Skills in England 2007 Volume 4: Regional and

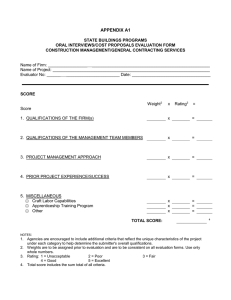

advertisement