2015 Government Contractors Survey Results: Selling Into the B2G Market Written by:

advertisement

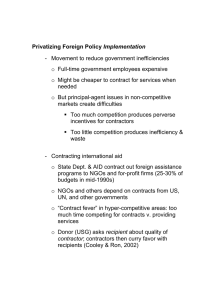

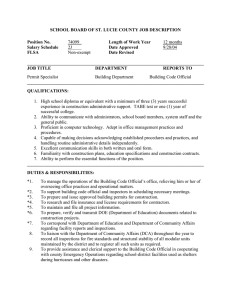

2015 Written by: Government Contractors Survey Results: Selling Into the B2G Market Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 TABLE OF CONTENTS Introduction 3 Profile of government contractors surveyed 4 Recent and upcoming sales to government agencies 5 Contractors point to market changes in 2015 6 2015 expectations vary based on 2014 results 7 Top themes for growth 8 Specific drivers of growth 9 Drivers of negative expectations 10 Onvia recommendation: Diversify into additional levels of state and local government 11 Onvia recommendation: Participate in cooperative purchasing 12 Onvia recommendation: Invest in the sales/marketing process 13 Top trends or issues of concern by industry 14 Conclusion 15 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 INTRODUCTION Introduction: Identifying trends and expectations to better understand the government market in 2015 While studying national patterns in contracts and bidding data can offer valuable insights, surveys of the government contractors themselves can offer a unique perspective into the expectations and concerns facing these firms. For this report, the market analysis team at Onvia reached out to the larger universe of SLED (State, Local and Education) government contractors with a focused survey. These firms were asked to identify recent and upcoming trends affecting their government sales activity while also considering some of the most important factors impacting their public sector sales in the coming year. Primary Goal The information and insights in this report will help vendors and contractors to understand the contracting environment for 2015 and make better, more objective decisions. To achieve this, a total of 188 online interviews were conducted with representatives from government contracting firms nationwide across the full range of industries and levels of government served. A number of findings emerged from the research, which we examine in this report. ©2015 Onvia, Inc. All rights reserved. Top Findings 2014 was a year of mixed results for contractors, with less than half reporting sales growth One of the top reasons cited for growth is an expansion of public sector sales and marketing efforts Aided by an improving economy, 2015 is expected to be a year of broader opportunity for government contractors Cooperative purchasing was more important to larger sales contractors, but very few firms cited it as a negative factor The more levels of state and local government a firm sells into the higher the likelihood they will grow Many firms consider competition to be the greatest negative factor 3 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 PROFILE OF GOVERNMENT CONTRACTORS SURVEYED Profile of government contractors surveyed Current Government Sales Location of Company 28% 19% 23% 27% $1M-$4.9 23% Central States under $1M 26% Job Title/Role 27% $5M-$19M 24% $20M or more Western States Business Development Northeast States 22% 27% 21% 14% Marketing 30% Executive Southern States Industry Sales 12% Technology (IT,telecom) 35% Professional services, healthcare, public safety 44% Infrastructure (construction & maintenance related) Other In terms of government sales revenue, the survey included a wide range of firms, with 47% under $5M and 26% over $20M Looking at the business locations of companies, the sample was representative of national patterns Those responding held a range of job titles spanning sales, business development, executive and marketing roles Levels of Government Served 74% Federal 82% State 78% County 76% City and Town 52% School District The sample was fairly evenly distributed across industries, including infrastructure (i.e. construction and maintenance related), professional services/ healthcare/public safety and IT/ telecom 27% Special District The typical contractor surveyed sold into state, local and federal agency levels ©2015 Onvia, Inc. All rights reserved. 4 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 RECENT AND UPCOMING SALES TO GOVERNMENT AGENCIES Recent and upcoming sales to government agencies 2014 reported change in sales* 19% 47% Discussion and takeaway After a slower year in 2014, government contractors are looking ahead to improved growth opportunities. During 2014, less than half of firms reported growth and 19% declined in their volume of government business. While some of the optimism surrounding 2015 could be attributed to wishful thinking, evidence of an improving economy and healthier public sector can be found across many 3rd party sources, making a more favorable scenario in the realm of possibility. It should be noted that these answers do not consider how fast firms will grow, only that some level of growth is expected by the majority. 69% of contractors expect growth in 2015 34% Lower 2014 was a mixed year About the same Higher 2015 expected change in sales* Contractors and vendors were more optimistic as a group as far as whether their sales to public agencies would grow in the coming year (69% expect to grow) compared to only 47% that reported growth during 2014. “ It seems that the economy is getting better. The government has been 69% holding off but will turn up the spending for 2015. ” 9% - Manufacturing firm with $1M-$5M government sales 22% Lower About the same Higher *Note: The survey, which was administered in early 2015, asked respondents to answer questions about their government sales for the previous 12 months and the upcoming 12 month period rather than the actual calendar years of 2014 and 2015 ©2015 Onvia, Inc. All rights reserved. 5 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 CONTRACTORS POINT TO MARKET CHANGES IN 2015 Contractors point to market changes in 2015 % of firms with an increase in sales for the year by range of government revenue 79% 69% 61% 69% 68% 66% 49% 47% 41% The impact of smaller sales contractors changing direction towards “growth” With a majority of contractors expecting to grow in 2015, size of current government sales volumes doesn’t appear to play a key role in the direction of the sales trend. Much of the shift in optimism from 2014 to 2015 appears to be weighted toward the smaller sales contractors, who generally were not growing in 2014. For example, in the group of contractors with under $1M in public sector sales, only 24% grew their government business in 2014 but 61% expect to grow this year. 2014 was strong…for firms with larger government sales Among the group of companies with the largest public sector revenue (>$20M), more than twothirds were able to grow their government sales last year. In contrast, only 20-40% of the smaller sales firms reported an increase. 24% Under $1M 2015 outlook: opportunities to grow regardless of size/scale of government sales $1M -$4M $15 - $19M 2014 Reported $20M or more 2015 Expected All Firms Discussion and takeaway In slower markets, larger contractors can still attain growth based on their name recognition and greater scale. In an expanding market, all can benefit from growing agency spending. With 69% expecting an increase, even without the potentially over-optimistic companies, the survey results suggest a high likelihood of growth for the majority of firms. “ 2015 results will be based on relationships, loyalty and hard work. ” - Technology firm with over $50M government sales ©2015 Onvia, Inc. All rights reserved. 6 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 2015 EXPECTATIONS VARY BASED ON 2014 RESULTS 2015 expectations vary based on 2014 results Growing before, still growing now Half of the “flat” companies expect to trend higher Less than half of the “decliners” expect improvement It would seem that recent growth is a good predictor of continued growth in this often challenging government market. Nearly all contractors (90%) who reported having grown in 2014 in government sales looked forward to a better year in 2015. Only four percent expected a decrease in sales. Just over half (51%) of the firms with flat sales in 2014 expect an increase in 2015, with only four percent expecting an decrease. 45% expect to continue their sideways trend with no change in sales volume for 2015. A total of 47% of the companies reporting a decrease for 2014 expected sales growth in 2015. One-third (33%) expected to continue in the negative direction with another decline for 2015. Firms that grew in 2014: Expected change in 2015 Firms flat in 2014: Expected change in 2015 Firms declining in 2014: Expecting change in 2015 6% 51% 33% 20% 90% 4% 4% 47% 45% Lower ©2015 Onvia, Inc. All rights reserved. Higher About the same Lower Higher About the same Lower Higher About the same 7 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 TOP THEMES FOR GROWTH Top themes for growth Examples of reasons for growth expectation Improving economy and tax revenues • “It seems the economy is getting better” • “I am simply optimistic as to the direction of the economy” • “Local government tax revenues are improving” More spending in our area of expertise • “The market in public safety is greatly expanding” • “More expenditures for road and bridge repair” Higher spending in general by government agencies • “Government will be spending more” • “The government will turn up the spending for 2015” We are expanding in our marketing/sales efforts • “Greater investment in sales and marketing” • “Better CRM and sales initiatives for 2015” • “Extensive new marketing efforts” • “Heavier marketing” • “We’re bidding on more contracts” • “More involvement with states and cities” ©2015 Onvia, Inc. All rights reserved. The top reasons for positive 2015 sales expectations are listed on the left. We first selected answers from companies that indicated expected growth in the coming year. Out of these contractors surveyed with growth expectations we were able to identify four major themes or categories, including improvement in the economy and revenues, higher spending in general, more spending in a related area, and winning or expanding in a firm’s sales/marketing efforts. Of these four, only the last one has to do with a factor within the control of the company. Businesses that choose to invest in their marketing and sales teams would presumably do so with an expectation of reward at some level. The other three themes generally have to do with macro factors such as economic improvement, or greater spending or demand in specialized areas that affect the contractor’s area of government business. 8 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 SPECIFIC DRIVERS OF GROWTH Specific drivers of growth A total of 10 different potential factors or reasons were tested that could influence the growth expectations of contractors either positively or negatively. % Expect positive impact Contractors were asked to indicate for each one whether they felt it had a positive impact, negative impact or no impact on their future 2015 outlook. The chart reports on the percentage of respondents who thought a given factor had a positive impact overall. Allocation of Funding by Agency Overall Economy Overall Agency Budgets Company Budget for Govt. Sales The highest factors include funding by specific agencies, overall economy and overall agency budgets. These can be considered the reasons that are the most broad-based. Cooperative Purchasing Contract Requirements Local Tax Revenues Regulations In the case of company sales budgets, the 37% impact suggests nearly four out of ten companies are setting their internal funding bar high enough to help drive additional revenues for the year. In what looks to be an improving market in 2015, many firms seem to believe that higher sales/marketing spend will be well worth the price. It may seem surprising that as many as 34% expect a positive impact for co-op purchasing but agencies can purchase through local and statewide cooperative groups as well as through the national high-volume co-op associations. Borrowing Cost Competition 0% 10% 20% 30% ©2015 Onvia, Inc. All rights reserved. 40% 50% 60% 9 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 DRIVERS OF NEGATIVE EXPECTATIONS Drivers of negative expectations The same 10 factors were also evaluated for whether or not they will cause a negative impact on company performance over the coming year. % Expect negative impact The percentage of companies in the survey that expect to be negatively impacted by each factor are reported in the chart. The top factor was competition, mentioned by 44% of the firms. Competition Overall Agency Budgets Regulations Besides funding, which shifts with the economy, regulations and contract requirements are things that are largely under the control of the public agencies and can have a significant impact on the revenues and success of government contractors; they may also serve as motivators for re-location or territory decisions. Allocation of Funding by Agency Contract Requirements Overall Economy Company Budget for Govt. Sales Local Tax Revenues At the very bottom of the list of negatives were borrowing cost and cooperative purchasing. Even with the prospect of an improving economy and rising interest rates, the low ranking here for borrowing cost suggests that the affordability of capital is generally not considered a barrier to reaching their business goals. The fact that cooperative purchasing ranked dead last as a negative points to the absence of critics and the broad base of support by contractors, who are either already competing for these contracts or who likely are considering doing so in the near future. Borrowing Cost Cooperative Purchasing 0% 10% 20% 30% ©2015 Onvia, Inc. All rights reserved. 40% 50% 10 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 ONVIA RECOMMENDATION: DIVERSIFY INTO ADDITIONAL LEVELS OF STATE AND LOCAL GOVERNMENT Onvia recommendation: Diversify into additional levels of state and local government % of firms with an increase in sales by number of SLED agency levels served Perception of growth opportunities varies by how much of the SLED market is targeted 86% 71% 74% 69% 66% 56% 47% 45% 40% 34% 69% Two or Less Three Four 2014 Reported Five Total Sample 2015 Expected Method: Each level of state & local (SLED) government a firm sells into was counted as “1” and summed. The possible five levels included state, city, county, schools and special districts ©2015 Onvia, Inc. All rights reserved. As the chart demonstrates, there is a correlation between number of agency types and how many firms are expecting to grow in 2015. The segment serving only two or fewer types of SLED agencies had statistically fewer companies expecting to grow (56%) compared to 86% for contractors serving all five levels. The highest performing category sells into every level of state & local agencies Firms who intentionally target every possible level of SLED government are much more likely to have grown over the last year (>70%) and are also more likely to expect to grow in 2015 (>80%). Current government sales doesn’t explain the pattern A majority of firms selling into every type of agency actually had small to mid-tier government sales volumes. It was clear that patterns of current sales cannot by themselves explain this pattern around agency level. Recommendation There appears to be a suggested path here for contractors to take in order to move toward a higher probability of growth or success. Focusing on many levels of government seems to be a winning proposition. Since not all bids or RFPs will apply to a given vendor or contractor, it makes sense to watch for suitable opportunities across as wide a net as possible. With 27% of the firms that target all five levels having sales of less than $5 million and another 27% with mid-tier sales of $5M - $19M, even smaller contractors are seeing success through diversification across multiple levels of government. 11 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 ONVIA RECOMMENDATION: PARTICIPATE IN COOPERATIVE PURCHASING Onvia recommendation: Participate in cooperative purchasing % of firms expecting positive impact from cooperative purchasing by government sales 56% 37% 34% 25% Under $5M It appears the most successful firms are engaged in cooperative purchasing Nearly 60% of contractors that had at least $20 million in government revenues expect to be positively impacted by cooperative purchasing, compared to only one in four of the smallest revenue firms. On the low side: barriers to success? $5M - $19M $20M or more Government Sales Revenue All Firms Companies with low government sales expected growth in the year ahead but for the most part do not expect it to come from cooperative purchasing. Contractors with larger government sales have certain understandable advantages in areas like solid brand awareness and a greater ability to deliver at a scale appropriate for a national co-op supplier. Smaller players may simply not be in a position to imitate them. Recommendation That said, there appears to be a path of opportunity for somewhat lower sales firms to grow their government business by building awareness and competing for cooperative contracts through local or statewide associations initially to prove capability. The cooperative movement has been growing faster than the broader market and winning contractors have a chance to increase volume while simultaneously decreasing marketing costs on a per unit basis. “ Cooperative contracts seem to be getting a larger share. ” - Technology company with $5M-$9M in government sales ©2015 Onvia, Inc. All rights reserved. 12 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 ONVIA RECOMMENDATION: INVEST IN THE SALES/MARKETING PROCESS Onvia recommendation: Invest in the sales/marketing process % of firms expecting positive impact from sales/marketing budget 57% 39% 37% 28% Under $5M $5M - $19M $20M or more All Firms A total of 57% of contractors with at least $20 million in government revenues expect their sales and marketing budgets to help drive their sales in 2015. This is considerably higher than mid-tier sales firms (39%) or smaller sales firms (28%). Recommendation Discussion On the lower end, a majority of firms in the survey expect to grow this year but as with cooperative purchasing, the vast majority of these decision-makers are not counting on their sales budget to make this happen. Contractors with larger government sales generally have a greater ability to invest in well-funded and carefully planned sales and advertising budgets. With the improving economy and evidence that some firms are making investments to grow market share, being highly conservative on sales budgets may not be wise in the year ahead. Even though this option to invest may be seen as riskier for those with smaller government sales volumes, this remains a key area to consider for any company’s B2G growth strategy. Government Sales Revenue “ We are investing in the government consulting practice of the firm ” - Real Estate company with at least $50M in government sales ©2015 Onvia, Inc. All rights reserved. 13 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 TOP TRENDS OR ISSUES OF CONCERN BY INDUSTRY Top trends or issues of concern by industry We asked our panel of contractors to tell us about the issues and trends they see affecting the market. We examined their comments and pulled out representative examples within three major industry groupings to provide additional insight into the factors that either assist or constrain businesses over the next 12 months. TECHNOLOGY • • • • • • • • • • • Improving economy will help tech budgets Continued need for more effective and efficient IT systems Need to upgrade very old legacy systems More agencies will look for a single software solution Increasing emphasis on timely, knowledgeable support/service as part of total product value FedRAMP approval will be important Bias for larger contractors (smaller firms squeezed out), such as growth in cooperative purchasing IDIQ (indefinite quantity contracts) to grow Cloud computing, big data, cyber security, mobile computing, fraud detection Connection improvements for Internet ©2015 Onvia, Inc. All rights reserved. INFRASTRUCTURE (CONSTRUCTION/ MAINTENANCE RELATED) • • • • • Growing economy will help demand Regional population growth or relocation will drive more municipal services Aging and stressed infrastructure will lead to more repairs and improvements Water conservation/quality projects are a focus; innovative solutions are needed 3-D printing will continue as a trend PROFESSIONAL SERVICES, HEALTHCARE, PUBLIC SAFETY • • • • • • • Economy, job market and consumer confidence will drive improvement Bonding requirements forcing some small firms out Threat of consolidation of contracts Cities or counties banding together to form local cooperative buying groups Focus on police reform and allocation of budgets to public safety Improvements in law enforcement technology Changes in demand for worker training create more continuing education opportunities 14 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 CONCLUSION Conclusion After a slower year in 2014, government contractors are looking ahead to improved growth opportunities, a positive outlook that is consistent with third party sources reported in Onvia’s 2015 Trends report calling for improved tax revenues, budgets and spending in state and local governments nationwide. With less than half of firms reporting government sales growth last year, a full 69% expect to grow this year. Moreover, the survey found that this outlook holds true regardless of government sales volume, industry, location or job title. But as important as this overall finding is, a primary goal of the survey was to explore some of the dynamics affecting the market or trends that will be shaping things in the year ahead. Three key strategies surfaced in conducting the research that can provide valuable insight for contractors looking at ways to grow their public sector sales: ©2015 Onvia, Inc. All rights reserved. Diversify into additional levels of state & local government One of the places where we found real differences in 2015 growth expectations was in the number of state and local agency levels a company serves. Companies focused on a more diverse list of agency types are more likely to have been growing and expect growth in the future. For those firms that have not yet diversified across agency levels this is a key tool to consider for increasing sales. Participate in cooperative purchasing The 34% who expect a positive impact from cooperative purchasing is slanted toward the larger contractors, where a majority are benefiting. However, this is not an exclusive market segment for the largest brands as some are benefiting at a smaller scale (such as through local or statewide associations). Whether the situation is a smaller sales company that can begin participating in local or regional co-ops, or a large sales firm not yet engaged in national co-op contracting, this is an important option to consider for growth. Invest in the sales/marketing process Investing in the sales and marketing function was another important lever for driving government sales revenues. 37% of all contractors indicated their sales/marketing budgets would have a positive impact on their sales for 2015. This impact was disproportionately skewed toward larger sales firms, who seemed to have a greater propensity to make investments in this area. Smaller sales contractors were generally planning on growing this year but very few planned on budgets that would make an impact. In a growing market characterized by some firms investing to gain market share, being highly conservative in sales and marketing budgets may not make sense. 15 Onvia Government Contractors Survey Results: Selling Into the B2G Market in 2015 ABOUT ONVIA Onvia specializes in providing business intelligence solutions to vendors to grow their government business, helping them get ahead of the bid and RFP process. Active vendors in the government market that need timely, comprehensive and unique insights in their industry vertical, key buyers and competitive landscape should visit www.onvia.com and request a demo to speak with a Business Development Manager in their industry. Onvia helps clients strategically grow their government business with solutions for project intelligence, agency intelligence and vendor intelligence in the public sector. Disclaimer: The information contained in this Onvia publication has been obtained from publicly available sources and survey responses provided by government contractors. Onvia disclaims all warranties as to the accuracy, completeness or adequacy of such information. The views and opinions expressed in this publication are those of Onvia’s research organization or contributors and are subject to change. For More Information Onvia - www.onvia.com (800) 575-1736 ©2015 Onvia, Inc. All rights reserved.