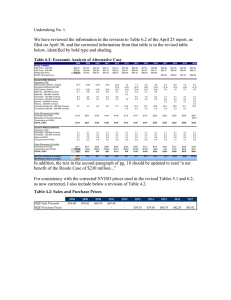

RÉGIE DE L’ÉNERGIE ’S HYDRO-QUÉBEC DISTRIBUTION RATE APPLICATION

advertisement