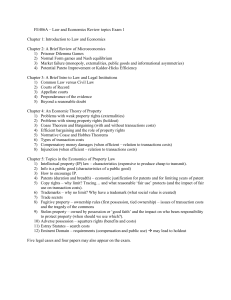

INTRODUCTION

advertisement