WORKING PAPER SERIES

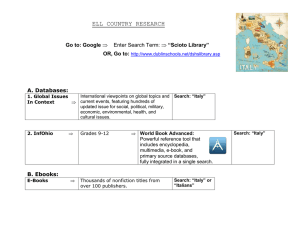

advertisement