Document 12215804

advertisement

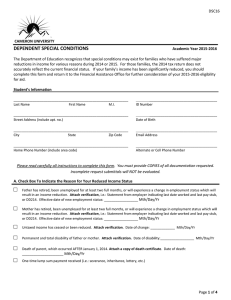

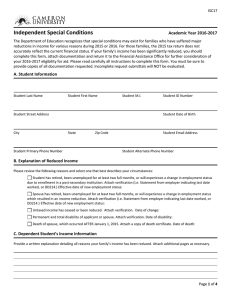

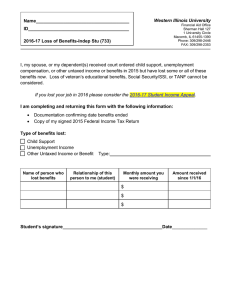

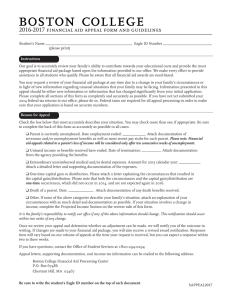

DSC17 Dependent Special Conditions Academic Year 2016-2017 The Department of Education recognizes that special conditions may exist for families who have suffered major reductions in income for various reasons during 2015 or 2016. For those families, the 2015 tax return does not accurately reflect the current financial status. If your family’s income has been significantly reduced, you should complete this form, attach documentation and return it to the Financial Assistance Office for further consideration of your 2016-2017 eligibility for aid. Please read carefully all instructions to complete this form. You must be sure to provide copies of all documentation requested. Incomplete request submittals will NOT be evaluated. A. Student Information Student Last Name Student First Name Student M.I. Student Street Address City Student ID Number Student Date of Birth State Zip Code Student Primary Phone Number Student Email Address Student Alternate Phone Number B. Explanation of Reduced Income Please review the following reasons and select one that best describes your circumstances: Parent has retired, been unemployed for at least two full months, or will experience a change in employment status due to enrollment in a post-secondary institution. Attach verification (i.e. Statement from employer indicating last date worked, or DD214.) Effective date of new employment status: Untaxed income has ceased or been reduced. Attach verification. Date of change: Permanent and total disability of applicant or spouse. Attach verification. Date of disability: Death of spouse, which occurred AFTER January 1, 2015. Attach a copy of death certificate. Date of death: One-time lump sum payment received (i.e. severance, inheritance, lottery, etc.) C. Dependent Student’s Income Information Provide a written explanation detailing all reasons your family’s income has been reduced. Attach additional pages as necessary. Page 1 of 4 DSC17 Student ID: D. Projected 2016 Income Worksheet Complete the Projected 2016 Income Worksheet. Provide a separate statement and documentation (copies of pay stubs, etc.) explaining how you arrived at these projections. Projected 2016 Income Worksheet Parent 1 Income Parent 2 Income Unemployment (Gross Wages) (Gross Wages) Benefits Untaxed Income Jan $ $ $ $ Feb $ $ $ $ Mar $ $ $ $ Apr $ $ $ $ May $ $ $ $ Jun $ $ $ $ Jul $ $ $ $ Aug $ $ $ $ Sep $ $ $ $ Oct $ $ $ $ Nov $ $ $ $ Dec $ $ $ $ Totals $ $ $ $ E. 2016 Gross Taxed and Gross Untaxed Income Using totals from your Projected 2016 Income Worksheet, complete gross taxed and gross untaxed income sections below with income your family expects to receive from January 1, 2016 until December 31, 2016 (prior to exemptions, adjustments, or deductions). If zero, enter zeros. Attach a statement explaining how your family’s living expenses are provided. 2016 Gross Taxed Income Parent 1 Income Parent 2 Income Wages, salaries, and/or tips Severance pay Pensions and Annuities Interest and dividend income Business or farm income Capital gains Income received from rents after expenses paid for mortgage interest, taxes, and insurance Alimony to be received Unemployment compensation Any other untaxed income TOTAL 2016 GROSS TAXED INCOME: $ $ Page 2 of 4 DSC17 Student ID: 2016 Gross Untaxed Income Payments to Tax-deferred Pension & Savings Plans (paid directly or withheld from earnings). Include untaxed portion of 401k and 403b plans Social Security benefits (SSI or disability) received by student, children or spouse, if married Retirement or Disability Benefits Parent 1 Income Parent 2 Income $ $ $ $ $ $ Workers’ Compensation $ $ Welfare benefits including TANF (excluding Food Stamps) $ $ Untaxed portion of pensions Living & Housing allowances (excluding rent subsidies for low income housing) for clergy, military and others. Include CASH payments and cash value of benefits. Don’t include the value of on-base military housing or the value of basic military housing allowance. Child Support or Maintenance payments which will be received for ALL children Veteran’s Benefits, except Student’s Educational Benefits $ $ $ $ $ $ $ $ Railroad Retirement Benefits Any other Untaxed Income and Benefits such as Black Lung Benefits, Refugee Assistance, etc. $ $ $ $ TOTAL 2016 GROSS UNTAXED INCOME: $ $ F. Tax Returns and W2s You must attach signed copies of student and parent 2015 Federal Tax Return(s) and 2015 W2s. G. Checklist, Certification, and Signatures Incomplete Special Conditions Requests will be returned or denied. Please review the form and initial each item indicating you have provided all requested documentation. Step A, check your reason for submitting the application and attach verification as requested. Step B, write a detailed explanation why the application is being submitted. Step C, complete the Projected 2016 Income Worksheet leaving NO blanks and provide documentation. Step D, complete both gross taxed and gross untaxed income tables. Step E, attach signed copies of student and parent 2015 tax return and all 2015 W2s. (See back page for certification and signatures.) Page 3 of 4 DSC17 Student ID: By signing this form I certify that all the information reported is true. I understand that purposely submitting false or misleading information is a federal offense punishable by fines or jail sentence or both. Student Signature Date Parent Signature Date Submit this worksheet and required documents to: Office of Financial Assistance Cameron University – North Shepler #301 2800 West Gore Boulevard Lawton, OK 73505-6320 FAX: 580-581-2556 | EMAIL: financialaid@cameron.edu Page 4 of 4