J Real Estate Finan Econ (2010) 41:103–125

DOI 10.1007/s11146-009-9190-2

Spatial Statistics Applied to Commercial Real Estate

Darren K. Hayunga · R. Kelley Pace

Published online: 21 May 2009

© Springer Science + Business Media, LLC 2009

Abstract Portfolio theory shows that diversification can enhance the riskreturn trade-off. This study uses the absolute location of commercial real

estate property along with spatial statistics to address the inherent problem

of determining geographical diversification based upon a set of economic and

property-specific attributes, some of which are unobservable or must be

proxied with noise. We find that commercial real estate portfolios exhibit

statistically significant spatial correlation at distances ranging from adjacent

zip codes to neighboring metropolitan areas. Given the common structure

Research supported by a grant from the Real Estate Research Institute. We thank

an anonymous referee, Richard Buttimer, the editor, Jeff Fisher, David Geltner,

Marc Louargand, Glenn Mueller, Tony Sanders, C.F. Sirmans, and seminar participants

at the RERI conference, UNC-Charlotte, and UT-Arlington for their suggestions and

guidance. Special thanks to Robert White of Real Capital Analytics for data.

D. K. Hayunga (B)

Department of Finance and Real Estate,

University of Texas at Arlington, Box 19449,

Arlington, TX 76019, USA

e-mail: hayunga@uta.edu

R. K. Pace

LREC Endowed Chair of Real Estate, Department of Finance,

E.J. Ourso College of Business Administration,

Louisiana State University, Baton Rouge, LA 70803-6308, USA

e-mail: kelley@spatial.us

URL: www.spatial-statistics.com

104

D.K. Hayunga, R.K. Pace

of dependence found in the data series, we discuss feasible strategies for

obtaining diversification within direct-investment real estate portfolios.

Keywords Spatial statistics · Commercial real estate · Portfolio diversification

With the introduction of inefficiencies into the real estate market such as those

suggested by Roulac (1976), diversification of portfolios that directly invest in

real estate assets is more complex than stock and bond portfolios. Specifically,

the local or spatial nature of real estate markets introduces a trade-off between

specialization and spatial diversification.

On the one hand, specialization enables investors to continue learning

and trading in previously researched and traded assets. To the extent such

information is costly, investors may be able to obtain a more precise understanding of future payoffs at a lower price.1 In applying specialization to a

direct-investment real estate portfolio, a manager may reduce information and

management costs as well as potentially increase returns from greater localmarket information.

On the other hand, specialization in managing real estate portfolios implies

holding properties within a limited geographic area (e.g., neighborhood or

metropolitan area). Since neighboring properties experience similar supply

and demand functions, labor markets, and regulations, prices of these properties within close proximity of each other will be positively correlated. However,

traditional diversification theory advocates holding portfolio assets that are

less-than-perfectly correlated. Moreover, using standard portfolio theory, we

show that spatial correlation between properties is an unsystematic risk. Thus,

portfolios that directly invest in real estate and experience spatial correlation

between properties may not be efficient.2

In addition to moving towards efficiency, a spatially-diverse portfolio may

benefit real estate portfolio managers in a different manner. Relative to wellestablished financial assets, distinguishing between unsystematic and systematic risk is more difficult for direct real estate portfolios. First, most portfolios,

as well as the indices, especially for individual real estate markets, may not

have a large number of observations. For example, the NCREIF index for

Baton Rouge began in 1995 and observations occur only quarterly. Second,

1 In support of this hypothesis, Radner and Stiglitz (1984) find that mutual fund managers with

higher asset concentrations by industry outperform diversified funds. Van Nieuwerburgh and

Veldkamp (2007) develop a rational model of investors who choose to specialize in trading a

set of highly-correlated assets because of asset costs. They find that returns to specialization in

information acquisition can explain why investors do not hold fully-diversified portfolios.

2 A lack of spatial diversification may also cause a problem for those portfolio managers that

owe a fiduciary responsibility to plan participants and beneficiaries. Endowments, ERISA plans,

and foundations may owe a fiduciary duty to decrease risk for a given return, which can lead to

geographical diversification.

Spatial Statistics Applied to Commercial Real Estate

105

the returns depend upon appraisals, which complicates partitioning systematic

and unsystematic risk. Potential clients may have difficulty discerning which

part of a firm’s performance comes from systematic versus unsystematic risk.

If clients use indices based on a large number of properties as benchmarks,

firms may have an incentive to reduce unsystematic risk.

We examine the trade-off between specialization and spatial diversification

by joining portfolio theory with the tools of spatial statistics. While previous

studies have identified the importance of geographic diversification—with the

regions of study advancing from four or eight U.S. zones to Metropolitan

Statistical Areas (MSAs) to neighborhoods within a city—the literature does

not use spatial tools for systematic examination of spatial dependence among

real estate properties. It is not surprising to find that nearby properties exhibit

some degree of spatial interdependence, but research questions exist regarding

(i) how much initial spatial correlation is present for juxtaposed properties,

especially for different commercial property types since diversification by

property type has been shown to be effective in other studies; (ii) how quickly

does the spatial correlation decay; and (iii) at what distance does the spatial

correlation decay to zero—a zero correlation allows real estate to be treated

like other financial assets in terms of portfolio risk.

With respect to the initial correlation of nearby properties, we find that

base commercial real estate returns and capitalization (cap) rates exhibit

correlation values ranging from 0.31 to 0.39 over a separation distance from

1/2 to 2 miles. As separation distances increase, spatial correlations decrease

but maintain magnitudes over 0.10 out to approximately 30 miles, depending

upon the dataset. In fact, for some metropolitan areas comprised of two

or more major cities, the spatial correlations between properties within the

greater metropolitan area can exhibit correlations of approximately 0.30 out to

40 miles. Lastly, the average correlation drops to zero at separation distances

beyond 45 miles.

Using the empirical results, we execute portfolio simulations involving three

scenarios. The first simulation applies the empirical spatial correlations to a

portfolio concentrated with one metropolitan area (MA).3 The results suggest

that inter-neighborhood diversification is helpful but that no amount of intraMA diversification will produce an efficient portfolio. The next and most

aggressive strategy to remove spatial correlation is total inter-MA diversification. This leads to an equally-weighted portfolio holding one property

per MA. But while this portfolio composition mitigates spatial correlation,

an equally-weighted portfolio strategy is not macro-consistent. Based upon

2002 NCREIF property counts, 69% of the real estate held by institutional

investors is concentrated within the largest 16 MAs. There are simply not

3 The

term Metropolitan Area (MA) was adopted in 1990 by the U.S. Office of Budget and

Management and refers collectively to MSAs (urbanized place of over 50,000 people), Primary

Metropolitan Statistical Areas (Contiguous MSAs of over 1,000,000 people), and Consolidated

Metropolitan Statistical Areas (Combinations of PMSAs that form a larger, interrelated network).

106

D.K. Hayunga, R.K. Pace

enough qualifying properties to allow all direct-investment portfolios to hold

one property per MA.

A different strategy is to hold a few properties per MA within a limited

number of MAs. This will reduce idiosyncratic risk, but simulations demonstrate that no combination entirely removes spatial portfolio risk. Further, as

more MAs are added, the portfolio converges to an equally-weighted portfolio

with one property per MA. Again, the equally-weighted portfolio reintroduces

management costs and a lack of specialization. Other potential strategies

include adding international real estate assets and indirect investments such

as REITs and the S&P/GRA Commercial Real Estate Indices derivative

contracts.

Overall, this study demonstrates that spatial correlation in real estate yields

unique results when compared to textbook finance models using nonspatial

financial assets. Whereas unsystematic risk decreases as less-than-perfectlycorrelated assets are added to a nonspatial portfolio (e.g., Fama 1976),

direct-investment real estate portfolios are inefficient if managers add more

properties within a localized market.

Geographical Diversification Literature

Diversification of real estate portfolios has been the subject of research for

over two decades. The two predominant paths of analysis are diversification

either by (1) property type or (2) geographic or economic regions. Initially,

Miles and McCue (1982) find that diversification by property type generates

better characteristics than a strategy based upon geographic regions. Subsequently, Hartzell et al. (1986) analyze commingled real estate fund returns

and find that geographic diversification is not as influential as diversification

by property type. One of the challenges in the Hartzell et al. (1986) study

is that four broad regional classifications form the basis for the geographical

diversification. Hartzell et al. (1987) refine the geographical area to eight areas

based upon common regional economies. They contend that by using smaller

economic regions, geographical diversification plays a role in real estate portfolio diversification.

The next progression in geographical diversification is the replacement of

regional or political boundaries (e.g., state borders) with economic definitions.

Wurtzebach (1988) removes geography boundaries and classifies cities based

upon their dominant industry employment type and employment growth

patterns. Subsequently, Mueller and Ziering (1992) test Wutzebach’s diversification strategy and find that economic diversification offers an improvement over geographic regions. Mueller (1993) also finds that a diversification

strategy based upon nine SIC code categories provides superior diversification

capabilities for a large real estate portfolio. Williams (1996) examines MSAs

and finds that economic-base diversification by industry and government

services at the MSA level yields diversification benefits.

Spatial Statistics Applied to Commercial Real Estate

107

Because diversification across heterogeneous regions should help reduce

idiosyncratic risk in a real estate portfolio, additional studies examine

other ways to identify location-specific economic forces. At the MSA level,

Goetzmann and Wachter (1995) identify families of cities based upon common

economic characteristics. Looking inside the MSA, Wolverton et al. (1998) find

gains in real estate portfolio efficiency through intracity diversification. Nelson

and Nelson (2003) use over 50 socioeconomic measures, depending upon the

year, to find that regions are not always contiguous.

Overall, the extant literature establishes that geographic grouping based

upon economic characteristics dominates geographic division based upon

political boundaries, and smaller regions, such as MSAs or neighborhoods,

are more appropriate for diversification than four or eight national regions.

Our contribution in this paper extends the understanding of geographic diversification, not as a function of any type of preconceived political or economic

definition, but as a direct function of the separation distance between actual

properties through the use of spatial statistics.

A challenge for any spatial-diversification study is the inherent problem in

capturing all the socioeconomic variables in a model. Even with a detailed and

extensive dataset, not every possible economic consideration will be modeled

due to a lack of prior understanding of economic boundaries, data availability,

and the unobservability of certain aspects (e.g., investor sentiment). Alternatively, basing geographical diversification of real estate portfolios on spatial

correlation factors as separation distance increases is a systematic method for

measuring idiosyncratic risk. As an example, Fik et al. (2003) demonstrate how

the use of Cartesian {x, y} coordinates and the unique location-value signature

of each real estate property increases a model’s ability to explain variability.

The application of separation distances and spatial statistics is new to

commercial real estate, however, prior use of spatial statistics is found in the

residential-market literature.4 Dubin (1998) models correlations between

houses as a function of distance in a hedonic pricing model using Baltimore

data. Basu and Thibodeau (1998) examine spatial correlation in Dallas house

prices and find spatial techniques generally improve ordinary least squares

(OLS). Dubin et al. (1999) present an overview of modeling spatial dependence in real estate.

Spatial Dependence and Portfolio Theory

To apply spatial statistics to commercial real estate portfolios, we begin by

examining the spatial implications of portfolio theory. Using the moments of

mean and variance, modern portfolio theory identifies the relation between

the relevant risk of an investment and its expected return. When a risk-free

4 See Cressie (1993) and LeSage and Pace (2009) for details regarding spatial statistics and

econometrics.

108

D.K. Hayunga, R.K. Pace

asset exists, the relation between the relevant risk of any portfolio holding

risky assets (including a real estate portfolio) and its expected return can be

expressed directly as the capital asset pricing model (CAPM) of Lintner (1965)

and Sharpe (1964). Hence, the CAPM quantifies and prices relevant risk. Since

the CAPM assumes that all investors hold their entire wealth in the market

portfolio, the variance of the market portfolio quantifies the risk exposure for

all investors. Mathematically, this is expressed as the familiar equation for risky

asset j as,

r j − r f = β j Rm − r f ,

(1)

where the price of risk or the expected risk premium on the right-hand side

of the equation is the covariance between the returns of the market portfolio

and the risky asset j. In short, the risk premium demanded by investors is

proportional to beta.

A main insight provided by CAPM is that every asset, in equilibrium, must

be priced such that the risk-adjusted rate of return falls exactly on the security

market line. Thus, theory shows that investors can diversify away all risk except

the covariance of an asset with the market portfolio. In other words, a property

of the CAPM is the irrelevance of specific asset or idiosyncratic risk. Any risk

that is in excess of its covariance with the market is diversifiable.

We can apply this last statement directly to a real estate portfolio that

experiences spatial correlation between properties, and determine if there

exists any risk that is in excess of the covariance between the risky real estate

asset and the market portfolio. We begin, similar to Sharpe’s (1963) diagonal

model or Copeland et al. (2005, p. 152), with the simple return generating

equation of the market model,

R̃j = a j + bj R̃m + ˜ j,

(2)

where a j and bj are constants, R̃m is the market return, and ˜j is a random error

term. This general equation denotes that the return on any specific asset is a

linear function of the market return plus a random error term.

Combining individual assets into a portfolio, Markowitz (1952) shows the

expected return and risk of that portfolio. The return is a function of the weight

of each asset in the portfolio, wj, and its return as specified by Eq. 2. Taking

expectations leads to the portfolio return of

E R̃p =

N

j=1

⎛

⎞

N

wj a j + ⎝

wj bj⎠ Rm .

(3)

j=1

The variance of the return is used to express portfolio risk, which is the sum

of the mean return differences squared. Thus, the portfolio variance is the sum

of the variance and covariance terms weighted by the portion of an asset’s

Spatial Statistics Applied to Commercial Real Estate

value to the entire portfolio as VAR(Rp ) =

109

N

N wi wj COV R̃i , R̃j , which can

i=1 j=1

also be expressed using correlations as in Eq. 4.

VAR(Rp ) =

N

N wi wj σi σjCORR R̃i , R̃j ,

(4)

i=1 j=1

where N is the total number of risky assets, wi and wj are the proportions

invested in each asset, σi and σj are the standard deviations of the two risky

assets, and CORR R̃i , R̃j is the correlation between the returns from asset

i and asset j. We show the correlation expression because we express our

empirical results in subsequent sections using correlations due to the well

known range of values from +1 to −1.

Equipped with the general equation for portfolio risk in Eq. 4, we can

examine a real estate portfolio with at least two spatially dependent risky

assets. Using the standard definition of covariance, COV R̃i , R̃j = E R̃i R̃j −

E R̃i E R̃j , and the standard assumptions (e.g., Blume 1971) where E ˜q = 0

and E ˜q Rm = 0 for q = i, j we can express portfolio risk as COV R̃i , R̃j =

bi bj σm2 + E ˜i ˜j or as the correlation equivalent of

bi bj σm2

E ˜i ˜j

+

.

(5)

CORR R̃i , R̃j =

σi σj

σi σj

A standard assumption in portfolio theory is that the error term ˜j in Eq. 2

is independent of the market portfolio and independent of error terms in

the return-generating process of other risky portfolio assets, thus, E(˜i ˜j) = 0

in Eq. 5. Substituting the remaining Eq. 5 into Eq. 4 yields VAR(Rp ) =

N N

wi wjbi bj[σm2 ].

i=1 j=1

Since σm2 is a constant that depends neither on i nor j and there is not a

variable that depends jointly on the indices

i and j, we can2regroup terms

N

N

N

2

such that VAR(Rp ) =

σm . And by

wi bi

wj bj σm2 =

wi bi

i=1

j=1

i=1

taking the square root of both sides, we see that portfolio risk expressed as

standard deviation in Eq. 6 depends upon the weighted average of the beta of

the individual assets, which is the standard result of, for example, Equation 2

in Blume (1971),

N

σ Rp =

wi bi σm .

(6)

i=1

The problem with spatial correlation in a real estate portfolio is that

COV(i , j) = 0 does not hold, thus, E(˜i ˜j) does not drop out as zero. The

question then becomes how far apart should properties be for COV(i , j) = 0

110

D.K. Hayunga, R.K. Pace

to hold? We put numbers to this question in the next section by applying spatial

statistics to multiple real estate datasets. Before examining the empirical results one point worth emphasizing is that the above analysis does not show that

eliminating the unsystematic spatial risk removes all portfolio risk. Obtaining

spatial independence between the random error terms is not the same as total

portfolio independence. The systematic portion in Eq. 5 is still present.

Commercial Property Results

We empirically examine commercial real estate data in this section to determine the necessary separation distances between commercial real estate

properties needed for COV(i , j) = 0 to hold. We use the spatial correlogram for many of our tests, the mathematical foundation of which is in the

appendix (found at spatial-statistics.com). In short, the correlogram computes

a correlation for an attribute (e.g., asset return) for every two properties as a

function of the distance between the properties. Small separation distances

should produce high correlations. As the separation distance increases, the

magnitude of the correlations should decrease.

We compute the experimental correlograms using two data sources. The

NCREIF dataset provides returns for apartment, industrial, office, and retail

properties. In addition to providing analysis for multiple property types, a

further benefit of the NCREIF data is the ability to test within an MA at the

zip code level. The other data source consists of apartment sale transactions,

which were provided by Real Capital Analytics (RCA). From both datasets,

we remove the observations from Alaska and Hawaii due to the spatial

discontinuity with the rest of the sample.

Spatial Correlation of NCREIF Returns

Since our focus in this section is the spatial aspects of real estate returns, we

initially control for time-series impacts by modeling the geometric mean of

four NCREIF quarterly returns from the second quarter of 2002 to the first

quarter of 2003. The resulting sample is 140 property returns. We compute

correlations for every observation pair and contrast them against the distances

of separation.5

In applying spatial statistics to real estate data, observations are not uniformly separated by a certain distance. Instead, real estate data are irregularly

spaced sample points. Therefore, it is standard practice to use intervals or

5 We

project the locations using the Transverse Mercator map projection (Snyder and Voxland

1989). This allows treating the points from a sphere (the Earth’s surface) as if they were on a plane

(a map).

Spatial Statistics Applied to Commercial Real Estate

111

bins such that observations at a certain separation distance plus observations

at separation distances close to the exact separation distance are grouped

together and the average correlation is used in the analysis (please see appendix for more detail about lags and lag tolerance). During the course of

our examination of spatial correlations, we find that the empirical results are

sensitive to the size of the bins. Our results detail the experimental correlograms that yield the most observations per interval using the smallest separation distances. The common suggestion in the literature is to have at least

30 pairs or 60 observations per interval (Journel and Huijbregts 1978, p. 194).

Using bins sizes with enough observations, Panel A of Table 1 details the

results using the NCREIF commercial real estate returns. The base returns

exhibit a spatial correlation of 0.38 at the separation distance of 2 miles. The

correlation decreases to 0.22 at 5.9 miles and 0.12 at 13.7 miles. The results

demonstrate that spatial correlation using base NCREIF returns is mitigated

by approximately 18 miles.

Spatial Correlation of NCREIF Return Residuals

Equation 5 above shows that spatial correlation is an idiosyncratic risk beyond

the systematic risk of the market portfolio. Thus, we next investigate the spatial

nature of the unsystematic portion of the property returns. We regress the

market return on the individual property returns and use the resulting residuals

to compute the correlogram. We use the NCREIF National Property Index

Table 1 Spatial correlations

as a function of separation

distance using NCREIF

commercial real estate returns

Avg. separation

distance (in miles)

Number of

observations

Panel A: base returns

2.0

58

5.9

108

9.8

154

13.7

116

17.6

152

Panel B: market model residual returns

2.0

58

5.9

108

9.8

154

13.7

116

17.6

152

Panel C: property type residual returns

2.0

58

5.9

108

9.8

154

13.7

116

Panel D: aggregate model residual returns

2.0

58

5.9

108

9.8

154

13.7

116

Experimental

correlogram

0.38

0.22

0.10

0.12

−0.04

0.36

0.19

0.13

0.10

−0.07

0.29

0.12

0.11

−0.07

0.25

0.12

0.12

−0.05

112

D.K. Hayunga, R.K. Pace

(NPI) as our proxy for the market portfolio.6 Both the overall model and the

individual beta estimate on the market portfolio are significant at the 5% level,

however, the adjusted R2 is 0.01.

After controlling for the market return, we model the residual return correlations across separation distance. Panel B of Table 1 details the results. There

is a slight reduction in the magnitude of the spatial correlations compared to

the base returns, however, the reduction is not dramatic.

Given that the market model is somewhat limited over the short sample

period, we investigate other determinants of real estate returns. The NCREIF

data include office, retail, multifamily, and industrial property types, therefore,

we consider a model that controls for the four types since this variety of diversification is well established in the literature. We also examine various economic

variables as well as proxies for size and quality. Insomuch as Wurtzebach

(1988), Mueller and Ziering (1992), and Mueller (1993) find that economicallybased diversification is preferable to purely geographic diversification, we

incorporate the economic variables detailed by Mueller (1993) and Cheng and

Black (1998) in the following model.7

Ri,t = β0 + β1 · ln(AV ESQFT) + β2 · ln(NU MU N IT S)

+ β3 · ln(MV L AST) + β4 · APT + β5 · I N D + β6 · OFF ICE

+ β7 · RET AI L +

12

β j · POP +

j=8

20

βk · EMPLOY

k=13

+ β21 · RAT I O + β22 · MIG + i,t

6 In

the spirit of Stambaugh (1982) we also examine using the global equity indices of Russell

Global Index and MCSI World Index as a proxy for the market model. Despite the fact that the

Russell Global Index is based upon approximately 10,000 global stocks or 98% of the investable

global universe, we find that equities are not a significant fit for US commercial real estate

properties.

7 The economic variables control for aspects of the real estate demand curve (Miles et al. 2007,

p. 26). Demand for retail space and apartments is a function of household composition and

population. Along with the overall population for a specific zip code, we break out population

by five age groups with breakpoints at 19, 34, 49, and 65, which is consistent with Cheng and

Black (1998). We execute the model with and without the breakpoints and find no difference

in the results. We also include the demand-side variables of median income and average house

price scaled by median household income. The demand for other commercial property—office

buildings, factories, and warehouses—is more closely tied to labor force and employment. To

control for these effects along with the economically-based diversification noted in Mueller (1993)

we use employment levels using the 2002 North American Industry Classification System codes

of 1) mining and agriculture, 2) utilities and construction, 3) manufacturing, 4) wholesale and

retail trade along with transportation and warehousing, 5) information, finance, insurance, real

estate, and profession, scientific and technical services, 6) education and health care, and 7) arts,

entertainment, and food services. Lastly, we account for changes in population and employment

using the migration of persons into the zip code.

Spatial Statistics Applied to Commercial Real Estate

113

where

Ri,t

AVESQFT

NUMUNITS

MVLAST

APT

IND

OFFICE

RETAIL

POP

EMPLOY

RATIO

MIG

the rate of return on the ith property for the tth quarter,

average square feet,

average number of units, which is used by some apartment

complexes instead of the avesqft. measure,

average market value from t − 1 quarter,

dichotomous variable equal to 1 if the property is an

apartment complex and 0 otherwise,

dichotomous variable equal to 1 if the property is an industrial

building and 0 otherwise,

dichotomous variable equal to 1 if the property is an office

building and 0 otherwise,

dichotomous variable equal to 1 if the property is a retail

building and 0 otherwise,

population as one continuous variable and divided into five

age groups,

employment by industry,

ratio of average house price to median household income, and

migration of persons into a zip code.

This specification explains more of the variation in property returns compared to the market model—the adjusted R2 is 0.15. Almost all of explanatory

power is due to the property-type variables. Each is significant with p-values

less than 0.01. The only significant economic variable is migration with a

p-value of 0.06.

As before, upon controlling for property type, employment, population,

et cetera, we use the residuals to compute the correlogram. Panel C of

Table 1 details the results. Compared to the base returns in Panel A, the

findings in Panel C demonstrate a material reduction in residual correlation

at most separation distances. Initial correlation decreases from 0.38 to 0.29.

At 5.9 miles, residual correlation is 0.12 versus 0.22 using base returns. Also,

the findings suggest that the point of randomness is found by 13.7 miles in

separation distance as compared to 17.6 miles using base returns.

Note that the residuals from a regression using returns as the dependent

variable can behave differently from a spatial perspective than just using the

raw returns. As one extreme, if the correlations between property returns all

stem from property type and economic variables, the resulting residuals will

not show any correlation over space. As another extreme, suppose that two

contiguous properties have almost perfect spatial dependence when controlling for other factors, but each property has many other characteristics that

cause the returns to diverge. In this case, the raw returns will show a smaller

correlation than the residuals—which will display very high levels of spatial

dependence. Consequently, controlling for various property characteristics can

result in residuals that display either lower or higher spatial dependence than

the raw returns.

114

D.K. Hayunga, R.K. Pace

Given the success of property type to examine return correlation our last

specification examines the market model along with property type and the

economic variables. Modeling property returns using this aggregate model we

find that property-type variables are the main determinants of returns.

The results in Panel D of Table 1 detail the spatial correlations after

controlling for the various factors in the aggregate model. The findings in

Panel D are similar to Panel C with a slight reduction in the initial residual

correlation—from 0.29 to 0.25. As before, spatial correlation is mitigated if

properties are separated by approximately 13 miles.

Apartment Cap Rates

The correlogram results thus far provide the benefits of examining diversification across property types and within a zip code submarket. However, a

concern of the NCREIF data is that the values are based on appraisals. The

use of appraisals is a potential issue because empirical evidence suggests that

appraisals smooth changes in property values, which causes downward-biased

estimates of total return volatility (Geltner 1991).

To protect against the specific panel of data driving the results, we compute

correlograms based on cap rates of apartment complexes from January 2001 to

December 2003. The cap rates offer another real estate measure using marketdriven transaction prices. Further, the cap rates provide over one million

individual pairs to compute the experimental correlogram, which allows us to

detail smaller separation distances.

Table 2 presents the results of spatially modeling the base cap rates. Similar

to the NCREIF results, the initial spatial correlation is 0.39. With more data,

the results demonstrate a slower spatial correlation decay—correlation values

of 0.18 extend out to approximately 21 miles. The results demonstrate that the

base cap rates obtain zero spatial correlation at approximately 32 miles.

Similar to our treatment of the NCREIF returns, we next examine the

spatial characteristics of cap rate residuals. We examine residual returns after

controlling for the building features of size, the number of units, and age.

We do not examine the market model or economic variables with this dataset

because the cap rates are a point-in-time measure resulting in insufficient data

to estimate a market model for these returns.

Table 3 present the results after controlling for structural features. Overall,

the residual results are quite similar to the base cap rates with slight reductions

in correlation at the same separation distances. The initial correlation is 0.36

and the separation distance when spatial correlation is effectively mitigated is

approximately 32 miles.

To summarize the empirical results thus far, we find that for both NCREIF

returns and RCA cap rates the initial correlation is approximately 0.38. Additionally, the greatest reduction in spatial correlation occurs at approximately

5 miles. This distance is likely referencing the neighborhood submarket and

suggests a portfolio should realize diversification benefits by holding properties

Spatial Statistics Applied to Commercial Real Estate

115

Table 2 Spatial correlations

as a function of separation

distance using RCA cap rates

Avg. separation

distance (in miles)

Number of

observations

Experimental

correlogram

0.5

1.4

2.3

3.3

4.2

5.1

6.0

7.0

7.9

8.8

9.8

10.7

11.6

13.5

14.4

15.3

16.3

17.2

20.9

24.6

28.4

31.2

32.1

740

1,254

1,498

1,890

2,216

2,310

2,428

2,416

2,582

2,614

2,602

2,470

2,446

2,436

2,330

2,296

2,422

2,310

1,876

1,672

1,488

1,312

1,290

0.39

0.35

0.28

0.34

0.31

0.21

0.21

0.20

0.23

0.19

0.26

0.18

0.23

0.26

0.17

0.19

0.20

0.22

0.18

0.13

0.14

0.11

0.04

Table 3 Spatial correlations

as a function of separation

distance using RCA cap

rate residuals

Avg. separation

distance (in miles)

Number of

observations

Experimental

correlogram

0.5

1.4

2.3

3.3

4.2

5.1

6.0

7.0

7.9

8.8

9.8

10.7

11.6

13.5

14.4

15.3

16.3

17.2

20.9

24.6

28.4

31.2

32.1

740

1,254

1,498

1,890

2,216

2,310

2,428

2,416

2,582

2,614

2,602

2,470

2,446

2,436

2,330

2,296

2,422

2,310

1,876

1,672

1,488

1,312

1,290

0.36

0.33

0.27

0.33

0.30

0.19

0.18

0.19

0.22

0.19

0.24

0.16

0.21

0.25

0.15

0.16

0.18

0.21

0.18

0.21

0.13

0.09

0.04

116

D.K. Hayunga, R.K. Pace

beyond the neighborhood. This thought meets prior expectations and is intuitively appealing as neighborhoods have previously been characterized as

lacking diversification. For example, Goodman (1977) defines neighborhoods

as “small urban areas with. . . a common set of socioeconomic effects.” Beyond

the neighborhood, the results suggest that a portfolio manager will receive a

reduction in spatial correlation, however, spatial correlations can exist out to

20 miles in separation distance, and farther.

CMSAs

The return and cap rate results use strict Euclidean distance. Our next test

examines the return correlations of primary metropolitan statistical areas

(PMSAs) that comprise a larger consolidated metropolitan statistical area

(CMSA). For example, the Fort Worth-Arlington and Dallas PMSAs form the

Dallas-Fort Worth CMSA.

We examine the return correlations between PMSAs to ensure spatial

discontinuity is not affecting the results. For example, the western portion of

the U.S. has large expanses of rural land, and since commercial properties

cluster in metropolitan areas, we want to ensure large distances between

sample observations are not driving the results.

We use NCREIF data to compute PMSA return correlations. Unlike the

previous two datasets, NCREIF MAs offer a data panel due to the availability

of a significantly longer time series for major metropolitan areas. The shortest

continuous time series is 27 quarters, the longest is 98 quarters, and the

average is slightly greater than 16 years. To isolate the spatial component,

we model PMSA residuals after controlling for time-series effects using the

vector autoregressive (VAR) model similar to Englund et al. (2002). The combination of contiguous PMSAs and sufficient time series yields 28 PMSA-pair

observations.

The residuals from the VAR model should produce time-series white noise.

However, we find that 50% of the PMSA pairs continue to exhibit residual

positive correlations with p-values less than 0.10. Both the mean and median

correlation of these statistically-significant observations is 0.42. The range of

separation distances is from approximately 9 miles to almost 84 miles. The

results exhibit a cluster of observations with an average residual correlation of

0.40 ranging from 23.8 to 38.9 miles in separation distance.

We also find that three PMSA pairs exhibit correlations of 0.44, 0.47, and

0.65 at separation distance greater than 40 miles. These correlations are not

inconsistent with prior findings. In fact, these results introduce a point that

we will reinforce later. Keeping in mind that these residual correlations are

PMSA pairs that are part of a contiguous CMSA, the high correlations at

greater distances alert real estate portfolio managers to the need to expand

beyond MAs. Separation distances as great as 83 miles, in this case Chicago

and Milwaukee, can experience significant return correlation when the PMSAs

are part of a larger socioeconomic region.

Spatial Statistics Applied to Commercial Real Estate

117

Residential Property

In addition to multiple commercial property databases and attributes, we

examine the impact of residential property on the spatial aspects of commercial

property. While most commercial real estate investment portfolios will not

incorporate residential property, local housing markets can serve as a proxy for

phenomena that also affect the behavior of commercial property. Additionally,

residential returns can provide a better proxy for the market model than

the NPI index in the previous section since residential returns are specific

to the local market and are subject to similar real estate supply and demand

functions. The standard spatial equilibrium model in urban economics predicts

similar longer-run movements in different real estate sectors because each is

driven by common fundamentals (Rosen 1979; Roback 1982). We examine

residential returns in this section and then combine commercial and residential

data types in the next section.

We compute residential returns from the Neighborhood Change Database,

a dataset that geographically standardizes the U.S. decennial census based

upon year 2000 census tracts. We compute 9000 base residential returns initially aggregated at the zip code level. The resulting correlogram specifications

use over forty million pairs. Table 4, Panel A details the time period from 1970

to 1990.

The residential results demonstrate a similar magnitude of initial spatial

correlation as commercial properties—an average of 0.35. The difference is

that the separation distance is 30.61 miles. As separation distance increases

spatial correlation decays monotonically to zero at a separation distance of

approximately 1,100 miles; a considerably longer distance than the commercial

property results.

Table 4 Spatial correlations

as a function of separation

distance using residential

returns from 1970 to 1990

Avg. separation

distance (in miles)

Panel A: base returns

30.61

153.05

306.10

459.15

612.20

765.25

918.30

1,010.13

Panel B: residual returns

15.31

30.61

76.53

153.05

229.58

306.10

382.63

428.54

Number of

observations

Experimental

correlogram

345,901

513,825

709,321

832,363

816,794

670,650

652,836

722,171

0.35

0.35

0.19

0.14

0.12

0.09

0.06

0.01

4,783,788

6,198,538

4,178,956

4,888,290

5,898,176

6,483,273

7,302,486

7,112,267

0.19

0.17

0.22

0.22

0.20

0.07

0.09

0.03

118

D.K. Hayunga, R.K. Pace

Similar to commercial returns, it is reasonable to expect that there exist

observable determinants that explain a portion of the correlation. Thus, we

regress the base residential returns by some typical determinants of housing

prices. As expected, all independent variables are statistically significant at the

5% level. The specification is

Ri,t = β0 + β1 · ln(EDUC12) + β2 · ln(EDUC16) + β3 · ln(H OMEPOP)

+ β4 · ln(I NCOME) + β5 · ln(SI Z E) + β6 · ln(BLT OC70)

+ β7 · ln(BLT OC59) + β8 · ln(BLT OC49) + β9 · ln(BLT OC39) + i,t ,

where

Ri

EDUC12

EDUC16

HOMEPOP

INCOME

SIZE

BLTOC

the rate of return on the ith house,

persons 25 years old or older who completed high school,

persons 25 years old or older who completed college,

number of persons 25 years old or older,

average family income,

aggregate number of rooms in the home, and

total occupied housing units built up to the year specified in

the variable.

Using the residuals, we compute the return correlations for each observation within census tracts. The residuals are not aggregated across zip codes

but left within census tracts since each observation is the remaining portion

not explained by the model, and, thus, is unique information. This method

produces millions of observations within each bin.

Table 4, Panel B details the residential residual returns findings. At the

shortest separation distance of 15.31 miles, the initial spatial correlation is 0.19.

This magnitude of spatial correlation persists out to approximately 230 miles.

While the degree of spatial correlation is not surprising, it is important to

note that, using on millions of observations, residential properties extending

150–225 miles in separation distance demonstrate an empirical correlation of

roughly 0.20.

Combining Commercial and Residential Types

Given the voluminous amount of data available for residential real estate, we

examine the effect of including the residential property type in the commercial analysis. Inclusion in the correlogram is based upon the rationale that

commercial and residential markets are affected by similar socioeconomic

conditions at common locations. Another argument comes from the kriging

spatial literature (see Goovaerts 1997, pp. 185–258). The reasoning follows that

if the secondary residential returns are correlated with the primary commercial

returns, then one can utilize observations at sites where they are both recorded

to estimate this correlation. Hence, we match residential returns by location

and include them as an explanatory variable in the NCREIF commercial

Spatial Statistics Applied to Commercial Real Estate

119

Table 5 Spatial correlations as a function of separation distance using NCREIF commercial real

estate residual returns after controlling for residential property returns

Avg. separation

distance (in miles)

Number of

observations

Experimental

correlogram

2.0

5.9

9.8

58

108

154

0.31

0.11

0.01

return specification along with the other property characteristics. We lag

the residential returns one quarter to avoid potential simultaneity between

commercial and residential prices in the same quarter. The other change from

the previous NCREIF specification is that the market return as well as the

property-type and economic variables are removed since residential real estate

is a proxy for fundamental characteristics at common locations.

The lead residential returns appear to be a quality proxy for the socioeconomic determinants of commercial returns. The findings in Table 5 suggest

that spatial correlation is mitigated at about 10 miles in separation distance; a

distance shorter than the residual results using the Aggregate Model in Panel

D of Table 1.

Applying Empirical Results to Portfolio Theory

Given the empirical findings in the previous section, we next consider portfolio

implications under three scenarios. At one end of the spectrum is the scenario

whereby a commercial real estate portfolio holds properties greater than

40 miles. Using U.S. Census Bureau centroids, we note that there are no MAs

within the largest 50, as measured by population, that are within 45 miles of

any of the other largest 50 MAs.8 Further, 4,945 out of the 4,950 pairs of the

most populated 100 MAs are at least 45 miles apart, and 11,162 out of the

11,175 pairs of the largest 150 MAs are separated by at least 45 miles. Overall,

99.88% of the possible pairs from the 270 conterminous U.S. MAs are over

40 miles in separation distance.

Hence, a strategy to effectively mitigate spatial risk in a real estate portfolio

is to hold one property per MA, regardless of the type of property. By

holding one property per MA, the portfolio will not experience intra-MA

spatial correlation and, given the sufficient spacing of each MA, inter-MA

correlation is not an issue. This strategy is intuitively appealing since real estate

markets are localized and allocating properties across MAs should create a

more diversified portfolio.

8 The MAs referenced here are distinct metropolitan areas and not PMSAs; otherwise, a real estate

portfolio manager may experience spatial correlations based upon the CMSA results above.

120

D.K. Hayunga, R.K. Pace

To examine this strategy further and based upon a reviewer’s comments,

we execute another test using the NCREIF data from Table 1. Instead of

modeling residuals after controlling the market return, property-type, or

demand variables, we spatially model residuals after controlling for the unconditional average for an entire metro area. For continuity, we maintain the

same separation distances as in Table 1. The results (not tabled) demonstrate

that properties within the first two bins and separated by 2 and 5.9 miles,

respectively, yield spatial correlations of approximately 0.14. After 5.9 miles,

the spatial correlation is mitigated. These results reinforce two main points of

this paper: (i) adjacent or juxtaposed properties will experience neighborhood

and MA socioeconomic factors that are difficult to diversify, and (ii) unique

MAs appear to be sufficient for portfolio diversification as the unconditional

MA average is effective in removing correlation for distances beyond a neighborhood submarket.

Note, however, that a strategy of one property per MA is not macroconsistent. The design implies an equal weighting across MAs and not all

large-scale real estate portfolios can hold one property per MA due to a lack

of acceptable properties in mid- to small-sized MAs. For example, the largest

16 MAs in the third quarter of 2002 comprised 68.9% of the total properties

reported to NCREIF. The largest 35 MAs held 85.0% of the NCREIF property

counts.

Intra-MA portfolio

Given macro-inconsistency, we consider owning properties within the same

MA, but in diverse neighborhoods. We note that some of the greatest rate of

decay in spatial correlation occurs beyond juxtaposed properties. We create

portfolios using a square grid of properties where the adjacent properties are

5 and 10 miles apart. We compute other non-square configurations and find

that the results are not sensitive to the configuration but are a function of

the number of properties that have sufficient separation distance to mitigate

spatial correlation. We use the results of the RCA cap rate residuals in

Table 3 since the number of observations is sufficient to generate correlation

values at separation distances consistent with CMSA findings (greater than

20 miles) and the residuals account for some observable determinants of prices.

Keeping with the theory above, we use correlation values to compute the

portfolio standard deviations, thus, without lose of generality, we standardize

the standard deviations to unity and focus on the relative improvement of

increasing the separation distance.

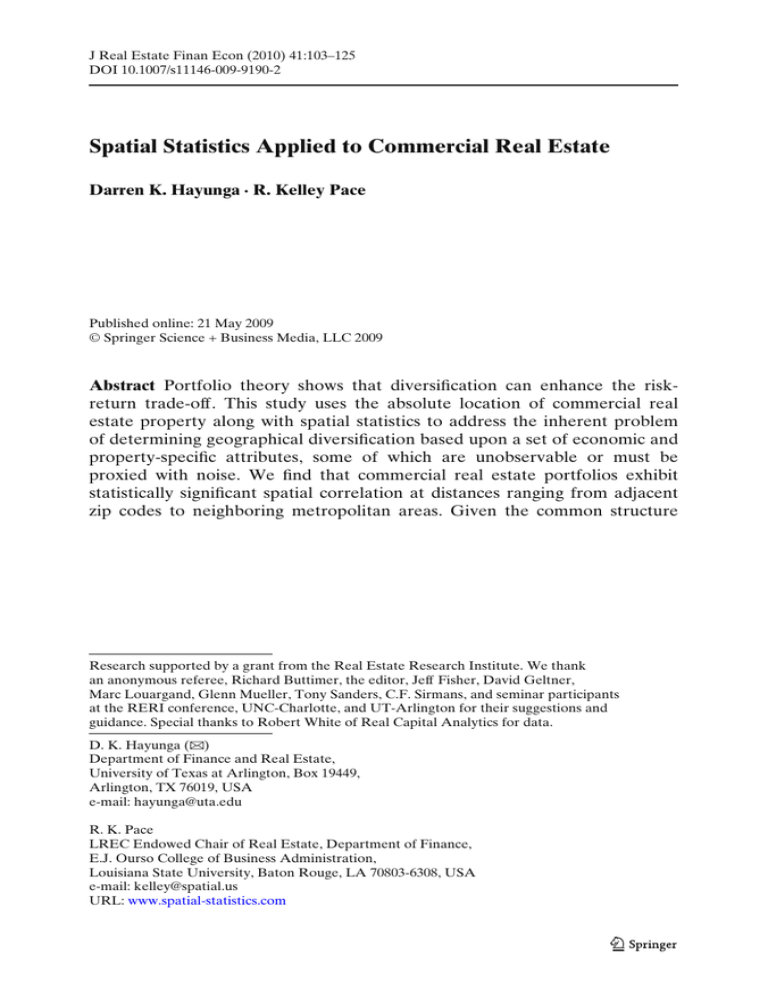

Figure 1 presents the increase in portfolio standard deviations due to spatial

correlation using an intra-MA strategy. The standard deviation values in Fig. 1

indicate the unsystematic portion of portfolio risk due to the spatial correlation

between the properties.

The top line in Fig. 1 is the relative portfolio risk with each portfolio

property separated by 5 miles. The bottom line is the relative portfolio risk

using separation distances of at least 10 miles. Of course, 10 miles in separation

Spatial Statistics Applied to Commercial Real Estate

121

0.8

0.7

0.6

0.5

σp 0.4

0.3

0.2

0.1

0

4 9 16

25

36

49

64

81

100

121

144

N

Fig. 1 Portfolio standard deviation as a function of the number of real estate properties if

a portfolio holds intra-MA properties only. Values demonstrate the increase in unsystematic

portfolio risk due to the average spatial correlation between portfolio properties. The top line

marked with stars represents a portfolio with at least 5 miles of separation distances between

properties. Using diamond markers, the bottom line is the additional unsystematic risk with

properties separated by at least 10 miles. The values not connected by a line use properties with

10 miles of separation distance, which require MSAs larger than exist in the US

distance decreases unsystematic risk, although the reduction is not as great

for smaller portfolios (i.e., 4 or 9 properties) as it is for portfolios of 25 or

36 properties. We extend the values of the 10-mile portfolio (unconnected

diamonds) for reference purposes. These portfolio are unfeasible as there are

no MAs large enough to hold the number of properties each 10 miles apart.

Both graphed scenarios in Fig. 1 demonstrate that there is practical limit

for reducing intra-MA unsystematic risk—no matter the size of the portfolio,

lingering spatial risk will be present since properties are not sufficiently separated.9 Although not graphed, we find that portfolios with properties separated

by 15 or 20 miles still experience unsystematic spatial risk. Thus, no amount of

intra-MA diversification will entirely mitigate spatial portfolio risk.

Value-weighted portfolio

As a final scenario, we envision holding a few properties within an MA over

a small number of MAs. This strategy yields a value-weighted portfolio that

9 Additionally,

the values do not account for levered cash flows, which will increase portfolio risk.

122

D.K. Hayunga, R.K. Pace

can be based upon a metric like MA population. A portfolio manager may

be able to reduce unsystematic risk by spreading property holdings across a

few MAs without incurring exorbitant search and portfolio management costs.

Hence, we build real estate portfolios holding 25 properties using portfolio

weighting based upon Census populations as of the year 2000. We assume

the portfolio manager mitigates intra-MA spatial risk to the greatest extent

possible by holding properties at the longest separation distances within an

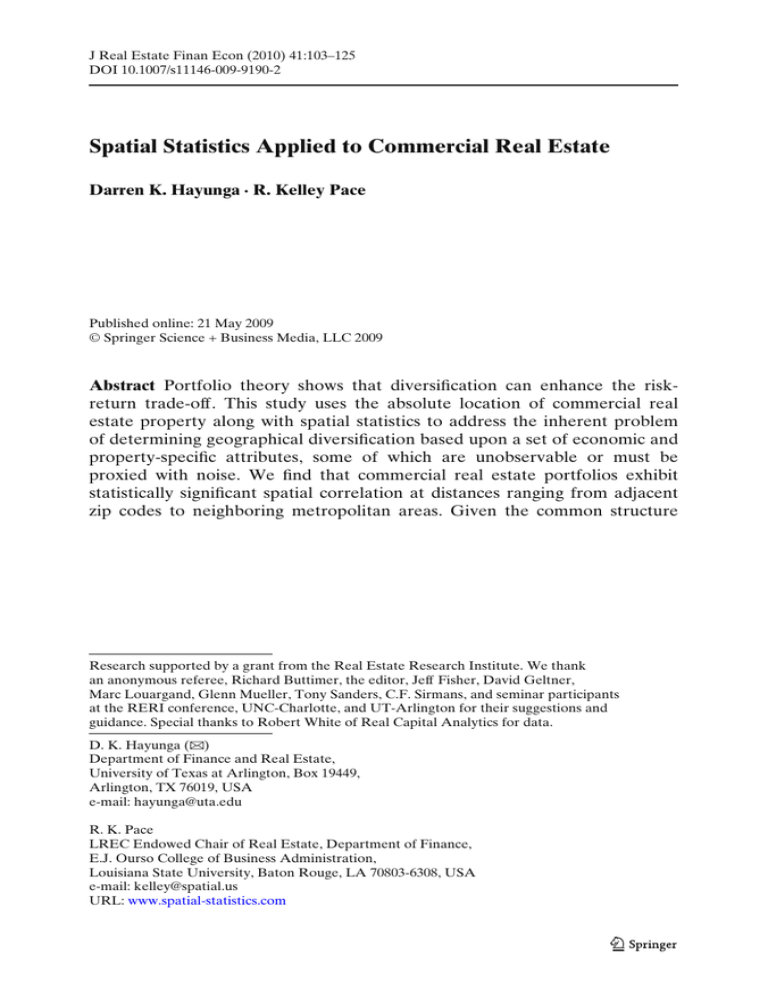

MA. Figure 2 details the findings.

In general, this value-weighted portfolio reduces unsystematic risk when

compared to the intra-MA strategy but still does not entirely mitigate spatial

portfolio risk. A manager will gain the greatest reduction in portfolio risk by

holding properties in the largest six MAs, which is consistent with Cheng and

Roulac (2007) who also examine geographic diversification across multiple

MSAs. The results of their “Mixed MSA” scheme indicate the greatest reduction in portfolio risk at approximately the seventh MSA. Despite the reduction

in unsystematic risk of these portfolios, the six-MA portfolio in Fig. 2 is still

inefficient—13% of the unsystematic spatial risk remains. Another overall

issue with the value-weighted portfolio is that it converges to an equallyweighted portfolio. As properties are added, beginning with the nine-MA

portfolio, the next new city adds one property that is taken from the previously

smallest city holding two properties.

0.35

0.30

0.25

0.20

0.15

0.10

0.05

0.00

N

5

10

15

20

Fig. 2 Portfolio standard deviation as a function of the number of metropolitan areas in a value

weighted portfolio. Portfolio weights based upon metropolitan population as of the year 2000.

Values demonstrate the unsystematic portion of portfolio risk due to spatial correlation between

the properties

Spatial Statistics Applied to Commercial Real Estate

123

In summary, the three scenarios (one property per MSA, all properties in

one MSA, and value weighted) demonstrate that spatial correlation in real

estate portfolios is different than traditional finance models using nonspatial financial assets. Whereas unsystematic risk is reduced in the standard

finance textbook as more less-than-perfectly-correlated stocks are added to

an equity portfolio, real estate portfolios are inefficient if they hold multiple

properties within a localized market such as a neighborhood or MA. Since

no amount of intra-MA diversification will produce an efficient portfolio, a

portfolio manager directly investing in real estate assets must look to interMA diversification.

Conclusion

Real estate is a field built on the notion of location, yet the literature has not

employed formal spatial techniques to examine the effects of geography on

commercial property portfolios. Consistent with the importance of location

on commercial property prices, we use spatial statistics to quantify the spatial

correlation between commercial real estate properties. Understanding the

spatial component within a commercial portfolio is essential since fundamental

portfolio theory shows that spatial correlation is an unsystematic risk that

should not be compensated by the market.

Using return and cap rate data, this paper examines the magnitude of initial

spatial correlation, spatial correlation as a function of separation distance,

and the distances of separation between commercial properties needed to

essentially eliminate spatial dependence. With respect to the initial correlation

of nearby properties, we find that base commercial real estate returns and cap

rates exhibit correlation values ranging from 0.31 to 0.39 over a separation

distance from 1/2 to 2 miles. As separation distances increase, spatial correlations decrease but maintain magnitudes over 0.10 out to approximately

30 miles, depending upon the dataset. The average correlation drops to zero at

separation distances generally beyond 45 miles.

These findings, combined with intra-MA simulations, suggest that interneighborhood diversification is helpful in moving towards efficient portfolios.

However, no amount of intra-MA diversification will entirely dispose of spatial

portfolio risk. To effectively diversify, real estate portfolios require inter-MA

diversification with the most beneficial diversification strategy being one property per MA regardless of the type of property. But inter-MA diversification

has its limits as, by one NCREIF measure, 69% of the portfolio-quality real

estate is concentrated in the largest 16 MAs. There are not enough qualifying

properties for all real estate portfolios to hold an equally-weighted portfolio.

The results suggest that combining intra-MA and inter-MA properties is one

of the best strategies for reducing the unsystematic spatial risk while trading off

the portfolio management costs of holding geographically-diverse properties.

The fact that this combination portfolio still does not eliminate spatial portfolio

risk provides motivation for using international direct-real estate holdings and

124

D.K. Hayunga, R.K. Pace

indirect real estate investments in portfolios. A further consideration of the

results of this study is to apply the correlations found here in a constrained

optimization framework that determines the trade-off between diversification

and increased portfolio management costs.

References

Basu, S., & Thibodeau, T. (1998). Analysis of spatial autocorrelation in house prices. Journal

of Real Estate Finance and Economics, 17, 61–85.

Blume, M. (1971). On the assessment of risk. Journal of Finance, 26(1), 1–10.

Cheng, P., & Black, R. (1998). Geographic diversification and economic fundamentals in apartment markets: A demand perspective. Journal of Real Estate Portfolio Management, 4(2),

93–105.

Cheng, P., & Roulac, S. (2007). Measuring the effectiveness of geographical diversification. Journal

of Real Estate Portfolio Management, 13(1), 29–44.

Copeland, T., Weston, J., & Shastri, K. (2005). Financial theory and corporate policy. Reading:

Pearson Addison Wesley.

Cressie, N. (1993). Statistics for spatial data. New York: Wiley.

Dubin, R. (1998). Predicting house prices using multiple listings data. Journal of Real Estate

Finance and Economics, 17, 35–59.

Dubin, R., Pace, R. K., & Thibodeau, T. (1999). Spatial autoregression techniques for real estate

data. Journal of Real Estate Literature, 7, 79–95.

Englund, P., Hwang, M., & Quigley, J. (2002). Hedging housing risk. The Journal of Real Estate

Finance and Economics, 24(1–2), 167–200.

Fama, E. (1976). Foundations of finance. New York: Basic Books.

Fik, T., Ling, D., & Mulligan, G. (2003) Modeling spatial variation in housing prices: A variable

interaction approach. Real Estate Economics, 31(4), 623–646.

Geltner, D. (1991). Smoothing in appraisal-based returns. Journal of Real Estate Finance and

Economics, 4, 327–345.

Goetzmann, W., & Wachter, S. (1995). Clustering methods for real estate portfolios. Real Estate

Economics, 23(3), 271–310.

Goodman, A. (1977). Comparison of block group and census tract data in a hedonic housing price

model. Land Economics, 53, 483–487.

Goovaerts, P. (1997). Geostatistics for natural resources evaluation. Oxford: Oxford University

Press.

Hartzell, D., Hekman, J., & Miles, M. (1986). Diversification categories in investment real estate.

AREUEA Journal, 14(2), 230–254.

Hartzell, D., Shulman, D., & Wurtzebach, C. (1987). Refining the analysis of regional diversification for income-producing real estate. Journal of Real Estate Research, 2(2), 85–95.

Journel, A., & Huijbregts, C. (1978). Mining geostatistics. New York: Academic.

LeSage, J., & Pace, R. K. (2009). Introduction to spatial econometrics. Boca Raton: CRC.

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock

portfolios and capital budgets. Review of Economics and Statistics, 47, 13–37.

Markowitz, H. (1952). Portfolio selection. Journal of Finance, 7(1), 77–91.

Miles, M., Berens, G., Eppli, M., & Weiss, M. (2007). Real estate development. Washington, DC:

Urban Land Institute.

Miles, M., & McCue, T. (1982). Historic returns and institutional real estate portfolios. AREUEA

Journal, 10(2), 184–198.

Mueller, G. (1993). Refining economic diversification strategies for real estate portfolios. Journal

of Real Estate Research, 8(1), 55–68.

Mueller, G., & Ziering, B. (1992). Real estate portfolio diversification using economic diversification. Journal of Real Estate Research, 7(4), 375–386.

Nelson, T., & Nelson, S. (2003). Regional models for portfolio diversification. Journal of Real

Estate Portfolio Management, 9(1), 71–88.

Spatial Statistics Applied to Commercial Real Estate

125

Radner, R., & Stiglitz, J. (1984). A nonconcavity in the value of information. In M. Boyer, &

R. Khilstrom (Eds.), Bayesian models in economic theory. New York: Elsevier.

Roback, J. (1982). Wages, rents, and the quality of life. Journal of Political Economy, 90(4), 1257–

1278.

Rosen, S. (1979). Wage-based indexes of urban quality of life. In P. Mieszkowski, & M. Straszheim

(Eds.), Current issues in urban economics. Baltimore: Johns Hopkins University Press.

Roulac, S. (1976). Can real estate returns outperform common stocks? Journal of Portfolio

Management, 2(2), 26–43.

Sharpe, W. (1963). A simplified model for portfolio analysis. Management Science, 9(2), 277–293.

Sharpe, W. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk.

Journal of Finance, 19(3), 425–442.

Snyder, J., & Voxland, P. (1989). An album of map projections. Washington, DC: US Government

Printing Office.

Stambaugh, R. (1982). On the exclusion of assets from tests of the two-parameter model: A

sensitivity analysis. Journal of Financial Economics, 10(3), 237–268.

Van Nieuwerburgh, S., & Veldkamp, L. (2007). Information acquisition and under-diversification.

NYU working paper. New York: NYU.

Williams, J. (1996). Real estate portfolio diversification and performance of the twenty largest

MSAs. Journal of Real Estate Portfolio Management, 2(1), 19–30.

Wolverton, M., Cheng, P., & Hardin, W. (1998). Real estate risk reduction through intracity

diversification. Journal of Real Estate Portfolio Management, 4(1), 35–41.

Wurtzebach, C. (1988). The portfolio construction process. Parsippany: Prudential Real Estate

Investors.

Copyright of Journal of Real Estate Finance & Economics is the property of Springer Science & Business

Media B.V. and its content may not be copied or emailed to multiple sites or posted to a listserv without the

copyright holder's express written permission. However, users may print, download, or email articles for

individual use.