CV: Tony Liu

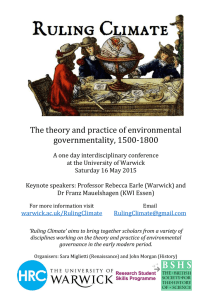

advertisement

CV: Tony Liu Dept. of Economics University of Warwick, Coventry Social Sciences Building Phone:+447511784463 E-mail: t.x.liu@warwick.ac.uk http://www2.warwick.ac.uk/fac/soc/economics/staff/txliu Education Ph.D in Economics, University of Warwick (Expected May 2016) MSc in Economics with distinction, University of Warwick, 2010 Diploma in Economics with distinction, University of Warwick, 2009 MSci and BA in Natural Sciences (specialisation in Physics), University of Cambridge, 2008 Reseach Interests Applied Theory, Corporate Finance, Finance, Microeconomics Working Papers “Hedge Funds, Distribution Picking and Competition” (Job Market Paper) (link) “Distribution Picking Hedge Funds: a Bayesian Extension” (link) “Tail Risk and the 2 and 20 Incentive Scheme in a Distribution Picking Environment” (link) Teaching Experience 2012-2015, Teaching Assistant, EC201 Macroeconomics 2 (Undergraduate level) Scholarships ESRC 1+3 Studentship, 2009-2013 References Dr. Robert Akerlof (Ph.D Supervisor) Dept. of Economics University of Warwick, Coventry R.Akerlof@warwick.ac.uk Prof. Marcus Miller (Ph.D Supervisor) Dept. of Economics University of Warwick, Coventry Marcus.Miller@warwick.ac.uk Prof. Herakles Polemarchakis (Advisor) Dept. of Economics University of Warwick, Coventry H.Polemarchakis@warwick.ac.uk Personal Information Gender: Male Citizenship: United Kingdom Birth Date: 22/11/1985 Languages: English, Chinese Abstracts “Hedge Funds, Distribution Picking and Competition” (Job Market Paper) Prominent commentators have argued that financial sophistication has made markets riskier. This paper contributes to that discussion by modelling an environment where a combination of competition and financial complexity induces risk taking. New hedge funds gain benefits from reaching high performance rankings relative to their peers, have opaque portfolios with return distributions subject to limited sampling and have access to complex financial instruments. This is modelled by treating hedge funds as entities that choose return distributions subject to ability constraints that limit mean returns. This proxies for the ability to manipulate portfolio returns using complex financial instruments. There is only one return draw from the portfolios due to limited sampling, and the fund that draws the highest return gains a benefit that can be interpreted as positive publicity. Fund failure occurs when the portfolio returns below some exogenous threshold. Although there are an infinity of equilibria, tail risk and fund failure occurs in every one, and this tail risk increases with the number of competing funds. Thus, competition and complexity have a perverse effect in this environment. This is because the return required for a good chance of achieving a high performance ranking increases with the number of competing funds, as there are more funds that need to be outperformed. Due to the funds' ability constraints, such high return draws can only exist at the cost of tail risk. A simple policy implication then follows: increasing the cost of using financial instruments can help remove this tail risk. “Distribution Picking Hedge Funds: A Bayesian Extension” “Hedge Funds, Distribution Picking and Competition” by Liu (2015) finds that competition increases tail risk in the portfolios of new hedge funds in a model where they gain positive publicity by achieving a high performance ranking. A criticism of this paper is that it assumes positive publicity is generated for the fund that draws the highest reward, which implies that investors interested in hedge funds are naive. This paper addresses the criticism by checking if the results of Liu (2015) hold if benefits from positive publicity are gained by the fund with the highest Bayesian probability of being a high ability type after return draws. Analysis of the new model finds that the results from “Hedge Funds, Distribution Picking and Competition” mostly hold, but in a weaker form. This is because the probability of gaining the benefit from being the top performer must be increasing with the observed portfolio return, which also happens in the naive case. In the revised model, tail risk and fund failure are found in all symmetric perfect Bayesian equilibria. However, tail risk and fund failure do not increase with competition in all equilibria. The main exception to this are equilibria where the support of the played distributions are two points. These equilibria exist because the Bayesian version of the model is more like a signalling game and less like a Blotto game. “Tail Risk and the 2 and 20 Incentive Scheme in a Distribution Picking Environment” The 2 and 20 compensation scheme is commonly used in hedge funds, and gives managers a cut (20%) of all profits above a certain threshold. Although such a compensation scheme provides incentives for managers to exert effort, it may have adverse effects on tail risk and fund failure when managers have access to complex financial instruments that can alter return distributions. This paper shows this by embedding a 2 and 20 like compensation scheme into the model from “Hedge Funds, Distribution Picking and Competition” by Liu (2015) and analysing it. Hedge funds are treated as entities that can pick the return distributions of their portfolios subject to a mean constraint that is due to manager ability, and are competing for high performance rankings. Comparative statics show that under the 2 and 20 style scheme, tail risk and fund failure is higher under some mild parameter assumptions, and that there is actually less probability mass above the bonus threshold. This is because the 2 and 20 scheme incentivises moving return probability mass above the bonus threshold, and when funds are constrained by manager ability, this must come at the cost of tail risk. The lower probability mass above the threshold is due to a combination of the ability constraint, and managers favouring higher variance above the threshold to increase chances of drawing a higher return.