T S L I 13 Annual Tax & Securities

advertisement

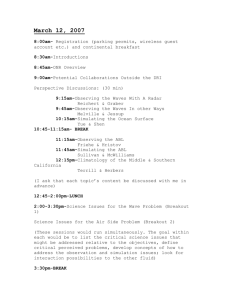

13 Annual Tax & Securities Law Institute th T SLI March 5-6, 2015 Hyatt Regency New Orleans 13Th Annual Tax & Securities Law Institute March 5-6, 2015 │Hyatt Regency New Orleans I t’s not April in Paris or autumn in New York – it’s March in New Orleans for TSLI at last. You can get here by caravan or night train (not the A train), but however you get here join your colleagues from around the country for in-depth discussions of the current topics in municipal finance. We have had many excellent TSLI sessions in the past, but the best is yet to come. There will also be opportunities to get together informally and share ideas. You can take five between sessions or go right up to around midnight. This year’s TSLI promises to be one of the milestones, but it won’t mean a thing if you don’t make it. So come rain or come shine, join us in New Orleans! BREAKOUT SESSION TRACKS Securities Track The Institute will explore the latest developments in the securities law area. Practitioners and regulators on the “Current Disclosure Issues in Primary Offerings” and “Current Continuing Disclosure Issues” panels will discuss, among other things, lessons learned from the SEC Enforcement Division’s Municipalities Continuing Disclosure Cooperative (MCDC) Initiative. In a panel entitled, “Tales from the Buy Side: Investors’ Perspectives on Disclosure and Other Issues,” representatives from the largest purchasers of tax-exempt bonds will provide an informative perspective on the concerns and requirements of investors in the current municipal debt market, as well as a unique viewpoint on various hot disclosure issues. Disclosure policies and procedures continue to be of significant importance and discussed as a critical component of remedial efforts in many enforcement actions. “Why You Should Care About Disclosure Policies” will examine the legal significance of disclosure policies and approaches to drafting such policies and procedures. Finally, practitioners and staff from the SEC Enforcement Division will discuss recent enforcement actions, including actions that result from the MCDC Initiative, on the SEC Enforcement panel. Tax Track The tax panels at the Institute will explore the latest issues confronting the Section 103 bar. The topics to be covered at the Institute include matters affecting financially strapped governmental issuers and conduit borrowers. The “Private Activity Bonds Tests” panel will focus on current developments in the application of the private activity bond tests. Two sessions (one of which will be for practitioners only) of the “Tax Enforcement” panel will address recent tax enforcement and Voluntary Closing Agreement Program developments and the practical implications of these developments. The "Long-term Working Capital” panel will discuss tax-exempt long-term working capital financings and remedial actions. The “Reissuance” panel will include a discussion of common fact patterns and analysis options in transactions giving rise to reissuance. Finally, in order to be as relevant as possible, the “Tax Hot Topics” panel will cover some of the most-discussed topics of the year, including any late-breaking developments in tax law affecting tax-exempt and tax-advantaged bonds. Ethics Panel This year’s ethics panel, entitled, “The 501(c)(3) Opinion in Qualified 501(c)(3) Bond Transactions” will discuss the purpose and common formulations of the 501(c)(3) opinion and provide commentary regarding the opinion language and due diligence that may be undertaken by counsel rendering and relying upon the 501(c)(3) opinion. Joint Panel Privately placed bonds and bank loans comprise a larger share of primary municipal market issuance today than they did in 2009 and 2010. In a joint panel entitled “Securities and Tax Law Issues in Private Placement and Bank Loan Transactions,” securities and tax law practitioners will discuss the securities and tax law issues that arise in private placements and bank loans. Securities law issues which will be discussed include the loan vs. security analysis, the applicability of the Municipal Advisor rule, certain MSRB rules and Rule 15c2-12, and voluntary filings. Tax law issues which will be discussed include analyzing whether there is a reissuance upon the occurrence of certain events (e.g., a change in the interest rate or a mandatory or optional tender of an obligation by the holder) and do the underlying documents have rate-setting or rate-changing mechanisms that lead to the obligation being considered a contingent payment instrument. Breakout Session Topics Agenda (Subject to change. For the most up-to-date agenda, please visit www.nabl.org.) Wednesday March 4 5:00pm – 7:00pm 7:00am – 5:30pm 7:00am – 8:00am 8:00am – 9:15am 9:15am – 9:30am 9:30am – 10:45am Thursday March 5 10:45am – 11:00am 11:00am – 12:15pm 12:15pm – 1:15pm 1:15pm – 2:30pm 2:30pm – 2:45pm 2:45pm – 4:00pm 4:00pm – 4:15pm 4:15pm – 5:30pm 5:30pm – 6:30pm 7:00am – 12:30pm Friday March 6 7:00am – 8:00am 8:00am – 9:15am 9:15am – 9:30am 9:30am – 10:45am 10:45am – 11:00am 11:00am – 12:15pm Check-in Desk Open Check-in Desk & Exhibits Open Continental Breakfast Breakout 1 (S-1) (S-2) (T-2) Break Breakout 2 (S-4) (T-3) (T-5) Break Breakout 3 (E-1) (S-3) (T-1) Lunch General Session Municipal Bankruptcy Update Break Breakout 4 (S-2) (T-4) (T-5) Break Breakout 5 (J-1) (S-3) (S-5) (T-2) Welcome Reception Information Desk & Exhibits Open Continental Breakfast Breakout 6 (E-1) (J-1) (S-4) Break Breakout 7 (S-1) (S-5) (T-1) Break Breakout 8 (S-3) (T-3 – practitioners only) (T-4) TSLI will cover at least 12 breakout session topics dealing with current issues of securities law, tax law, and ethics. Government participants will join many of the panels, offering attendees the most up-to-date views of industry regulators. Please indicate your topic preferences on your registration form so that panels can be appropriately scheduled to accommodate interest. Please note, however, that as developments warrant, the topics shown may need to be adjusted to address current developments in the area. Securities Law • • • • • S-1 Current Disclosure Issues in Primary Offerings S-2 Current Continuing Disclosure Issues S-3 SEC Enforcement S-4 Tales from the Buy Side: Investors' Perspectives on Disclosure and Other Issues S-5 Why You Should Care About Disclosure Policies Tax Law • • • • • T-1 Tax Hot Topics T-2 Long-term Working Capital T-3 Tax Enforcement (Friday’s panel is for practitioners only) T-4 Private Activity Bond Tests T-5 Reissuance Ethics Panel • E-1 The 501(c)(3) Opinion in Qualified 501(c)(3) Bond Transactions Joint Panel • J-1 Securities and Tax Law Issues in Private Placement and Bank Loan Transactions Accommodations The Institute will take place at the modern Hyatt Regency, which is conveniently located in vibrant downtown New Orleans. Institute Highlights Hyatt Regency New Orleans GENERAL SESSION A highlight of the Institute will be the General Session on Thursday, March 5 - “Municipal Bankruptcy Update.” NABL Past-President, Allen Robertson, will lead a panel of professionals who will provide various perspectives on the current landscape of municipal bankruptcy. Panelists will discuss recent events in Detroit, Jefferson County, and other jurisdictions and the impacts on the municipal securities industry of the actions taken, and decisions made, in those cases. Welcome Reception On Thursday evening, NABL will host a reception for all attendees. This Welcome Reception will provide a great opportunity to visit with bond lawyers from across the country as well as government representatives in the “Big Easy”. What You Should Know & All That Jazz CLE Credit The Institute offers the ability to earn up to 11 hours of CLE credit, depending on the jurisdiction, including ethics credit. This is an excellent opportunity to keep current with your law specialty and easily fulfill your mandatory CLE requirements. NABL will apply for continuing legal education credits, including ethics and professionalism credits, from those states that have mandatory CLE requirements. The necessary forms will be available at the program. Attendance & Registration The Institute is designed for individuals who have five (5) or more years of experience in the municipal finance area. It is open only to NABL members. NABL membership is by individual and not by firm. The number of registrants is limited, determined on a first-come, first-served basis. TSLI Executive Committee Chair Lorraine M. Tyson Pugh, Jones & Johnson, P.C. Chicago, Illinois Vice Chair Carol Juang McCoog Hawkins Delafield & Wood LLP Portland, Oregon 601 Loyola Avenue New Orleans, LA 70113 Tel: 504 561 1234 www.neworleans.hyatt.com Guestroom Rate The group guestroom rate is $269 per night single/double occupancy. This rate includes complimentary in-room internet service and access to the hotel’s state-of-the-art fitness center. A limited block of guestrooms is being held for attendees on March 4 and 5. All reservations are based on space and rate availability. Please call 1-888-591-1234 to book your reservation and identify yourself as being with the NABL to receive the group rate. You may also visit https://resweb.passkey.com/go/natlassnbondlawyersmtg to reserve your accommodations on-line. A non-refundable deposit will be required at the time of reservation. The reservation cut-off date is Monday, February 9, 2015. Reservations will be honored on a space and rate available basis until this date. Check In/Out Hotel check-in is 3:00pm and check-out is at noon. Institute Schedule and Attire The Institute’s schedule recognizes the many demands on attendees and provides regularly scheduled breaks throughout the day so you can check voicemail and e-mail. The Institute concludes at 12:15pm on Friday, allowing you to return home that same day or enjoy New Orleans many attractions. Attire for the Institute is business casual. Airport, Taxi, and Parking • • • Louis Armstrong International Airport (MSY) is approximately 12 miles from the hotel. The one-way cost of a taxi from MSY to the Hyatt is approximately $35. Valet Parking Fees: $30 up to 10 hours; $40 overnight Street Car See the city the way locals do, via street car! The street car fare is $1.25 each way and Jazzy Passes for unlimited rides are $3 per day. Visit www.neworleans.hyatt.com and click on the activities tab for additional information. 13TH ANNUAL TAX & SECURITIES LAW INSTITUTE Register online at www.nabl.org or complete and fax or mail this form. Registration Information Please print or type the information requested below. One form per person. Breakout Session Topics For detailed descriptions go to www.nabl.org. TSLI 15 WEB Securities Law Full Name • S-1 Current Disclosure Issues in Primary Offerings First Name on Badge (as you would like it to appear) • S-2 Current Continuing Disclosure Issues • S-3 SEC Enforcement Law Firm, Company, Employer • S-4 Tales from the Buy Side: Investors' Perspectives on Disclosure and Other Issues Address • S-5 Why You Should Care About Disclosure Policies City, State, Zip Tax Law Telephone, Cell, Email • T-1 Tax Hot Topics • T-2 Long-term Working Capital Date admitted to practice: • T-3 Tax Enforcement (Friday’s panel is for practitioners only) • T-4 Private Activity Bond Tests List your Continuing Legal Education State/s & CLE Number/s: • T-5 Reissuance Ethics Panel List Special Dietary and/or Accessibility Needs: • � Please check the circle if you would like your name to be omitted from the attendee roster. Registration fee CC#: • $795 per NABL member TSLI is a NABL members-only event. All Institute attendees must be paid NABL members at the time of the event. For more information on the benefits of NABL membership, please visit www.nabl.org. Method of Payment � Check: Please make check payable to NATIONAL ASSOCIATION Check #: OF BOND LAWYERS. Check#___________________________________ Or Charge My: � American Express � Visa � MasterCard �Discover E-1 The 501(c)(3) Opinion in Qualified 501(c)(3) Bond Transactions Joint Panel • J-1 Securities and Tax Law Issues in Private Placement and Bank Loan Transactions Breakout Session Preferences Please select one breakout session you are most likely to attend in each time slot. Thursday, March 5 Breakout 1 8:00am - 9:15am ○ S-1 ○ S-2 ○ T-2 Breakout 2 9:30am -10:45am Credit Card Account Number ○ S-4 ○ T-3 Expiration Date ○ T-5 Breakout 3 Signature For Office Use Only: Member ID: Registration Cancellation Policy Institute registration cancellations must be received in WRITING via fax or mail. The chart below indicates the refund you will receive based on the date of cancellation: Substitutions of attendees are permitted up to the first day of the Institute. Cancellation Received February 2, 2015 March 2, 2015 After March 2, 2015 Refund Amount Full Refund 50% Refund No Refund 11:00am - 12:15pm ○ E-1 ○ S-3 ○ T-1 Breakout 4 2:45pm - 4:00pm ○ S-2 ○ T-4 ○ T-5 ○ J-1 ○ S-3 ○ S-5 ○ T-2 Friday, March 6 Breakout 6 8:00am - 9:15am ○ E-1 ○ J-1 ○ S-4 Breakout 7 9:30am - 10:45am ○ S-1 ○ S-5 ○ T-1 Breakout 8 11:00am - 12:15pm ○ S-3 ○ T-3 – practitioners only ○ T-4 Questions? Please contact: National Association of Bond Lawyers 601 13 Tel: (202) 503-3300 Fax: (202) 637-0217 registration@nabl.org Breakout 5 4:15pm - 5:30pm th Street NW, Suite 800 South Washington, DC 20005-3875