Quality and the Great Trade Collapse Natalie Chen and Luciana Juvenal

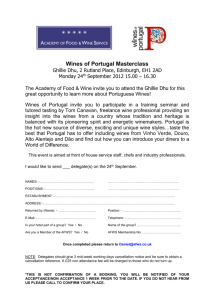

advertisement