Le 20 octobre 2008 No de dossier : R-3677-2008

advertisement

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 1 de 11

TRADUCTION DE CERTAINES RÉPONSES AUX DEMANDES DE

RENSEIGNEMENTS N°1 ET N°2 D’OPTION CONSOMMATEURS À HQD

DEMANDE DU DISTRIBUTEUR RELATIVE À L'ÉTABLISSEMENT DES TARIFS

D'ÉLECTRICITÉ POUR L'ANNÉE TARIFAIRE 2009-2010

R-3677-2008

Pièce : HQD-16, document 9

Réponses traduites: 9.10, 9.11, 10.1, 10.3, 10.5, 11.4, 13.1, 15.2, 17.1, 20.1,

27.1, 28.1, 30.3, 32.2 et 34.1

Question:

9.10 If multiple but separate events (i.e., separate causes) occur on the same day

must the continuity of service associated with an individual event meet threshold

for it to be defined as a “major outage” or do all events occurring on that day

qualify as “major outages”?

Response:

For one individual event to cause a major outage, the continuity of service

index that is associated with it must exceed the 2.5 β threshold. All outages

that occur in that instance are an integral part of the “major outage”. In

practice, several outages are necessary to exceed the threshold.

The following definitions contribute to a better understanding of the

different notions that are used:

•

Outage: Interruption of the line service which affects one or several

customers.

•

Major outage or major event: set of service interruptions generally

provoked by severe weather conditions which lead to one or several

consecutive days of major events.

•

Day of Major Event (DME): Day during which a significant number of

outages occur such that the overall continuity of service index for

that day exceeds the statistical threshold of 2.5 β calculated

according to method C.23-01 and based on the standard IEEE Std

1366TM-2003. If an outage persists over several days, the resulting

continuity of service index is always associated with the day the

outage began.

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 2 de 11

Therefore, these severe weather conditions can provoke a major outage

which leads to one or several DME although the re-establishment of service

may take longer. For example, on August 1st 2006 there was a major outage

that lead to three DME. Starting on the fourth day, although the threshold

was no longer exceeded, service had not been fully re-established.

Question:

9.11 In those cases where a single event leads to outages for more than one day

and for some days (i.e. towards the end of the restoration activity) the continuity

index does not exceed the threshold, is a “major outage” deemed to have

occurred that day?

Response:

The continuity of service index for an outage that extends over several

days is always attributed to the first day of the outage.

Question:

10.1 Is an emergency plan for re-establishment of service triggered only for

“major outages” or in case of any outage on the system?

Response:

An emergency plan is implemented as soon as a weather event provokes

or risks provoking service interruptions or whenever two of the following

criteria are met in an area that is served by a business office:

•

The continuity of service is significantly affected (> 6 hours);

•

All teams on site (or > 5 teams for a larger site) are required to

respond to service interruptions;

•

Two or more outages are attributed to each available team;

•

The service of 5% of customers for a site is interrupted.

As the event gets larger, the emergency plan is expanded.

Nonetheless, the event that triggers an emergency plan may or may not

lead to a day of major event. Therefore, when the established threshold for

the continuity of service index is not met, the costs of the emergency plan

are not considered in the calculation of costs associated with days of

major events.

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 3 de 11

Question:

10.3 If for all outages, are the two different cost centres (per lines 3-5) created in

all such circumstances and are the costs for all outage tracked accordingly?

Response:

In every case or for every outage, specific cost centres are created. It is

therefore possible to establish a link between costs and days of major

event, which are determined in compliance with the technical threshold of

the continuity index. It is thereby possible to track the costs associated

only with these.

Question:

10.5 What is HQD’s policy with respect to what types of costs are capitalized

versus expensed during restoration from an outage?

Response:

For all restoration related to the replacement of an existing asset on the

network (devices, electricity poles, conductors, etc.), all the costs will be

capitalized. For all restoration pertaining to an accessory of the distribution

system (connecting wire, cable joint, cross-arm bracket for poles, insulator,

lightning conductor, etc.), all costs will be recorded as operating costs.

Question:

11.4 If the Table sets out the number of days with major events and the outages

associated with an event last more than one day, is the day only counted if the

continuity index for that day exceeds the threshold? Alternatively, were all days

associated with an event counted as long as there was at least one day where

the continuity index exceeded the threshold?

Response:

The Distributor takes into account each day for which the continuity index

exceeds the established threshold. It can occur that a significant weather

event generates two or more major event days. For example, in 2006, there

were about ten events which led to 17 days of major event.

However, one event can extend over more than one day or may lead to a

first day of major event but not affect a sufficient number of customers on

the second day to exceed the established threshold.

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 4 de 11

Question:

13.1 Please confirm that the recovery of the deferral account balances related to

weather normalization is a “new” cost for 2009 for which the cost allocation

treatment has not been dealt with in previous HQD applications.

Response:

The implementation of a transmission and distribution levelling mechanism

associated with weather fluctuations, as well as its calculation methods by

customer class, were discussed in rate application R-3579-2005 and

approved in decision D-2006-34. The levelling account by customer class

has been presented in the allocation methodology since case R-3610-2006,

in Table 26B pertaining to the rate base under the function “Other”.

In the current application, the Distributor requests the amortization of this

account, in compliance with the terms described in HQD-4, document 2.

More specifically, page 11 mentions that since the levelling account is

already established by customer class, in compliance with the

methodology approved by the Régie, the amortization by customer class is

calculated using the same proportions, corresponding to one-fifth of the

residual balance for each customer class. Thus, the amortization charge by

customer class corresponds to variances recorded in the levelling account

and included in the rate base for each of these categories. Thus, it is not a

new element of the allocation methodology.

Question:

15.2 How does HQT determine the portion of the variation in point to point

revenues for the preceding year that is to be allocated to native load (i.e. HQD)?

If it is based on an allocation, does the allocation factor used for native load

include all native load transmission costs or does it exclude the cost of

connections?

Response:

The Transmission Provider allocates the balance of the variance account

between native load service and point-to-point service based on projected

long-term transmission service requirements, as mentioned in Exhibit HQT12, document 1, page 17 of case R-3669-2007. Once the amounts by service

are determined, either an upward or downward adjustment is directly

applied to the native load bill.

As explained in Exhibit HQT-10, document 2 of the case mentioned in the

preceding paragraph, native load requirements correspond to all of the

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 5 de 11

Distributor’s customer requirements for transmission services including

municipal systems but excluding remote communities.

Consequently, the Transmission Provider determines the variance account

for point-to-point revenues in the same way as in the establishment of

native load billing. I.e. the revenue requirement excluding short-term pointto-point transmission revenues divided by total native load and long-term

point-to-point transmission service requirements (MW).

These revenue requirements include connection costs.

17.1 Please explain more fully why the application of a criterion based on

maximum deviation assumes that the weight given to the “Cost Increase” in the

calculation of differentiated increases is reduced.

Response:

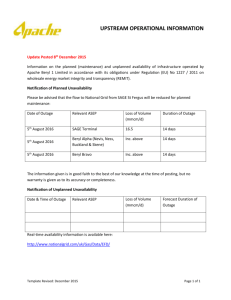

The two Tables that follow compare the underlying calculations for two

differentiated increase scenarios.

TABLE R-17.1

COMPARISON OF TWO DIFFERENTIATED INCREASE SCENARIOS

Illustration of the application of differentiated increases in 2009

The first scenario is taken from Appendix A of HQD-12, document 1; it is a

scenario of growth in which the cost increases of a given rate class are

entirely allocated to that class, the value of the regulatory provision is

determined on an historical basis and the adjustments are allocated prorated to sales in that category. An average increase of 2.2% is necessary to

meet the new revenue requirement of $207 M.

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 6 de 11

The second scenario provides the underlying calculations for one of the

additional scenarios the Distributor submitted to the Régie in Table 3 of

HQD-12, document 1. Any scenario of differentiated increases by customer

class which departs from scenario 1 entails a distortion in the cost

increase that is attributed to each customer class. For this distortion to be

fair to all customer classes the cost increase requires a uniform adjustment

via a weighting factor.

The second scenario was therefore established by calculating the

weighting factor associated with the cost increase that is attributed to each

customer class, so that:

1) The increase for each class does not exceed 2.64% (120% * 2.20%)

2) The regulatory provision for each class remains the same relative to the

base scenario.

3) Total additional revenues are $207 M. For a scenario in which the

maximum increase is 20% higher than the average increase, a single

weighting factor makes it possible to meet these constraints, i.e. 29%.

A comparison of column “Cost Increase 2009” in the first Table and column

“Cost Constraints 2009” (i.e.« Coûts contraints 2009 ») in the second Table

shows the impact of this weighting factor. For example, the domestic “Cost

Increase 2009” of $120 M becomes “Cost Constraints 2009” of $35 M (i.e.

$120 M * 29%). In total, the column “Cost Constraints 2009” in the second

scenario totals $39 M instead of $135 M like in the first scenario, for a $96 M

variance.

This variance will be recovered via the column “2009 Adjustments” for

which the total goes from $42 M in the first scenario to $138 M in the

second scenario. This adjustment is allocated evenly pro-rated to revenues

before increases for each customer class.

Question:

20.1 Please reconcile the total 2009 cost of service reported in reference (i)

{$9,828.5 M} with the total reported in reference (ii) of $9,930.4 M (i.e.,

$10,683.5-$753.1).

Response:

The main variations are attributable to the two internal billing line-items

and the amortization of the weather normalization account.

Concerning the two internal billing line-items, explanations were already

provided in response to OC question 15.2 in case R-3492-2002, Phase 1

(HQD-10, document 8, page 22) and in response to OC questions 1-A and 1B in case R-3579-2005 (HQD-14, document 6, page 4), as well as in

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 7 de 11

response to questions by the FCEI (question 10.3 of case R-3610-2006 in

Exhibit HQD-16, document 16, page 16 and question 11.1 of case R-36442007 in Exhibit HQD-15, document 6, page 15). It consists of reclassifying

reciprocal transactions between two of the Distributor’s internal units,

which must be considered when cost-allocation is carried out.

The separate presentation of other revenues (HQD-5, document 1) and

cost-of-service (HQD-6, document 1) shows the variance associated with

the reclassification of reciprocal transactions.

As for the amortization of the weather normalization account, the

Distributor has allocated this account using the same methodology as

approved by the Régie for the deferral account associated with the levelling

account of the rate base. The amount coincides with the amortization of the

levelling account provided in Exhibit HQD-1, document 1, page 13. See also

response to Régie question 2.1 in Exhibit HQD-16, document 1.

Finally, the Distributor has included revenues other than those generated

from electricity sales in its allocation methodology because these elements

must be allocated by customer class, whereas these other revenues are

excluded from the cost-of-service. Revenues other than those generated

from electricity sales are provided in Exhibit HQD-5, document 1 on page 3.

It is important to note that totals from other revenues differ from one

exhibit to the other as a result of the reallocation of reciprocal transactions.

Table R-20.1 shows the conciliation of data provided in Table 1 of Exhibit

HQD-6, document 1 and Exhibit HQD-11, document 3.

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 8 de 11

Table R-20.1

Conciliation of Cost-of-Service between Exhibits HQD-6 and HQD-11

Projected Test Year 2009

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 9 de 11

Question:

27.1 The first reference suggests that departure from cost causality is not

sustainable in the long-term, even if based on the principle of social equity.

However, the second reference suggests that departure from the principle of cost

causality is acceptable. Please reconcile.

Response:

The second reference does not suggest that the Distributor has chosen to

set the level of the customer charge without taking costs into account.

However, it does indicate that there is no absolute rule to set the level of

the customer charge and that the Distributor must make choices that will

take several elements into account.

Therefore, the Distributor has chosen to include customer service and

metering costs in the customer charge.

Question:

28.1 Please indicate what activities are captured by each of the following

components of Customer Service:

•

Collections;

•

Electricity Theft;

•

Remote Communities – Other.

Response:

The main activities that are captured by the “Collections” function deal

with the recovery of amounts owing as a result of negotiations and the

follow-up of different collection agreements, service interruptions when

attempts to negotiate an agreement fail (except for the main residence of

residential customers between December 1st and April 1st) and the

treatment of closed accounts (collection of amounts owing that are

associated with accounts that are closed).

As for electricity theft, this function essentially includes activities

associated with inspectors on the ground that look for and report

electricity theft, as well as licensed engineers. Another activity consists of

billing customers that are at fault.

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 10 de 11

For the cost of services rendered to remote community customers, see

response to Option consommateurs question 40.2 in Exhibit HQD-11,

document 8 of case R-3492-2002 – Phase 2.

Question:

30.3 Given the comment in footnote #21 why isn’t the break-even point in Table

26 $1.42/litre as opposed to $1.27/litre?

Response:

The price of 1.42 $/litre for fuel-oil is equivalent in ¢/litre to 17.55 ¢/kWh

which is the price applicable during on-peak periods. This means, as

indicated in Exhibit HQD-12, document 1, page 47, lines 11 to 13, that it is in

the interest of existing dual energy customers to use fuel-oil during onpeak periods if the price of fuel-oil is below 1.42 $/litre. This price provides

a real-time signal to customers upon which they can base their decision.

As mentioned in response to question 30.1, the price of 1.27 $/litre is the

result of an ex-post analysis of savings for a Rate DT customer who uses

dual-energy mode throughout the year compared with the price that would

have been paid under Rate D for AEH. This analysis accounts for the

electricity bill, the fuel-oil bill and the differential costs associated with

maintenance and it is used as a benchmark in the decision to subscribe or

not to the dual-energy rate.

Question:

32.2 Does the 10.97 cents/kWh represent a constant annuity in real or nominal

terms? If in nominal terms (i.e., fixed at 10.97 cents/kWh for 10 years) please

restate in “real” terms (i.e., annuity is escalated each year at inflation).

Response:

A constant annuity determines the price or the cost that will be used every

year over the defined period. Here, the annuity of 10.97 ¢/kWh is the

avoided cost of supply – transmission for space heating (Rate D) over the

next ten years. In other words, 10.97 ¢/kWh in 2009, 10.97 ¢/kWh in 2010

and so on for each of the ten years. The increasing annuity to which it is

associated is 10.12 ¢/kWh.

Le 20 octobre 2008

No de dossier : R-3677-2008

Traduction de certaines réponses aux DDR N°1 et N°2 d’Option consommateurs

Page 11 de 11

Question:

34.1 Please comment on whether, with this fourfold increase in seasonal cost

difference, it is still appropriate to extend the demand charge to the summer

months. If so, please explain why.

Response:

The Distributor proposes to bill capacity that exceeds 50 kW on an annual

basis to ensure better consumption management of domestic customers’

capacity requirements since these customers currently have no incentive

to do so. The seasonal aspect is captured by the mechanism for minimum

capacity billing which ensures that a winter capacity requirement does not

have the same impact on customers’ bills than a summer capacity

requirement.