Residential Rate Study for the Kansas Corporation Commission Final Report

advertisement

Residential Rate Study for the

Kansas Corporation

Commission

Final Report

Daniel G. Hansen

Michael T. O'Sheasy

April 11, 2012

Christensen Associates Energy Consulting, LLC

800 University Bay Drive, Suite 400

Madison, WI 53705-2299

Voice 608.231.2266 Fax 608.231.2108

Table of Contents

Executive Summary .......................................................................................................... 1

1. Introduction and Purpose of the Study....................................................................... 6

2. Description of the Rate Structures Included in the Study ........................................ 7

2.1 Base residential rate .................................................................................................. 8

2.2 Flat rate ..................................................................................................................... 9

2.3 Straight fixed variable (SFV) rate ........................................................................... 10

2.4 Inclining block rate (IBR) ....................................................................................... 11

2.5 Time-of-use (TOU) rate .......................................................................................... 12

2.6 Day-type TOU rate ................................................................................................. 13

3. Rate Design Methodology .......................................................................................... 14

3.1 Prepare customer usage data ................................................................................... 14

3.2 Rate design summary .............................................................................................. 15

3.2.1 Flat rate ........................................................................................................ 15

3.2.2 Straight-fixed variable rate .......................................................................... 15

3.2.3 Inclining block rate ...................................................................................... 16

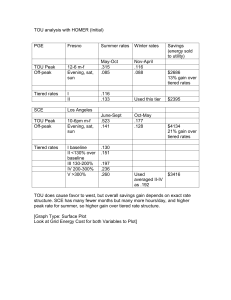

3.2.4 Time-of-use rate ........................................................................................... 17

3.2.5 Day-type TOU rate ...................................................................................... 18

4. Bill Impacts .................................................................................................................. 19

4.1 Flat rate ................................................................................................................... 19

4.2 Straight fixed variable rate ...................................................................................... 22

4.3 Inclining block rates ................................................................................................ 25

4.4 IBR and SFV ........................................................................................................... 27

4.5 Time-of-use rates .................................................................................................... 29

4.6 Day-type TOU rates ................................................................................................ 30

4.7 Summary of bill impacts ......................................................................................... 32

5. Load Response............................................................................................................. 33

5.1 SFV ......................................................................................................................... 34

5.2 IBR .......................................................................................................................... 35

5.3 TOU ........................................................................................................................ 35

5.4 Day-Type TOU ....................................................................................................... 36

6. Potential for Utility Revenue Attrition ..................................................................... 37

6.1 Revenue attrition due to customer self selection .................................................... 37

6.2 Revenue attrition due to customer demand response.............................................. 39

7. Summary and Conclusions ........................................................................................ 41

i

CA Energy Consulting

Tables

Table ES.1: Summary of Bill Impacts by Rate Structure, KCP&L

Table ES.2: Summary of Bill Impacts by Rate Structure, Westar

Table ES.3: Summary of Bill Impacts by Rate Structure, Midwest

Table 2.1: Base Residential Rates, KCP&L

Table 2.2: Base Residential Rates, Westar

Table 2.3: Base Residential Rates, Midwest

Table 3.1: Number of Customers used in the Analysis, by Utility

Table 3.2: Flat Rate ($/kWh), by Utility

Table 3.3: SFV Rates, by Utility

Table 3.4: Inclining Block Definitions and Prices ($/kWh), KCP&L

Table 3.5: Inclining Block Definitions and Prices ($/kWh), Westar

Table 3.6: Inclining Block Definitions and Prices ($/kWh), Midwest

Table 3.7: TOU Periods and Prices ($/kWh), KCP&L

Table 3.8: TOU Periods and Prices ($/kWh), Westar

Table 3.9: Day-type TOU Prices by Day Type ($/kWh), KCP&L

Table 3.10: Day-type TOU Prices by Day Type ($/kWh), Westar

Table 4.1: Share of High and Low Bill Impacts, by Utility

Table 4.2: Summary of Bill Impacts by Rate Structure, KCP&L

Table 4.3: Summary of Bill Impacts by Rate Structure, Westar

Table 4.4: Summary of Bill Impacts by Rate Structure, Midwest

Table 5.1: Percentage Changes in Usage by Season and Utility, SFV

Table 5.2: Percentage Changes in Usage by Season and Utility, IBR

Table 5.3: Percentage Changes in Usage by TOU Pricing Period and Utility

Table 5.4: Percentage Changes in Usage by Day-type TOU Day Type

Table 6.1: Revenue Attrition Due to Customer Self Selection

Table 6.2: Elasticity Assumptions by Rate and Scenario

Table 6.3: Revenue Attrition Due to Customer Demand Response, Expected Elasticity

Table 6.4: Revenue Attrition Due to Customer Demand Response, High Elasticity

Table 6.5: Revenue Attrition Due to Customer Demand Response, Low Elasticity

ii

4

4

4

8

8

9

15

15

16

16

16

17

18

18

19

19

27

33

33

33

35

35

36

37

38

39

40

40

40

CA Energy Consulting

Figures

Figure 4.1: Percentage Flat Rate Bill Impacts, KCP&L ............................................................... 20

Figure 4.2: Percentage Flat Rate Bill Impacts, Westar with Peak Management .......................... 21

Figure 4.3: Percentage Flat Rate Bill Impacts, Westar ................................................................. 21

Figure 4.4: Percentage Flat Rate Bill Impacts, Midwest ............................................................... 22

Figure 4.5: Percentage SFV Rate Bill Impacts, KCP&L .............................................................. 23

Figure 4.6: Percentage SFV Rate Bill Impacts, Westar ................................................................ 24

Figure 4.7: Percentage SFV Rate Bill Impacts, Midwest.............................................................. 24

Figure 4.8: Percentage IBR Bill Impacts, KCP&L ....................................................................... 25

Figure 4.9: Percentage IBR Bill Impacts, Westar ......................................................................... 26

Figure 4.10: Percentage IBR Bill Impacts, Midwest..................................................................... 26

Figure 4.11: Percentage IBR+SFV Bill Impacts, KCP&L ........................................................... 28

Figure 4.12: Percentage IBR+SFV Bill Impacts, Westar ............................................................. 28

Figure 4.13: Percentage IBR+SFV Bill Impacts, Midwest ........................................................... 29

Figure 4.14: Percentage TOU Bill Impacts, KCP&L ................................................................... 30

Figure 4.15: Percentage TOU Bill Impacts, Westar ..................................................................... 30

Figure 4.16: Percentage Day-Type TOU Bill Impacts, KCP&L .................................................. 31

Figure 4.17: Percentage Day-Type TOU Bill Impacts, Westar .................................................... 32

iii

CA Energy Consulting

Executive Summary

This report documents a residential rate study that Christensen Associates Energy

Consulting, LLC (CA Energy Consulting) conducted on behalf of the Kansas Corporation

Commission (KCC). The KCC is interested in studying rates that can encourage

conservation and/or provide efficient rates. "Conservation" refers to providing customers

with incentives to reduce energy consumption. "Efficient rates" are those that provide

customers with prices that reflect the marginal cost to serve them, which in theory leads to

the most efficient use of resources (e.g., electricity generators). These two goals do not

always coincide. For example, a TOU rate may have low off-peak prices to reflect the fact

that only low-cost generators are needed to serve off-peak loads. While this price is

efficient, it provides less incentive to conserve in off-peak hours than an equivalent flat

price (in which the price is the same across all hours).

We used data from Kansas City Power & Light (KCP&L), Westar Energy (Westar), and

Midwest Energy (Midwest) to analyze several alternative residential rate structures. The

rate structures included in the study are:

• Flat rate;

• Straight-fixed variable (SFV) rate;

• Inclining block rate (IBR);

• Time-of-use (TOU) rate; and

• Day-type TOU rate.

The flat rate is included primarily as a reference case, in which the price does not vary by

time or with the level of customer use. SFV rates address the utility's incentive to promote

conservation and energy efficiency by increasing the fixed monthly customer charge and

reducing the throughput volumetric rate, thereby recovering all utility fixed costs through

fixed charges rather than through volumetric rates. An IBR is intended to provide an

incentive to conserve by increasing the rate a customer pays as its usage level increases.

TOU rates are intended to provide efficient price signals by charging rates that are based on

the average cost to serve customers. TOU rates therefore give customers an incentive to

reduce usage during high-cost hours (e.g., summer afternoons) and increase usage during

low-cost hours (e.g., overnight hours). Day-type TOU rates add a "dynamic" component to

TOU rates that provides customers with a significant incentive to reduce usage on the

hottest, most costly days to serve them.

Each of these rate structures affects customers differently depending on their usage levels

and patterns. The relationship between bill impacts and customer usage levels is of interest

because stakeholders often wish to avoid adverse bill impacts for low-income customers,

and low-income customers are often believed to use less electricity than other customers.

The advantages and disadvantages of each rate structure are described in the full report.

Research Approach

The following steps were used to evaluate the alternative rate structures of interest:

1) Design revenue-neutral alternative residential rates for each utility;

2) Estimate customer-level bill impacts for each rate structure at historical loads;

1

CA Energy Consulting

3) Evaluate the relationship between bill impacts and customer usage levels;

4) Simulate the changes in customer usage levels and patterns (i.e., "demand

response") in response to the new rate structures; and

5) Estimate the potential for utility revenue loss (revenue attrition) due to mispricing

the new rate options.

Design revenue-neutral alternative residential rates for each utility: Separate revenueneutral rates were designed for each utility using utility-specific residential customer usage

data and Southwest Power Pool (SPP) price data (to design the TOU and day-type TOU

rates). The rates were designed so that they produced the same amount of total revenue as

the current rate produces.

Estimate customer-level bill impacts for each rate structure at historical loads: Each

customer's bill was calculated for both their current rate and each alternative rate structure

using historical loads.

Evaluate the relationship between bill impacts and customer usage levels: To evaluate the

relationship between bill impacts and customer usage levels, the bill impacts are displayed

as scatter plots against each customer's average monthly usage (in kWh). This allows for

an easy examination of how bill impacts vary with customer usage level.

Simulate customer demand response to each rate structure: Simulation was used to estimate

the changes in load that could be expected from each rate structure. We used evidence

from existing studies on customer price responsiveness to provide estimates of the potential

magnitude of the load changes (which, depending on the rate, could be an overall increase,

an overall reduction, or shifting from high- to low-cost hours) that might be expected from

each rate structure.

Estimate the potential for utility revenue loss (revenue attrition) due to mispricing the new

rate options: The final step was to examine the potential for utility revenue attrition, or lost

revenues, due to self selection and demand response. Revenue attrition due to customer

self selection can occur when the utility sets rates without accounting for the tendency of

customers to select the rate that is most beneficial for them (i.e., gives them the lowest bill).

Revenue attrition due to customer demand response can occur when the utility sets rates

using historical load profiles but customers modify their usage patterns in response to the

pricing signals of their new rate.

2

CA Energy Consulting

Research Implementation

We used utility-specific customer data to calculate bill impacts for each rate structure.

KCP&L and Westar provided us with 2007 hourly data from their residential load research

samples. Midwest did not have a load research sample, and instead provided us with 2009

monthly billing data for its residential customers.

The rates within the alternative structures were set to produce the same total revenue as the

existing base residential rate for the available sample customers. Therefore, the first step in

the rate design process was to calculate the total revenue (accounting for the sample

weights) from the base residential rate. The assumptions used when setting the rates were

(a) all customers are on the rate (i.e., there is no customer selection issue), and (b) the

historical load profiles are retained (i.e., we ignore the potential effect of demand response

on customers’ usage and bills).

For each of the rate structures, we calculated customer-level bills using the available

customer-level load data, the "base" residential rates, and the newly designed rates. We

then calculated "instant" bill impacts, which are the bill impacts before the customers

modify their load profiles in response to the new price signals. For ease of analysis, scatter

plots of bill impacts verses customer’s average monthly usage were used. For some of the

rate structures, such as IBR or SFV, the bill impacts are strongly related to customer size.

For others, such as TOU, this is not the case.

Research Results

Bill Impacts

Tables ES.1 through ES.3 provide results that summarize the bill impact analyses. Four

statistics are provided for each utility and rate structure:

• The share of customers that experienced a bill increase of 10% or more on the new

rate structure;

• The share of customers that experienced a bill decrease of 10% or more on the new

rate structure;

• The average percentage bill impact for customers who use an average of 500 kWh

per month or less; and

• The average percentage bill impact for customers who use an average of 2,000 kWh

per month or more.

These statistics are intended to facilitate comparisons of bill impacts across rate structures

and utilities. Following are the key observations from these tables:

• The flat, TOU, and day-type TOU rates do not produce large percentage load

impacts for very many customers (as shown in the "Greater than 10% column").

• The bill impacts for the flat, TOU, and day-type TOU rates are not strongly related

to customer usage levels (as illustrated by the similarity of the average bill impacts

in the "Low Use " and "High Use" columns).

3

CA Energy Consulting

•

•

The high customer charge in the SFV rate leads to large bill increases for low-use

customers (e.g., 27.4 percent for KCP&L's low-use customers). The percentage bill

decreases for high-use customers on this rate structure are smaller in magnitude

(e.g., 5.7 percent for KCP&L's high-use customers).

Despite the fact that IBR and SFV have opposite effects by customer usage levels,

combining the two rate structures is not enough to offset SFV's adverse bill impacts

for low-use customers.

Table ES.1: Summary of Bill Impacts by Rate Structure, KCP&L

Rate Structure

Flat rate

SFV

IBR

IBR + SFV

TOU

Day-type TOU

Share of Customers by Bill

Impact Amount

Greater than

Less than

10%

-10%

1.3%

0.0%

15.1%

0.0%

4.9%

0.0%

3.9%

0.0%

0.3%

0.0%

0.3%

0.0%

Average Bill Impact by Customer Usage

Low Use (<500

kWh/mo.)

0.1%

27.4%

-6.6%

21.2%

-0.5%

-0.5%

High Use (>2,000

kWh/mo.)

0.6%

-5.7%

10.4%

2.6%

-0.2%

-0.5%

Table ES.2: Summary of Bill Impacts by Rate Structure, Westar

Rate Structure

Flat rate

SFV

IBR

IBR + SFV

TOU

Day-type TOU

Share of Customers by Bill

Impact Amount

Greater than

Less than

10%

-10%

0.0%

0.0%

35.9%

6.6%

5.6%

0.0%

28.8%

0.0%

0.0%

0.0%

0.0%

0.0%

Average Bill Impact by Customer Usage

Low Use (<500

kWh/mo.)

-0.1%

46.6%

-1.5%

42.2%

0.1%

1.4%

High Use (>2,000

kWh/mo.)

2.6%

-10.1%

8.9%

-4.8%

1.9%

1.5%

Table ES.3: Summary of Bill Impacts by Rate Structure, Midwest

Rate Structure

Flat rate

SFV

IBR

IBR + SFV

Share of Customers by Bill

Impact Amount

Greater than

Less than

10%

-10%

0.0%

0.0%

19.5%

0.4%

6.0%

0.0%

13.7%

0.0%

Average Bill Impact by Customer Usage

Low Use (<500

kWh/mo.)

-2.2%

20.7%

-7.3%

16.7%

High Use (>2,000

kWh/mo.)

3.9%

-8.8%

17.9%

1.9%

The customer-level bill impacts shown above are those that occur before customers take

actions to adapt to the new rate structures (e.g., by shifting or reducing load). Of course,

the goal of most of these rate structures is to provide customers with incentives to change

behavior. The primary incentive goal of each rate structure can be summarized as follows:

4

CA Energy Consulting

•

•

•

•

SFV: Eliminates the utility's disincentive to encourage conservation and energy

efficiency. As a side effect, SFV reduces the customer-level incentive to conserve

because the volumetric rate has been reduced.

IBR: Discourages increases in consumption levels, particularly for high-use

customers who face the high tail-block price. Note that low-use customers may

experience a decrease in their incentive to conserve because they face the relatively

low initial block price.

TOU: Encourages customers to shift intra-day load from peak to off-peak hours.

Day-type TOU: Builds upon standard TOU by providing added incentives to

reduce usage on high-cost days.

Demand Response

To evaluate the potential magnitude of the usage changes described above, we developed

simple elasticity-based models to simulate the changes in usage for each of these rate

structures. The results of these simulations show that SFV leads to small increases in

overall usage; IBR leads to small decreases in overall usage; TOU leads to decreases in

peak-period usage and increases in off-peak period usage; and day-type TOU produces

larger shifts of usage from peak to off-peak periods on higher-priced days.

Revenue Attrition

Finally, the report examined the potential for utility revenue attrition (recovering less

revenue than forecast) due to customer self selection and demand response. That is, when

the utility sets the rates for an optional pricing program, it does not know which customers

will select the rate, or how the customers who select the rate will modify their load profiles

in response to the new price signals. Our analysis provided an indication of the scale of

this potential problem by assuming that customers select the rate that provides them with

the lowest bill (customer self selection); and by simulating customer demand response

using a range of price responsiveness parameters (i.e., price elasticities). The results

indicated that both types of revenue attrition (i.e., due to customer self selection and

demand response) are more pronounced for SFV and IBR than they are for TOU and daytype TOU.

5

CA Energy Consulting

1. Introduction and Purpose of the Study

This report documents a residential rate study that Christensen Associates Energy

Consulting, LLC (CA Energy Consulting) conducted on behalf of the Kansas Corporation

Commission (KCC). The KCC is interested in studying rates that can encourage

conservation and/or provide efficient rates. "Conservation" refers to providing customers

with incentives to reduce energy consumption. "Efficient rates" are those that provide

customers with prices that reflect the marginal cost to serve them, which in theory leads to

the most efficient use of resources (e.g., electricity generators). 1 These two goals do not

always coincide. For example, a TOU rate may have low off-peak prices to reflect the fact

that only low-cost generators are needed to serve off-peak loads. While this price is

efficient, it provides less incentive to conserve in off-peak hours than an equivalent flat

price (in which the price is the same across all hours).

We used data from Kansas City Power & Light (KCP&L), Westar Energy (Westar), and

Midwest Energy (Midwest) to analyze several alternative residential rate structures. The

rate structures included in the study are:

• Flat rate;

• Straight-fixed variable (SFV) rate;

• Inclining block rate (IBR);

• Time-of-use (TOU) rate; and

• Day-type TOU rate. 2

Each of these rate structures is capable of furthering progress toward encouraging

conservation or efficient pricing. The advantages and disadvantages of each are described

in the report.

Separate rates were designed for each utility using utility-specific residential customer

usage data and Southwest Power Pool (SPP) price data (to design the TOU and day-type

TOU rates).

The primary goals of the evaluation are the following:

• Design revenue-neutral alternative residential rates for each utility;

• Estimate customer-level bill impacts for each rate structure at historical loads;

• Evaluate the relationship between bill impacts and customer usage levels; and

• Estimate the potential for utility revenue loss (revenue attrition) due to mispricing

the new rate options.

1

The marginal cost of electricity in a particular hour represents the forward-looking change in the cost of

generating and delivering electric power that is caused by a change in load in that hour. With the advent of

competitive regional wholesale markets, hourly wholesale prices are generally interpreted as representing

marginal costs. Retail prices that reflect time-based changes in wholesale costs (e.g., averaged over certain

time periods) signal consumers about the cost of consuming power at those times, leading to efficient use of

resources.

2

We did not study TOU or day-type TOU rates for Midwest because they do not have a residential load

research sample. Hourly load data are required to design and evaluate these rate structures.

6

CA Energy Consulting

The relationship between bill impacts and customer usage levels is of interest because

stakeholders often wish to avoid adverse bill impacts for low income customers, and low

income customers are often believed to use less electricity than other customers. 3

A second goal of the evaluation is to simulate the demand response (i.e., changes in load)

that could be expected from each rate structure. Some of the rate structures (e.g., day-type

TOU) provide customers with the incentive to reduce load in peak periods (e.g., summer

weekday afternoon hours) and we will use existing evidence on customer price

responsiveness to provide estimates of the potential magnitude of the load reductions that

might be expected from each rate structure.

A third goal is to examine the potential for utility revenue attrition, or lost revenues, due to

customer self selection and demand response. Revenue attrition due to customer selfselection can occur when the utility sets rates without accounting for the tendency of

customers to select the rate that is most beneficial for them (i.e., gives them the lowest bill).

Revenue attrition due to customer demand response can occur when the utility sets rates

using historical load profiles and customers modify their usage patterns in response to the

pricing signals of their new rate.

After this introductory section, Section 2 describes each of the rate structures included in

the study. Section 3 describes our methodology for designing each rate structure. Section

4 presents the estimated bill impacts for each rate structure and utility. Section 5 contains

estimates of the customer load reductions and/or load shifting in response to each rate

structure. Section 6 contains an analysis of the potential for utility revenue attrition due to

customer self selection and demand response. Section 7 provides a summary and

conclusions.

2. Description of the Rate Structures Included in the Study

In the sub-sections below, we describe each of the rate structures included in the study. For

each of the new structures, we evaluate each structure according to a range of criteria:

• Economic efficiency: the extent to which prices reflect marginal costs.

• Conservation incentives: the extent to which prices encourage customers to use less

energy.

• Simplicity/transparency for customer: reflects how easily the customer can

understand the rates.

• Stability in utility revenues and customer bills: reflects the variability in revenues

and bills as changes occur in system conditions or weather.

• Utility administrative costs: how costly the rate is to administer.

• Metering requirements: the meter technology required to bill the rate.

The rating given for each of these items is qualitative in nature. That is, the exact rating

may depend on a variety of factors. The ratings given here are only intended to facilitate

comparison across rate structures.

3

We may explore the extent to which low income customers are also low use customers in Kansas, subject to

data availability and stakeholder interest.

7

CA Energy Consulting

2.1 Base residential rate

Existing utility-specific residential rates (some of which date back to 2007) were used as

the basis for all bill impact analyses in the study.

KCP&L's rates are shown in Table 2.1 below. The General Use rate shown in the second

column applies to 91 of the 95 customer load profiles that we used in the analysis.

Table 2.1: Base Residential Rates, KCP&L

Rate Component

Customer Charge ($ per customer month)

Summer Energy 1st 1,000 kWh ($/kWh)

Summer Energy over 1,000 kWh ($/kWh)

Winter Energy 1st 1,000 kWh ($/kWh)

Winter Energy over 1,000 kWh ($/kWh)

General Use Rate

$9.07

$0.08899

$0.08899

$0.08037

$0.08003

Water Heater Rate

$9.07

$0.08899

$0.08899

$0.05177

$0.07910

Westar's residential rates are shown in Table 2.2 below. In addition to the rates in the table,

10 of the 87 customers in the load research sample are on the Peak Management Rate,

which has a $10 per customer-month customer charge, flat energy charge of $0.043189 per

kWh, and seasonal demand charges of $1.65 per kW in the winter and $5.45 per kW in the

summer. Because this rate tends to produce a lower average rate paid, the bill impacts for

the Peak Management customers tend to be quite high. (There is only one rate per

alternative structure that applies to all customers.) Therefore, we typically present bill

impacts that assume that these customers are on the "standard" residential rate.

Table 2.2: Base Residential Rates, Westar

Rate Component

Customer Charge ($ per customer month)

1st 500 kWh ($/kWh)

Next 400 kWh ($/kWh)

All additional kWh ($/kWh)

Winter Rate

$8.00

$0.067892

$0.067892

$0.056045

Summer Rate

$8.00

$0.067892

$0.067892

$0.081240

Table 2.3 shows the residential rates that we used for Midwest. The have a declining block

structure in the non-summer months, though the decrease in price is not large across

blocks.

8

CA Energy Consulting

Table 2.3: Base Residential Rates, Midwest

Month

Jan-09

Feb-09

Mar-09

Apr-09

May-09

Jun-09

Jul-09

Aug-09

Sep-09

Oct-09

Nov-09

Dec-09

Customer Charge

($/cust.-mo.)

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

$ 13.00

Energy Block 1

($/kWh)

$ 0.0888

$ 0.0873

$ 0.0874

$ 0.0905

$ 0.0904

$ 0.0926

$ 0.0906

$ 0.0892

$ 0.0872

$ 0.0898

$ 0.0904

$ 0.0938

Energy Block 2

($/kWh)

$ 0.0818

$ 0.0803

$ 0.0804

$ 0.0835

$ 0.0834

$ 0.0856

n/a

n/a

n/a

$ 0.0828

$ 0.0834

$ 0.0868

Energy Block 3

($/kWh)

$ 0.0758

$ 0.0743

$ 0.0744

$ 0.0775

$ 0.0774

$ 0.0796

n/a

n/a

n/a

$ 0.0768

$ 0.0774

$ 0.0808

2.2 Flat rate

Description

A flat rate is the simplest tariff structure. For our analysis, this structure consists only of a

single price per kWh. That is,

Monthly Bill = Flat Price ($/kWh) x Monthly Usage (kWh).

More commonly, the flat rate is combined with a monthly customer charge. 4 That is,

Bill = Customer Charge + Flat Rate ($/kWh) x Monthly Usage (kWh).

The distinguishing characteristic of a flat rate is that the marginal price to the customer

does not change with the level of usage or over time.

Economic Efficiency

Rating: Low

Notes: The price does not vary with expected or actual market conditions. The price tends

to reflect average costs more than marginal costs.

Conservation Incentives

Rating: Low 5

Notes: The price does not vary with the level of usage. The price is below the cost to serve

in high-cost hours. The price exceeds the cost to serve in low-cost hours.

Simplicity / Transparency for Customer

Rating: High

Notes: It is easy for a customer to determine the change in bill associated with a change in

consumption, as the price does not change by time or with the level of usage.

4

5

The customer charge may also be expressed as dollars per day of service.

In off-peak hours, the conservation incentive could be regarded as "high" relative to the cost to serve.

9

CA Energy Consulting

Stability in Utility Revenues and Customer Bills

Rating: Medium

Notes: Revenues / bills change with usage levels, which are affected by weather, economic

conditions, etc.

Utility Administrative Costs

Rating: Low

Notes: Bill calculation is easy and rates are set infrequently.

Metering Requirements

A standard energy meter is the only requirement.

2.3 Straight fixed variable (SFV) rate

Description

SFV rates are flat rates in which all fixed costs are recovered through a monthly customer

charge. 6 This rate structure is intended to remove the utility's disincentive to promote

conservation and energy efficiency that occurs when some or all fixed costs are recovered

through volumetric rates.

Economic Efficiency

Rating: Medium

Notes: By recovering all fixed costs through the customer charge, the energy price ought to

more closely approximate the marginal cost of energy. However, the energy price does not

vary with expected or actual market conditions.

Conservation Incentives

Rating: Low for the customer.

Notes: The customer-level incentive to conserve is lower relative to a flat rate in which

fixed costs are partly recovered through the energy price. However, the utility has an

increased incentive to promote conservation, which may offset this effect.

Simplicity / Transparency for Customer

Rating: High

Notes: It is easy for a customer to determine the change in bill associated with a change in

consumption, as the price does not change by time or with the level of usage.

Stability in Utility Revenues and Customer Bills

Rating: High

Notes: Revenues / bills change with usage levels, but by much less than on a standard flat

rate. Utility revenues to recover fixed costs do not vary (on a per-customer basis).

Utility Administrative Costs

Rating: Low

Notes: Bill calculation is easy and rates are set infrequently.

6

The energy rate does not need to be flat in general, but that is how we designed it for this study.

10

CA Energy Consulting

Metering Requirements

A standard energy meter is the only requirement.

2.4 Inclining block rate (IBR)

Description

Under block rates, the per-unit price of electricity changes with the level of consumption.

Block rates may be used to achieve a variety of goals. Inclining block rates, in which the

rate increases with the level of usage, may be used to encourage conservation or subsidize

low-use customers.

We use a three-block rate, which is billed as follows:

Monthly Bill = Customer Charge + Block 1 Rate ($/kWh) x Block 1 Usage (kWh)

+ Block 2 Rate ($/kWh) x Block 2 Usage (kWh)

+ Block 3 Rate ($/kWh) x Block 3 Usage (kWh)

For an inclining block rate, the rate in the first block is lower than the rate in the second

block, which in turn is lower than the rate in the next block. Section 3 describes the

methods used to set the block sizes and rates.

Economic Efficiency

Rating: Low

Notes: The price does not vary with expected or actual market conditions. The tail-block

price is likely to exceed marginal costs in most hours of the year.

Conservation Incentives

Rating: High for high-use customers, low for low-use customers

Notes: Customers who use enough energy to reach the high-cost blocks face a high price at

the margin. Low-use customers have a conservation incentive that is lower than it would

be under an equivalent flat rate.

Simplicity / Transparency for Customer

Rating: Low to medium

Notes: Understanding how changes in usage affect bills requires the customer to understand

(and possibly forecast) its total usage levels as well as the tariff block sizes and associated

rates.

Stability in Utility Revenues and Customer Bills

Rating: Low

Notes: The high tail-block price, combined with variability in tail-block usage levels, can

produce relatively high variability in utility revenues and customer bills.

Utility Administrative Costs

Rating: Low

11

CA Energy Consulting

Notes: Bill calculation is easy and rates are set infrequently. Block rates may be more

difficult to implement than flat rates depending upon the capabilities of the billing system

and the ability to determine appropriate block thresholds and rates.

Metering Requirements

A standard energy meter is the only requirement.

2.5 Time-of-use (TOU) rate

Description

TOU rates contain prices that vary across the hours of the day. These rates are fixed within

a time-of-use period and do not respond to changing system cost conditions. The primary

motivation for TOU rates is that electricity costs vary across the hours of the day in

reasonably predictable ways. By establishing different rates for different periods of the

day, it is possible for rates to be more reflective of average differences in the cost to serve.

TOU rates provide customers with an incentive to reduce peak-period usage, perhaps by

shifting it to lower-cost hours. For this study, the TOU rates have two pricing periods

(peak and off-peak) per season (summer is defined as May through September and all other

months are defined as non-summer).

Economic Efficiency

Rating: Medium

Notes: TOU rates account for average variations in electricity costs by hour and day type.

Therefore, the rates can reflect expected marginal costs to serve by time periods. However,

on any particular day, there can still be a substantial difference between, for example, the

TOU peak price and the peak-period marginal energy costs on that day.

Conservation Incentives

Rating: Low in off-peak hours, higher in peak-hours

Notes: Relative to a flat rate, the incentive to conserve is higher during peak hours and

lower during off-peak hours. 7

Simplicity / Transparency for Customer

Rating: Medium

Notes: In order for a customer to understand how changes in usage affect their bill, the

customer must know the relevant TOU time periods and the applicable rates. However, the

schedule of rates does not change.

Stability in Utility Revenues and Customer Bills

Rating: Medium

Notes: Relative to a flat rate, TOU rates may increase the variability of utility revenues and

customer bills because of the higher peak-period prices. However, costs are expected to be

higher during those hours as well, so the variability of net revenues may not increase.

Utility Administrative Costs

7

This assumes that the flat rate and the TOU rate are set to recover the same level of revenue. Therefore,

setting the peak period rate higher than the flat rate requires the off-peak rate to be lower than the flat rate.

12

CA Energy Consulting

Rating: Low

Notes: Within each TOU pricing period, the bill calculation is simply the metered usage

multiplied by the applicable rate.

Metering Requirements

A time-of-use energy meter is required.

2.6 Day-type TOU rate

Description

A day-type TOU rate allows TOU rates to vary with expected system conditions. For

example, the rate may consist of three sets of summer TOU rates (we use a standard TOU

rate for the non-summer months):

• "Red", or high rates that apply to a maximum of 5 summer non-holiday weekdays;

• "Yellow", or medium rates that apply to a maximum of 15 summer non-holiday

days; and

• "Green", or low rates that apply to the remaining summer days.

Customers are provided with the green, yellow, and red TOU rates at the beginning of the

year or season, but do not know ahead of time which of the three sets of rates will be in

effect on a particular day until the preceding afternoon.

This rate structure is an extension of critical peak pricing (CPP), which typically has two

day types: "critical days", in which the peak-period price is very high (sometimes $1 per

kWh or more), and all other days.

Economic Efficiency

Rating: High

Notes: Rates account for variations in electricity costs by hour and day type. Day-type

TOU moves beyond standard TOU rates by better aligning the rates with market conditions

(on a day-ahead basis).

Conservation Incentives

Rating: Low in off-peak hours, higher in peak-hours

Notes: Relative to a flat rate, the incentive to conserve is higher during peak hours and

lower during off-peak hours.

Simplicity / Transparency for Customer

Rating: Low to medium

Notes: In order for a customer to understand how changes in usage affect their bill, the

customer must know the time periods during which rates apply and the applicable rates,

and be prepared to obtain information on the following day’s type, as the schedule of TOU

rates that applies on a particular day changes with day-ahead notice.

Stability in Utility Revenues and Customer Bills

Rating: Medium

13

CA Energy Consulting

Notes: Relative to a flat rate, Day-type TOU rates may increase the variability of utility

revenues and customer bills because of the higher peak-period prices. However, costs are

expected to be higher during those hours as well, so the variability of net revenues may not

increase.

Utility Administrative Costs

Rating: Medium

Notes: The utility must develop a protocol for determining the TOU day type for the

following day and communicating that information to its customers. Also, three sets of

rates must be designed.

Metering Requirements

An interval meter is required.

3. Rate Design Methodology

3.1 Prepare customer usage data

KCP&L and Westar provided us with 2007 hourly data from their residential load research

samples. Midwest does not have a load research sample, and instead provided us with

2009 monthly billing data for its residential customers. We examined the usage data to

ensure that they provided a reasonable basis for bill comparisons under the potential

alternative rate designs. In some cases for the hourly customer data, we could "clean" a

relatively small number of observations (i.e., to remove data missing because of service

outages or metering error) and retain the customer's data. In other cases, we excluded the

customer's data entirely, typically because it appeared that the customer closed its account

during the sample timeframe.

Table 3.1 provides a summary of the number of customers for whom we received data and

the number of those customers that we retained for the analysis, for each utility. For

Midwest, we used only M system, regular residential schedule customers. For KCP&L and

Westar, we used the utility-provided sample weights to ensure that each customer was

given the proper weight in the study. 8

8

For example, utilities often over-sample high-use customers in their load research samples, to ensure that

their profile is represented in the limited number interval data that can be obtained. When using the data to

calculate a class load profile, these over-sampled customers are given less weight than other customers to

ensure that the profile properly represents the average class usage pattern.

14

CA Energy Consulting

Table 3.1: Number of Customers used in the Analysis, by Utility

Utility

KCP&L

Westar

Midwest

# of Customers in

Raw Data

105

114

4,532

# of Customers Retained

for the Analysis

95

87

3,620

3.2 Rate design summary

The rates within the alternative structures are set to produce the same total revenue as the

existing base residential rate (in Section 2.1) for the available sample customers.

Therefore, the first step in the rate design process is to calculate the total revenue

(accounting for the sample weights) from the base residential rate. The assumptions used

when setting the rates are a) all customers are on the rate (i.e., there is no customer

selection issue), and b) the historical load profiles are retained (i.e., we ignore the potential

effect of demand response on customers’ usage and bills).

3.2.1 Flat rate

The flat rate is comparatively easy to set: we simply solve for the single rate that provides

the same revenue as the base residential rate at the historical usage level. We set the

customer charge at its level in the base residential rate. Table 3.2 summarizes the flat rates

that were set for each utility. 9

Table 3.2: Flat Rate ($/kWh), by Utility

Utility

KCP&L

Westar

Midwest

Flat Rate ($/kWh)

$0.08570

$0.06779

$0.08595

3.2.2 Straight-fixed variable rate

Two steps are required to set the SFV rate. First, we use cost-of-service information to

obtain the amount of fixed costs per customer, which is then converted into a monthly

customer charge. 10 Given the revenue implied by this customer charge, we then solve for

the flat energy price that produces the same amount of total revenue (based on the sampleweighted average bill from the load research sample for KCP&L and Westar) as the base

rate. Table 3.3 summarizes the SFV rates that were set for each utility.

9

The Westar rate assumes that no customers are on the Peak Management rate. If the appropriate customers

are billed on the Peak Management rate (i.e., the customer is in the load research sample and is on the Peak

Management rate), the flat rate goes down to $0.06498.

10

It would be quite easy for us to update the results if the utilities believe that a different customer charge is

required to recover all fixed costs.

15

CA Energy Consulting

Table 3.3: SFV Rates, by Utility

Utility

KCP&L

Westar

Midwest

Customer Charge

($ per cust-mo.)

$19.72

$25.00

$26.21

Flat Rate ($/kWh)

$0.07578

$0.05198

$0.06921

3.2.3 Inclining block rate

To create the Inclining Block Rates (IBR), we examined the distribution of monthly usage

amounts for residential customers. We allow for three block prices in each season. The

thresholds were established using the distribution of customer monthly usage values in

2007 for Westar and KCP&L and 2009 for Midwest. Within each season, we attempted to

set the thresholds such that approximately one-third of the customers fall into each category

(e.g., one-third of the customers have monthly usage that reaches into the second block).

The block rates were set to be revenue neutral within season, where the first block price is

10% lower than the second block price, and the third block price is 25% higher than the

second block price. While somewhat arbitrary, these relationships between block prices

reflect the goal of increasing the customer-level incentive to conserve, at least for

customers who are exposed to the higher block prices. The resulting block definitions and

revenue neutral rates for each utility are shown in Tables 3.4 through 3.6.

Table 3.4: Inclining Block Definitions and Prices ($/kWh), KCP&L

Block Description

Block Definition

Summer First

Less than 900 kWh

Summer Second

900 kWh to 1,500 kWh

Summer Third

More than 1,500 kWh

Non-summer First

Less than 700 kWh

Non-summer Second 700 kWh to 1,000 kWh

Non-summer Third

More than 1,000 kWh

Rate

$0.07934

$0.08816

$0.11020

$0.07591

$0.08435

$0.10543

Table 3.5: Inclining Block Definitions and Prices ($/kWh), Westar

Block Description

Block Definition

Summer First

Less than 1,200 kWh

Summer Second

1,200 kWh to 1,800 kWh

Summer Third

More than 1,800 kWh

Non-summer First

Less than 600 kWh

Non-summer Second 600 kWh to 1,000 kWh

Non-summer Third

More than 1,000 kWh

16

Rate

$0.06736

$0.07485

$0.09356

$0.05518

$0.06132

$0.07665

CA Energy Consulting

Table 3.6: Inclining Block Definitions and Prices ($/kWh), Midwest

Block Description

Block Definition

Summer First

Less than 800 kWh

Summer Second

800 kWh to 1,300 kWh

Summer Third

More than 1,300 kWh

Non-summer First

Less than 500 kWh

Non-summer Second 500 kWh to 800 kWh

Non-summer Third

More than 800 kWh

Rate

$0.08211

$0.09123

$0.11404

$0.07668

$0.08520

$0.10649

An alternative, and possibly more effective, method for defining block sizes is to make

them customer specific, based on each customer’s historical usage levels. This method is

currently being tested in a residential pilot program at Commonwealth Edison. While it is

administratively more complicated, this method has the potential to provide every customer

with an increased incentive to reduce usage (relative to current or flat rates), while

maintaining revenue neutrality for all customers at their historical usage pattern. Under

“standard” inclining block pricing (in which everyone has the same block definitions), lowuse customers are likely to experience reductions in their incentive to conserve and their

bills decrease. In contrast, high-use customers are likely to experience bill increases, along

with greater incentives to conserve. We do not explicitly analyze IBR with customerspecific blocks in this study, but we may examine them in greater depth if there is sufficient

interest from the stakeholders.

3.2.4 Time-of-use rate

We set TOU rates for KCP&L and Westar. The lack of hourly load data at Midwest left us

unable to examine time-differentiated rates for their residential customers.

Under the assumption that TOU rates should reflect expected differences in marginal costs

by time period, and that wholesale market prices signal those marginal costs, we used 2007

hourly data on Southwest Power Pool (SPP) prices in the design of TOU rates. We

combined that data with the load research sample data to determine the TOU seasons,

pricing periods, and price ratios across pricing periods. The goal is to create pricing

periods that contain hours that are most alike in terms of marginal costs (e.g., hours of high

costs and low costs), and therefore produce peak to off-peak price ratios that reflect the

greatest difference between costs by time period. We set the summer season to be May

through September and the non-summer season to be all other months. During the summer

season, the peak hours are from 11:00 a.m. to 7:00 p.m. During the non-summer season,

the peak hours are from 6 a.m. to 10 p.m. Weekends and holidays have the same TOU

pricing periods as non-holiday weekdays. Note that these are broader peak periods than we

prefer to select, particularly in the non-summer months. While the periods match the

patterns of the SPP data, broad peak periods have the disadvantage of reducing the

customers’ ability to reduce peak load and/or shift load to off-peak hours.

As with the other rates, we set the TOU rates to be revenue neutral to the base rate (prior to

any demand response). To do this, we assumed that the price ratios across TOU pricing

periods equal the ratio of SPP prices across pricing periods (using 2007 SPP data). We

17

CA Energy Consulting

then solved for the set of rates (given the ratios) that obtains revenue neutrality. 11 Tables

3.7 and 3.8 show the resulting TOU rates for each utility.

Table 3.7: TOU Periods and Prices ($/kWh), KCP&L

TOU Pricing Period

Summer Peak

Summer Off-peak

Non-summer Peak

Non-summer Off-peak

Hours

11 a.m. to 7 p.m.

7 p.m. to 11 a.m.

6 a.m. to 10 p.m.

10 p.m. to 6 a.m.

Rate

$0.11135

$0.07134

$0.09362

$0.05849

Table 3.8: TOU Periods and Prices ($/kWh), Westar

TOU Pricing Period

Summer Peak

Summer Off-peak

Non-summer Peak

Non-summer Off-peak

Hours

11 a.m. to 7 p.m.

7 p.m. to 11 a.m.

6 a.m. to 10 p.m.

10 p.m. to 6 a.m.

Rate

$0.08777

$0.05648

$0.07422

$0.04617

3.2.5 Day-type TOU rate

Day-type TOU rates allow prices to vary with day-ahead notice during the summer months,

and therefore better reflect wholesale costs, particularly on the relatively few high-load and

high-cost days during the summer. The non-summer TOU rates and all peak and off-peak

hour definitions are identical to the values presented in Section 3.2.4. Three sets of TOU

rates are set:

• "Red", or high rates, which apply on up to five summer days;

• "Yellow", or moderate rates, which apply on up to fifteen summer days; and

• "Green", or low rates, which apply on all of the remaining summer days.

The day types were set using SPP prices, where the five highest-price (defined as the

average peak-period price) weekdays are defined as "Red", the next fifteen highest-price

weekdays are defined as "Yellow", and the remaining days are defined as "Green".

The 2007 SPP prices that we used are not high enough (even on the highest-price days) to

create a significant amount of differentiation between the prices on the different day types,

as might be seen in some years. Therefore, to illustrate a price structure more reflective of

a wider distribution of wholesale prices, we have set the Red and Yellow prices to

relatively high levels and high ratios of peak to off-peak prices (compared to 2007 values),

and solved for the Green prices that obtain revenue neutrality to the base residential rates.

The Green prices are set using the peak to off-peak price ratio observed in the SPP prices

for the Green days. Tables 3.9 and 3.10 contain the summer day-type TOU prices for

KCP&L and Westar, respectively. 12

11

This is not the only method that can be used to create revenue neutral TOU rates. For example, the peak

rate could be set at the expected market marginal cost with the off-peak rate set to obtain revenue neutrality.

12

Utilities in some states have developed rates similar to day-type TOU (e.g., critical-peak pricing, or CPP) in

which peak prices on “critical” days include an allocation of avoided capacity costs as well as energy costs,

thus resulting in substantially higher critical-day peak prices, on the order of $1.00/kWh or more.

18

CA Energy Consulting

Table 3.9: Day-type TOU Prices by Day Type ($/kWh), KCP&L

Day Type

Peak

Off-peak

Red (5 days)

$0.24000 $0.08000

Yellow (15 days)

$0.15000 $0.07500

Green (all other days) $0.10284 $0.06745

Table 3.10: Day-type TOU Prices by Day Type ($/kWh), Westar

Day Type

Peak

Off-peak

Red (5 days)

$0.24000 $0.08000

Yellow (15 days)

$0.15000 $0.07500

Green (all other days) $0.07538 $0.04967

4. Bill Impacts

For each of the rate structures, we calculated customer-level bills using the available

customer-level load data, the "base" residential rates, and each of the rates described in

Section 3. We then calculated bill impacts at the customers’ historical usage patterns,

before accounting for any possible modification in customers’ load profiles in response to

the new price signals.

The bill impacts are displayed as scatter plots against each customer's average monthly

usage (in kWh). This allows for an easy examination of both the range of magnitude of the

bill impacts, as well as how the bill impacts vary with customer usage. For some of the

rate structures, such as IBR or SFV, the bill impacts are strongly related to customer usage.

For others, such as TOU, this is not the case, as bill impacts are related to differences in

percentage of usage in peak periods.

The relationship between bill impacts and customer usage may be of interest because

customer usage is often equated with customer income levels, where smaller customers are

believed to have lower income levels. Therefore, bill impacts that adversely affect low-use

customers are believed to reflect adverse outcomes for low-income customers. Utilities

typically do not have customer income data, so it is not a straightforward exercise to

determine whether this relationship between income and usage actually exists. However,

some studies have attempted to make use of Census data to explore the link between usage

and income. One example is a recent article that examined the redistribution of income

that occurs under inclining block rates. 13 We could consider implementing a similar

analysis as an extension of this work if there is sufficient interest from the stakeholders.

The sub-sections below present bill impacts for each utility's residential customers, ordered

by rate structure.

4.1 Flat rate

Figures 4.1 through 4.4 show the customer-level bill impacts for the flat rates shown in

Table 3.2. For KCP&L (shown in Figure 4.1), there are four customers who have

13

Borenstein, Severin. "The Redistributional Impact of Non-Linear Electricity Pricing", Energy Institute at

Haas Working Paper Series, March 2010.

19

CA Energy Consulting

significantly higher bill impacts than the other customers (i.e., approximately 10 percent,

where the bill impact for majority of customers is between +/- 2 percent). These customers

are on the space heating rate, which offers lower winter rates than the standard residential

rate. Because one flat rate is set to apply to all of the residential customers, the space

heating customers experience a more adverse bill impact than the others.

Figure 4.1: Percentage Flat Rate Bill Impacts, KCP&L

12.0%

10.0%

% Flat Rate Bill Impact

8.0%

6.0%

4.0%

2.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

-2.0%

-4.0%

Avg Monthly kWh

A similar situation is present for Westar, shown in Figure 4.2. In this case, ten of the load

research sample customers are on the Peak Management Rate, which contains a single

energy price and a demand charge. The average price on this rate is significantly below the

average price on the standard residential rate, so these customers experience a large bill

increase when they are migrated to the flat rate. Because these customers are such outliers

relative to the standard residential customers, for the remainder of the analysis we treat

them as standard rate customers, and calculate their base bills at the standard rate. This is

shown in Figure 4.3.

20

CA Energy Consulting

Figure 4.2: Percentage Flat Rate Bill Impacts, Westar with Peak Management

35.0%

30.0%

25.0%

15.0%

10.0%

5.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-5.0%

-10.0%

-15.0%

Average Monthly kWh

Figure 4.3: Percentage Flat Rate Bill Impacts, Westar

12.0%

10.0%

8.0%

6.0%

% Flat Rate Bill Impact

% Flat Rate Bill Impact

20.0%

4.0%

2.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-2.0%

-4.0%

-6.0%

-8.0%

Average Monthly kWh

21

CA Energy Consulting

Figure 4.4 shows the bill impacts for Midwest's residential customers. Notice that data for

many more customers are available (because we use billing data and not hourly data),

which may provide a more complete picture of the distribution of bill impacts.

Figure 4.4: Percentage Flat Rate Bill Impacts, Midwest

10.0%

8.0%

% Flat Rate Bill Impact

6.0%

4.0%

2.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

-2.0%

-4.0%

Average Monthly kWh

For Midwest, the bill impacts are strongly related to customer size, with bill decreases for

small customers and bill increases for large customers. This is because Midwest's base

residential rate has a declining block structure in nine of the twelve months of the year, and

the tail block rate is 1.3 cents/kWh lower than the rate in the first block. This effect is not

as pronounced for KCP&L and Westar. For KCP&L most of the customers are on a rate

that has seasonal differentiation with a declining block in the winter months, but the

magnitude of the decline is trivial ($0.00034 per kWh). For Westar, the effect of the

declining block rates in the winter months is offset by the use of inclining block rates in the

summer months.

4.2 Straight fixed variable rate

Figures 4.5 through 4.7 show the bill impacts for straight fixed variables rates in Table 3.3.

These have the same structure as the flat rates presented in Section 4.1, but with higher

customer charges set to cover all fixed costs. The basic story is the same for all three

utilities: because of the increase in the customer charge, low-use customers experience bill

increases and high-use customers experience bill decreases. The magnitude of the bill

increases for low-use customers varies somewhat across utilities. One way to quantify this

22

CA Energy Consulting

is the share of customers who experience a bill increase of more than 20 percent, which is

20 percent for Westar, 9.4 percent for Midwest, and 3.2 percent for KCP&L. 14

While Westar has the highest share of customers who experience an especially adverse bill

impact, it also has the highest share of customers who experience significant bill reductions

on SFV. Approximately 6 percent of Westar's customers experience more than a 10

percent bill decrease on SFV. In contrast, none of KCP&L's customers and only 0.4

percent of Midwest's customers achieve that level of bill reduction on SFV. 15

Figure 4.5: Percentage SFV Rate Bill Impacts, KCP&L

60.0%

50.0%

40.0%

% SFV Bill Impact

30.0%

20.0%

10.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

-10.0%

-20.0%

Average Monthly kWh

14

The shares are calculated using the customer sample weights, as opposed to simply using the share of

customers in the available sample.

15

We are aware of a few utilities that have attempted to reduce the adverse effect of higher customer charges

on low-use customers by instituting a graduated customer charge, on the theory that the amount of fixed costs

that customers cause the utility to incur are related to their usage level.

23

CA Energy Consulting

Figure 4.6: Percentage SFV Rate Bill Impacts, Westar

100.0%

80.0%

% SFV Bill Impact

60.0%

40.0%

20.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-20.0%

-40.0%

Average Monthly kWh

Figure 4.7: Percentage SFV Rate Bill Impacts, Midwest

100.0%

80.0%

% SFV Bill Impact

60.0%

40.0%

20.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

-20.0%

Average Monthly kWh

24

CA Energy Consulting

4.3 Inclining block rates

The bill impacts associated with the inclining block rates introduced in Tables 3.4 through

3.6 are shown in Figures 4.8 through 4.10. IBR, in which the rate increases with the usage

level, produces bill impacts that benefit low-use customers at the expense of high-use

customers. This is the opposite of the effect of SFV rates.

Figure 4.8: Percentage IBR Bill Impacts, KCP&L

25.0%

20.0%

% IBR Bill Impact

15.0%

10.0%

5.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

-5.0%

-10.0%

Average Monthly kWh

25

CA Energy Consulting

Figure 4.9: Percentage IBR Bill Impacts, Westar

20.0%

15.0%

% IBR Bill Impact

10.0%

5.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-5.0%

-10.0%

Average Monthly kWh

Figure 4.10: Percentage IBR Bill Impacts, Midwest

35.0%

30.0%

25.0%

% IBR Bill Impact

20.0%

15.0%

10.0%

5.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

4,500

5,000

-5.0%

-10.0%

-15.0%

Average Monthly kWh

The distribution of the percentage bill impacts is similar for the three utilities. Table 4.1

shows the share of customers on the high and low end of the bill impacts. Across all three

26

CA Energy Consulting

utilities, approximately five percent of the customers experience a bill increase of at least

ten percent on IBR (these are the large customers), while 40 to 50 percent of the customers

experience at least a five percent decrease (these are low-use customers).

Table 4.1: Share of High and Low Bill Impacts, by Utility

Utility

Share with 10% or higher Share with -5% or lower

KCP&L

4.9%

45.8%

Westar

5.6%

42.1%

Midwest

6.0%

50.0%

The "break-even" usage level (where the bill impact is zero) is approximately 1,500 kWh

per month for KCP&L and Westar and 1,000 kWh per month for Midwest.

4.4 IBR and SFV

It is useful to note that the alternative rate structures are not mutually exclusive. For

example, we can combine the SFV and IBR structures by simply increasing the customer

charge on IBR and re-calculating the rates to obtain revenue neutrality. This is an

intuitively appealing combination because of the potential for offsetting bill impacts. For

example, SFV tends to increase bills for low-use customers while IBR tends to reduce

them.

Figures 4.11 through 4.13 show the resulting bill impacts of a combined SFV/IBR rate.

The results indicate that the SFV bill impacts "dominate" the IBR bill impacts for low-use

customers. That is, for low-use customers, the higher customer charge produces larger

effects than the reduction in the initial block price.

Interestingly, for KCP&L and Midwest, the combination of SFV and IBR also produces

adverse bill impacts for the largest customers. The "middle class" of customers, with usage

ranging from approximately 750 to 1,500 kWh per month, tends to benefit from this

combination of rate structures.

27

CA Energy Consulting

Figure 4.11: Percentage IBR+SFV Bill Impacts, KCP&L

50.0%

40.0%

% IBR + SFV Bill Impact

30.0%

20.0%

10.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

-10.0%

Average Monthly kWh

Figure 4.12: Percentage IBR+SFV Bill Impacts, Westar

100.0%

80.0%

% IBR + SFV Bill Impact

60.0%

40.0%

20.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-20.0%

-40.0%

Average Monthly kWh

28

CA Energy Consulting

Figure 4.13: Percentage IBR+SFV Bill Impacts, Midwest

100.0%

80.0%

% SFV + IBR Bill Impact

60.0%

40.0%

20.0%

0.0%

0

500

1,000

1,500

2,500

2,000

3,000

3,500

4,000

4,500

5,000

-20.0%

Average Monthly kWh

4.5 Time-of-use rates

The bill impacts associated with the TOU rates in Tables 3.7 and 3.8 are shown in Figures

4.14 and 4.15. Note that we cannot analyze TOU rates for Midwest because they do not

have the hourly usage data required to bill the rate (i.e., to obtain sales by pricing period).

The bill impacts associated with TOU rates are related to the timing of a customer's usage

(e.g., the share of usage that is in peak hours) rather than the amount of the customer's

usage, as is the case for SFV and IBR. The distributions of bill impacts in the figures

reflect this difference, showing no strong relationship between bill impacts and customer

usage levels.

The magnitude of the bill impacts for TOU rates is lower than we observed for SFV and

IBR. The vast majority of the bill impacts are within +/- 5 percent, with 98 percent of

KCP&L's customers and 90 percent of Westar's customers falling within that range.

29

CA Energy Consulting

Figure 4.14: Percentage TOU Bill Impacts, KCP&L

16.0%

14.0%

12.0%

10.0%

% TOU Bill Impact

8.0%

6.0%

4.0%

2.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

-2.0%

-4.0%

-6.0%

Average Monthly kWh

Figure 4.15: Percentage TOU Bill Impacts, Westar

8.0%

6.0%

4.0%

% TOU Bill Impact

2.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-2.0%

-4.0%

-6.0%

-8.0%

Average Monthly kWh

4.6 Day-type TOU rates

The bill impacts associated with the day-type TOU rates in Tables 3.9 and 3.10 are shown

in Figures 4.16 and 4.17. As was the case with TOU rates, we are not able to analyze this

rate structure for Midwest.

30

CA Energy Consulting

This rate structure builds upon the TOU rates to provide higher price signals on days in

which the wholesale market prices are the highest. Therefore, a customer's bill impact

(prior to demand response) will depend upon the level of usage on these high-cost days.

Because wholesale market prices are driven by electricity demand, and air conditioning

load is often a significant driver of demand, it is reasonable to suppose that the customers

whose load is most weather dependent will have the most adverse bill impact on day-type

TOU rates (because they tend to use the most on the hottest, highest cost days).

The figures show that, as with TOU rates, the day-type TOU bill impacts are not strongly

related to customer size. In fact, the bill impacts are quite similar to the TOU bill impacts.

The correlation between the TOU and day-type TOU bill impacts is 0.98 for KCP&L and

0.92 for Westar. This indicates that, for the most part, a customer who is helped (or

harmed) by TOU rates will also be helped (or harmed) by day-type TOU rates.

Figure 4.16: Percentage Day-Type TOU Bill Impacts, KCP&L

16.0%

14.0%

12.0%

% Day-Type TOU Bill Impact

10.0%

8.0%

6.0%

4.0%

2.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

-2.0%

-4.0%

-6.0%

Average Monthly kWh

31

CA Energy Consulting

Figure 4.17: Percentage Day-Type TOU Bill Impacts, Westar

12.0%

10.0%

8.0%

% Day-Type TOU Bill Impact

6.0%

4.0%

2.0%

0.0%

0

500

1,000

1,500

2,000

2,500

3,000

3,500

4,000

-2.0%

-4.0%

-6.0%

-8.0%

Average Monthly kWh

4.7 Summary of bill impacts

Tables 4.2 through 4.4 provide information that summarizes the figures presented in the

previous sub-sections. Four statistics are provided for each utility and rate structure:

• The share of customers that experienced a bill increase of 10% or more on the new

rate structure;

• The share of customers that experienced a bill decrease of 10% or more on the new

rate structure;

• The average percentage bill impact for customers who use an average of 500 kWh

per month or less; and

• The average percentage bill impact for customers who use an average of 2,000 kWh

per month or more.

These statistics are intended to facilitate comparisons of bill impacts across rate structures

and utilities. Following are the key observations from these tables:

• The flat, TOU, and day-type TOU rates do not produce large percentage load

impacts for very many customers (as shown in the "Greater than 10% column").

• The bill impacts for the flat, TOU, and day-type TOU rates are not strongly related

to customer usage levels (as illustrated by the similarity of the average bill impacts

in the "Low Use " and "High Use" columns).

• The high customer charge in the SFV rate leads to large bill increases for low-use

customers (e.g., 27.4 percent for KCP&L's low-use customers). The percentage bill

decreases for high-use customers on this rate structure are smaller in magnitude

(e.g., 5.7 percent for KCP&L's high-use customers).

32

CA Energy Consulting

•

Despite the fact that IBR and SFV have opposite effects by customer usage levels,

combining the two rate structures is not enough to offset SFV's adverse bill impacts

for low-use customers.

Table 4.2: Summary of Bill Impacts by Rate Structure, KCP&L

Rate Structure

Flat rate

SFV

IBR

IBR + SFV

TOU

Day-type TOU

Share of Customers by Bill

Impact Amount

Greater than

Less than

10%

-10%

1.3%

0.0%

15.1%

0.0%

4.9%

0.0%

3.9%

0.0%

0.3%

0.0%

0.3%

0.0%

Average Bill Impact by Customer Usage

Low Use (<500

kWh/mo.)

0.1%

27.4%

-6.6%

21.2%

-0.5%

-0.5%

High Use (>2,000

kWh/mo.)

0.6%

-5.7%

10.4%

2.6%

-0.2%

-0.5%

Table 4.3: Summary of Bill Impacts by Rate Structure, Westar

Rate Structure

Flat rate

SFV

IBR

IBR + SFV

TOU

Day-type TOU

Share of Customers by Bill

Impact Amount

Greater than

Less than

10%

-10%

0.0%

0.0%

35.9%

6.6%

5.6%

0.0%

28.8%

0.0%

0.0%

0.0%

0.0%

0.0%

Average Bill Impact by Customer Usage

Low Use (<500

kWh/mo.)

-0.1%

46.6%

-1.5%

42.2%

0.1%

1.4%

High Use (>2,000

kWh/mo.)

2.6%

-10.1%

8.9%

-4.8%

1.9%

1.5%

Table 4.4: Summary of Bill Impacts by Rate Structure, Midwest

Rate Structure

Flat rate

SFV

IBR

IBR + SFV

Share of Customers by Bill

Impact Amount

Greater than

Less than

10%

-10%

0.0%

0.0%

19.5%

0.4%

6.0%

0.0%

13.7%

0.0%

Average Bill Impact by Customer Usage

Low Use (<500

kWh/mo.)

-2.2%

20.7%

-7.3%

16.7%

High Use (>2,000

kWh/mo.)

3.9%

-8.8%

17.9%

1.9%

5. Load Response