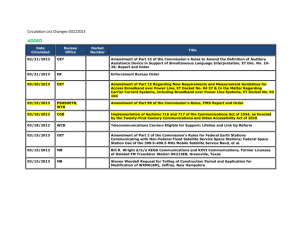

UNITED STATES OF AMERICA FEDERAL ENERGY REGULATORY COMMISSION

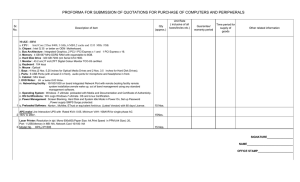

advertisement