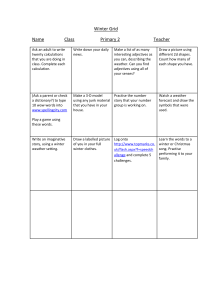

2006/2007 WINTER ASSESSMENT

advertisement