Medical Care Spending and Labor Market Outcomes Evidence from Workers' Compensation Reforms

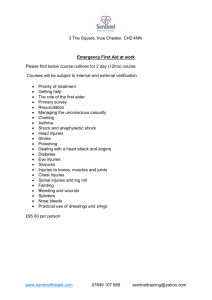

advertisement