994-2004.” Public Finance Review 37 (1) (January 1): 3–26. doi:10.1177/1091142108324423.

Korpi, Walter, and Joakim Palme. 1998. “The Paradox of Redistribution and Strategies of

Equality: Welfare State Institutions, Inequality, and Poverty in the Western Countries.”

American Sociological Review 63 (5): 661–687.

De La O, Ana L., and Jonathan A. Rodden. 2008. “Does Religion Distract the Poor?”

Comparative Political Studies 41 (4-5) (April 1): 437 –476. doi:10.1177/0010414007313114.

Lupu, Noam, and Jonas Pontusson. 2011. “The Structure of Inequality and the Politics of

Redistribution.” American Political Science Review 105 (02): 316–336. doi:10.1017/S0003055411000128.

Luttmer, Erzo F. P. 2001. “Group Loyalty and the Taste for Redistribution.” Journal of Political

Economy 109 (3): 500–528.

Mares, Isabela. 2003. The Politics of Social Risk. Business and Welfare State Development .

Cambridge, MA: Cambridge University Press.

Margalit, Yotam. 2013. “Explaining Social Policy Preferences: Evidence from the Great

Recession.” American Political Science Review 107 (01): 80–103. doi:10.1017/S0003055412000603.

Mehrtens, F. John. 2004. “Three Worlds of Public Opinion? Values, Variation, and the Effect on

Social Policy.” International Journal of Public Opinion Research 16 (2): 115–143. doi:10.1093/ijpor/16.2.115.

22

Meltzer, Allan H., and Scott F. Richard. 1981. “A Rational Theory of the Size of Government.”

Journal of Political Economy 89 (October): 914–927.

Moene, Karl O., and Michael Wallerstein. 2001. “Inequality, Social Insurance, and

Redistribution.” American Political Science Review 95 (4): 859–874.

———. 2003. “Earnings Inequality and Welfare Spending. A Disaggregated Analysis.” World

Politics 55 (July): 485–516.

OECD. 2008. “How Much Redistribution Do Governments Achieve? The Role of Cash

Transfers and Household Taxes.” In Growing Unequal? Income Distribution and Poverty in OECD Countries , edited by OECD. Paris: OECD.

Piketty, Thomas. 1995. “Social Mobility and Redistributive Politics.” Quarterly Journal of

Economics 110 (3): 551–584.

Rehm, Philipp. 2009. “Risks and Redistribution: An Individual-Level Analysis.” Comparative

Political Studies 42 (7): 855–881. doi:10.1177/0010414008330595.

Rehm, Philipp, Jacob S. Hacker, and Mark Schlesinger. 2012. “Insecure Alliances: Risk,

Inequality, and Support for the Welfare State.” American Political Science Review 106

(2): 386–406.

Robertson, David Bruce. 1976. A Theory of Party Competition . J. Wiley.

Romer, Thomas. 1975. “Individual Welfare, Majority Voting, and the Properties of a Linear

Income Tax.” Journal of Public Economics 4: 163–185.

Rueda, David. 2013. “Food Comes First, Then Morals? Redistribution Preferences, Altruism, and Group Heterogeneity in Western Europe.” Manuscript .

Scheve, Kenneth, and David Stasavage. 2006. “Religion and Preferences for Social Insurance.”

Quarterly Journal of Political Science 1 (3): 255–286.

Shayo, Moses. 2009. “A Model of Social Identity with an Application to Political Economy:

Nation, Class, and Redistribution.” American Political Science Review 103 (02): 147–

174. doi:10.1017/S0003055409090194.

Sinn, Hans-Werner. 1995. “A Theory of the Welfare State.” Scandinavian Journal of Economics

97 (4): 495–526.

Steinmo, Sven. 2002. “Globalization and Taxation Challenges to the Swedish Welfare State.”

Comparative Political Studies 35 (7) (September 1): 839–862. doi:10.1177/0010414002035007004.

Stigler, George J. 1970. “Director’s Law of Public Income Redistribution.” Journal of Law and

Economics 13 (1): 1–10.

Svallfors, Stefan. 1997. “Worlds of Welfare and Attitudes to Redistribution: A Comparison of

Eight Western Nations.” European Sociological Review 13 (3): 283–304.

———. 2004. “Class, Attitudes and the Welfare State: Sweden in Comparative Perspective.”

Social Policy & Administration 38 (2): 119–138.

Varian, Hal R. 1980. “Redistributive Taxation as Social Insurance.” Journal of Public

Economics 14: 49–68.

Wilensky, Harold L. 1975. The Welfare State and Equality: Structural and Ideological Roots of

Public Expenditures . University of California Press.

23

Figures and Tables

Figure 1: Income as predictor of redistributional attitudes

NZL

DNK

AUS

CAN

NLD

USA

NOR

CZE

GBR

SWE

DEU

FIN

FRA

CHE

JPN

POL

IRL

HUN

ESP

KOR

PRT

-.15

-.1

-.05

Slope of income from regression (ISSP):

0

Redistribution = Income + Controls

.05

Note:

Shown are BLUPs (Best Linear Unbiased Predictors) from multi-level models.

Based on ISSP 2006.

Preferences for redistribution: “On the whole, do you think it should be or should not be the government’s responsibility to reduce income differences between the rich and poor” [1. Definitely should not be; 2. Probably should not be; 3. Probably should be; 4. Definitely should be].

Controls are education, gender, and age. Sample is restricted to employed respondents aged 18-65.

24

Figure 2: Inequality, welfare state size, vocational training and income slopes

.05

PRT

0 KOR

-.05

-.1

CHE

IRL

JPN

FIN

FRA

DEU

SWE

NOR

DNK AUS

NZL

POL

-.15

.3

.35

.4

.45

.5

.55

Gini coefficient (before taxes and transfers) (age 18-65)

Coef=.07, SE=.19, t=.4, adj. R2=-.05, N=19

.05

0

-.05

-.1

PRT

SWE

DNK

KOR

ESP

IRL

JPN

FIN

DEU

CAN

GBR

AUS

POL

USA

NZL -.15

.2

.25

.3

.35

.4

Gini coefficient (after taxes and transfers) (age 18-65)

Coef=.31, SE=.22, t=1.4, adj. R2=.05, N=21

.05

.05

PRT PRT

0 KOR 0

ESP

-.05

IRL POL

-.1

CZE NOR

AUS

NZL -.15

5 10 15 20 25

Total social expenditure (% GDP)

Coef=0, SE=0, t=-.7, adj. R2=-.03, N=21

FIN

DEU

FRA

SWE

DNK

30

-.05

-.1

-.15

USA

AUS

IRL

CAN

JPN

NZL

FIN

SWE

DNK

0 10 20 30 40

Incidence of vocational training indicator (Iversen & Soskice)

Coef=0, SE=0, t=-.1, adj. R2=-.07, N=17

NOR

25

Figure 3: Concentration of benefits / benefits and taxes and income slopes

.05

0

-.05

-.1

KOR

ESP

HUN

IRL

AUS

FIN

CHE

GBR

NLD

DNK

NOR

CAN

SWE

CZE

USA

DEU

JPN

FRA

POL

-.15

NZL

-.4

-.2

0 .2

Progressivity public cash benefits, working age

Coef=.18, SE=.03, t=6.2, adj. R2=.65, N=21

.05

PRT

.4

0

KOR

-.05

-.1

POL

FRA

JPN

CHE

FIN

DEU

SWE

NOR

USA

CAN

DNK

IRL

GBR

AUS

-.15

NZL

.2

.4

.6

.8

1

Overall progressivity (concentration of taxes - concentration of benefits)

Coef=-.12, SE=.03, t=-3.8, adj. R2=.44, N=18

26

Figure 4: Correlation between concentration of benefits in various social policy domains and income-slopes in matched social policy domains

P

.02

D

0

-.02

-.04

H

H

H

H

H

H

P

P

H

P

U

P

D

P

P

U

D H

D

D

U

D

P P

U

U

U

U

H

U

D

P

P

P

U

P

P

U

U

D

U

U

P

H

P

U

D

D

U

P

D

U

-.06

H

H U

-.6

-.4

-.2

0

Concentration of benefits

D=Disability, H=Housing, P=Pensions, U=Unemployment

Coef=.029, SE=.009, t=3.09, adj. R2=.116

.2

U

P

P

D

.4

H

Note:

The unit of analysis is a social-policy-domain in different countries. The solid line is the pooled regression line (for equation, see note of figure). The four dotted lines are separate regression lines for each of the four social policy domains. The four social policy domains are disability (D), housing (H), pensions (P), and unemployment (U). The mapping of social policy attitudes

32

and concentration of benefit domains is as follows:

•

Provide decent standard of living for the unemployed

→

concentration of unemployment benefits

•

Provide decent standard of living for the old

→

concentration of old age pensions

•

Provide health care for the sick

→

concentration of disability benefits

• Provide decent housing for those who can’t afford it → concentration of housing benefits

32

These are based on ISSP survey items, with the following wording stem: “On the whole, do you think it should or should not be the government's responsibility to ...”. The answer categories are 1 “Definitely should not be”, 2

“Probably should not be”, 3 “Probably should be”, and 4 “Definitely should be.”

27

Figure 5: Sweden – income slopes and progressivity

.3

.05

.25

.2

.15

.1

1960 1970 1980 1990 2000 2010

0

1968

1970

-.05

1973

2002

1979

1988

1991

1998 2006

1976

-.1

.1

.15

.2

.25

Progressivity (vertical redistribution)

Coef=-.34, SE=.13, t=-2.6, adj. R2=.34, N=12

.3

.05

0

-.05

-.1

1960 1970 1980 1990 2000 2010

Note:

Top-left-panel: Progressivity estimates are calculated based on data derived from the Swedish Longitudinal

Individual Data Base (LINDA), as provided by Bengtsson, Holmlund, and Waldenstrom (2012, Table A7).

Progressivity is approximate by vertical redistribution, which can be calculated as (Kim and Lambert 2009, equation

4): Gini(market)-Gini(disposable)+reranking effect.