The Likely Effects of Price Increases on Commissary Patronage

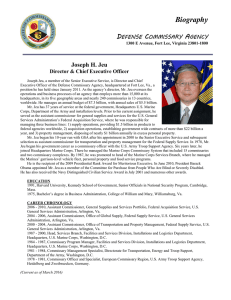

advertisement