PLANNING ASSISTANCE SCAN OF EXTERNAL

ScanRCCD 1 CMcIntyre, 01/05

Computer-Aided Planning (CAP)

1721 Eastern Ave, Sacramento CA 95864

916-489-9273

PLANNING

ASSISTANCE

FOR

REDWOODS

COMMUNITY

COLLEGE

DISTRICT

SCAN OF

EXTERNAL

CONDITIONS

Chuck McIntyre

January 2005

ScanRCCD 2 CMcIntyre, 01/05

PLANNING ASSISTANCE

REDWOODS COMMUNITY COLLEGE DISTRICT

SCAN OF EXTERNAL CONDITIONS

Introduction

Demographics

3

4

8

9

Culture and Environment

Public Policy

Educational Policy, Practices, and Trends

Community Commentary

Common Conditions

Del Norte

Humboldt

Mendocino

Appendix

12

13

15

16

17

18

20

21

24

ScanRCCD 3 CMcIntyre, 01/05

PLANNING ASSISTANCE

REDWOODS COMMUNITY COLLEGE DISTRICT

SCAN OF EXTERNAL CONDITIONS

INTRODUCTION

This is one of three papers from a study designed to provide planning assistance to

College of the Redwoods (CR). Findings, observations and suggestions here draw from and provide input to the other two papers:

District Service Evaluation

Planning Implications and while this paper is based on data and information provided by CR staff and derived from other sources, along with extensive review of the research with CR staff and community, the content is solely the responsibility of the contractor and paper’s author,

Chuck McIntyre.

Strategic planning begins with a look at where CR is now: an evaluation of how well it serves its communities, performing its stated mission and carrying out its vision, philosophy, and values. The evaluation uses as its benchmark CR’s 2004-07 Strategic

Plan – statements of mission, vision, values and the strategic plan drivers of access, curriculum, economic vitality, inclusiveness, diversity, and outreach/marketing.

This “scan” complements that evaluation by reviewing the environment external to the

College of the Redwoods (CR) and covers events, trends and likely futures relevant to

CR planning – mostly, but not entirely, along the North Coast – for the following categories:

Demographics

Economics and Jobs

Culture and Environment

Public Policy

Educational Policies, Practices, and Trends

Community Commentary

Few can predict the future confidently, what with the wild cards or unforeseen events that seem to take place with increasing frequency. To handle this problem, as CR attempts to plan its future, it should be useful to work with several plausible scenarios, subjecting them to scrutiny and building iterations until one or more may be used to develop long-

ScanRCCD 4 CMcIntyre, 01/05 term solutions. The scenarios for such planning can be derived and written in large part from information contained in this scan.

DEMOGRAPHICS

Estimated population trends along the North Coast (NC) provide CR with a picture of its potential student markets or niches. The future enrollment of those students depends on

CR policies and practices.

The North Coast (NC) will experience an increased rate of population growth this decade, but may still be less than ½ that of California (Charts A and B).

After a modest 0.4% annual population increase between 1995 and 2002, the North

Coast (counties of Del Norte, Humboldt, and Mendocino) may double its prior growth rate to nearly 1% (up to 2,000 persons) per year, through 2010.

This North Coast (NC) growth rate equals that expected for the San Francisco Bay

Area (SFBA), but may be less than half that expected for the rest of California.

Over the past decade, the NC has grown from equal parts of natural increase (births less deaths) and migration – in contrast to other regions of California (Chart A).

Domestic migration has comprised a large part (1/3) of the NC’s growth since 1990, as it has for other areas of northern California (except the SFBA).

Since 1990, foreign migration has made up more than ½ of California’s total growth, while domestic migration has been negative (116,000 left CA yearly).

•

Unlike central and southern California, 4/5 of the NC’s population is Non-Hispanic

White. Like the rest of California, however, most current and future NC growth will be among people of color, with Whites decreasing in number (Charts A and B).

The NC is similar to other regions north of Sacramento, but different from areas south of Sacramento where people of color make up more than ½ of the population.

Compared to California generally, the NC has relatively more: Whites

American Indians (5% vs. 1% in CA) less: Hispanics

Asians

Blacks (1% vs. 7%)

Most NC growth through 2020 is projected for

ScanRCCD 5 CMcIntyre, 01/05

American Indians + 6,200

Persons of >1 race + 3,600 (Whites decline by – 6,000)

By contrast, the greatest growth statewide will be among Hispanics and Blacks;

Hispanics will outnumber Non-Hispanic Whites in California by 2011.

While the NC has grown by 2,500 in each of the past two years, this rate is expected to slow to around 1,500 (each year, on average) between now and 2020 (Charts C and

D).

During this decade (2000-2010), Mendocino County is projected to exhibit the largest

NC growth, then slow to equal that of Humboldt between 2010 and 2020:

Projected Population Change per Year

Del Norte

Humboldt

Mendocino

2000-2010 2010-2020

147

596

745

164

638

636

Through 2020, growth in Hispanics will be largest in Mendocino (+12,600); growth in American Indians will be largest in Humboldt (+3,600). The number of Whites will decline in both counties, but be stable in Del Norte.

The proportions of Asians, Pacific Islanders, Blacks and persons of >1 race will change little on the NC.

Half of the NC population lives outside the area’s 12 major incorporated cities and

2/3 of recent growth has taken place outside.

Largest city growth is reported in Eureka and Fortuna in 2002 and in Crescent City,

Fortuna (again), and Arcata in 2003.

California’s population growth in the 1990s was primarily among

K-12 school ages 5-19

Baby boomers ages 35-54

Growth this decade (2000-2010) is mostly among

College ages 15-24 (20% increase)

Baby boomers, now 45-64 (39% increase) least among

Youngest, ages 0-14

Maturing young adults, ages 25-44 (Chart E).

ScanRCCD 6 CMcIntyre, 01/05

With the NC’s growth typically made up of migrants (5/10 vs. California’s 3/10), it is reasonable to expect the NC’s growth to be greater (less) among older (younger) age groups. (See Figure 1, Chart E2, and the NC high school graduation projections below.)

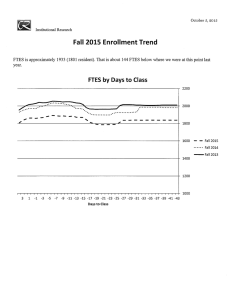

Figure 1. Growth Rates by Age Group, North Coast and California,

2000-10 and 2010-20

0.3

0.25

0.2

0.15

0.1

0.05

0

-0.05

0.45

0.4

0.35

<25 25-54 55+ Total <25 25-54 55+ Total

NC

CA

-0.1

It is estimated by DOF that during the decade 2000-10, population change by age group along the North Coast will be:

<25 years of age

- 5,000

+ 800

Trends in NC high school graduates mirrored those of California until 2001 when the former peaked and the latter continued increasing – to peak in 2011 or beyond

(Charts F and G).

If high school graduates in the NC continued to mirror those of California, NC graduates would currently number 3,200, 500 (1/5) higher than estimated for 2004.

By 2012, this disparity grows to 1,600 or 2/3).

Current declines in NC high school graduates through 2010 are largely in Humboldt and Mendocino Counties, while Del Norte graduates are declining somewhat less.

ScanRCCD 7 CMcIntyre, 01/05

Mendocino high school graduates turn up in 2011, while Humboldt and Del Norte graduates may continue downward at that time.

ECONOMICS AND JOBS

Economic cycles are important to CR planning largely because of:

•

Enrollment at CR : as the North Coast economy improves (declines) and individuals in the labor market work (need retraining), CR enrollment typically falls (rises), other things being equal.

•

Curriculum at CR : development of the regional North Coast economy dictates labor market needs, which in turn, suggest useful curriculum change.

•

Funding for CR : as California’s economy improves (declines), state general and local property taxes and CR’s funding rise (fall) with consequent impact on the college’s growth cap and its ability to deliver programs and services.

While key, economic cycles are difficult to forecast and few agents do so for more than one or two years into the future. Consequently, CR long-range planning may best proceed by identifying probable futures and building several plausible socioeconomic scenarios that, in some sense, define what is likely at national, state, and regional levels.

A recent poll of forecasters by the Economist (January 2005) suggests that the modest worldwide recovery from the 2000-02 downturn will slow somewhat in 2005: annual price-adjusted rate of GDP change

U.S.

Euro area

2003 2004 2005

4.8% 4.4% 3.5%

2.0 1.8 1.7

Canada

Japan

Mexico

1.6

4.4

3.9

2.9

3.9

4.4

3.1

1.9

na

While recovery from the 2000-02 downturn has been less robust than other recent recoveries, optimistic analysts argue that the U.S. is in a period of long-term growth – albeit at rates less than those of the late 1990s – to be interrupted only by some event or

“wild card,” like a foreign financial crisis, stock market crash, oil crisis, energy crisis, or other unexpected shock to economic activity – like the September 2001 terrorist attacks on the East Coast. For the long-term economy, the key appears to be how consumers and financial markets react, and are supported by central banks like the U.S. Federal Reserve.

California’s economy is expected (by the State Legislative Analyst) to improve gradually as well, but at rates somewhat lower than experienced in the late 1990s:

ScanRCCD 8 CMcIntyre, 01/05

Personal Income Growth: 2002

2003

1.2%

4.0

2004 5.6

2005 5.8

2006 6.0

North Coast Socioeconomics

Perhaps the most dramatic feature of the North Coast’s socioeconomics is the extent of poverty in the region, much of it outside the few urban areas.

Of the three NC counties, Del Norte has the highest poverty rate – one in every five residents – after a dramatic increase during the 1990s (Chart H).

Poverty rates in Humboldt and Mendocino Counties are only slightly less than Del Norte and the entire NC reports a poverty rate 1/3 higher than that of California and 50% higher than the rest of the U.S.

NC households are largest in Del Norte, smallest in Humboldt and smaller than elsewhere in California (Chart I).

In contrast to other regions of California (except the mountains), average household size in the NC (2.54) is smaller (CA=2.99) and has decreased over the past decade.

NC counties are populated more densely than the Mountain regions, but are similar to the

Valley (north of Sacramento).

Mirroring the poverty figures, median household incomes along the NC are ½ those of the SFBA and about 3/5 of California generally, but are expected to grow at comparable rates over this decade (Chart I).

Modest real (price-adjusted) changes in household income in Del Norte and Humboldt

Counties (Mendocino grew more rapidly) held the NC below northern California growth rates between 1995 and 2002, and substantially below California statewide rates.

The pattern of a lower rate of household income growth in the NC is expected to change during this decade, with the NC increasing by one-fifth, similar to other regions of

California.

Sales in the NC are expected to grow at ½ the rate of California, mirroring the difference in population growth. Humboldt will grow the most, Del Norte the least.

ScanRCCD 9 CMcIntyre, 01/05

North Coast Jobs

While growing at less than the national rate during the 1990s, the California labor market actually weathered the 2000-02 recession better than the nation – jobs dropping just

-0.1% in the state in contrast to –0.5% nationally (Chart J). (The big drop, of course, occurred in the San Francisco Bay Area.) Meanwhile, the North Coast fared better during the downturn, adding nearly 600 jobs (0.7%) in the two years.

Because its industry differs, the NC job profile contrasts markedly to that of California generally (Chart K), with relatively more jobs in: lumber and wood products manufacturing overall services retail trade, like eating and drinking establishments hotels and lodging local government (nearly twice the state average: 19% vs. 11% of all jobs) relatively fewer jobs in: health state government (largely because of Pelican Bay) overall manufacturing wholesale trade finance, insurance and real estate services other than hotel/lodging and health

Nearly half of all Del Norte County jobs are in government: One of every five are at the state-run correctional facility at Pelican Bay and another one in five are in local government, the City of Crescent City and Del Norte County. By contrast, Humboldt and

Mendocino industries are characterized far more by manufacturing (including lumber and wood products that employ 7% of all workers), trade, and finance, though local government similarly accounts for one in five workers in these counties as well.

On average, NC businesses are smaller – by about one-third (9.1 employees vs. a

California-wide average of 13.4 employees) – and nine out of 10 employ fewer than 20 employees (Chart L). (Surprisingly, however, 88% of all businesses in California employ fewer than 20 employees; only 2% employ 100 or more.)

The North Coast entered the recent (2000-02) downturn with an unemployment rate slightly higher than California and the U.S. as a whole (Chart L). As noted above, the downturn was less severe on the NC and the area has fared better during the current modest recovery, led by Mendocino where the unemployment rate has dropped by 13% in the past two years, a substantial improvement.

ScanRCCD 10 CMcIntyre, 01/05

Analysis of employment opportunities/needs in the NC must include those from separations (retirements, deaths, moves and the like) as well as those from the formation of new jobs. For the seven year period, 2001 to 2008 (Chart M): new jobs account for nearly three of ten opportunities separations account for over seven of every ten opportunities

Of these area job opportunities, nearly one of every three rely on skills that may be obtained in programs offered by College of the Redwoods (CR):

Appropriate Openings per year

Training on the North Coast

2001-08

AA/AS/Certificate

505

901

Growth in NC job openings requiring skills and knowledge for which CR trains – AA,

AS, and certificate programs – is estimated at about 3% per year, a rate similar to the job openings that require baccalaureate and higher degrees, but lower than the expected 4% annual rate for those not needing post-secondary education training.

From a different perspective – that of skill and knowledge “clusters” in Figure 2 and

Chart N – the job/career areas for which CR trains that show the largest numeric annual growth are:

300

Figure 2. Annual Job Openings by Skill & Education, North Coast, 2001-08

250

200

150

100

BA/BS+

AA/AS/C

50

0

AG&NR COMPSCI FS&H HLTH M/A/DES S&CS

Source: EDD (2004).

JobsxEducRCCD01-08Sum1

AG&NR

BUS

COMPSCI

EDUC

BA/BS+ AA/AS/C

26 42

186 162

30

183

6

49

FS&H

ENG&R

HLTH

LEGL

18

7

22

2

70

266

146

3

M/A/DES

PUBSEC

S&CS

6

0

28

7

140

17

CMcIntyre, 8/04

ScanRCCD 11 CMcIntyre, 01/05

Engineering and Related

Business

Health

Public Security

Food, Service, and Hospitality

Education

Area job growth requiring baccalaureate and higher degrees is largest in:

Business

Education (teachers)

NC industries using these job/career skills are detailed in Chart O.

Notably, these projections presume that CR may choose to train in such skills as the construction, manufacturing, and institutional maintenance trades; a variety of health care para-professions, local police and fire officials, including officers at the state correctional facility in Pelican Bay, many hospitality and tourism skills, and teacher aids.

The projections include some offsetting considerations: (1) they are slightly high, on the one hand, because they include the job projections for the entire County of Mendocino, a portion of which is served by the Mendocino-Lake Community College, but (2) they

(projections) are slightly low in that they do not include the need for upgrading incumbents in the three of four jobs which do not become open – largely offsetting considerations.

CULTURE AND ENVIRONMENT

The North Coast culture is changing and with modest growth, much of it from immigration of older age cohorts, and continuing change in the industrial base from lumber and fishing to a more diverse mix of firms. As a result, issues about the local environment, transportation and quality of life.

Significant changes in values, lifestyles, family formation, and other factors affecting the quality of life – crime, air and water quality, child care and the like – can be expected as the North Coast grows and as local and regional communities become older and more multi-cultural.

The implications of “virtual” entertainment, wearable or wireless handheld computers, and other such devices are unclear, but students will be entering CR far more conversant

– than ever before – with information technologies and with a greater need to understand not only the mechanics (and electronics), but also the moral and ethical ramifications of technological change.

ScanRCCD 12 CMcIntyre, 01/05

A number of other North Coast conditions and trends are relevant for CR planning:

North Coast will continue to search for a balance between economic development and preservation of the area’s natural environment.

Vehicle emissions account for two-thirds of all air pollutants and they could adversely impact air quality in certain concentrated areas of the North Coast – like the

Humboldt Bay – as traffic increases.

Certain areas of the North Coast are hard to traverse and transportation has become problematic for residents. Some corridors – Highway 101 between Trinidad and

Fortuna, for instance – present time challenges and many east-west roads are in poor condition. Typical estimates for urban areas of California suggest that peak travel times could nearly double over the next 25 even if use of mass transit were to double in overall ridership. Circuitous rural and/or mountainous roads like those accessing the Mendocino Coast also present significant travel time problems.

PUBLIC POLICY

Statewide public policies have weakened California’s infrastructure, with a “backlog” estimated by the Center for the Continuing Study of the California Economy (2002) to be over $100 billion in schools, transportation, water, and public facilities. Transportation, housing and fiscal management are major on-going problems, although a number of federal and local policy issues also are of concern to CR as well:

The North Coast General Plans are undergoing revision in both Mendocino and

Humboldt counties and will outline growth policies for the unincorporated areas.

Disposition of the many zoning and development requests and proposals that follow from these plans will determine much of the North Coast’s future growth and development.

Delays in liberalization of federal immigration policy and changing enforcement of policies may impact North Coast population and subsequent CR enrollment.

While broad-based, State General Fund revenues have been more volatile than the

State’s economy, resulting in the development of a substantial deficit over the past five years. Solutions include reducing the capital gains component of revenues and building reserves and/or funding one-time expenditures during revenue upswings.

The state’s share and overall funding of Proposition 98 funding depends, of course, on deals between the Governor/Legislature and K-12. The community college share of

P98 (CR’s primary operating budget revenue source) is uncertain as a result.

The Governor’s 2005-06 budget proposes $9.1 billion in savings to cover a projected deficit of $8.6 billion. If approved by the Legislature, the LAO estimates that about

ScanRCCD 13 CMcIntyre, 01/05 one-half of these savings would continue, leaving an expected annual General Fund deficit of $5+ billion in 2006-07 and beyond. (If not approved by the Legislature, the

Governor may take the proposals to public election in November 2005.)

Nearly $3 billion of the Governor’s savings results from withholding P98 and STRS payouts. Despite this, California Community Colleges are proposed to receive a 7.5% increase from P98 in 2005-06 to fund:

Cost of living increase (COLA) $196 million (3.93%)

Economic development with K-12 $ 20 million

Budget restoration, based on accountability $ 31 million

Moreover, the budget proposes no increase in CACC student fees (now $26 per unit), but 8% increases (accepted) for UC and CSU undergraduates, along with funds for

2.5% enrollment growth (if it occurs).

Whatever the scenario for P98, State operating budget support for CR is not likely to approach late 1990s levels – for some time – because of the recent revenue downturn and modest economic recovery noted above and because of the long term obligations of the State government for

Energy contracts

Repayment of loans from pension funds

Repayment for bonds used to cover operating deficits

State policies for funding CR will likely continue without significant change, and, if so, the College may need to share and secure operating resources from other sources :

Local partnerships

Foundation activity

Contract and work-site training

Continuing and community education

Development of revenue-raising assets

Federal grants and contracts

Recent passage of a local capital outlay bond measure provides CR with a significant opportunity to fund not only deferred maintenance and other needed facility improvements, but also undertake expansion of its delivery capability.

Passage of a statewide Higher Education capital outlay bond measure in Fall 2002, provides the opportunity for CR to also obtain funding for several capital outlay projects from the State, though this involves a lengthy and laborious proposal and approval process.

ScanRCCD 14 CMcIntyre, 01/05

EDUCATIONAL POLICIES, PRACTICES, AND TRENDS

As concerns about (1) student competencies, (2) proper use of learning technologies, (3) expanding competition, and (4) institutional accountability grow, community colleges confront new challenges and opportunities .

Much recent research and discussion about community college education focuses on: shifting from teaching to learning paradigms longer-term education (interspersed with work) as opposed to shorter-term job training imparting knowledge and meaning, rather than just data and information cooperative or collaborative, rather than competitive, approaches.

Many community colleges are adopting a “learning college” paradigm, which typically embodies, among other things:

Collaboration (within, say, CR and with North Coast communities)

Adequate support for staff development and for applications of technology

Appropriate facilities and equipment: technology infrastructure, active learning rooms, and other support

Attention to assessment: identification and measurement of learning outcomes: needed skills and knowledge

Formation of groups – “comunities” – of learners, both in- and out-of-class

A number of specific external events, trends and studies also are important for CR:

The California Legislature completed work on a new Master Plan for Education in

2002, and legislation has been introduced to implement some of it. Despite a number of reforms in recent years, K-12 expenditures per pupil rank 37 th

in the nation. While most significant reforms in the new Plan are for K-12, other features would alter the balance of state and local management of community colleges. Just how and when – or, indeed, if – such measures will impact CR isn’t yet clear.

More recently, the Governor’s Comprehensive Performance Review (CPR) suggested, among other things, that the California community colleges be reorganized from their position under a relatively independent State Board with little governing authority to becoming part of a larger Department of Education.

Thus far, this proposal has been rejected, but its impact on CR is uncertain in any case.

The number and prior preparation of CR students is problematic. As noted elsewhere, NC demographics will result in the number of high school graduates declining through at least the end of this decade.

ScanRCCD 15 CMcIntyre, 01/05

Disposition of the controversy surrounding concurrent enrollment of K-12 students at community colleges has implications for the way CR connects to its area high schools. In addition, while delayed until 2008, the new high school exit exam is expected to push some students on to CR without having completed high school and, thereby, add to CR basic skill responsibilities.

UC and CSU policies on fees, admissions and remediation will impact the number and kind of future CR enrollments. Recent budget proposals and apparent agreements (the “compact”) suggest that UC and CSU admissions may become more restrictive and fees relatively higher, with the result that relatively more young students – who complete high school – will attend CR.

The activities of other providers (competitors or partners) are of moderate importance to CR, since few exist on the North Coast. Among these providers are (1) other public community colleges and four-year institutions, (2) proprietary institutions, non-profits and agencies (University of Phoenix, Jones International, the U.S.

Military, community-based organizations, and the like), and (3) business and industry (McDonalds, GM, Cisco, Oracle, Harcourt, and others).

COMMUNITY COMMENTARY

As part of the effort in this project to “Refine study of conditions external to the

(Redwoods Community College) District,” or “external scan,” as it is commonly called, meetings were held with groups of community leaders and planners in

Arcata, June 2, 2004

Eureka, June 2, 2004

Crescent City, June 3, 2004

Ft. Bragg, June 4, 2004

These communities span, from north to south, the entire North Coast of California area that is served by the College.

The discussions were informal, but each centered around two basic questions:

How do community leaders and planners see their communities developing demographically, economically and socially?

How does/can College of the Redwoods fit in with/contribute to the positive development of these communities?

Note: The following represents the perceptions of the author (Chuck McIntyre) as derived from the discussions and do not necessarily represent opinions of particular individuals in these communities or at the College of the Redwoods (CR).

ScanRCCD 16 CMcIntyre, 01/05

Common Conditions

While the three communities are widely dispersed geographically – about five hours driving time along the coast from Crescent City in the north to Ft. Bragg in the south – and differ in dramatic ways – demographically, culturally, economically, and physically – they do share some common trends and perceptions:

After some two decades of declines in lumber and fishing industries, the entire North

Coast faces an uncertain economic future.

All three communities (and others along the North Coast) consider recreation and tourism to be a big part of their present and future economies.

Recently, all three areas have experienced rapidly-rising housing prices, such that the

“affordability index” – the percent of local residents whose incomes qualify them for median-priced homes – in each area has dropped to new lows.

It seems that both insufficient supply and rising demand are driving home prices up in each community. Moreover, infrastructure issues are emerging as these communities consider population growth that is currently, in each case, exceeding projections.

Leaders in all three areas are aware of and concerned about the demographic tendency away from age balance because the elderly are entering and the young are leaving the region.

An aging population along the North Coast is leading to expanded health care needs, particularly of a long-term character increasingly delivered to seniors in their homes or in long-term care facilities.

Partnering among public and private agencies is seen generally as essential because local communities and operations are small and are confronted by scale diseconomies.

Leaders all exhibit an enthusiasm for the future of their communities, even given their obvious and sometimes painful awareness of local problems.

And, all leaders are equally enthusiastic about the ability of and need for College of the

Redwoods to be a prominent player in the development of their respective communities.

ScanRCCD 17 CMcIntyre, 01/05

Del Norte

The Area

The area served by CR’s Center in Crescent City seems to extend from the Klamath

River in the South to parts of Trinity County to the east, and southern Oregon to the north, particularly the town of Brookings and Curry County. Community leaders, mostly from the Crescent City area, cite their regional identification more with southern Oregon

– as part of the mythical state of “Jefferson” (once put forth as a separate state) – than as any part of northern California south or east of the Klamath River.

Del Norte County has a population of 21,000, about one-third of which resides in

Crescent City. Prominent in this area are Pelican Bay State Prison and the Elk Valley

Rancheria, whose new casino will add some 500 to 600 local hospitality jobs in 2005-06.

At the south end of the County are clustered the small communities of Klamath, Klamath

Glen and Requa.

From Crescent City, Highway 101 extends north along the Coast through Ft. Dick, Smith

River and Brookings (Oregon), the latter two communities producing 90% of the nation’s

Easter lillies. Despite the lillies, the area is known primarily for its recreational opportunities, scenic vistas, and redwoods. Also from Crescent City, Highway 199 extends northeast into Josephine County, Oregon, home to many vineyards and wineries, and to active theatre in Ashland.

The Area’s Development

Poverty is a major problem – half of Crescent City residents are on Medical and, after years of modest increase, Del Norte reports one of the lowest median household incomes of any County or region in California. This adverse condition is compounded by rapidlyrising housing prices, brought about by strong demand in the face of limited supply of housing, land and infrastructure. Moreover, many new buyers are absentee owners, who contribute little to the area’s vitality. In addition, the area’s ability to provide needed public services – health, housing, and other aids – is constrained by a meager tax base; most of the available property is publicly-owned and, therefore, tax exempt.

Seven of every 10 Del Norte residents are White NonHispanic, compared to 5 of 10 across California. However, during this decade (2000-10), nine of 10 added residents are expected to be people of color, and virtually all added residents during the following decade (2010-20) will be people of color, as the White NonHispanic population stabilizes. Del Norte’s Native American population is increasing and comprises 7% of

County residents – similar to the North Coast areas just to the South in CR’s service area, but quite unlike the rest of California generally (1%).

ScanRCCD 18 CMcIntyre, 01/05

Area Leaders’ Comments

A dozen leaders from Crescent City and surrounding communities met with this

Contractor. These leaders represented civic, education, health, and security agencies, business, a local newspaper, a local Native American rancheria, and Pelican Bay State

Prison. Discussion emphasized the area’s problems and its opportunities, and CR’s local role. Despite the area’s problems, local leaders are extraordinarily bullish about future possibilities and CR’s role.

Problems:

Isolation: being west of the “redwood curtain” and north of the Klamath River

Small size: diseconomies of small scale necessitate collaboration on most efforts

Health: increasing numbers of seniors; also subtle, but significant, local drug use

A high poverty level and lack of affordable housing

Scarce land and infrastructure

Meager tax base

Loss of the traditional local economy: timber and fisheries

Resources and Opportunities:

Prime location for “end of destination” tourism and recreation

A significant global bio-region

Potential leader in sustainable forestry and fisheries

College of the Redwoods’ Role

Leaders feel that CR is a valuable local asset and should serve as a prominent leader/partner in most community initiatives and activities.

Among other contributions suggested for CR:

Train individuals in locally-needed skills:

Health care, especially for “long-term” settings

Hospitality/tourism: managers, operatives, cooks, etc.

Small business/agency skills of all kinds

Senior services

Provide post-secondary education for Pelican Bay inmates

(Surprisingly, efforts by CR to provide continuing education to Pelican Bay staff have proved problematic.)

Partner with local high schools to improve typically-low college-going rates

Help with the training of individuals in public safety and security professions

ScanRCCD 19 CMcIntyre, 01/05

Eureka/Humboldt Bay and County

The Area and Its Development

Humboldt County has relatively fewer people of color than either Del Norte or

Mendocino. But, it will lose NonHispanic Whites during the two decades 2000-2020 and gain mostly people of color, while growing at about 600 total population per year. More than ½ of County population resides in the Humboldt Bay Area, stretching roughly from

McKinleyville south to Fields Landing. And, half is reportedly in incorporated cities,

Eureka the largest at 26,000.

Despite avoiding – to a degree – the 2000-02 downturn, the County reports a median household income below that of Mendocino County, the Mountain region and the

Sacramento Valley, and, amazingly, at just half of San Francisco Bay Area incomes.

County jobs are estimated to grow at about 400 (1%) per year over the rest of this decade, down from 530 per year between 1990 and 2000.

Comments of Area Leaders and Planners

Two meetings were held with more than a dozen leaders and planners from the Humboldt

Bay area, representing education, public and private sectors, civic foundations and other groups. Discussions included a variety of local issues and topics, including CR’s role.

A “big” local issue, like elsewhere on the North Coast, is the rapid increase in Humboldt

Bay area housing prices. A combination of robust demand and inadequate supply are the underlying causes. The quantity and quality (style) of new housing are both concerns, as is the need to work with builders to ensure enough affordable housing.

Other issues on which the leaders feel new thinking is needed include:

Health, given the area’s growth in older age cohorts

Manufacturing, both new and “retooled”

Small business: 80% of businesses in Humboldt County employ nine or fewer

Research and technology: in, say, marine science

Discussions also touch on the needs of a rapidly-growing area Hispanic population.

Settling throughout the area – not just in certain communities like Fortuna – this ethnic group needs particular help in family health planning and personal finance or asset development.

Planners cite the following regional problems as most challenging:

Increasing demand for skilled labor

Transportation difficulties: not only poor east-west roads, but also congestion problems along the main north-south corridor, US 101, at certain times and locations

ScanRCCD 20 CMcIntyre, 01/05

Rising housing costs

High poverty rates

Senior housing, health and education

College of the Redwoods’ Role

Discussion about CR’s role in the community deals largely with the difficulty of delivering education via small scale programs and services, and the need to somehow make such work economically viable by partnering and sharing resources.

Area planners are very positive about several aspects of CR’s operational capabilities:

CR’s flexibility and ability to quickly address evident community educational needs and demand for training in job skills.

CR’s potential as a partner – with local firms and agencies – in the area’s economic development.

Ft. Bragg/Mendocino Coast

The Area

The Mendocino Coast, one of California’s most picturesque, is accessed from the north and south by Highway 1 and from the east by several routes, the largest being Highways

20 and 128 that wind through the redwoods of the Coast Range. Despite its proximity, just two hours north of the Golden Gate bridge, the area is not easy to reach, thereby giving it something of an isolated feel. Access to the Mendocino Coast will likely continue to be an issue for residents and visitors alike.

The greater Ft. Bragg, Noya, Mendocino area – location of CR’s local educational center

– is home to around 16,000 residents, about one in every six of the County’s estimated

90,000 population. More of the County’s population lives east of the Coast Range, and fully two-thirds of its residents are outside incorporated cities. The coast is an arts/tourist area, the interior, east of the Range, more of a ranch/winery area.

The Area’s Development

While population growth during the last two years has not been robust, the Mendocino

County and its Coast are expected to grow more rapidly than the rest of the North Coast – at about 1,100 (1.2%) per year over the balance of this decade. If current and expected trends hold, the County will lose NonHispanic Whites, but gain Hispanics, Native

Americans, Asians and Blacks.

In contrast to Humboldt and Del Norte (where the numbers are declining), Mendocino high school graduates are expected to fluctuate over the rest of this decade. Mendocino

County has a higher median household income than its neighbors to the north. Job growth is estimated at 300 per year between 2002-10, down by one-fourth from the 400

ScanRCCD 21 CMcIntyre, 01/05 created each year between 1990-2000 – similar in percentage change, but less numerically, when compared to Humboldt County to the north.

A 2004 Economic Outlook Conference in Ft. Bragg reviewed area challenges and discussed the need for residents to (1) create a Mendocino Coast identity and (2) engage in public-private partnerships so as to develop effective and sustainable development plans, that build on the area’s natural environment.

Area Leaders’ Comments

A dozen community leaders, representing health, education, business, public and private agencies, and the arts, gathered at CR’s Educational Center in Ft. Bragg on June 4, 2004 for a two-hour discussion of the community’s development and CR’s role in that.

As lumber and fishing have declined and tourism increased, Mendocino County searches for jobs to keep the area, particularly the Mendocino Coast, viable. Key issues include housing, health, small business, tourism, education and the arts.

There has been some local debate about growth-no growth policies. Housing is scarce, but the land and infrastructure are supportive, and water and sewer difficulties are being solved. Interestingly, the community currently faces two unusual opportunities: possible development and use of Georgia-Pacific property (430 acres) and the White property (80 acres north of Ft. Bragg).

The Mendocino Coast’s demographic balance is a concern to local leaders – as the area’s young leave and older, retirees, enter. A related concern is the area’s scarcity of skilled labor, especially in health, tourism/hospitality, and small businesses generally. A major local issue is how to preserve and develop the area’s arts, one of its traditionally positive attributes.

College of the Redwoods’ Role

The continuing demand for skilled health workers, driven by needs of the area’s aging population and high turnover among health practitioners, suggests a prominent role for

CR in this sector. Two-thirds of the area’s health practitioners are licensed, and the majority are recruited statewide; i.e., from outside the area. Most of these positions are within CR’s normal training mission. Local leaders are interested in CR helping the area

“grow its own” health workers, using “career ladders” where, say, local individuals begin their work as Nursing Assistants, with the possibility to train further as Licensed

Vocational Nurses (LVNs), then Registered Nurses (RNs) or via an alternative track of, say, Emergency Medical Technician (EMT), into Paramedic, then into the RN.

Observing that CR is too “eclectic,” one leader suggests that CR needs to focus more on specific “niches.” Despite its older student age profile, the CR Center in Ft. Bragg is not always viewed as adequately meeting the needs of local individuals for continuing

ScanRCCD 22 CMcIntyre, 01/05 education. Nor is CR known as a good (small) business supporter. (An estimated 80% of area business is made up of firms with five or fewer employees.)

Area education, promoted by CR, is thought by several leaders to be the best tool for addressing the problem of area demographic (age) imbalance. More specific “niches” suggested for CR include promotion of the local arts and serving as the local “convener” of educational experiences: forums, symposia, exhibits, conferences, and the like.

The need for local agencies, such as hospital, clinic and resource centers, among others, to partner with CR was discussed. The sharing of resources – between community and college or “town and gown” – is viewed as essential in order to achieve community objectives. Local health officials are especially eager to share resources with the college to support the training efforts noted above.

Also discussed was the need for more connection between CR and local high schools, building “bridge” – type programs, particularly around the senior year. At one time, three of every five high school graduates could graduate and secure local jobs. This, of course, is no longer the case as job skills have steadily increased and the old jobs in lumber, fishing and light manufacturing have all but disappeared.

Finally, while the student population in local K-12 is not increasing, teachers are retiring in large numbers and will need to be replaced. Once again, the need to “grow our own” was expressed, and CR’s role – together with four-year institutions – in that effort emphasized.

ScanRCCD 23

REDWOODS COMMUNITY COLLEGE DISTRICT

SCAN OF EXTERNAL CONDITIONS

APPENDIX

CMcIntyre, 01/05

CHART A

DEMOGRAPHICS OF NORTH COAST AND OTHER CALIFORNIA REGIONS, 1990-2010

CHART A

DEMOGRAPHICS OF NORTH COAST AND CALIFORNIA, 1990-2010

POPULATION in 000s

POPULATION GROWTH

Rate Rate #Ch/Year

Del Norte

Humboldt

Mendocino

North Coast

Mountain Region

Sacramento Valley

Sacramento Region

S.F. Bay Area

California

1995

27.9

125.0

83.8

236.7

380.1

592.2

1,631.8

6,344.7

31,711.0

2002

27.9

127.5

87.9

243.3

406.1

628.5

1,912.5

6,956.0

2010

29.9

133.2

96.9

260.0

456.7

712.2

2,277.0

7,544.9

35,301.0

39,710.0

1995-02

0.0%

0.3%

0.7%

0.4%

0.9%

0.9%

2.3%

1.3%

1.5%

2002-10

0.9%

0.5%

1.2%

0.9%

1.5%

1.6%

2.2%

1.0%

1.5%

2002-10

250

712

1,125

2,088

6,325

10,463

45,563

73,613

551,125

Del Norte

Humboldt

Mendocino

North Coast

Mountain Region

Sacramento Valley

Sacramento Region

S.F. Bay Area

California

POPULATION CHANGE BY SOURCE, 1990-2002 (per Year)

Natural For. Migr. Dom. Migr. Total Migr.

Total Migr/Total

100

400

300

0

100

200

200

200

100

200

300

300

300

700

600

67%

43%

50%

800

900

2,500

13,200

50,300

330,600

300

300

1,700

5,800

500

4,200

2,800

16,100

42,900 -15,300

241,900 -116,400

800

4,500

4,500

21,900

27,600

125,500

1,600

5,400

7,000

35,100

77,900

456,100

50%

83%

64%

62%

35%

28%

Del Norte

Humboldt

Mendocino

North Coast

Mountain Region

Sacramento Valley

Sacramento Region

S.F. Bay Area

California

POPULATION BY ETHNIC GROUP, JULY 2002 (%)

Hispanic NHWhite Black Asian+

14%

6%

71%

82%

4%

1%

8%

7%

16%

12%

9%

76%

78%

84%

1%

1%

2%

5%

6%

3%

15%

17%

20%

34%

75%

62%

49%

46%

1%

7%

7%

6%

6%

11%

21%

12%

>1Race

3%

3%

2%

3%

2%

3%

3%

3%

2%

Del Norte

Humboldt

Mendocino

North Coast

Mountain Region

Sacramento Valley

Sacramento Region

S.F. Bay Area

California

POPULATION CHANGE BY ETHNIC GROUP, 2000-02 (per Year)

Hispanic NHWhite Black Asian+ >1Race

100

500

750

1,350

0

-100

-150

-250

0

50

0

50

-100

-450

-150

-700

0

350

0

350

1,700

5,000

21,900

42,200

485,200

3,050

5,200

23,150

-46,600

-13,800

150

250

5,400

-4,400

18,600

-500

-200

10,600

49,000

122,750

50

950

5,550

4,300

9,450

Total

0

350

450

800

4,450

11,200

66,600

44,500

622,200

Source: CCSCE (2003).

CMcIntyre, PopChgxReg90-10

90%

80%

70%

60%

50%

40%

30%

20%

10%

0%

CHART B. POPULATION CHANGE, NORTH COAST AND CALIFORNIA,

BY RACE AND ETHNICITY, 2000-2020

2000 2000

%

NORTH COAST

NH White

Hispanic

Asian

Pacific Islander

Black

American Indian

Multirace

Total

188,709 78%

26,878 11%

3,882 2%

392 0%

2,834 1%

12,093 5%

6,889 3%

241,677 100%

2010

186,482

36,968

4,754

435

3,448

15,700

8,775

2000-10

Chg.

872

43

614

3,607

1,886

%Chg.

-2,227 -1.2%

10,090 37.5%

22.5%

11.0%

21.7%

29.8%

27.4%

256,562 14,885 6.2%

2020

182,822

47,906

6,188

455

4,826

18,310

10,440

2010-20 2020

Chg.

%Chg.

%

-3,660 -2.0% 67%

10,938 29.6% 18%

1,434 30.2%

20 4.6%

1,378 40.0%

2,610 16.6%

1,665 19.0%

2%

0%

2%

7%

4%

270,947 14,385 5.6% 100%

CALIFORNIA

NH White 16,047,989 47% 15,377,948 -670,041 -4.2% 14,757,146 -620,802 -4.0% 34%

Hispanic 11,082,985 33% 15,181,594 4,098,609 37.0% 18,877,590 3,695,996 24.3% 43%

Asian 3,746,292 11% 4,713,693 967,401 25.8% 5,565,651 851,958 18.1% 13%

Pacific Islander 111,200 0.3% 151,365 40,165 36.1% 184,457 33,092 21.9% 0%

Black 2,222,816 7% 2,628,971 406,155 18.3% 2,935,929 306,958 11.7% 7%

American Indian 192,753 1% 398,048 205,295 106.5% 615,393 217,345 54.6% 1%

Multirace 639,163 2% 795,148 155,985 24.4% 915,575 120,427 15.1% 2%

Total 34,043,198 100% 39,246,767 5,203,569 15.3% 43,851,741 4,604,974 11.7% 100%

Race and Ethnic Percentages, North Coast and California, 2000

NC

CA

White Hispanic Asian Pacific

Islander

Black American

Indian

Multirace

CHART C

POPULATION CHANGE, NORTH COAST BY RACE AND ETHNICITY, 2000-2020

2000 2000% 2010 2000-10

Chg. %Chg.

2020 2010-20

Chg. %Chg.

2020%

DEL NORTE

NH White

Hispanic

Asian

Pacific Islander

Black

American Indian

Multirace

Total

19,324 70%

3,913 14%

667

18

1,176

1,660

894

2%

0%

4%

6%

3%

19,459

4,559

761

20

1,180

2,029

1,118

135 0.7%

646 16.5%

94 14.1%

2 11.1%

4 0.3%

369 22.2%

224 25.1%

27,652 100% 29,126 1,474 5.3%

19,520

5,506

860

20

1,180

2,397

1,282

61 0.3% 63%

947 20.8% 18%

99 13.0%

0

0

0.0%

0.0%

368 18.1%

164 14.7%

3%

0%

4%

8%

4%

30,765 1,639 5.6% 100%

HUMBOLDT

NH White 104,234 82% 103,070 -1,164 -1.1% 101,530 -1,540 -1.5% 73%

Hispanic 8,515 7% 11,808 3,293 21.5% 15,348 3,540 30.0% 11%

Asian 2,107 2% 2,361 254 8.3% 3,075 714 30.2% 2%

Pacific Islander

Black

American Indian

Multirace

250

1,089

6,931

4,047

0%

1%

5%

3%

290

1,341

9,033

5,233

40 12.9%

252 10.5%

2,102 19.9%

1,186 18.8%

310

2,407

10,543

6,305

20 6.9%

1,066 79.5%

1,510 16.7%

1,072 20.5%

0%

2%

8%

5%

Total 127,173 100% 133,136 5,963 4.3% 139,518 6,382 4.8% 100%

MENDOCINO

NH White

Hispanic

Asian

Pacific Islander

Black

American Indian

Multirace

Total

65,151 75%

14,450 17%

1,108

124

569

3,502

1%

0%

1%

4%

63,953

20,601

1,632

125

927

-1,198 -1.8%

6,151 42.6%

524 47.3%

1 0.8%

358 62.9%

4,638 1,136 32.4%

61,772

27,052

2,253

125

1,239

5,370

-2,181 -3.4%

6,451 31.3%

621 38.1%

0 0.0%

312 33.7%

732 15.8%

61%

27%

2%

0%

1%

5%

1,948 2% 2,424 476 24.4% 2,853 429 17.7% 3%

86,852 100% 94,300 7,448 8.6% 100,664 6,364 6.7% 100%

NORTH COAST TOTAL

NH White 188,709 78% 186,482 -2,227 -1.2% 182,822 -3,660 -2.0% 67%

Hispanic

Asian

26,878

3,882

11%

2%

36,968

4,754

10,090 37.5%

872 22.5%

47,906

6,188

10,938 29.6%

1,434 30.2%

18%

2%

Pacific Islander

Black

American Indian

392

2,834

12,093

0%

1%

5%

435

3,448

43 11.0%

614 21.7%

455

4,826

20 4.6%

1,378 40.0%

15,700 3,607 29.8% 18,310 2,610 16.6%

0%

2%

7%

Multirace 6,889 3% 8,775 1,886 27.4% 10,440 1,665 19.0% 4%

Total 241,677 100% 256,562 14,885 6.2% 270,947 14,385 5.6% 100%

Source: CA DOF (2004).

CMcIntyre, PopChgNC2000-20xRECo.

CHART D

POPULATION CHANGE, NORTH COAST by CITY AND COUNTY, 2002-04

Jan-02 Jan-03

DEL NORTE

CRESCENT CITY

BALANCE

27,725

7,275

27,825

7,325

20,450 20,500

2002 % Chg Jan-04

Chg.

100

50

50

0.4%

0.7%

0.2%

28,250

7,550

20,700

2003 % Chg

Chg.

425

225

200

1.5%

3.1%

1.0%

HUMBOLDT

ARCATA

BLUE LAKE

EUREKA

FERNDALE

FORTUNA

RIO DELL

TRINIDAD

BALANCE

MENDOCINO

FORT BRAGG

POINT ARENA

UKIAH

WILLITS

BALANCE

TOTAL

127,300 128,800

16,850 17,000

1,160 1,170

26,000 26,200

1,410 1,410

10,700 10,900

3,170

310

6,850

480

242,530

3,190

310

67,700 68,600

87,505 88,400

6,900

480

15,600 15,900

5,075 5,050

59,500 60,100

245,025

1,480

150

10

200

0

200

20

0

900

925

50

0

300

-25

600

2,495

1.2% 130,000

0.9% 17,100

0.9%

0.8%

0.0%

1.9%

0.6%

0.0%

1.3%

1.1% 89,200

0.7%

0.0%

6,900

480

1.9%

-0.5%

1.0%

1.0%

1,170

26,250

1,390

11,100

3,210

320

69,400

15,900

5,025

60,900

247,450

1,200

100

0

50

-20

200

20

10

800

800

0

-25

0

0

800

2,425

0.9%

0.6%

0.0%

0.2%

-1.4%

1.8%

0.6%

3.2%

1.2%

0.9%

0.0%

0.0%

0.0%

-0.5%

1.3%

1.0%

North Coast Populations, 2004

70,000

60,000

50,000

40,000

30,000

20,000

10,000

0

CRESCENT

CITY

ARCATA FERNDALE TRINIDAD FORT

BRAGG

WILLITS

Source: CA DOF, 2004.

CMcIntyre,PopChgNC200-04XCoCity

Age

Group

CHART E

CALIFORNIA POPULATION BY AGE GROUP, 2000-2010

2000 2000% 2010 2000-10

Chg.

% Chg.

2010%

0-4

5-14

15-19

20-24

25-34

35-44

45-54

55-64

65+

Total

2,525,800

5,295,500

2,426,900

2,380,800

7%

16%

7%

7%

5,115,800

5,450,000

4,457,200

2,690,900

15%

16%

13%

8%

3,693,400 11%

34,036,300 100%

2,906,200

5,448,700

2,892,000

2,899,700

380,400

153,200

465,100

518,900

5,526,500

5,577,000

410,700

127,000

5,572,500 1,115,300

4,391,600 1,700,700

4,495,800 802,400

39,710,000 5,673,700

15.1%

2.9%

19.2%

21.8%

7%

14%

7%

7%

8.0%

2.3%

25.0%

63.2%

14%

14%

14%

11%

21.7% 11%

16.7% 100%

Growth by Age Group, California, 2000-2010

25-34

20-24

15-19

5-14

0-4

65+

55-64

45-54

35-44

0

Source: CCSCE (2003).

500,000 1,000,000 1,500,000 2,000,000

CMcIntyre, PopChg2000-10xAge

DEL NORTE

<25

25-54

55+

Total

CHART E2

POPULATION CHANGE BY AGE, NORTH COAST AND CALIFORNIA

2000 2000

%

2010 Chg.

%Chg 2020 Chg.

%Chg 2020

%

9,144

12,641

5,867

27,652

33%

46%

21%

100%

9,146

12,335

7,645

29,126

2

-306

1,778

1,474

0%

-2%

30%

5%

8,501

12,652

9,537

30,690

-645

317

-7%

3%

28%

41%

1,892 25% 31%

1,564 5% 100%

HUMBOLDT

<25

25-54

55+

Total

MENDOCINO

<25

25-54

55+

Total

45,438

54,729

27,006

127,173

29,368

36,801 42%

20,683 24%

86,852

36%

43%

21%

100%

34%

100%

44,504

51,903

36,723

133,130

31,125

34,989

28,186

94,300

-934

-2,826

9,717

5,957

1,757

-1,812 -5%

7,503 36%

7,448

-2%

-5%

36%

5%

6%

9%

44,751

51,673

43,094

139,518

32,883

36,851

31,430

101,164

247

-230

6,371

6,388

1,758

1,862

1%

0%

17%

5%

6%

32%

37%

31%

100%

33%

5% 36%

3,244 12% 31%

6,864 7% 100%

NORTH COAST

<25

25-54

55+

Total

83,950 35%

104,171 43%

84,775

99,227

825

-4,944

1%

-5%

53,556 22% 72,554 18,998 35%

241,677 100% 256,556 14,879 6%

86,135

101,176

1,360

1,949

2%

2%

32%

37%

84,061 11,507 16% 31%

271,372 14,816 6% 100%

CALIFORNIA

<25

25-54

12,653,168

15,121,186

37% 13,913,669 1,260,501

44% 16,618,329 1,497,143

10% 14,709,206

10% 17,608,539

795,537

990,210

6% 34%

6% 40%

55+ 6,268,844 18% 8,714,769 2,445,925 39% 11,533,996 2,819,227 32% 26%

Total 34,043,198 100% 39,246,767 5,203,569 15% 43,851,741 4,604,974 12% 100%

Source: CA DOF (2004).

PopProjNCAge2000-20 CMcIntyre, 8/04

CHART F

HIGH SCHOOL GRADUATES, NORTH COAST, 1974-2012

1985

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1974

1975

1976

1977

1978

1979

1980

1981

1982

1983

1984

2004

2005

2006

2007

2008

2009

2010

2011

2012

1997

1998

1999

2000

2001

2002

2003

345

330

311

345

319

308

288

300

270

264

248

306

301

427

331

329

Del Norte Humboldt Mendocino NC Total %Chg.

238 1,456 825 2,519

241

197

199

190

1,389

1,364

1,375

1,336

826

812

849

629

2,456

2,373

2,423

-2.5%

-3.4%

2.1%

2,155 -11.1%

184

197

216

214

173

186

1,279

1,133

1,117

1,072

1,010

941

832

889

867

766

862

804

2,295

2,219

2,200

2,052

2,045

1,931

6.5%

-3.3%

-0.9%

-6.7%

-0.3%

-5.6%

228

221

194

202

227

271

266

164

176

188

201

200

930

1,000

1,059

1,035

886

981

987

967

1,081

1,140

1,195

1,183

882

933

1,003

903

921

837

899

893

915

910

949

951

1,976

2,109

2,250

2,139

2,007

2,046

2,107

2,054

2,198

2,277

2,415

2,400

2.3%

6.7%

6.7%

-4.9%

-6.2%

1.9%

3.0%

-2.5%

7.0%

3.6%

6.1%

-0.6%

1,302

1,384

1,369

1,377

1,418

1,477

1,420

1,391

1,347

1,348

1,336

1,304

1,244

1,173

1,227

1,133

955

1,008

1,041

1,032

1,080

1,055

997

1,001

968

982

1,039

973

928

885

914

951

2,521

2,640

2,716

2,710

2,925

2,863

2,746

2,737

2,645

2,641

2,720

2,596

2,480

2,346

2,441

2,354

5.0%

4.7%

2.9%

-0.2%

7.9%

-2.1%

-4.1%

-0.3%

-3.4%

-0.2%

3.0%

-4.6%

-4.5%

-5.4%

4.0%

-3.6%

Source: CA DOF (2004).

CMcIntyre, HSGrdsRCCDbyCo1974-2012

CHART G. High School Graduates,

North Coast and California, 1974-2012

3,000

2,500

2,000

1,500

1,000

500

0

4,500

4,000

3,500

Source: DOF (2004).

2011

1984

1990

Humboldt

CA/100

NC Total

2001

2004

NC Total

Mendocino

Del Norte

CMcIntyre, HSGrdsRCCDbyCo1974-2012

Chart H

POVERTY RATES

ON NORTH COAST

1990

Del Norte

Humboldt

Mendocino

North Coast

California

USA

North Coast/CA

North Coast/USA

2000

Del Norte

Humboldt

Mendocino

North Coast

Ratio in Poverty

Overall Under 18

0.157

0.176

0.142

0.162

0.249

0.231

0.210

0.226

0.125

0.131

1.29

1.23

0.182

0.183

1.24

1.23

0.195

0.195

0.156

0.186

0.281

0.241

0.245

0.254

California

USA

North Coast/CA

North Coast/USA

Change 1990-2000

Del Norte

Humboldt

Mendocino

North Coast

California

USA

0.137

0.119

1.36

1.56

24%

11%

10%

15%

10%

-9%

0.202

0.171

1.25

1.48

13%

4%

17%

12%

11%

-7%

Source: HSU, Redwood Coast Rural Action , 2004. CMcIntyre, 8/04

CHART I

SOCIOECONOMIC DATA, NORTH COAST AND OTHER

CALIFORNIA REGIONS, 1990-2010

Del Norte

Humboldt

Mendocino

North Coast

Mountain Region

Sacramento Valley

Sacramento Region

S.F. Bay Area

California

Del Norte

Humboldt

Mendocino

North Coast

Mountain Region

Sacramento Valley

Sacramento Region

S.F. Bay Area

California

HOUSEHOLD SIZE

1990

3.49

2.69

2003

3.00

2.44

2.76

2.79

2.58

2.54

2010

2.99

2.44

2.57

2.54

2.48

2.61

2.60

2.61

2.79

2.39

2.63

2.65

2.71

2.93

2.48

2.67

2.71

2.71

2.99

$57,105 $63,774 $74,698

$55,512 $62,022 $74,737

$74,950 $83,950 $102,671

$100,060 $123,772 $147,983

$83,003 $97,640 $118,449

12%

12%

12%

24%

18%

COUNTY SIZE, 2002

# Co's Co.Ave.Pop.

27,900

3

17%

21%

22%

20%

21%

127,500

87,900

81,100

14 29,007

7 89,786

4 478,125

9 772,889

58 608,638

1995

AVERAGE HOUSEHOLD INCOME (in $2002)

2002 2010 %ch95-02 %ch02-10

$52,763 $53,547 $65,967

$54,989 $59,181 $72,026

1%

8%

23%

22%

$58,021 $67,676 $80,129

$55,353 $61,468 $73,766

17%

11%

18%

20%

Del Norte

Humboldt

Mendocino

North Coast

Mountain Region

Sacramento Valley

Sacramento Region

S.F. Bay Area

California

1995

$171

TAXABLE SALES (in $2002 millions)

2002 2010 %ch95-02 %ch02-10

$183 $205 7% 12%

$1,243 $1,337

$838 $1,023

$2,253 $2,543

$1,615

$1,168

$2,988

8%

22%

13%

21%

14%

18%

$3,238 $3,856

$5,666 $6,871

$4,966

$8,648

$19,871 $26,885 $39,514

$91,350 $100,447 $142,890

$363,442 $437,907 $604,687

19%

21%

35%

10%

20%

29%

26%

47%

42%

38%

Sources: CCSCE (2003), CA DOF (2004).

CMcIntyre, PopHHChg1900-2010xReg

Region

Mendocino

Humboldt

Del Norte

North Coast

Mendocino

Humboldt

Del Norte

CHART J

CALIFORNIA REGIONAL COMPARISON OF NONFARM JOBS, 1990, 2000, 2002, 2010

1990

Job Number

2000 2002 2010

Job Change (per year)

90-00 00-02 02-10

Job Change (%/yr)

90-00 00-02 02-10

26,300

44,000

8,470

78,770

30,300

49,300

8,960

88,560

31,500

49,500

8,750

89,750

33,916

52,700

9,568

96,183

400

530

49

979

600

100

-105

595

302

400

102

804

1.5%

1.2%

0.6%

1.2%

2.0%

0.2%

-1.2%

0.7%

1.0%

0.8%

1.2%

0.9%

San Francisco Bay Area 3,209,900 3,825,000 3,618,200 4,276,200

Sacramento

San Joaquin Valley

661,500

1,093,600

841,500

1,302,700

875,800

1,326,300

1,088,100

1,643,700

Los Angeles Basin

San Diego

6,889,500 7,389,300 7,438,900 8,609,700

1,081,800 1,317,500 1,351,400 1,641,800

Rest of CA

CALIFORNIA

UNITED STATES

61,510 -103,400

18,000

20,910

49,980

23,570

17,150

11,800

82,250

26,538

39,675

24,800 146,350

16,950 36,300

1,082,530 1,435,840 1,455,650 1,734,517 35,331 9,905 34,858

14,097,600 16,200,400 16,156,000 19,090,200 210,280 -22,200 366,775

122,035,400 143,786,600 142,372,000 160,422,000 2,175,120 -707,300 2,256,250

1.9%

2.7%

1.9%

0.7%

2.2%

3.3%

1.5%

1.8%

-2.7%

2.0%

0.9%

0.3%

1.3%

0.7%

-0.1%

-0.5%

2.3%

3.0%

3.0%

2.0%

2.7%

2.4%

2.3%

1.6%

2008

33,230

51,900

9,399

01-08/yr

343

400

84

2010

33,916

52,700

9,568

Source: CCSCE (2003), CA EDD (2004). CMcIntyre, JobsRCCDCAReg90-10

CHART K

BUSINESS COMPOSITION

NORTH COAST AND CALIFORNIA

Goods Producing

Constr/Mining

Manufacturing

Lumber/Wood

Service Producing

Transportation

Comm/Utilities

Trade

Wholesale

Retail

Eat/Drink

Finance/Ins./RE

Services

Hotels/Lodging

Health

Government

Federal

State

Local

Total NonFarm

Del Norte

2001 %

Annual Employment

Humboldt Mendocino

2001 % 2001 %

North Coast

2001 %

California

2000

(00s)

%

580 8%

210 3%

370 5%

130 2%

0%

6900 92%

180 2%

50 1%

1530 20%

100 1%

1420 19%

530 7%

130 2%

1560 21%

260 3%

690 9%

3450 46%

150 2%

1580 21%

1720 23%

7000

1800

5300

3400

42100

14%

4%

11%

7%

0%

86%

1900 4%

800 2%

12200 25%

1500 3%

10700 22%

3900 8%

2000 4%

12700 26%

900 2%

4400

13300

900

3300

9100

9%

27%

2%

7%

19%

6460

1630

4820

2030

24370

650 2%

480 2%

7950

820 3%

7130 23%

2410 8%

1000 3%

7610 25%

1330 4%

2200

6690

300

560

5830

21%

5%

16%

7%

0%

79%

26%

7%

22%

1%

2%

19%

14040 16%

3640 4%

10490 12%

5560 6%

2420 3%

19250 22%

6840 8%

3130 4%

21870 25%

2490 3%

7290 8%

23440 27%

1350 2%

5440 6%

16650 19%

26981 19%

7504 5%

19478 13%

620 0%

0 0% 0%

73370 84% 117900 81%

2730 3%

1330 2%

21680 25%

4699

27370

32956

3%

19%

23%

8182

24774

9268

8199

46129

1972

9269

23181

2729

4434

16018

6%

17%

6%

6%

32%

1%

6%

16%

2%

3%

11%

7480 100% 49100 100% 30830 100% 87410 100% 144881 100%

Source: CA EDD (2004). Business CMcIntyre, 8/04

Del Norte

Humboldt

Mendocino

North Coast

California

NC/CA

CHART L

NORTH COAST AND CALIFORNIA BUSINESS AND INDUSTRY

BUSINESS SIZES

Business Employed Ave.Bus. <20 n Size n %

20-100 n %

100+ n

833

5,467

4,148

10,448

0.009

7,850

50,867

36,344

95,061

1,117,316 14,967,297

0.006

9.4

9.3

8.8

9.1

740

4,916

3,736

9,392

90%

90%

90%

90%

78

485

369

932

10%

9%

9%

9%

13.4

983,607 88% 110,828 10%

0.679

0.010

0.008

%

1 0%

66 1%

39 1%

106 1%

22,881 2%

0.005

Del Norte

Humboldt

Mendocino

North Coast

California

U.S.A.

NC/CA

NC/USA

7.3%

UNEMPLOYMENT RATES

2001

Annual Average

2002 2003

8.9% 9.1%

6.5%

7.2%

7.0%

8.5%

6.5%

7.1%

6.9%

5.4%

4.6%

1.36

1.59

6.7%

5.8%

1.04

1.21

6.7%

6.2%

1.03

1.11

(July)

2004

8.4%

6.3%

6.3%

6.5%

6.5%

5.5%

1.00

1.18

Change

2002-04

-8%

-3%

-13%

-7%

-3%

-5%

Source: CA EDD (2004). Business CMcIntyre, 8/04

County

Chart M

RCCD SERVICE AREA JOBS by TYPE AND EDUCATION, 2001-08 SUMMARY

Training

Annual Average

Employment

Job

Chg.

2001 2008 # %

Sep'ns

Total

Open Jobs Jobs % per

% Year

RCCD Area Total 90,608 98,558 5,942

BA/BS+ 16,270 17,594 1,324

AA/AS/Cert.

29,260 31,258 1,998

<AA/AS/Cert.

45,078 49,706 2,620

Humboldt Total 49,400 54,238 2,830

BA/BS+ 9,650 10,450 800

AA/AS/Cert.

14,510 15,330 820

<AA/AS/Cert.

25,240 28,458 1,210

Del Norte Total

BA/BS+

10,668

2,010

AA/AS/Crt 4,220

<AA/AS/Crt 4,438

11,430

2,104

4,688

4,638

7% 16,853 22,795 25% 3,256 3.6%

8% 2,213 3,537 22%

7% 4,310 6,308 22%

505 3.1%

901 3.1%

6% 10,330 12,950 29% 1,850 4.1%

6% 9,212 12,042 24% 1,720 3.5%

8% 1,314 2,114 22% 302 3.1%

6% 2,158 2,978 21%

5% 5,740 6,950 28%

425 2.9%

993 3.9%

762

94

7%

5%

468 11%

200 5%

1,916

304

672

940

2,678

398

1,140

1,140

25%

20%

27%

26%

383 3.6%

57 2.8%

163 3.9%

163 3.7%

Mendocino Total

BA/BS+

AA/AS/Crt

<AA/AS/Crt

30,540 32,890 2350

4,610 5,040

10,530 11,240

430

710

15,400 16,610 1210

8% 5,725 8,075 26% 1,154 3.8%

9% 595 1,025 22%

7% 1,480 2,190 21%

8% 3,650 4,860 32%

146 3.2%

313 3.0%

694 4.5%

Source: EDD (2004).

JobsxEducRCCD01-08Sum CMcIntyre, 8/04

Chart N

Skills/Knowledge Cluster

Agriculture and Natural Res.

Business

Computer Science

Education

Food, Service and Hospitality

Engineering and Related

Health

Legal

Media/Art/Design

Public Security

Social and Community Service

Total

NORTH COAST JOB OPENINGS, PER YEAR, 2001-08

BA/BS+

508

AA/AS/ <AA/AS

% Certificate % Cert.

26 3.7%

186 3.1%

30 3.1%

183 3.2%

18 4.6%

7 1.5%

22 2.7%

2 1.1%

6 2.1%

0 0.0%

28 3.2%

3.1%

42

49

7

908

3.2%

162 2.2%

6 4.1%

4.1%

70 4.1%

266 2.5%

146 4.2%

3 2.7%

1.9%

140 4.1%

17 5.2%

3.1%

25

695

0

31

550

505

36

0

0

59

2

Total

% %

1.9% 93 2.8%

4.2% 1043 3.5%

0.0% 36 3.2%

3.2% 263 3.4%

6.2%

3.3%

3.8%

0.0%

0.0%

5.3%

6.3%

638 5.8%

778 2.9%

204 3.9%

5 1.7%

13 2.0%

199 4.4%

47 3.8%

1903 4.1% 3319 3.6%

Source: EDD (2004).

JobsxEducRCCD01-08Sum1 CMcIntyre, 8/04

Chart O

CHART O

RCCD AREA JOBS by TYPE AND EDUCATION, 2001-08 SUMMARY2

Released December 2003

Annual Average

Employment Job Chg.

Occupation Training 2001 (2) 2008 # % Sep'ns

Total Jobs Jobs per

Jobs % Year

AG & NAT. RES.

LifePhySci BA/BS+

LifePhySci

SciOccups

BA/BS+

BA/BS+

FarmFishFor AA/AS/Crt

FrmFshFor

LifePhySci

AA/AS/Crt

AA/AS/Crt

LifePhySci

SciOccups

AA/AS/Crt

AA/AS/Crt

FarmFishFor <AA/AS/Crt

FrmFshFor <AA/AS/Crt

FarmFishFor <AA/AS/Cert.

FarmFishFor <AA/AS/Cert.

3,364

136

170

380

686

162

350

108

470

240

1,330

108

470

250

520

1,348

3,478

148

180

400

728

168

350

112

510

250

1,390

110

510

240

500

1,360

114

12

10

20

3%

9%

6%

5%

42

6

6%

4%

0

4

40

10

0%

4%

9%

60

2

40

4%

5%

2%

9%

-10 -4%

-20 -4%

12 1%

538 652 19%

34

20

46 34%

30 18%

84 104 27%

138 180 26%

28

70

28

34 21%

70 20%

32 30%

50

60

90 19%

70 29%

236 296 22%

14 16 15%

50

50

50

90

40

30

19%

16%

6%

164 176 13%

%

93 2.8%

7 4.8%

4 2.5%

15 3.9%

26 3.7%

5 3.0%

10 2.9%

5 4.2%

13 2.7%

10 4.2%

42 3.2%

2 2.1%

13 2.7%

6 2.3%

4 0.8%

25 1.9%

BUSINESS

Mgmt

Mgrs

Mgrs.

Mgrs

BA/BS+

BA/BS+

BA/BS+

Sales

Sales

BA/BS+

BA/BS+

Sales BA/BS+

Sales

Bus&FinOps BA/BS+

BusFinOper BA/BS+

BusFinOpr

BusFinOpr

BA/BS+

Total BA/BS+

Mgmt

Mgrs

Mgrs.

AA/AS/Crt

AA/AS/Crt

AA/AS/Crt

Mgrs.

Sales

Sales

Sales

AA/AS/Crt

AA/AS/Crt

AA/AS/Cert.

Sales

Bus&FinOps AA/AS/Crt

BusFinOper AA/AS/Crt

BusFinOper

OffAdmSupt AA/AS/Cert.

OffAdmSupt AA/AS/Crt

OffAdmSupt AA/AS/Crt

Source: CA EDD (2004).

106

290

330

726

176

530

640

1,346

50

34

84

2790

558

1770

30,062 31,790 1,728

442

1110

1970

3,522

14

130

20

164

1420

284

460

1160

2090

3,710

18

50

120

188

16

160

30

206

2 14%

30 23%

10

42

50%

26%

1570 150 11%

288 4 1%

740 80 12%

6% 5,570 7,298 24% 1,043 3.5%

4% 60 78 18% 11 2.5%

5%

6%

5%

145 195 18%

275 395 20%

480 668 19%

28 2.5%

56 2.9%

95 2.7%

2

20

0

22

4 29%

50 38%

10

64

50%