Simon Fraser University Spring 2016 ECON 804 S. Lu

advertisement

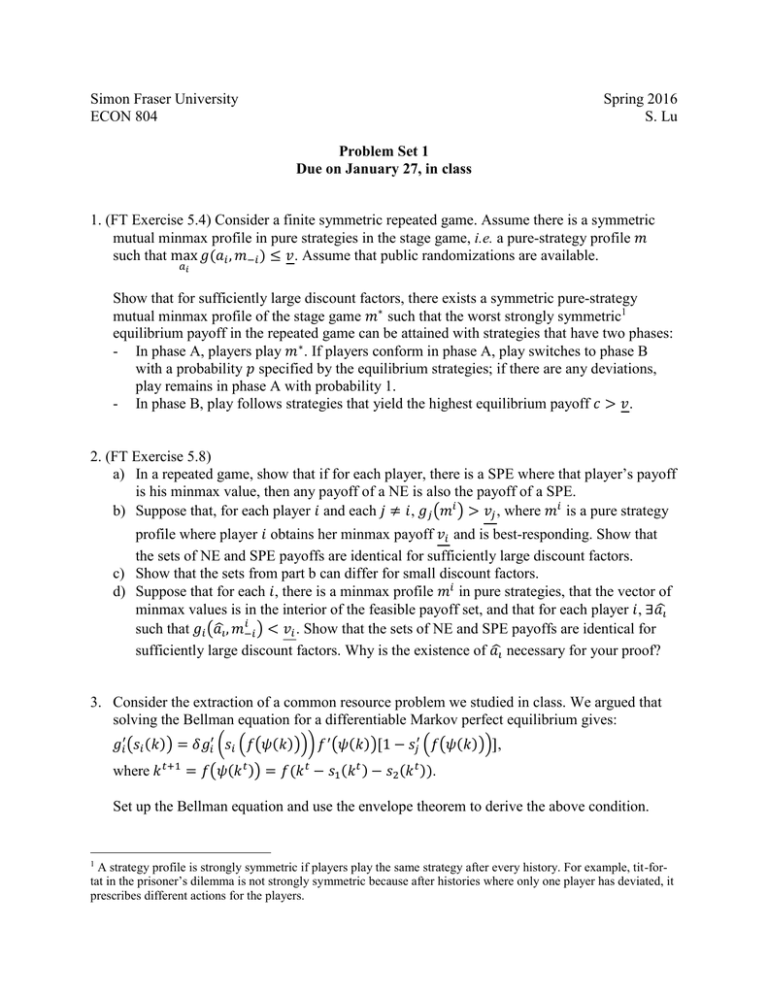

Simon Fraser University ECON 804 Spring 2016 S. Lu Problem Set 1 Due on January 27, in class 1. (FT Exercise 5.4) Consider a finite symmetric repeated game. Assume there is a symmetric mutual minmax profile in pure strategies in the stage game, i.e. a pure-strategy profile 𝑚 such that max 𝑔(𝑎𝑖 , 𝑚−𝑖 ) ≤ 𝑣. Assume that public randomizations are available. 𝑎𝑖 Show that for sufficiently large discount factors, there exists a symmetric pure-strategy mutual minmax profile of the stage game 𝑚∗ such that the worst strongly symmetric1 equilibrium payoff in the repeated game can be attained with strategies that have two phases: - In phase A, players play 𝑚∗ . If players conform in phase A, play switches to phase B with a probability 𝑝 specified by the equilibrium strategies; if there are any deviations, play remains in phase A with probability 1. - In phase B, play follows strategies that yield the highest equilibrium payoff 𝑐 > 𝑣. 2. (FT Exercise 5.8) a) In a repeated game, show that if for each player, there is a SPE where that player’s payoff is his minmax value, then any payoff of a NE is also the payoff of a SPE. b) Suppose that, for each player 𝑖 and each 𝑗 ≠ 𝑖, 𝑔𝑗 (𝑚𝑖 ) > 𝑣𝑗 , where 𝑚𝑖 is a pure strategy profile where player 𝑖 obtains her minmax payoff 𝑣𝑖 and is best-responding. Show that the sets of NE and SPE payoffs are identical for sufficiently large discount factors. c) Show that the sets from part b can differ for small discount factors. d) Suppose that for each 𝑖, there is a minmax profile 𝑚𝑖 in pure strategies, that the vector of minmax values is in the interior of the feasible payoff set, and that for each player 𝑖, ∃𝑎̂𝑖 𝑖 such that 𝑔𝑖 (𝑎̂𝑖 , 𝑚−𝑖 ) < 𝑣𝑖 . Show that the sets of NE and SPE payoffs are identical for sufficiently large discount factors. Why is the existence of 𝑎̂𝑖 necessary for your proof? 3. Consider the extraction of a common resource problem we studied in class. We argued that solving the Bellman equation for a differentiable Markov perfect equilibrium gives: 𝑔𝑖′ (𝑠𝑖 (𝑘)) = 𝛿𝑔𝑖′ (𝑠𝑖 (𝑓(𝜓(𝑘)))) 𝑓 ′ (𝜓(𝑘))[1 − 𝑠𝑗′ (𝑓(𝜓(𝑘)))], where 𝑘 𝑡+1 = 𝑓(𝜓(𝑘 𝑡 )) = 𝑓(𝑘𝑡 − 𝑠1 (𝑘𝑡 ) − 𝑠2 (𝑘𝑡 )). Set up the Bellman equation and use the envelope theorem to derive the above condition. 1 A strategy profile is strongly symmetric if players play the same strategy after every history. For example, tit-fortat in the prisoner’s dilemma is not strongly symmetric because after histories where only one player has deviated, it prescribes different actions for the players. [Hint: To apply the envelope theorem and find 𝑉′(𝑘𝑡 ), you should keep the resource stock fixed in all future periods; because player 𝑗 will absorb part of the variation in 𝑘 𝑡 , this means that player 𝑖 will not take all of it. Equivalently, you can explicitly take into account the constraint for 𝑘 𝑡+1 and the associated Lagrange multiplier, but this is more complicated.] 4. (FT Exercise 13.3) Two firms play the Cournot game repeatedly. Let 𝑎𝑖𝑡 denote firm 𝑖’s output at date 𝑡, and let 𝑎𝑡 ≡ 𝑎1𝑡 + 𝑎2𝑡 . A fraction 𝜀 > 0 of the good sold at date 𝑡 is recycled once. The consumers do not receive income when the good they consumed is recycled (a recycling industry purchases the old units at price 0 – this ensures that consumers are myopic). The inverse demand curve at date 𝑡 is 𝑝𝑡 = 1 − 𝑎𝑡 − 𝜀𝑎𝑡−1 . Production by the duopolists is costless. Assume that 𝜀 is “small.” a) What is the payoff-relevant variable in this game? b) Write the first-order condition for an MPE. [Hint: Use value functions 𝑉𝑖 (𝑎𝑡−1 ).] 𝑑𝑉 c) Find a symmetric equilibrium with quadratic valuation function, so 𝑑𝑎𝑡−1 = −𝛼 + 𝛽𝑎𝑡−1 . 5 Show that 𝛽(3 − 2𝛿𝛽)2 = 2𝜀 2 and 𝛼𝜀 = 𝛽(1 + 𝛿 2 𝛼𝛽 − 2 𝛿𝛼); 𝛿 is the discount factor. [Note: FT asks you to show that 𝛽(3 − 2𝛿𝛽) = 𝜀 2 and 𝛼𝜀 = 𝛽(1 − 𝛿𝛼), but I’m pretty sure that’s wrong – I got the above expressions in two different ways: the envelope theorem (recommended, but again remember to change the stock in the relevant period only) and directly solving for 𝑉 (very messy). See if your answer matches mine or theirs.]