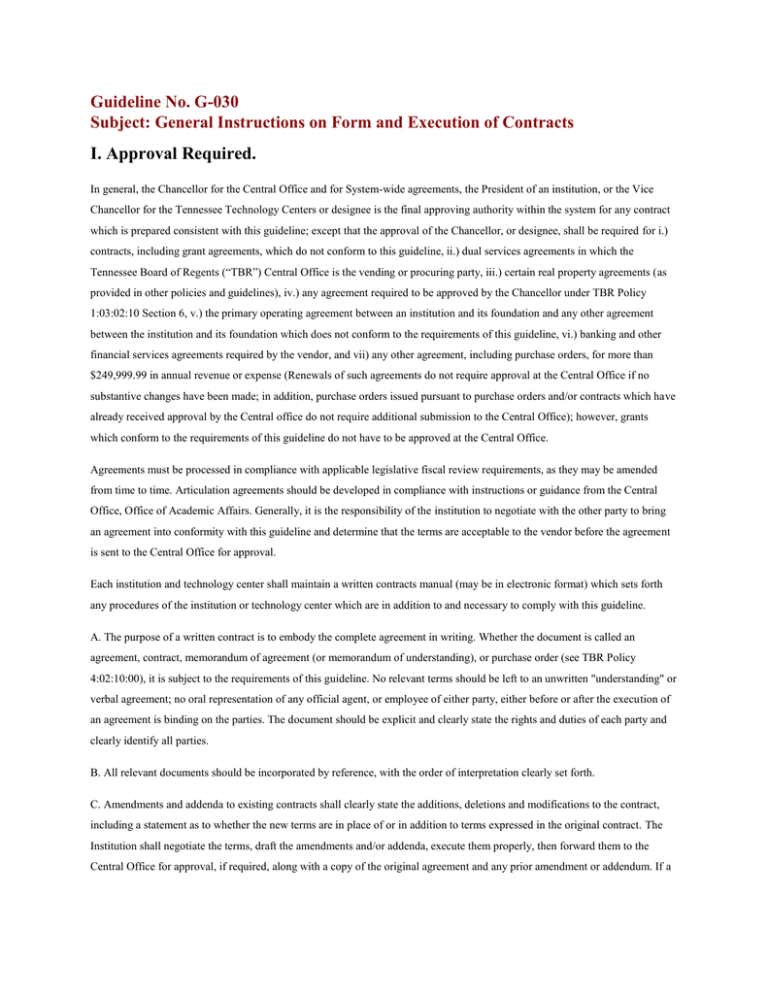

I. Approval Required. Guideline No. G-030

advertisement