Document 12232946

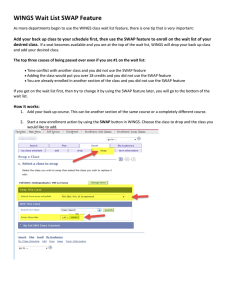

advertisement